Quarterly Outlook • December 19, 2024

Walnut Prices Likely to Remain Elevated Into Early 2025

Situation

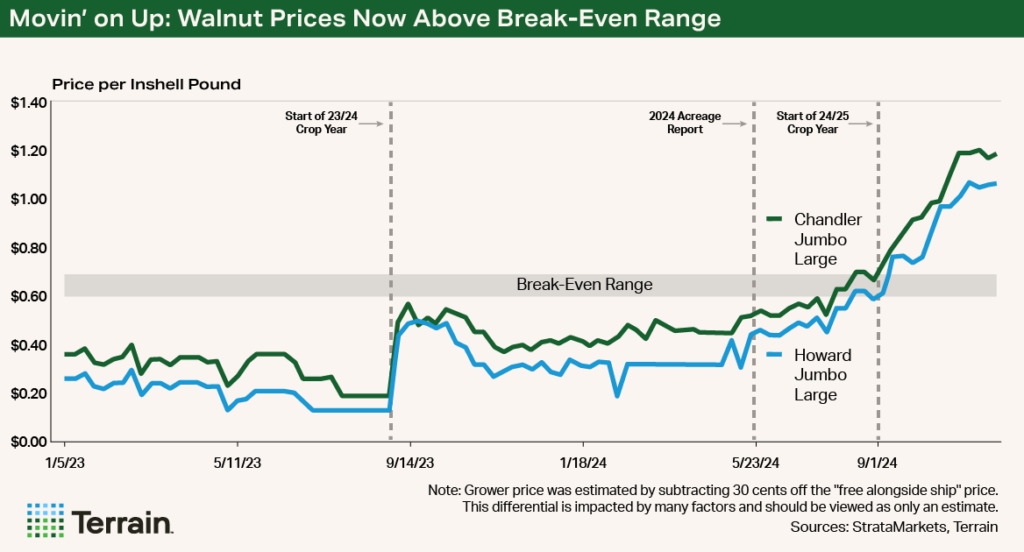

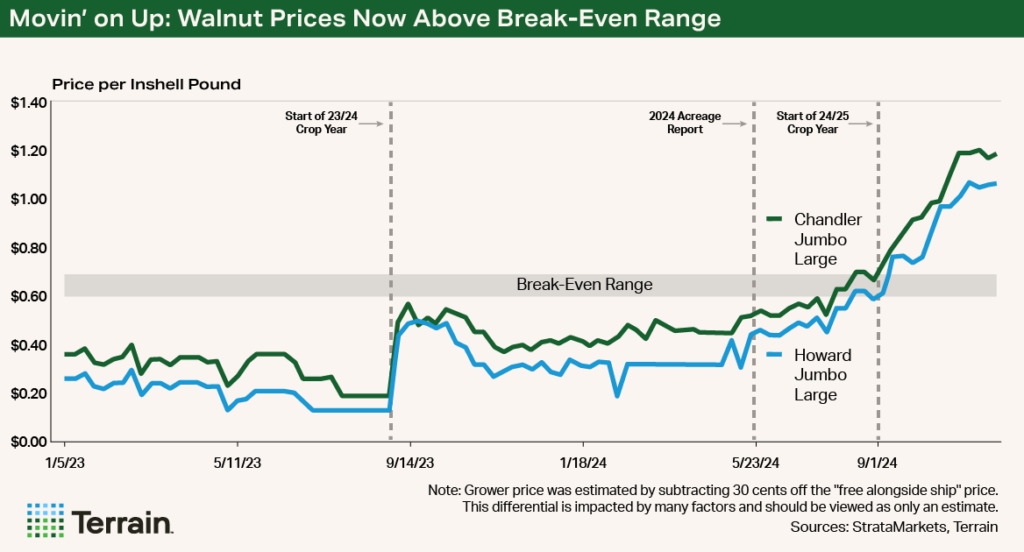

After some of the most challenging years the industry has ever faced, California walnut growers have seen an impressive rebound in prices. The upswing is a result of tighter inventories, high quality on the 2023 and 2024 crops, and reduced production at home and abroad. Looking forward, prices are likely to remain elevated going into the first quarter of 2025.

Industry Moves Past Some Recent Challenges

Walnuts have faced significant challenges in recent years. Shipping constraints led to a large inventory buildup as the industry increased production; carry-in reached 141,000 inshell tons, more than double the typical value before the pandemic. To make matters worse, tariffs, an appreciated dollar, heightened economic uncertainty, and quality problems with the 2022 crop added to the industry’s challenges. All these factors together dropped the walnut price to 30 cents/lb. in 2022, the lowest since 1987, while production costs continued to rise with inflation.

Short-term obstacles have been made worse by structural, long-term ones.

On the demand side, growth in domestic consumption has not been as impressive as it has been among other nut crops.

On the supply side, competition has increased. California growers once produced over 60% of global production but now produce only 25%, according to the USDA. This is mostly due to China becoming the dominant player in the industry, and Chile competing with the same varieties we grow in the U.S. On top of that, both competitors have grown their exports significantly, chipping away at California’s export numbers. See this Terrain report for a more in-depth discussion on these topics.

Typically, cumulative shipments end around 640,000 inshell tons, but the industry shipped nearly 840,000 inshell tons this past crop year.

All the temporary, short-term obstacles combined with the structural, long-term ones forced profitability to take a dive, with growers losing anywhere from $500 to $1,500 per acre in 2022. As a result, many walnut acres have been removed. From September 2023 to August 2024, growers in the Golden State have removed approximately 18,000 acres with nearly 10,000 more acres under high stress and abandoned. While this is a slowdown from the previous year, this is still a high removal rate, continuing the decline in producing bearing acres, which now stand at 370,000 acres.

Recently, however, many of the industry’s short-term issues have been resolved. The walnut carry-in has been reduced to 95,000 inshell tons as we move into the 2024/2025 crop year. This smaller carry-in is attributed to record shipments in the 2023/2024 season. Typically, cumulative shipments end around 640,000 inshell tons, but the industry shipped nearly 840,000 inshell tons this past crop year, partially due to a short crop from Chile and expectations for a smaller 2024 California crop.

The shift in market dynamics has been sizable enough that the price has risen steadily for nearly a year.

The shift in market dynamics has been sizable enough that the price has risen steadily for nearly a year. The high quality of the 2023 crop put immediate upward pressure on the price, along with the 2024 USDA acreage report showing a drop in producing acreage. Prices climbed higher once again as we entered the 2024/2025 crop year, which coincided with the USDA’s objective crop estimate of 670,000 inshell tons, a nearly 20% drop from last year’s crop of about 824,000.

All indications point to a return for the 2024 crop that is much higher than what it’s been in the last few years and above breakeven for many.

Outlook

Moving into the new year, my expectation is that we see the walnut industry continue to benefit from the short-run tailwinds. Though the size of China’s and Chile’s crops could push California growers’ returns downward once again, Chile won’t begin harvest until March and there are still buyer concerns about the quality of China’s product. Furthermore, it appears that California handlers are having no trouble selling this year’s crop.

All indications point to a return for the 2024 crop that is much higher than what it’s been in the last few years and above breakeven for many. This will prove to be a much-needed improvement to growers’ bottom lines for growers who can yield.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.