Situation

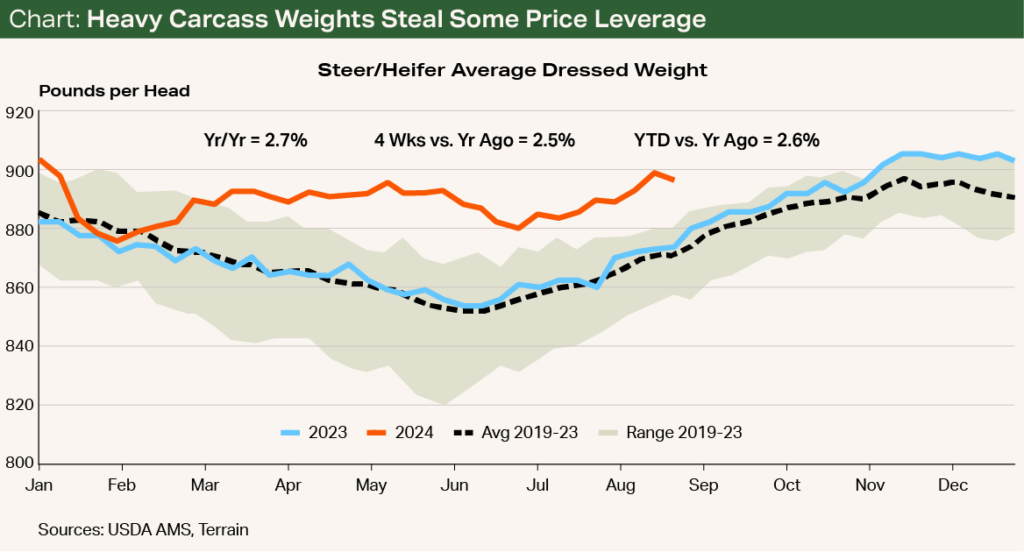

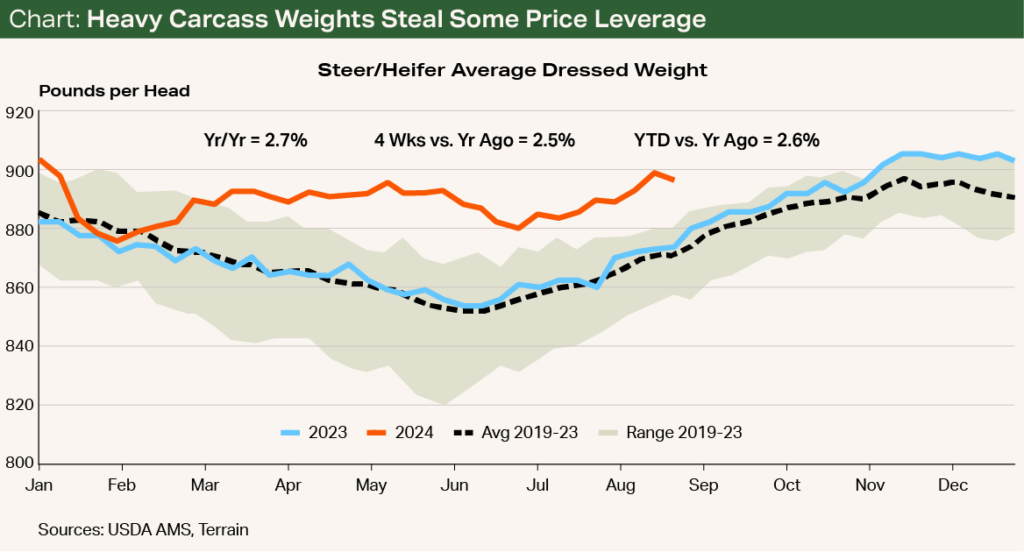

Cattle markets have been marked by ample fed cattle supplies and heavy carcass weights over the last several months. Steer and heifer slaughter is dead even with year-ago levels during June through August. Heavy fed cattle carcasses have added nearly 3% to beef production on a weekly basis and simultaneously limited cattle feeders’ bargaining position. Five-area live steer prices began and ended these same three months even with year-ago prices. I expect prices to stay stuck, as long as consumer demand for beef remains at its current level.

Herd Rebuilding Still in the Future

Summer beef cow slaughter was 19% smaller than a year earlier, supporting 90% lean trim values in record territory. Values averaged 26% above the record set a year earlier. Despite the slowdown in beef cow slaughter, the lack of heifer retention in 2022 and limited number of heifers bred to have their first calves in 2024 will likely result in a decline of 225,000 to 250,000 head (0.8% to 1%) in beef cow numbers in the USDA January 1, 2025, cattle industry estimate.

The large number of beef heifers that ranches had retained last fall but placed into feedlots this spring has bolstered fed supplies for Q4 2024 and will likely lead to further declines in the beef-cow inventory going into 2025. If significant drought arrives, expect the same again in 2026.

I expect the availability of market-ready fed cattle to progressively tighten in Q4 2024.

Prices Stuck

I expect the availability of market-ready fed cattle to progressively tighten in Q4 2024. The number of cattle placed against and expected to be marketed in October is forecast to be 5% or 6% smaller than a year ago. I expect this transition to help the feeding industry better manage the carryover, unmarketed cattle from late summer and get them off the show lists. In doing so, the industry has a chance to get weights in check or at least slow their progression toward seasonal highs in mid-November.

I expect 5-Area fed steer prices to be stuck in the low to mid-$180s/cwt into mid-October, with a chance of trading in the upper $180s/cwt to $190/cwt by late year, depending on demand. Fed cattle price recovery will likely translate to higher feeder cattle prices as pen occupancy declines, summer yearling cattle supplies dwindle, and feed grain costs continue to decline. This could lead to some cattle placed over the next 60 to 90 days to see profits.

Lower feed grain prices, tightening yearling supplies, and any heifer calf retention will support prices.

I expect the CME feeder index to spend a large part of Q4 2024 in the $245/cwt to $255/cwt range. Oklahoma City 500-pound calf prices are likely to stay in the $300/cwt to $320/cwt range as seasonal calf-run supply pressure mounts. Lower feed grain prices, tightening yearling supplies, and any heifer calf retention will support prices.

Combined with the loss of feeder leverage, the additional pounds explain a good share of the weakness in the market.

The Challenges Ahead

Fed cattle carcass weights remain elevated at 25 pounds above a year earlier, on average, from the beginning of June to August. The extra 25 pounds of carcass weight per head equates to an additional 12.4 million pounds of beef produced on a weekly basis — the beef tonnage equivalent of slaughtering an extra 13,800 head of fed cattle per week.

The 12.4 million pounds per week of extra beef on the market lowers expected fed cattle prices by $4/cwt to $5/cwt. Combined with the loss of feeder leverage, the additional pounds explain a good share of the weakness in the market (see Chart).

My thinking has transitioned to looking at 2024 as more of the normal trend instead of years like 2022 and 2023 with high grain prices and winter weather-constrained weights. Packers aren’t likely to move maximum carcass limits lower (most are at 1,100 pounds) during the next year or two; tighter fed supplies will limit daily slaughter volumes, and pounds per head will be even more important to packers when trying to spread fixed costs.

Long gone are the days of marketing cattle when feed intakes decline, average daily weight gains diminish, and cost of gain increases at an alarming rate.

The same principle applies to feed yards. A feed yard manager will be inclined to just keep feeding the animal he already owns when pen occupancy declines, feed prices are declining, marketed cattle aren’t making a ton of money, and the swap on feeder cattle isn’t signaling to flush inventory and try again.

Long gone are the days of marketing cattle when feed intakes decline, average daily weight gains diminish, and cost of gain increases at an alarming rate. Chasing quality grade and getting more cattle in the pen to grade Prime or make it into an upper two-thirds Choice branded program is the driver. The only limit is how many discounts for yield grade 4 and 5 cattle an owner is willing to stand.

Quality is the clear driver in consumers’ decisions. Producers must remain vigilant in catering to these consumer expectations.

Speaking of Quality…

Quality continues to drive beef demand. July all-fresh retail prices were record high at $8.15/lb. and up 4.6% versus a year earlier. Our last computations of real per capita spending by species still show that beef is the clear winner when consumers make center-of-the-plate protein selections.

- So far in 2024, the all-fresh beef demand index is up about 4% year over year (YOY) and all-fresh real (deflated) per capita expenditures (RPCE) are up 4.5% on a year-to-date (YTD) basis.

- Conversely, chicken spending during 2024 is down 3.5% YTD and losing ground, as the July 2024 chicken RPCE total was down 5.9% versus a year earlier.

- The pork RPCE spent January through April in negative territory but averaged nearly 4% growth from May through July, narrowing the YOY gap to -1%.

Quality is the clear driver in consumers’ decisions. Producers must remain vigilant in catering to these consumer expectations. Macroeconomic headwinds are of concern, but consumers haven’t traded down en masse to cheaper proteins.

Macroeconomic headwinds are of concern, but consumers haven’t traded down en masse to cheaper proteins.

The Federal Reserve cut interest rates by 0.5% at the end of September and appears poised to continue lowering the fed funds rate in the coming months. This action is expected to bolster consumer sentiment and will likely help beef demand.

If prolonged, the longshoremen strike that began October 1 at 14 East and Gulf Coast ports could cause significant disruption to container shipments of U.S. meat exports through these facilities. Chicken export tonnage — followed by pork and then beef — is at risk of being delayed or canceled, leading to additional volumes that will need to clear domestic channels.

From an import volume perspective, beef imports of 90% lean trim from Australia and New Zealand could be delayed and would be difficult to reroute. I expect the shortfall of supplies of this critical component of ground beef production to bolster domestic cull cow and cow-sourced 90% lean trimmings prices as well as prices for other trimmings categories and chuck and round primals. However, prices for fed cattle slaughter-sourced 50% lean trimmings could see significant downward pressure due to reduced supplies of leaner trimmings that are used for blending in order to create a salable product.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.