Production Forecast

- We expect both hog slaughter and pork production to be down 0.5% to 1% during Q3 2023 versus a year earlier.

- Q4 2023 slaughter and production are forecast to see slightly larger declines compared with Q3 2023 (-1.25% to -1.75% year over year), as sow slaughter increased sharply in late April and May, driven predominantly by the downsizing of sow inventories by the largest integrator in the country. Additional sow liquidation is expected for the balance of the year but will be limited by available slaughter capacity.

Price Forecast

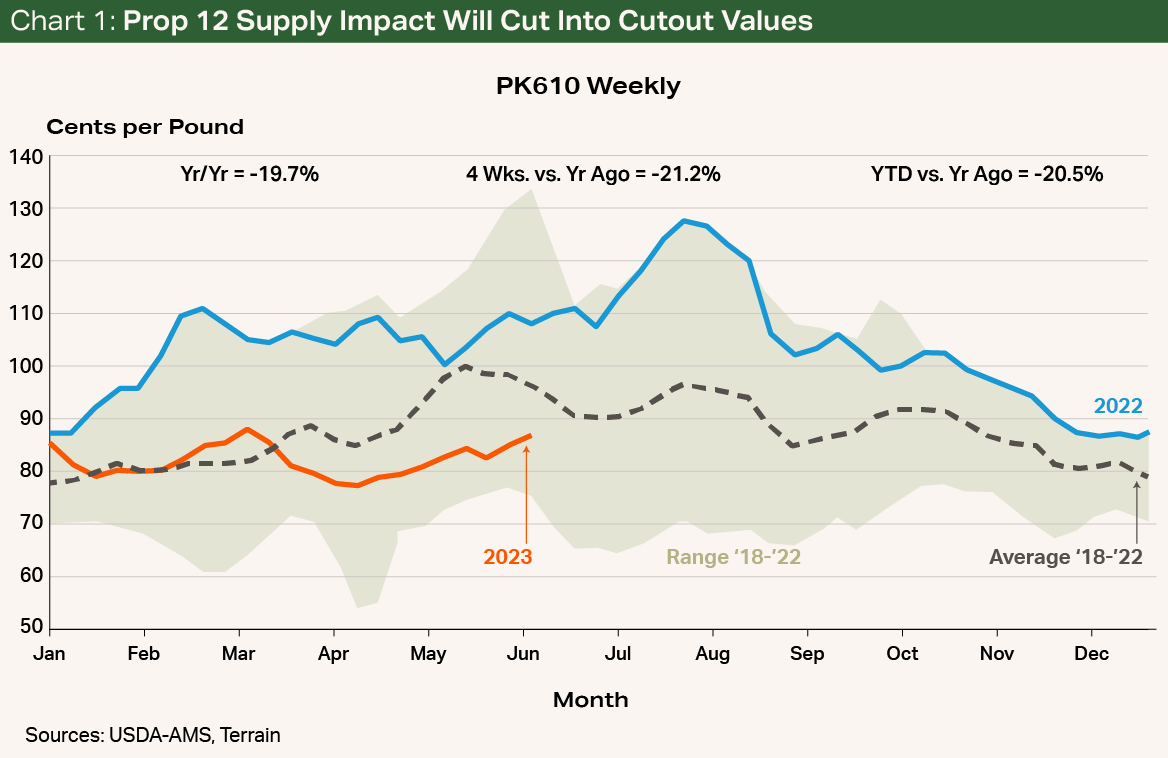

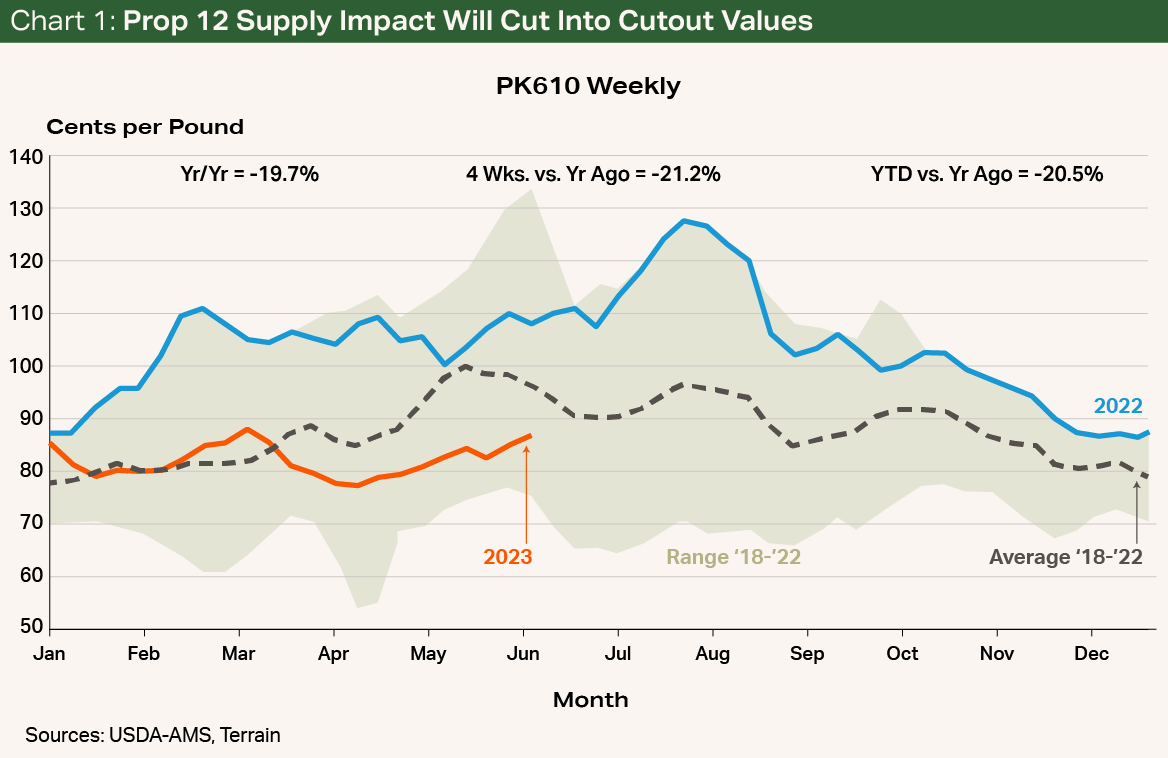

As we expected, the gradual tightening of supplies underpinned prices, resulting in a smaller-than-seasonal rally in cutout values and near-seasonal rally in hog prices during Q2 2023. In sharp contrast, price trends during Q3 are likely to be highly volatile and decidedly lower because of the fallout from the implementation of California Prop 12. Pork producers and processors outside California, as well as distributors, grocers and restaurants within California, have voiced concern about their ability to comply with the new regulations and still have pork supplies for Californians. This suggests that the balance of noncompliant pork supplies in the marketplace outside California will increase and could move pork cutout values lower by at least 10%, or $8 to $10/cwt, and into the low-$80s/cwt (see Chart 1).

There is much discussion and analysis among industry participants on the amount of compliant pork that will be available to supply California after July 1, 2023, when CA Prop 12 is set to become effective despite the state’s inability to issue certificates of compliance to any producer, processor or vendor in the supply chain. On June 16, 2023, plaintiffs as well as the California attorney general and California Department of Food and Agriculture agreed to another modification of the early-2022 judgment in the litigation over CA Prop 12. A judge in the Sacramento County Superior Court approved the agreement, which allows noncompliant fresh and frozen pork products to continue to be shipped into California through June 30, 2023, and then move through commerce normally until January 1, 2024. This action has resulted in large quantities of pork to be purchased by distributors, grocers and restaurants and will buffer the impacts of Prop 12 on Californians who buy pork. The degree to which this occurs depends on the undetermined volume of product that is getting shipped into California. Fresh product that arrives in California by July 1 will clear the supply chain and likely be consumed by late July. Frozen product will move through the supply chain at a slower rate but must be clear of the system by the end of December.

The consensus in the industry is that about 25% of California pork needs will be filled with compliant product, leaving about a 3.2 billion-pound gap on an annualized basis. Pork prices in California are likely headed much higher. We are hearing from industry sources that overages on compliant pork to the commodity markets are in the $1 to $1.50/lb. range, suggesting 50% to 100% increases in wholesale values depending on the item. Price increases like these will certainly ration consumption of pork in California and begin to move consumer purchases into other proteins.

Price impacts outside California are expected to further exacerbate negative margins for hog producers. Current farrow-to-finish profit margins range from -$30 to -$50/head and worse in some areas or price formulas. We estimate that pork supplies in the other 47 contiguous states will swell by 11% to 14% and increase losses by an additional $20 to $25/head. This market signal of oversupply will have far-reaching impacts in the pork supply chain. This will be one of the rarer economic circumstances where all participants will be affected. Being an integrated producer/processor will not offer any protection. Integrated producers have actually been the first to make decisions to reduce sow numbers. Trade media has widely reported that Smithfield Foods did so before the U.S. Supreme Court ruling was announced and is taking 37 farms out of its system and is expected to remove between 100,000 and 200,000 sows.

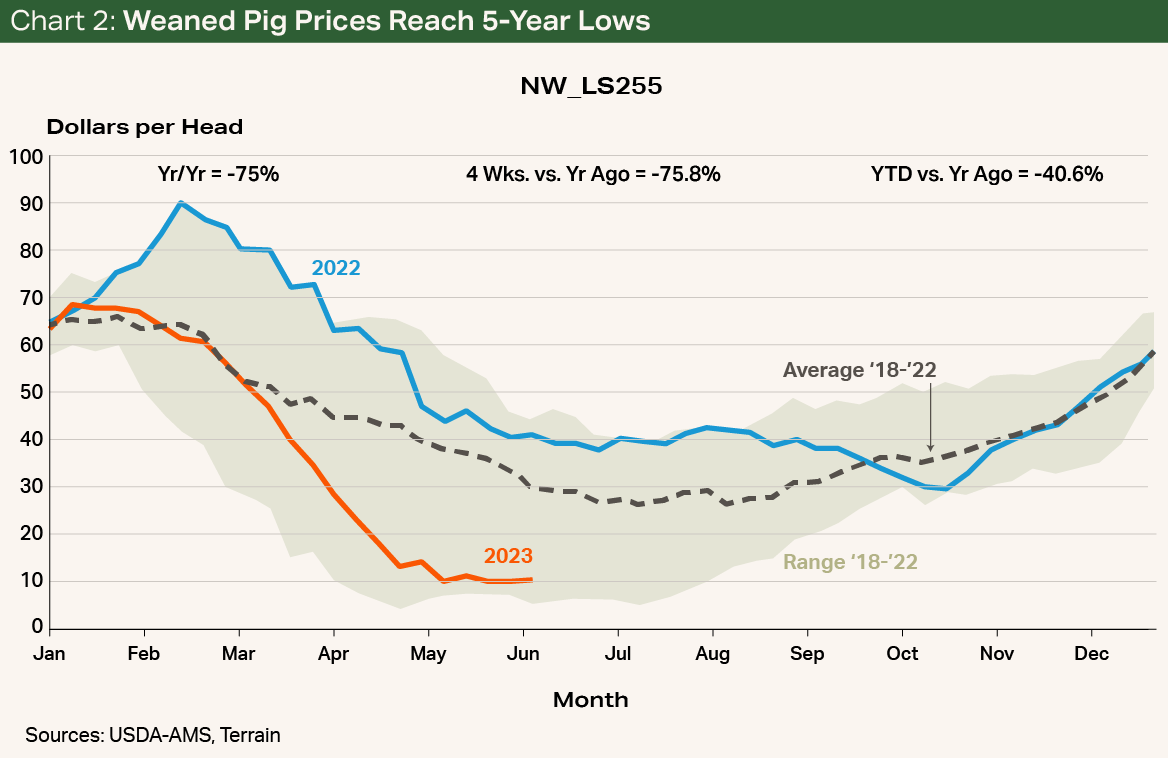

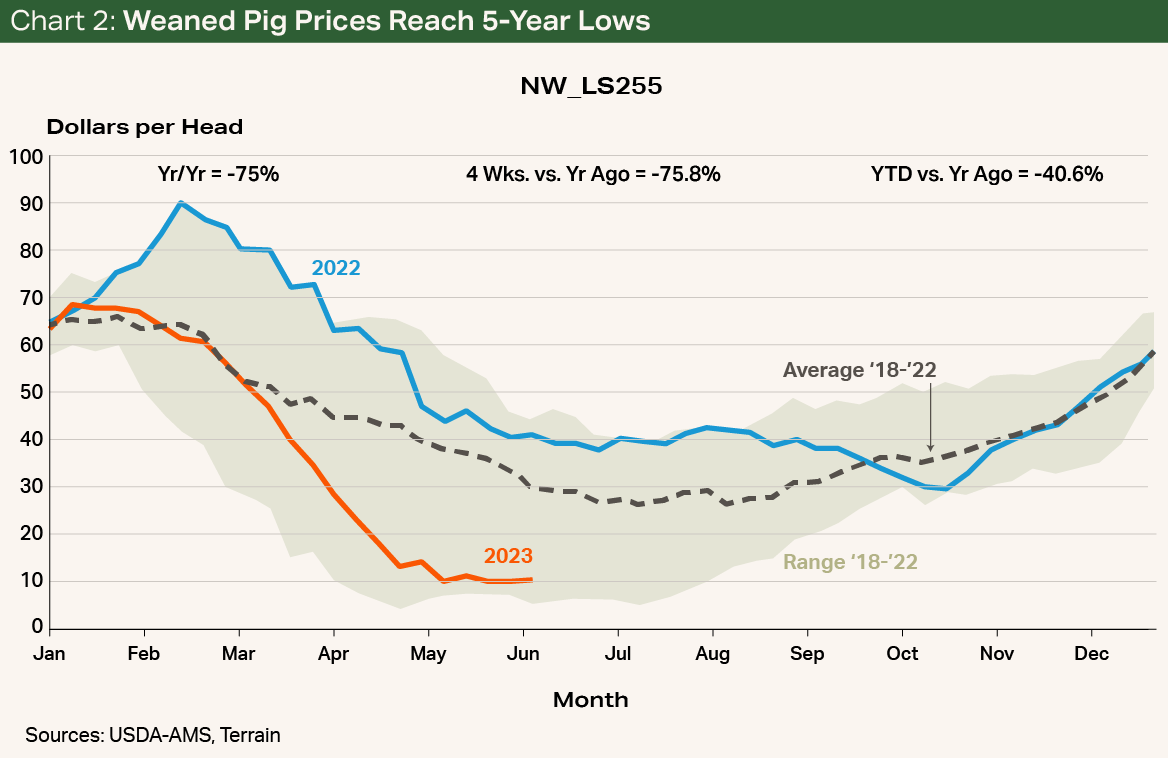

We estimate that the oversupply of hogs driven by CA Prop 12 in the second half of 2023 will require the removal of at least an additional 400,000 sows from the breeding herd. This is expected to be a slow and expensive process for most producers to complete, as entities that have already decided to liquidate have filled nearly all available sow packing capacity, leaving liquidation nearly impossible and at best very slow for the rest of the system. Increasing exports, by way of attractive lower prices, could partially offset the needed reduction in numbers as supplies and the market seek balance, but they are usually slow to develop as buyers wait to see indications of prices bottoming before making purchase commitments. Sow prices and 10- to 12-pound weaned pig prices, as a result, are already at five-year lows and likely headed lower (see Chart 2).

The normally much-anticipated June 1 hog and pig report that is scheduled for June 29 can’t be interpreted as anything but bearish regardless of the data it contains. Expected gains in sow productivity from both pigs saved per litter and litters per sows will only add insult to injury as producers are forced to wait to liquidate. This isn’t a new occurrence in the pork industry, just one that is hard to watch from the sidelines and even worse to have to participate in.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.