Background

The U.S. wheat industry is stuck at “average.” Relative to the 15-year average:

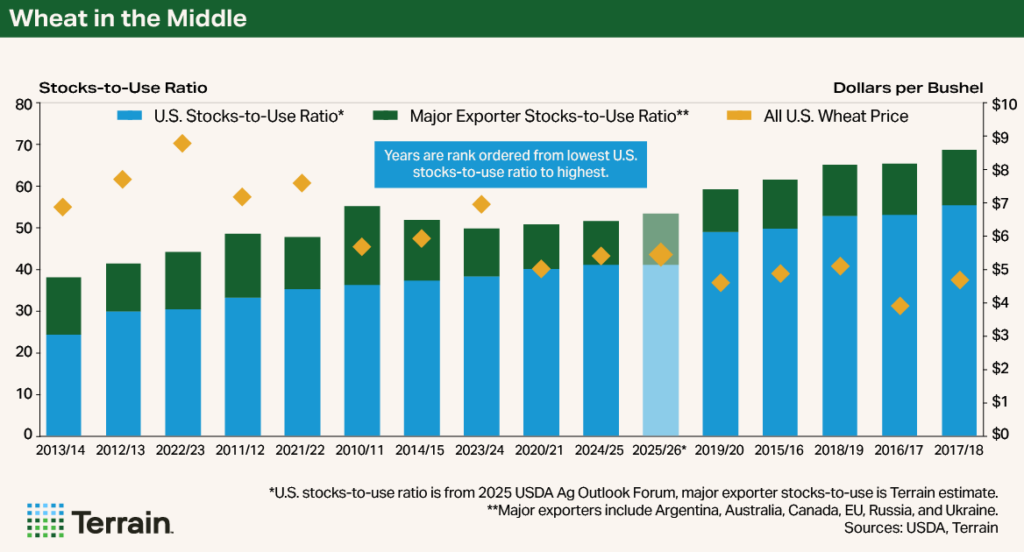

- The old-crop 2024/25 U.S. stocks-to-use ratio is only 2% higher

- The amount of winter wheat that is in drought is near average

- The USDA’s annual Agricultural Outlook Forum estimated total production for the new 2025/26 crop about 1.7% lower at 1.926 billion bushels

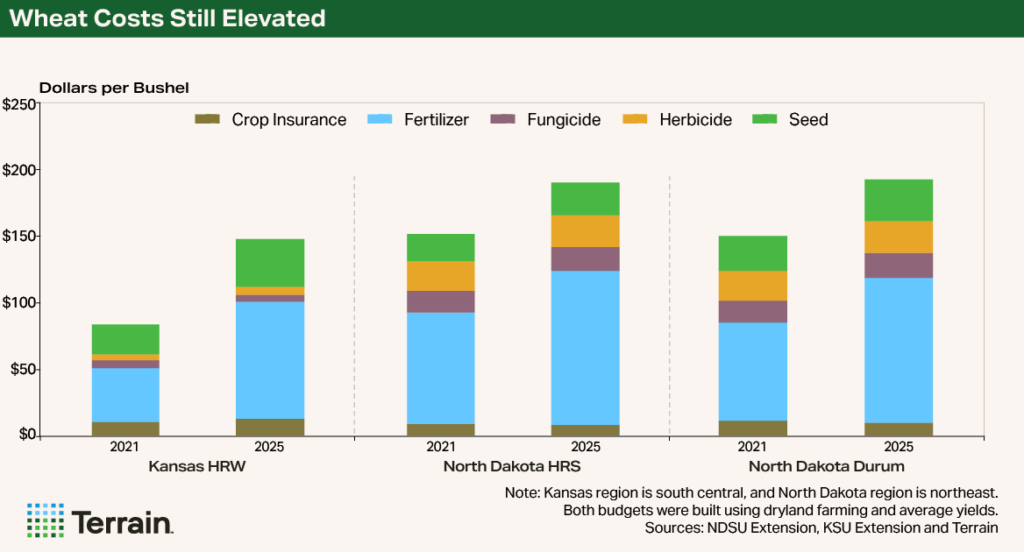

The key input costs of growing wheat remain elevated.

On the other hand, the USDA’s estimated all-wheat price for the 2024/25 and 2025/26 crops is $5.50/bu., which is more than 8% below the 15-year average of $6.01/bu.

The key input costs of growing wheat remain elevated. For example, North Dakota State University expects crop insurance, fertilizer, fungicide, herbicide and seed costs to increase by 4% for hard red spring wheat and 2% for durum. The 2025 estimate costs are 26% and 29% above 2021 costs, respectively.

Wheat needs some market mover to help new-crop prices reach profitability levels.

Production costs for Kansas hard red winter wheat are expected to decline about 3% from year-ago levels, providing a little relief. However, estimated 2025 costs are 77% higher than in 2021.

Current production estimates at today’s prices with today’s input costs will leave thin margins for the second consecutive year. Wheat needs some market mover to help new-crop prices reach profitability levels.

Outlook

The futures market is pricing in limited upside. For example, on March 12, the day after the World Agricultural Supply and Demand Estimates (WASDE) release, the July Kansas City hard red winter wheat contract traded only 5% above the 2025 low and 10% below the 2025 high. Likewise, the September Minneapolis hard red spring wheat contract traded only 2% above the contract low and 9% below the 2025 contract high.

Domestic use of wheat is unlikely to significantly increase without further price deterioration.

The chief limiting factor to the upside is the heavy U.S. stocks-to-use ratio. At the Agricultural Outlook Forum, the USDA estimated the new-crop 2025/26 stocks-to-use ratio at 41.2, slightly above year-ago levels and the highest since 2019/20.

Domestic use of wheat is unlikely to significantly increase without further price deterioration. The Agricultural Outlook Forum’s new-crop estimate is already 2.6% above the 10-year average and is tied with the previous year as the largest usage since 2016/17. To significantly improve the food or feed outlook, the price of wheat would likely need to fall further.

That leaves the export market as a possible area for improvement. The USDA estimates old-crop, 2024/25 marketing year exports will increase about 18% from a year ago. The increase in exports is due to historically tight stocks-to-use ratios of major export competitors.

Importantly, ending stocks of major export competitors heading into the 2025/26 crop year are the seventh lowest in 25 years. I estimate the stocks-to-use ratio of our major export competitors for the new 2025/26 crop to be slightly higher than last year but still in the bottom quartile of the last 25 years.

Given the tighter stocks-to-use ratio, there could be some positive momentum for exports.

Given the tighter stocks-to-use ratio, there could be some positive momentum for exports. I calculate that only a 3% increase in the USDA’s export expectation could push the all-wheat price just above $6/bu.

For the wheat farmer with unpriced bushels, old crop or new crop, this means that the waiting game is probably here to stay. However, “waiting” does not equate to “inactivity” in marketing. Rather, it is likely that this marketing season will again be a year of constantly updating break-even projections, the amount of projected unpriced bushels, and monitoring the market for opportunities.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.