The wine market’s malaise appears to have both deepened and broadened in early 2023. U.S. wine sales are declining at a slightly faster rate — and the contraction now extends to nearly all sales channels, price tiers and varietals.

Looking ahead, wine sales may see a slower decline during the second half of the year if inflation continues to slow and the U.S. avoids a recession, but a return to outright growth in sales volume appears to be unlikely.

Situation

Off-premise retail sales through May 6 were off 6% in volume terms versus the same period last year, and fell by 2% in value, based on my analysis of NielsonIQ data. This compares to a 5% drop in volume in 2022 compared to the year prior.

SipSource data, which also includes the on-premise channel, indicates that distributor depletions fell by 8% during the first four months of the year — slightly worse than the 6% decline registered in 2022. On-premise depletions, which bolstered the market last year, are down marginally year to date.

Three-tier sales volumes are falling across the price spectrum. The upper end of the market ($30+) is contracting at the fastest rate, while the middle is holding up a bit better than the low end. While sales of both red and white varietals are declining, white wines, led by Pinot Gris and Sauvignon Blanc, are outperforming across all price segments. High-end sparkling wine sales have softened, and the rosé category continues to plummet.

The direct-to-consumer (DtC) sales channel does not appear to be faring any better. DtC shipments, as measured by Wines Vines Analytics / Sovos ShipCompliant, dropped 7% in volume terms and 2% by value during the first four months of 2023 from year-ago levels. Shipments by California wineries fell 9% by volume and 3% in value. The state’s three most important DtC regions — Napa, Sonoma and the Central Coast — each saw declines in their shipment volume.

Finally, I’ll note that none of the data sets referenced above can be considered definitive. Each covers just a slice of the broader market. Even so, the fact that they are all telling a similar story lends confidence that the broad contours of the story are accurate.

Is This the New Normal for Wine?

With each passing month, it becomes harder to characterize slumping wine sales as simply a post-pandemic normalization. True, wine sales did surge during the pandemic. And a correction was inevitable.

However, the correction appears to have already been accomplished, as several data points suggest that case sales had slipped back to their pre-pandemic level by year-end 2022. If this were the only issue, sales should now be beginning to stabilize. Unfortunately, this is not the case. It looks like the decline has intensified a bit in early 2023 rather than abated.

Inflation and economic uncertainty are undoubtedly impacting wine sales. But shifting consumer attitudes toward alcohol consumption and evolving alcoholic beverage preferences may be playing a role as well. It is impossible to disentangle the impact of these economic and behavioral factors — and the new normal for wine may not become apparent until the economic situation stabilizes.

There has been relatively little change in the U.S. economy since last quarter. The economy continues to expand, albeit at a slow pace, jobs remain plentiful, and consumers are still spending (at least selectively). Inflation has gradually abated but remains stubbornly high and well above the Federal Reserve’s 2% target.

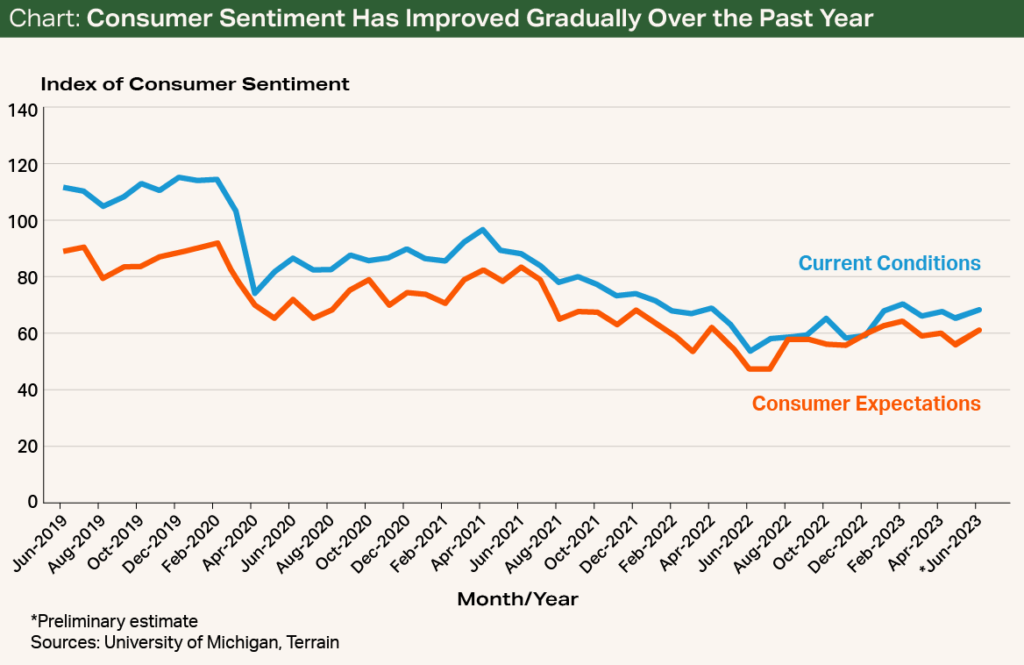

There have been a few positive developments. Consumer sentiment has improved a touch as inflation has subsided, though it remains very weak by historical standards (see chart). Housing prices have stabilized, and the stock market has rebounded. The banking and debt ceiling crises have diminished (at least temporarily). Thus, there could be further improvement in sentiment and the soft-landing scenario looks a bit more plausible now than it did three months ago.

Nonetheless, economic uncertainty remains heightened and downside risks elevated.

Given the uncertain outlook and challenges in separating the economic and behavioral drivers of the wine market’s slump, the near-term trajectory of the wine market remains ambiguous. If inflation continues to slow and the U.S. economy avoids a recession, we could see improvement in wine demand during the back half of 2023, particularly in the premium and luxury wine segments. By this I mean that sales may decline at a slower rate, as even under this optimistic economic scenario, a return to outright growth in sales volume looks improbable.

Prospects for the DtC channel may be brighter as leisure travel is expected to rise this summer.

Buyers Have the Upper Hand in the Grape Market

With retail wine sales declining across nearly all segments of the market and little clarity about the size of the 2023 crop, it’s not surprising that grape-buying activity in California has been slow. Nonetheless, buyers have clearly gained the upper hand over sellers at this point, driving softer prices in some areas of the market. That said, pockets of strength do still exist, though these seem to have become fewer.

The grape crop is running two to four weeks behind schedule due to the heavy winter rains and a cool, cloudy spring in California, so it is still too early to make a firm prediction regarding how large it will be. Nonetheless, early reports suggest that this year’s crop is shaping up to be of average size, or just above average, depending on the region and varietal. The picture will become clearer over the next month or so as the fruit begins to set.

Due to the continuing deterioration in wine sales and increasing bulk wine inventories, an average-sized crop is likely to lead to some softening in grape prices. Even another small crop is not likely to stimulate as much appreciation as it did last year, while a large crop could result in a more forceful decline. In that case, some fruit may ultimately be left on the vine.

While it’s difficult to generalize in such a highly differentiated market, regions producing for the premium and particularly the upper tiers of the wine market should be better positioned to absorb a larger crop than those focused on the value end. And white varietals look to be more favorably situated than reds, given the shift in consumer demand that has taken place over the last several years.

Given the asymmetry in potential outcomes, growers with uncontracted fruit may want to jump on deals that make sense rather than to hold out for a higher price at harvest time.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.