Tight U.S. hard red winter (HRW) wheat inventory will provide support for attractive harvest prices, but global wheat exporters such as Russia, the EU and Australia will continue to be a lower-cost option and will force a lid on U.S. wheat prices. HRW harvest 2023 is going to be one marked with short wheat, low yields, and a race to finish before weeds take over. If you have grain to sell, I expect harvest to meet you with cash prices ranging from $8 to $9/bu.

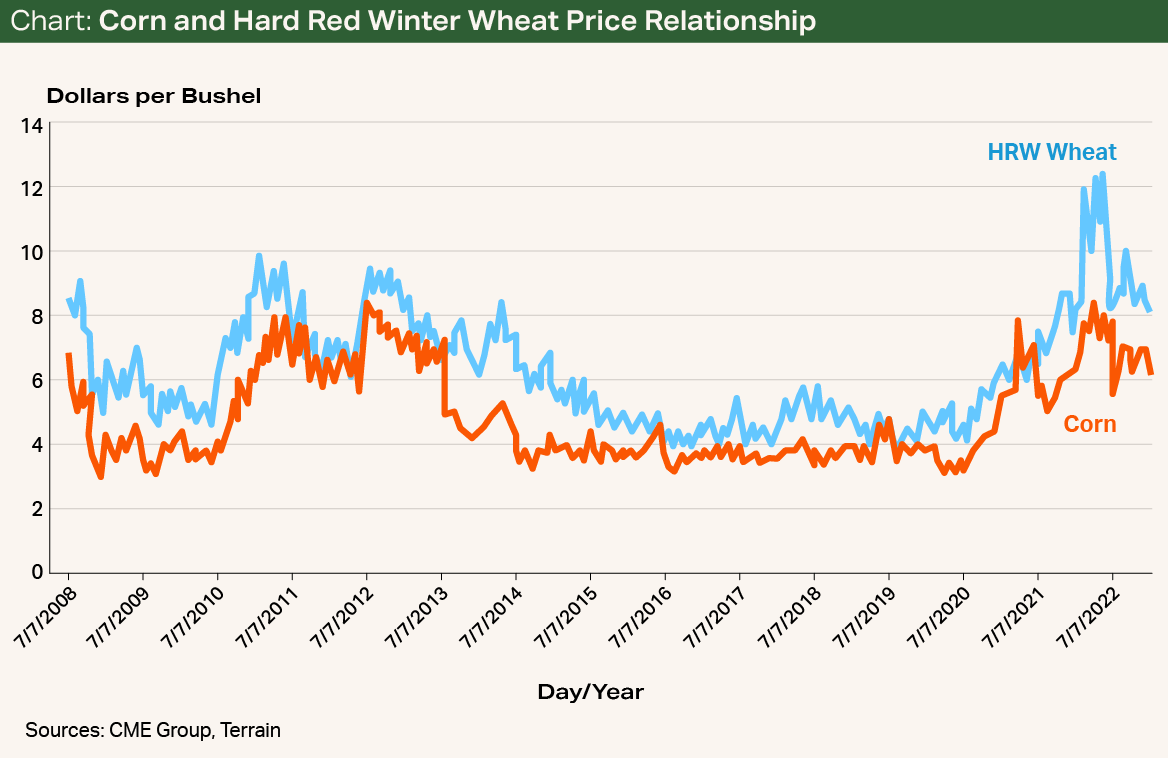

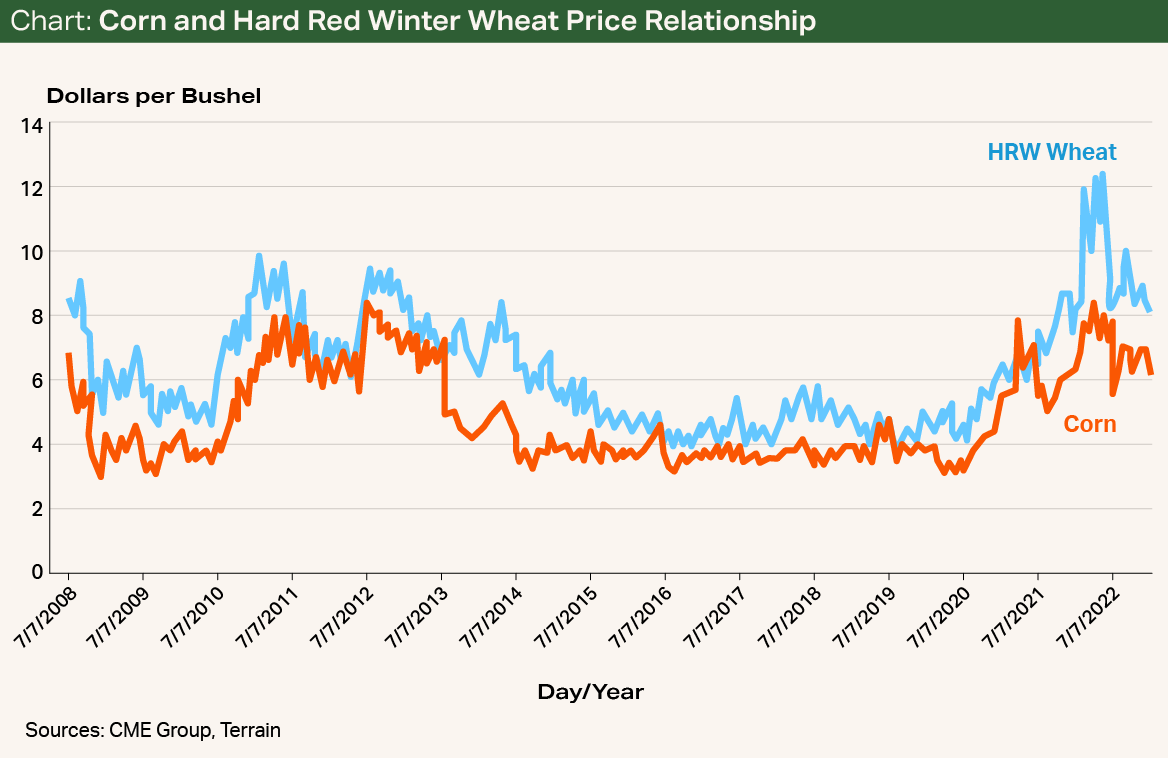

Corn is the leader of the grain complex with other grains following its moves. HRW prices are 62% correlated with corn prices over the last 15 years, which indicates a moderate correlation (see chart). On average, HRW prices are $1.60/bu. higher than corn. HRW prices are currently $2.00 over corn futures. The past 12 months have shown an even higher correlation of .72 for HRW and corn.

The corn complex is currently in a weather market. This creates volatility, which wheat can benefit from if the corn belt stays dry, but it can also cause negative price pressure if the corn belt receives adequate moisture and corn prices fall. Keep in mind, the 10-year average price for HRW is $5.89, exports are lackluster, and there isn’t much of a story for wheat demand growth.

The U.S. continues to be the residual supplier of wheat globally. U.S. wheat is over $100 per metric ton higher than that of key competitors such as Russia, Ukraine and France. The elevated wheat prices in the U.S. are driven by a supply story and not a demand story. In fact, wheat exports are at the lowest levels since 1971/1972.

The Russia-Ukraine war will continue to provide bullish tailwinds for U.S. wheat producers. On May 18, the Black Sea grain corridor was extended for an additional 60 days, but it will make headlines again soon. If the Black Sea grain corridor agreement were to dissolve, there would be selling opportunities, but overall the market has become unconcerned over recent news coming out of the Black Sea.

Looking to the 2023/2024 marketing year, June 2023 through May 2024, global wheat production and consumption are forecast to increase slightly. As El Nino sets in, the U.S. and Argentina are expected to increase production while the opposite effect takes place in Australia. The EU and Canada are also expected to increase production.

In its June Wheat Outlook, the USDA forecast Russia and Ukraine to increase production because of beneficial rainfall, but that forecast was made prior to the destruction of the Kakhovka Dam in Ukraine. The dam provides irrigation to at least half a million hectares of land in southern Ukraine. The loss of irrigation in addition to farmland below the dam that was flooded is certain to decrease production in this important wheat region.

In conclusion, wheat prices will be supported by tight supplies both domestically and globally, but poor exports and an uncompetitive U.S. wheat price will keep a lid on prices.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.