Three Hurdles to Heifer Retention and Rebuilding

Article Originally Published in the July 2024 Issue of the National Cattlemen Magazine

By Don Close, Chief Research & Analytics Officer

In my conversations with cow/calf producers over the past year, they have voiced three primary explanations or concerns regarding the holdup in retaining heifers to start rebuilding inventory:

- Poor pasture and range conditions

- A need to restore equity in operations by selling as many calves as possible before considering rebuilding

- A lack of confidence that this rebuild will have enough longevity to make heifer retention profitable

This column addresses the first issue, which is the most critical, because if a producer doesn’t have adequate feed supply, none of the other concerns really matter.

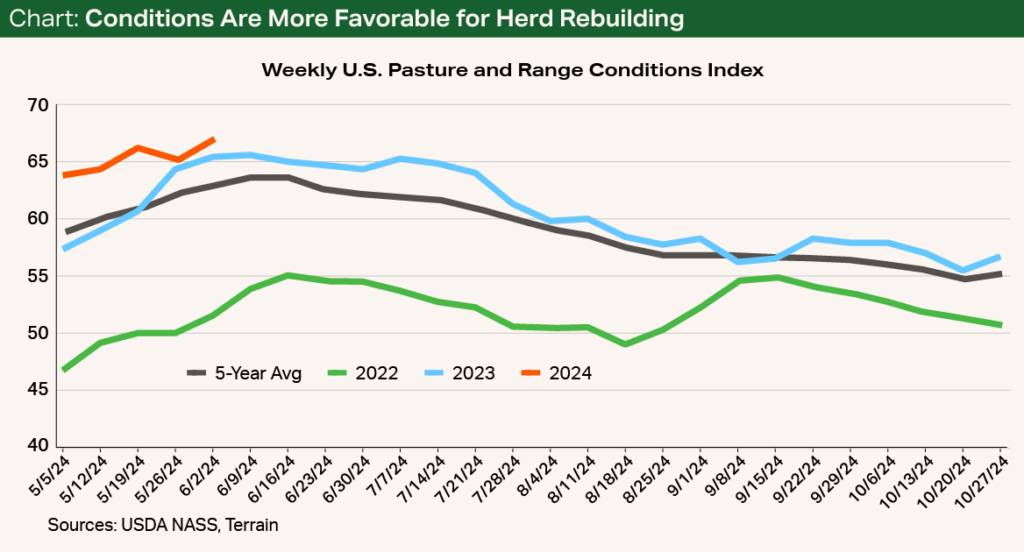

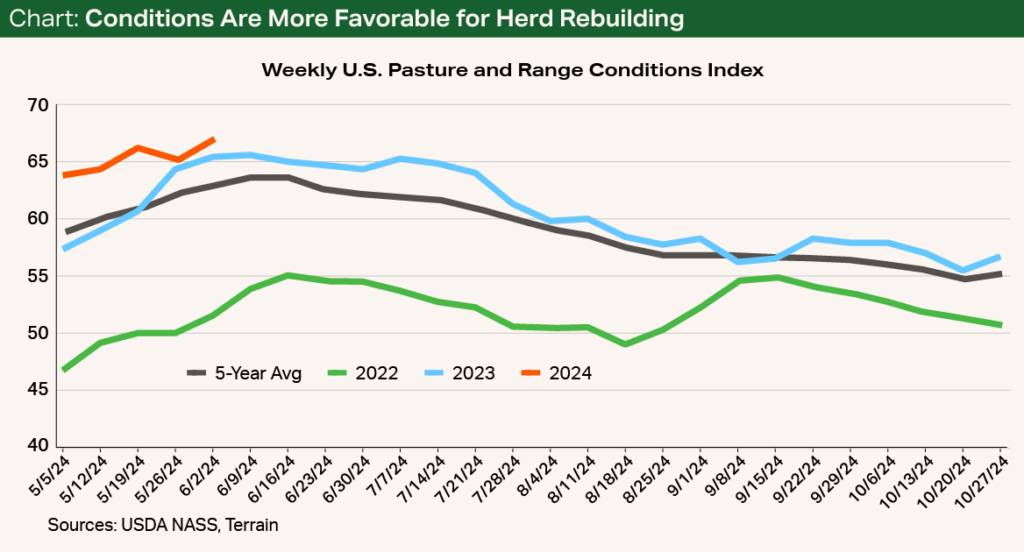

The weekly U.S. Pasture and Range Conditions Index is currently at 67 as of June 2, the highest reading for the date in years and well above the five-year average (see Chart). While current conditions have certainly improved enough across the country for heifer retention to get started, there is considerable variability among the regions.

Conditions are substantially better in the Great Plains, Southeast and corn belt. Conditions across the Southern Plains and West are currently above the five-year average, but they still trail in pasture conditions and appear to be the most vulnerable in the event of dryer than normal conditions as the season unfolds.

How Will Conditions Influence the Rebuilding Pace by Region?

While the variation between reporting regions shouldn’t be a surprise, it is important that pasture conditions start the season strong with ample soil moisture.

Meteorologist Matt Makens’ weather comments include a forecast for the conclusion of El Niño and a return of La Niña, which would escalate the risk of dry weather returning, especially for the West and Southern Plains.

My hopes are for cow/calf producers in all areas to have an exceptional year. After seven years of herd contraction and tough weather conditions, they deserve a great year.

Prices for calves and yearlings clearly show that we need more replacement cattle entering the system. However, pasture and range conditions may warrant herd rebuilding to develop at differing levels of intensity across regions. Rebuilding is likely to start across the Great Plains, corn belt and Southeast before going into full swing across the Southern Plains and West.

Are Heifers Being Retained for Expansion Purposes?

The short answer: Yes. But I do not think the numbers are significant enough on a state or national level.

Heifers as a percentage of fed cattle slaughter is a lagging indicator, so it won’t show anything until after the fact. At the end of March, heifers as a percentage of cattle on feed was at 38.5% — fractionally lower than the first of the year but well above the 36% level needed to confirm expansion ideas.

If we look at the percentage of heifers in the sale barn mix, it has remained at the high end of the historical range and well above the five-year average. While heifers as a percentage of the sale barn mix is not the strongest indicator, it fits into the broader evidence that meaningful numbers are not yet being retained.

As high as feeder cattle and calf prices have been for 2023 and 2024 year to date, we have yet to see the effect of full-blown female retention on replacement cattle prices.

Will We See the Same Rebuilding and Retention as Before?

Given the average age of cow owners, the challenges in hiring and keeping help, and the escalation in costs to run cows (especially interest rates), I am often asked if we will ever see heifer retention and the rebuilding of females like we have in the past.

The truth is that the escalation in fed cattle carcass weights and the impact on total beef production curb the total number of replacement cows needed.

Above all else, I believe in economics. Before this rally is over and there are adequate supplies of feed for all classes of cattle, the market is going to offer a carrot to producers that is so big there will be people interested in owning cows. Consumer demand for beef is so strong, the market will find a way to expand.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.