Quarterly Outlook • October 3, 2024

Will Tortilla Tensions Spoil the U.S. Feed Corn Fiesta?

The U.S. corn market has had more bearish than bullish news lately, with looming large stocks and flat domestic demand. Maintaining and growing export markets like Mexico are critical for corn prices.

For crop year 2023/2024, over 40% of U.S. corn export volume has been to Mexico. The U.S. could see additional demand from Mexico for the 2024/2025 corn market, but there is a risk to the trade relationship stemming from a tortilla war tied to white corn imports.

Corn Controversy

Mexico recently elected a new president, Claudia Sheinbaum, who took office on October 1. She is a climate scientist and supports nearshoring (greater regionalization of supply chains to decrease costs and lower climate impacts), which should benefit U.S. producers regarding future grain exports to Mexico.

The ongoing battle over U.S. corn imports began under Sheinbaum’s predecessor, Andres Manuel Lopez Obrador (AMLO). In 2020, AMLO banned glyphosate and genetically modified (GM) grains. Three years later, the policy was relaxed with a decree applying only to corn in tortillas for human consumption (which is primarily white corn grown domestically in Mexico).

The decree also indicated GM corn as acceptable for feed and industrial use (predominantly yellow corn imported from the U.S.). For context, thus far in crop year 2023/2024 (September through July), corn exports from the U.S. to Mexico are 99% yellow corn and 1% white corn (see Chart).

The controversy has been hard to follow with all the bans, decrees and other updates. Mexico claimed it is protecting the biodiversity of its domestic corn crop and voiced concerns about the health risks associated with GM products, which continue to be debated. Since AMLO’s ban on GM corn, the United States Trade Representative has insisted on technical consultations with Mexico concerning biotechnology in agricultural commodities.

Additionally, the U.S. National Corn Growers Association argues there is no scientific evidence to support these claims, and currently the U.S. government is arguing that Mexico's position on banning GM corn is protectionist and not in compliance with the U.S.-Mexico-Canada trade agreement terms. While a third-party panel is set to rule on the dispute in November, both countries align on GM corn used for livestock feed.

Julio Berdegue, Sheinbaum's incoming agriculture minister, has gone on record indicating Mexico is not trying to reduce corn imports or become self-sufficient in domestic yellow corn production. Combined with the potential influence of Sheinbaum’s scientific background on Mexico’s stance on GM corn, there is hope that the U.S.-Mexico trade relationship can improve under the new presidency.

Mexico’s domestic corn demand continues to outpace Mexico's corn production, thus increasing imports.

Mexico’s Corn Demand Continues to Pop

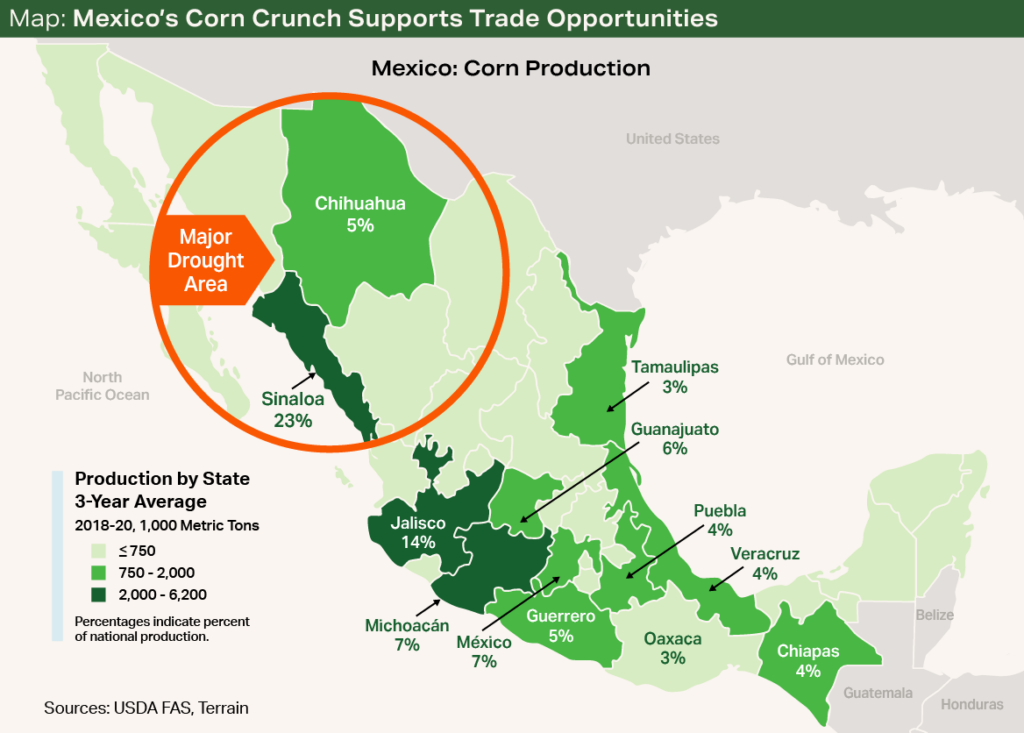

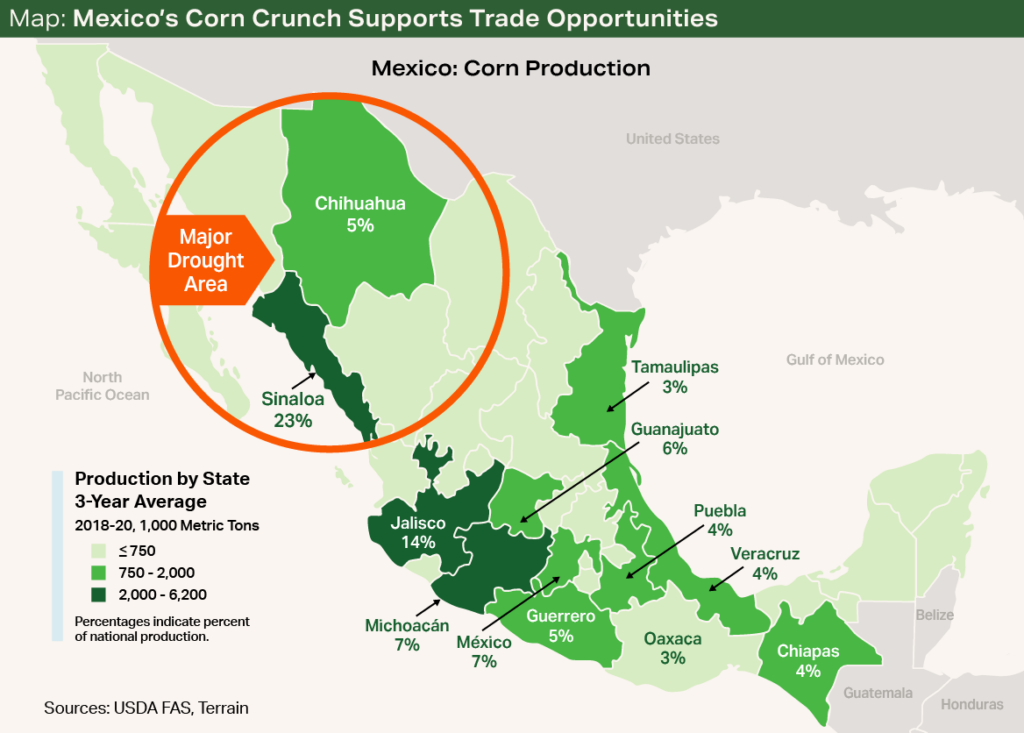

Mexico’s domestic corn demand continues to outpace Mexico's corn production, thus increasing imports. Yellow corn production is limited in Mexico because of a smaller growing region and ongoing drought (see Map). U.S. corn imports to Mexico reached a record high of 22.6 million metric tons, up 32%, in 2023/2024. Given the abundant supplies of new-crop corn in the U.S., prices should be favorable to countries with significant import needs, such as Mexico, and the U.S. is currently price-competitive with other global producers like Brazil and Argentina. The U.S. is in an excellent geographic position to continue to support Mexico's growing imported corn needs.

One concern to note is the value of the peso relative to the U.S. dollar. As the U.S. dollar strengthens, our exports become more expensive. Given recent market volatility caused by changes in Mexico’s presidency, the peso has dipped below 20 to the U.S. dollar, further compounding the expense of U.S. imports.

The bottom line for U.S. grain producers: Mexico is a critical market for U.S. corn demand. If the export pace to Mexico were to decline, there would be significant future corn price risk given the expected abundant U.S. supplies. Farmers should stay defensive in this current environment and know that long-term demand exists south of the border if we can continue to play nice with our neighbors.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.