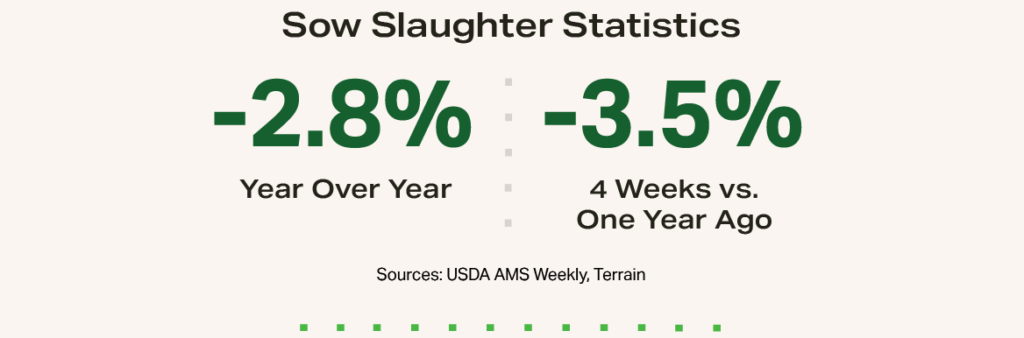

Sow Slaughter Trends Change With the Calendar

Sow slaughter trends since the December USDA Hogs and Pigs report changed dramatically. Slaughter was 7% larger than a year earlier in December, then down 3.5% on a year-to-date basis during January and February compared with the same period in 2024.

The notion that disease-related deaths did the culling, so producers didn’t have to do it, can be ruled out. Swine disease monitoring data for December through February show that disease pressure on sow farms was slightly below year-earlier levels. A milder and drier weather pattern across major Midwest pork production areas was likely a positive influence on farms.

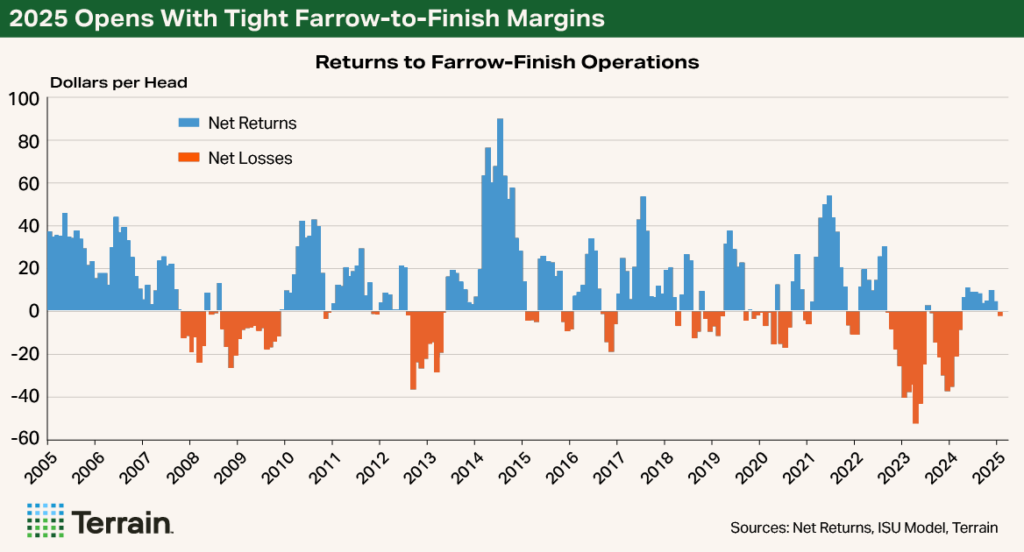

It appears that the continuous, though modest, profits earned in farrow-to-finish operations during the last nine months of 2024 were enough to encourage some operations to begin retaining sows by slightly reducing culling rates. I expect they have started adding a few more gilts to the breeding herd as well.

The swing in year-over-year sow slaughter comparisons from up 7% to down 3.5% has erased all the reduction in sow numbers that the industry achieved during December. Without accounting for potential changes in gilt retention, just the changes in sow slaughter suggest that the March 1 breeding herd could be 0.5% to 1% larger than a year earlier and up another 0.5% to 1% if any gilt retention occurred. Current gains in sow productivity, measured by pigs saved per litter, mean that sow slaughter needs to outpace year-earlier levels by about 1% to keep pig crop and eventual market hog numbers from growing.

Market observers are anxiously awaiting an update on swine breeding herd and market hog inventories given the shift in slaughter totals and the continued uncertainty around trade and market access. The USDA’s National Agricultural Statistics Service will release the Hogs and Pigs report for March 1 on March 27.

Lower Grain Costs Could Partly Offset Lean Hog Price Decline

From early December through early February, elevated lean hog futures contract prices added to producer optimism, as the contracts were offering hedgeable profits for nearly three-quarters of an operation’s 2025 market hogs. Since the new U.S. presidential administration took office, uncertainties in the political landscape have both producers and futures market participants on edge. Both groups are anticipating a higher-risk and more volatile environment for the foreseeable future and should be planning accordingly.

Producer use of Livestock Risk Protection (LRP) is off to a fast start for 2025, as more than 22 million head of market hogs have been risk-protected using LRP insurance contracts. The total is already 81% of all the hogs protected by LRP during 2024.

During the week of Valentine’s Day, producers could have hedged hogs for the April through August strip at a maximum of $102.49/cwt, about $13/cwt higher than was possible during the first week of March, when the same strip of contracts averaged $89.52/cwt. My hope is that many producers were willing and able to get some risk management done near the highs.

A more likely scenario is that sizable numbers of Q1 2025 market hogs got hedged in early December at $2/cwt to $4/cwt ($4/head to $8/head) below the late-February highs, thus putting expected hedged margins at nearly $20/head. For Q2 2025, $28.50/head margins for market hogs were achievable.

The nearly 10% break from Valentine’s Day to early March in hog futures prices was accompanied by a 10% drop in projected feed costs (corn and soybean meal futures at $4.50/bu. and $300/ton, respectively). The feed cost break offset nearly half of the impact that lower projected market hog prices had on break-even projections and expected margins.

The big selloff in lean hog futures during February appears to have been due to the concerns of traders (mostly managed money and hedge funds) over the sharp break to fresh belly prices, the Lenten season approaching, and trade disruptions with key partners like Mexico, Canada and China. Managed money and hedge funds trimmed their net long position by nearly 30%. While their position remains historically long, it was enough to swing market sentiment and push futures prices lower.

Trade disruptions remain a wild card and could influence prices during Q2.

The rollover of open interest on February 27-28 resulted in a massive change in futures position ownership. This trade action could aid in setting new lows in early March and provide a springboard for futures, hog prices and pork cutout values going into summer.

Price and Production Outlook

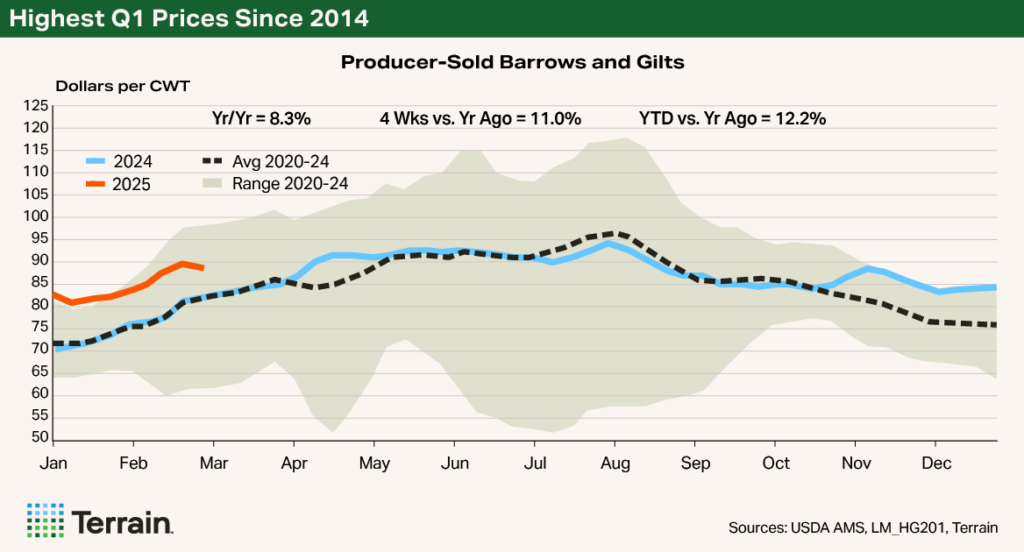

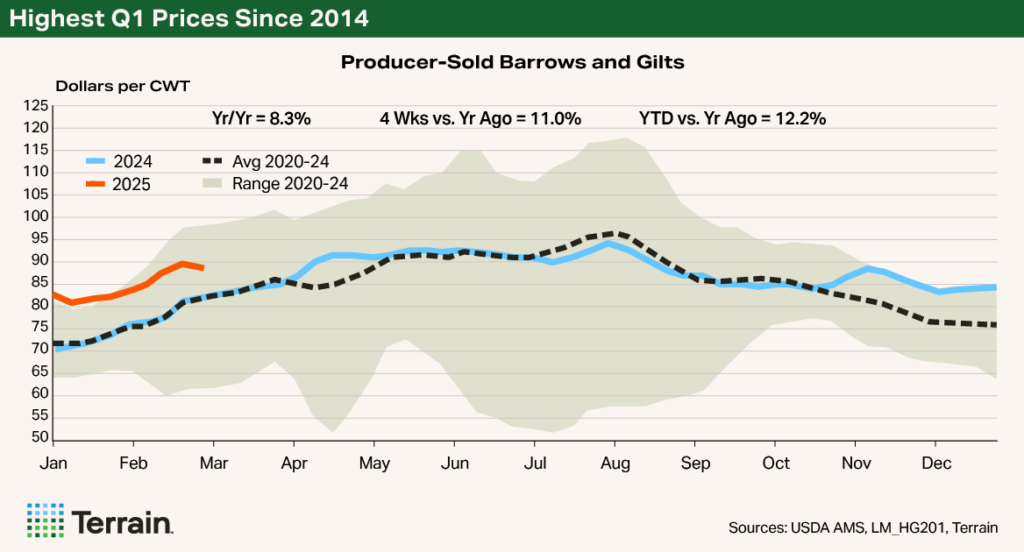

Market hog prices have, so far, performed within my previous forecast range for Q1 2025. My forecast of a quarterly average price of $85/cwt to $87/cwt may be $1/cwt or $2/cwt low, as prices rallied stronger than expected in February. Trade disruptions remain a wild card and could influence prices during Q2.

Nonetheless, I expect that Q2 2025 prices for producer-sold barrows and gilts will range from the low-$90s/cwt early on to $102/cwt to $106/cwt at quarter’s end. This puts the forecast quarterly average prices for barrows and gilts in a range of $98/cwt to $102/cwt and nearly 8% above the average price achieved during Q1 2024.

Looking ahead to Q2, loin, butt and rib primals will have to pick up the pace and kick in additional value.

The pork cutout outperformed my expectations for Q1 2025. The contribution of ham and belly primal carcass value led the charge.

My projections put cutout values in a range of $100/cwt to $112/cwt for Q2 2025.

Looking ahead to Q2, loin, butt and rib primals will have to pick up the pace and kick in additional value. Seasonally, these cuts will find a better demand period as the weather warms and barbecue season gets into full swing.

My projections put cutout values in a range of $100/cwt to $112/cwt for Q2 2025, and the forecast average for the quarter is $106/cwt to $108/cwt. Like last quarter, several key drivers could cause product to trade outside these bounds, most likely near the bottom of the range:

- Trade disruptions

- Strengthening of the U.S. dollar

- An economic downturn in the U.S.

- Further macroeconomic weakening among our trade partners

There is a small chance that ongoing disease pressure in wean-to-finish facilities could result in smaller-than-expected barrow and gilt slaughter. The resulting lower pork production would lead to higher-than-expected hog prices and pork cutout values.

I am raising my expected 2025 market hog prices to average 3.5% to 5% higher than 2024’s, somewhere in the $88.50/cwt to $90/cwt range. My expectations for hog slaughter levels for the year remain unchanged and could be near even, down 0.5% to 1.5% during the first half of 2025 and up 0.5% to 1.5% in the second half. Carcass weights are expected to “normalize” near five-year average levels (omitting 2020 COVID-19 impacts) as lower feed costs incentivize adding more pounds before hogs are marketed.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.