Quarterly Outlook • March 25, 2025

Why There Will Be Fewer Processing Tomato Acres in 2025

High interest rates make the prospect of holding more inventory more costly, leading to lower contracted tonnage.

Situation

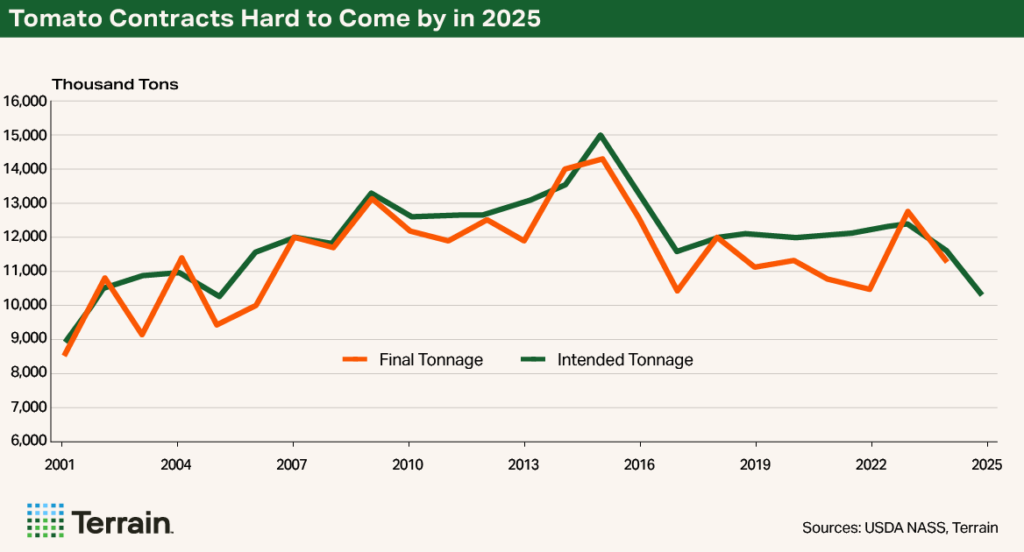

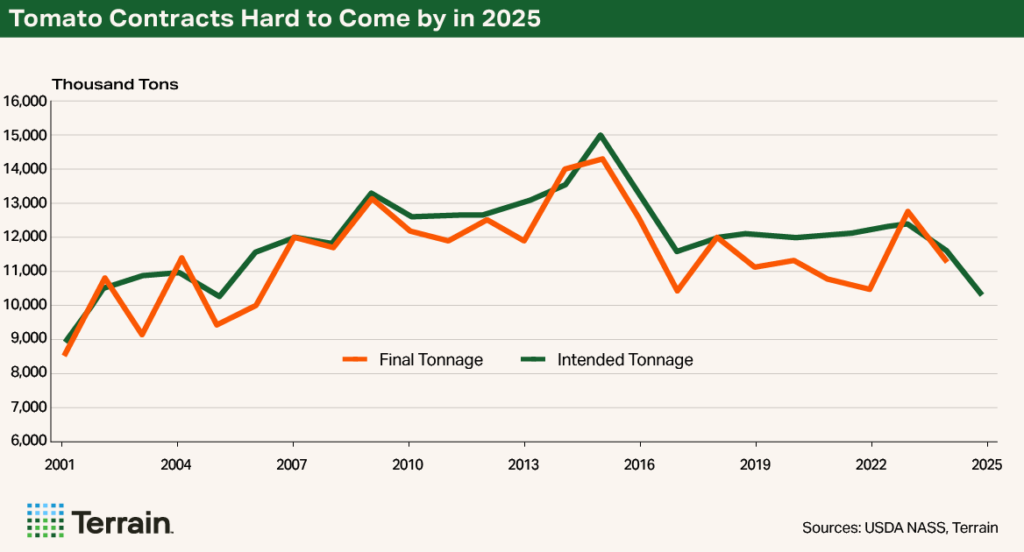

The first report released each year for California’s processing tomato market is the intended production report, which shows the number of contracts processors have or will have each year. This year’s report shows contracted tonnage of about 10.2 million tons, the lowest number since 2001. The decline can be attributed primarily to higher inventory levels, which are due to the big production years in 2023 and 2024 next to normalizing consumption.

While the industry has held large levels of inventory in the past, high interest rates make the prospect of holding more inventory more costly, leading to lower contracted tonnage.

Behind the Numbers

While the pandemic resulted in record-low pricing in some California crops like almonds and walnuts, tomato paste prices more than doubled. Higher prices at the processor level led to higher prices at the grower level, which saw its highest nominal price on record of $138 per ton in 2023, a stark increase from the approximately $75 per ton from just a few years prior. Higher pricing can be attributed to stronger demand spurred by the pandemic at a time when supply was low, a development discussed in a previous Terrain report.

Despite higher prices for farmers and processors, the USDA's latest report shows a contracted tonnage of just 10.2 million tons of processing tomatoes. The USDA assumption of an average yield of 51 tons/ac. implies 200,000 planted acres. This equates to the fewest number of acres since the 1970s. Though it’s true that fewer acres could increase yield as more marginal fields go to other uses, it’s quite possible that total production comes in below the USDA estimate given that average yields tend to come in under 51 tons/ac.

The smaller contracted tonnage may seem unusual, considering economic principles suggest higher prices should increase supply, but analysis of inventory data from the California League of Food Producers provides insight. After almost a decade of declining stocks, inventory levels began increasing significantly in mid-2023. The most recent inventory number (averaged due to seasonality) is roughly 50% higher than its 2023 trough.

Increasing inventory has occurred due to larger production in the last two years combined with normalizing demand (coming back down from a COVID-related demand spike). The 2023 crop of 12.8 million tons, the largest since 2015, for example, was enough to immediately reverse the 2017 to 2023 inventory decline. Though the 2024 crop wasn’t especially large, it continued to put upward pressure on inventory. Now monthly disappearance data are below pre-pandemic levels. All factors combined have led to higher stocks.

Growing demand to eat away at the large stocks is challenging given the already-high per capita consumption in North America and global competition and the strong dollar limiting export opportunities for California tomato paste.

The industry isn’t letting inventories pile up like it has in the past. The record levels of production and stocks in the mid-2010s reduced paste prices and grower prices, hurting everyone in the industry. Perhaps the industry has learned from recent history. Or, a more compelling reason is that higher interest rates have made holding inventory expensive, enforcing discipline on the industry to avoid overcapacity.

Total processing tomato production coming out of California will be significantly lower than it’s been in decades.

Outlook

Given the USDA report, we can be confident that total processing tomato production coming out of California will be significantly lower than it’s been in decades. Though this may seem unusual given the strong demand-supply ratio the industry has seen in recent years, it’s best thought of as the industry normalizing from its pandemic peaks.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.