The Global Soybean Revolution

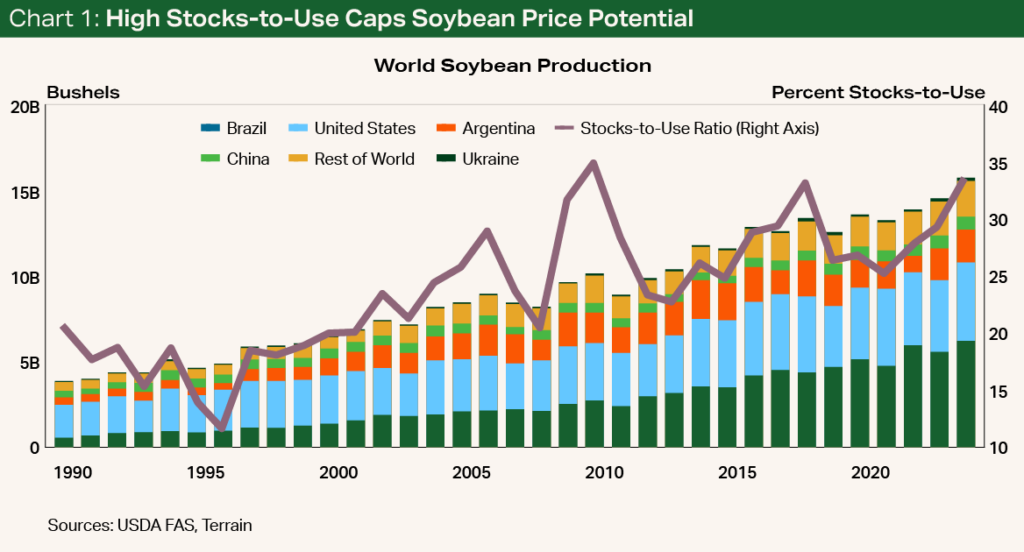

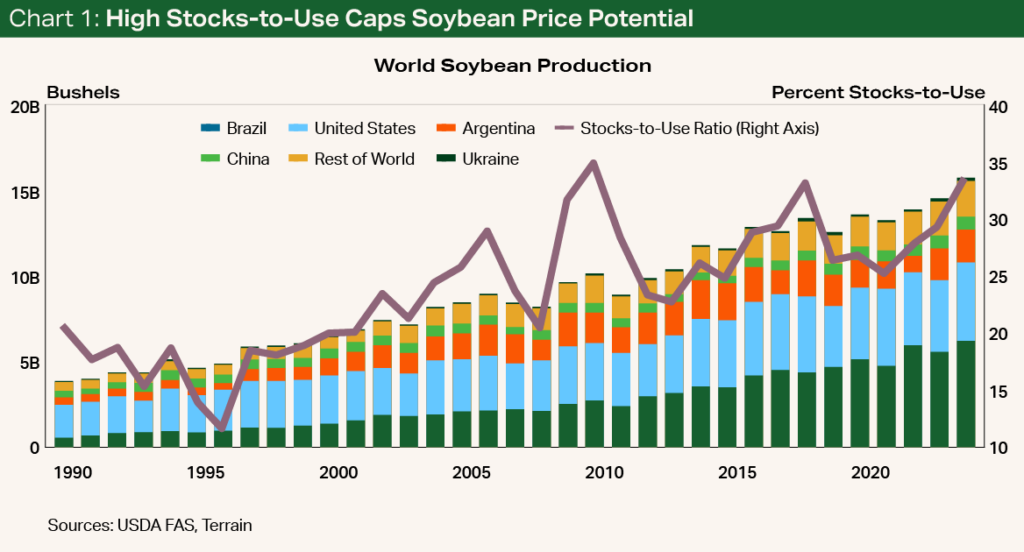

The U.S. is poised for record-breaking soybean yields if the USDA’s September World Agricultural Supply and Demand Estimates (WASDE) are realized. Production is expected to rise by 421 million bushels year over year (YOY), reaching 4.586 billion bushels in 2024/2025. Despite strong expected yields of 53.2 bu./ac. — primarily in Iowa, Illinois and Indiana — the U.S. is burdened by large carryover stocks from the previous year.

Ending stocks are now projected at 550 million bushels, potentially the third largest on record.

Wet weather earlier in the season may have led U.S. farmers to increase soybean acreage at the expense of corn. Ending stocks are now projected at 550 million bushels, potentially the third largest on record. Soybean demand indicates that 55% of the new crop will be for crush and 42% for exports. However, the export projections are heavily dependent on one customer: China.

Globally, Brazil is set to increase its soybean production, and its persistent expansion in row crops will continue to challenge U.S. exporters. Ten years ago, Brazil's exports were like those of the U.S. Now, Brazil exports over 105 million metric tons (MMT) while U.S. exports have stagnated. As of the September WASDE, the USDA projects Brazil’s production will increase by over 10% YOY in 2024/2025. If dry weather delays Brazilian planting, it could elongate the U.S. export window, offering a temporary reprieve.

Meanwhile, Argentina is also shifting to soybeans from corn, with leafhopper disease affecting 25% to 30% of corn acres. Ukraine is also shifting corn acres to soybeans but for different reasons: the pressures associated with rising input costs as well as the need to quickly sell harvested grain, as storage elevators are easy targets for Russia in the war. The USDA also expects record production from Ukraine, at 6.8 MMT. These global production changes could limit export opportunities for U.S. producers.

Given the ballooning supplies, the ending stocks-to-use ratio does not support higher future soybean prices (see Chart 1). The last time the carryout and stocks-to-use percentages were at these levels was in 2018/2019, the start of the U.S.-China trade war; the U.S. saw soybeans trade in the $8 range.

While the U.S. is currently the best-priced global supplier of soybeans, sustained demand from China is questionable long term.

The Dragon’s Bite on Soybeans

China remains the world’s largest soybean crusher, domestic consumer and importer, but signs of an economic slowdown could lead to reduced demand. For the 2023/2024 marketing year, China accounted for 50% of U.S. soybean exports, down more than 20% YOY. While the U.S. is currently the best-priced global supplier of soybeans, sustained demand from China is questionable long term.

Domestic policy on green energy has a bright future and potential for increasing domestic demand for U.S.-produced grain.

China has made significant efforts to diversify its soybean suppliers, particularly through investment in Brazil. This highlights the importance of developing domestic demand outlets for U.S. soybeans, such as by increasing crush to use soybean oil as a primary feedstock for renewable diesel and diversifying other global export opportunities beyond China.

Green Dreams to Policy Nightmares

Domestic policy on green energy has a bright future and potential for increasing domestic demand for U.S.-produced grain. The situation is fluid and dynamic, presenting both risk and reward to U.S. grain producers.

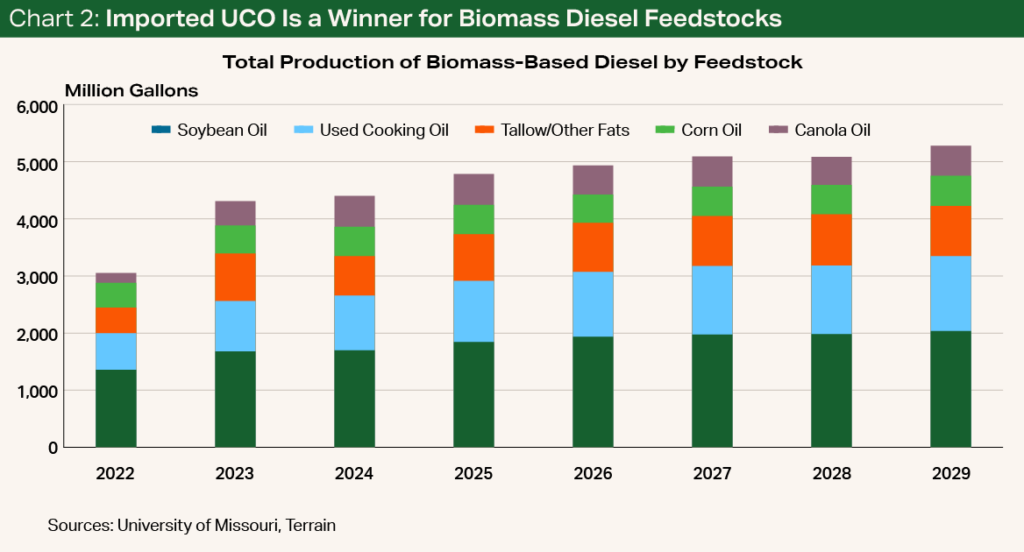

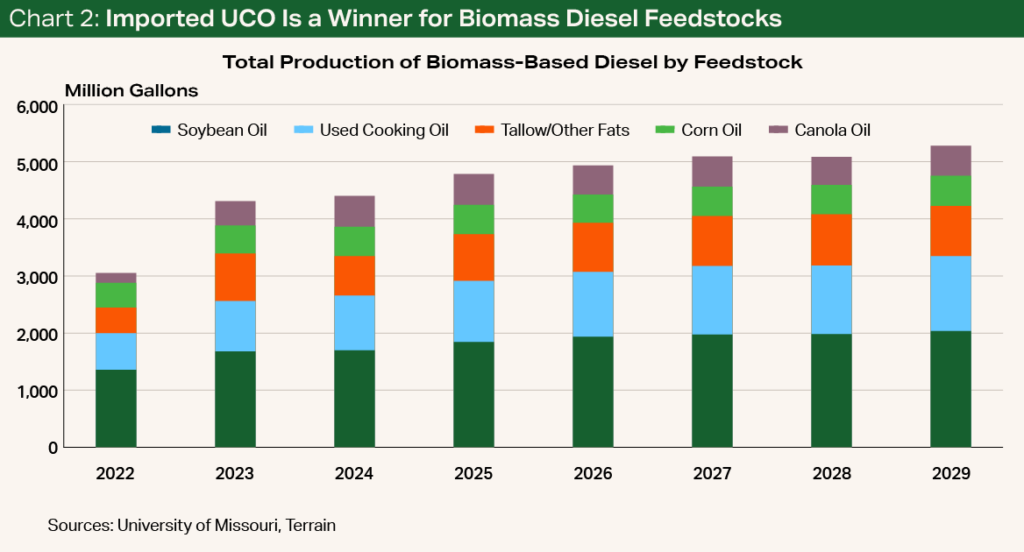

California, the nation’s largest renewable diesel consumer, has recently proposed revisions to regulations that would cap the use of seed oils (canola and soybeans) as a feedstock in renewable diesel production to 20%. If this proposal is realized, this will further incentivize an increased reliance on used cooking oil (UCO), or fraudulent palm oil, jeopardizing the U.S. soybean oil market.

Chart 2 shows how the feedstock usage has changed in the recent past and the future estimate market share breakdown. Starting next year and during the next five years, UCO is expected to have a compound annual growth rate of 4%, double that of soybean oil used as a feedstock for domestic renewable diesel production. A November 4 hearing on these proposed changes could significantly impact the industry.

Relying solely on exports to rally prices long term will not be a viable strategy.

Bottom Line

Given these challenges, farmers must stay informed on evolving domestic policy and global market dynamics. Relying solely on exports to rally prices long term will not be a viable strategy. Instead, the U.S. needs domestic demand solutions with renewable energy. Although biomass diesel demand is dependent on government policy and regulation, farmers’ agility in responding to market changes and employing risk management strategies will be essential to capitalize on opportunities going forward.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.