2024 is shaping up to be a remarkable year for dairy profitability. After a spiritless start, an early-spring surge in prices seemed too good to last. But prices have continued to climb. Making matters better, there’s an abundance of feed helping to improve margins through lower costs, and an ongoing shortage of beef cattle providing strong, nonmilk revenue streams.

Can this strength continue into Q4? Class III and Class IV milk price futures think so. Milk prices are still shy of the peaks seen in 2022, but milk/feed margins are already significantly better.

Can this strength continue into Q4? Class III and Class IV milk price futures think so.

The foundation of the price strength is a tight supply of raw milk, and that doesn’t appear poised to change soon. Markets are sending clear price signals that more milk is needed, but barriers to expansion that range from biological to economic remain. Replacement inventories are low, and the incentives to breed to beef semen for a quick $1,000 on a day-old calf are still too good to pass up. It will take time to rebuild the herd.

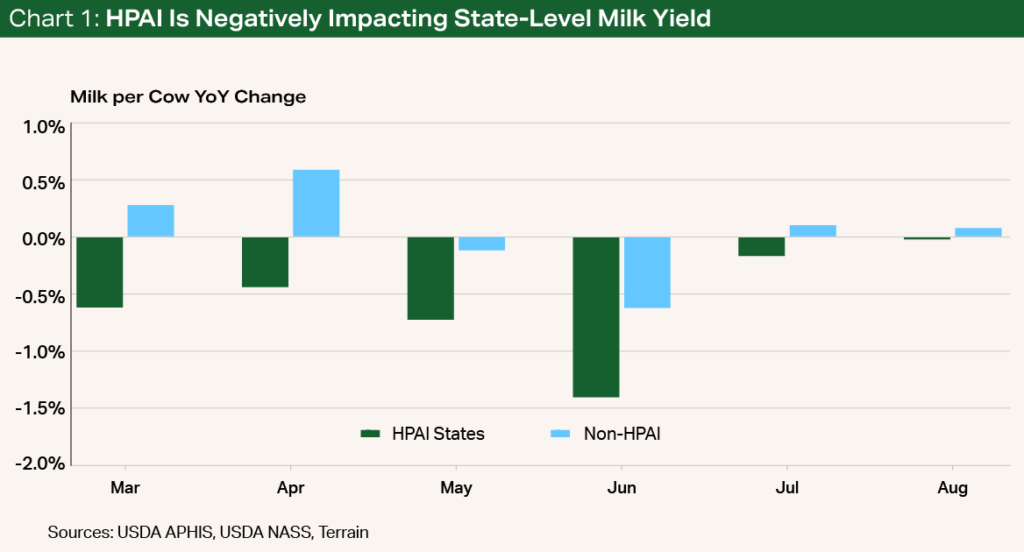

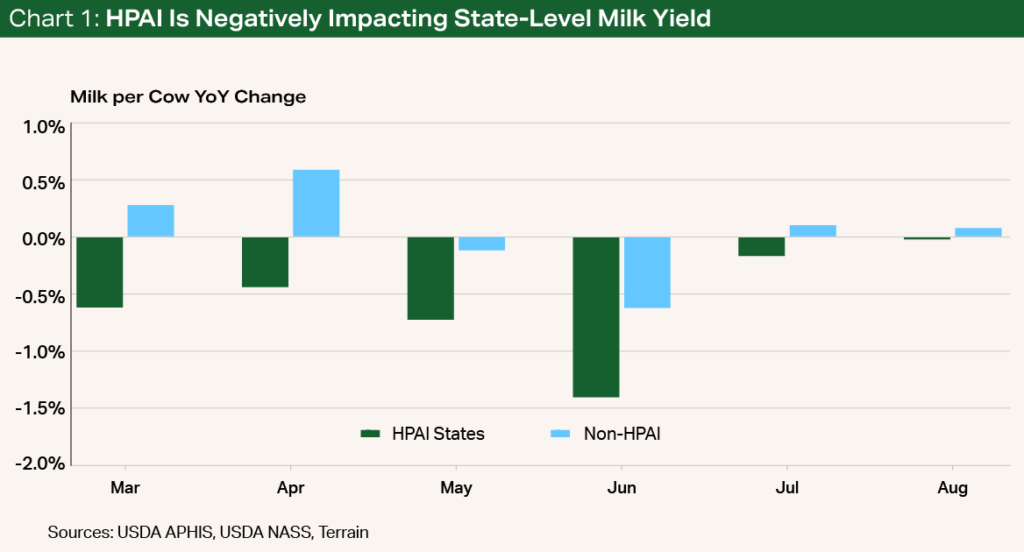

Adding to the milk supply constraints, avian influenza (HPAI) is spreading rapidly through California’s dairies. This could have a temporary but measurable impact on statewide production. With nearly 200 confirmed cases in the U.S. and six months of data where milk production can be compared with the number of cases, a negative correlation is beginning to emerge that suggests states with more cases of HPAI experience lower milk per cow yield (see Chart 1).

The foundation of the price strength is a tight supply of raw milk, and that doesn’t appear poised to change soon.

August milk production data showed a stronger average U.S. yield than many anticipated, up 8 pounds per cow compared with last year. But the number of herds with confirmed cases of HPAI was the lowest since it began to appear in March. The same will not be true in September.

Adding to the milk supply constraints, avian influenza (HPAI) is spreading rapidly through California’s dairies.

In the previous Quarterly Outlook, I questioned if the export strength was too good to last and whether we would price ourselves out of global markets. Not yet apparently.

Despite U.S. cheese prices climbing above our global competitors’ prices, exports continue to impress. In July, cheese exports increased by 7.8 million pounds (9.6%) from last year, representing the largest export quantity on record for the month of July.

Despite U.S. cheese prices climbing above our global competitors’ prices, exports continue to impress.

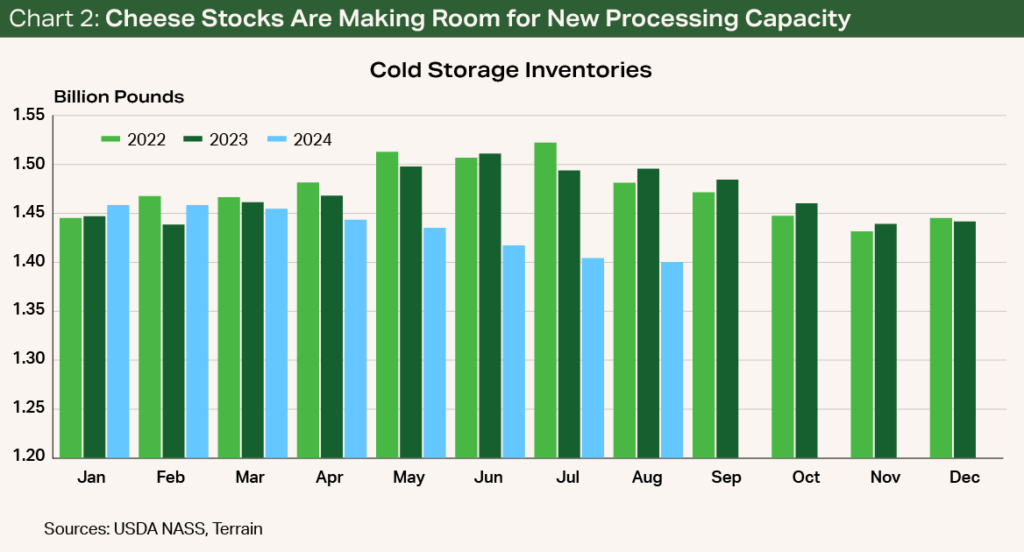

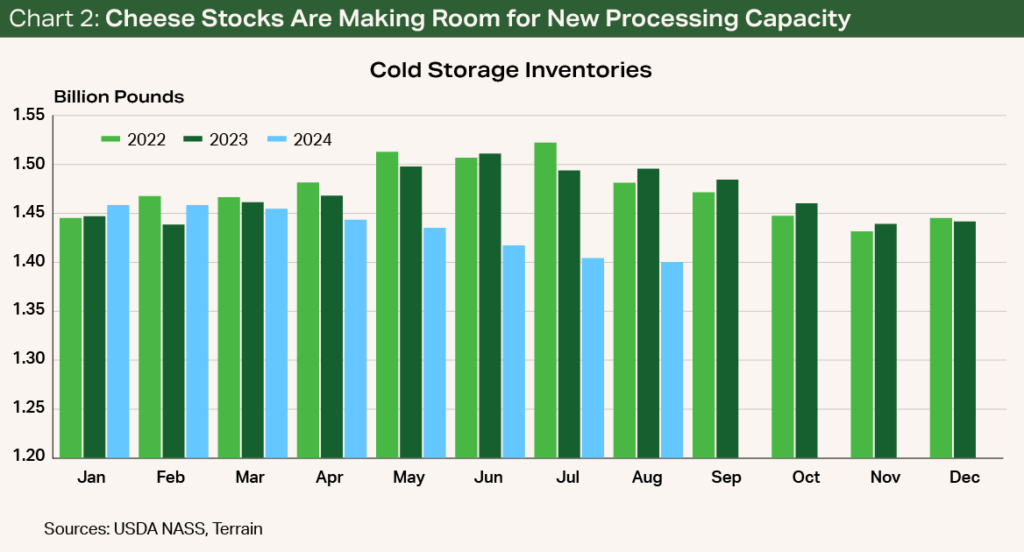

Total cheese production in the first half of this year was in line with the levels of the past two years; however, this year the combination of strong exports and stable domestic demand has eaten away at stocks. As of the end of August, cheese inventories in cold storage sit 6% below the same time last year, a shortfall of 95 million pounds (see Chart 2). There is a significant amount of cheese processing capacity on the way in the coming months, but the inventory drawdown suggests that the market has room to absorb some additional cheese.

Butter prices in the U.S. have fallen sharply from their peak near $3.20/lb. to below $2.80/lb. at the time of writing. Butter stocks in cold storage have been above 2023 levels since February and ended August 11% higher than in 2023. The market appears to be comfortable, with butter availability heading into the high-demand fall season.

If milk prices do decline from their current levels, lower feed costs will help soften the blow to margins.

Strong milk check prices seem increasingly likely to stick around for now. If milk prices do decline from their current levels, lower feed costs will help soften the blow to margins. As we begin looking ahead to next year, there will be more weight on cheese and Class III milk prices as new plants come on line. But, with milk supplies still constrained, demand from cheese plants for farm milk could lead to shortages of milk available to butter and powder plants, ultimately supporting Class IV prices.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.