Situation and Outlook

The Federal Reserve has maintained a strong stance on monetary policy, and it is unlikely that interest rates will be lower as farmers begin to plan for the tax and loan renewal season.

Background

The Fed has continued to maintain pressure on short-term interest rates throughout 2023 by raising the federal funds rate, the effective base rate for the economy, in four of its first six meetings of 2023. The fed funds rate now operates in the 5.25% to 5.5% range, up a full percentage point from the start of January.

Farmers, who utilize a wide variety of debt tools, have felt the pinch of interest rates on their bottom line. In the August report of the Purdue University/CME Group Ag Economy Barometer, nearly 35% of farmers responded that rising interest rates were the primary reason for not investing in buildings and machinery. Additionally, 24% of farmers indicated that interest rates were their main concern for their farming operation in the coming years. Data from the Fed and the USDA validates farmers’ concern around interest rates.

Additionally, 24% of farmers indicated that interest rates were their main concern for their farming operation in the coming years.

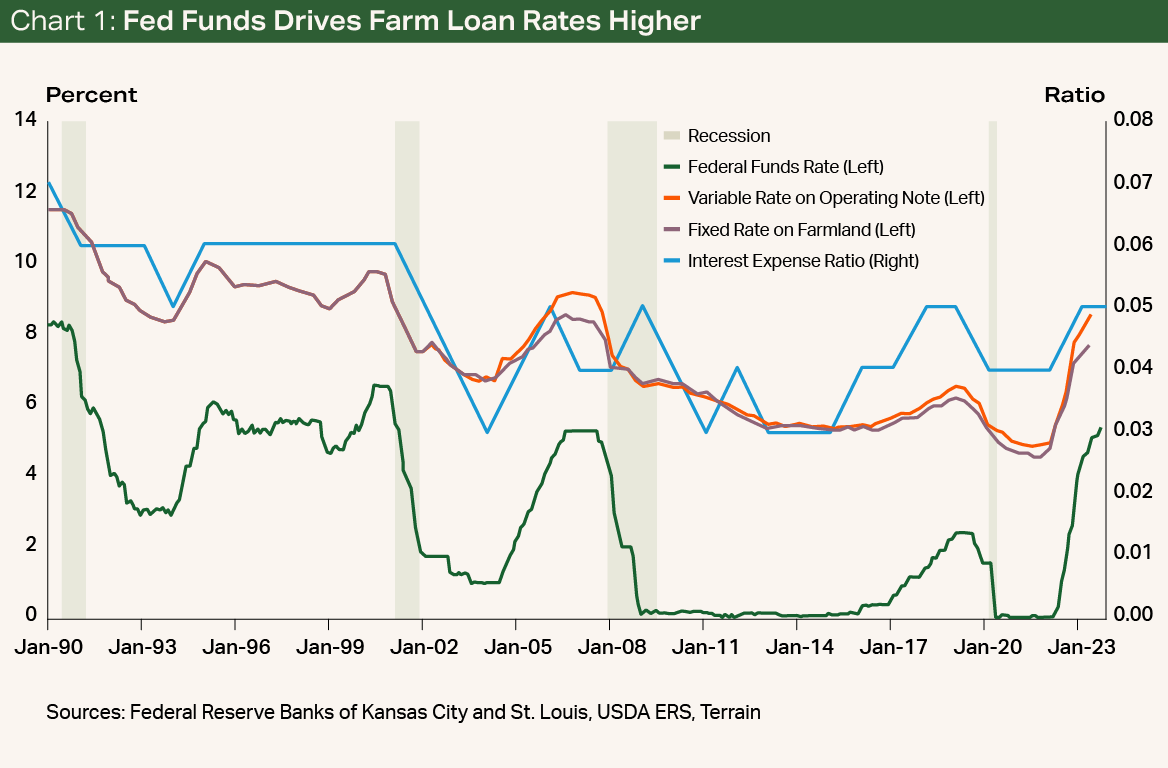

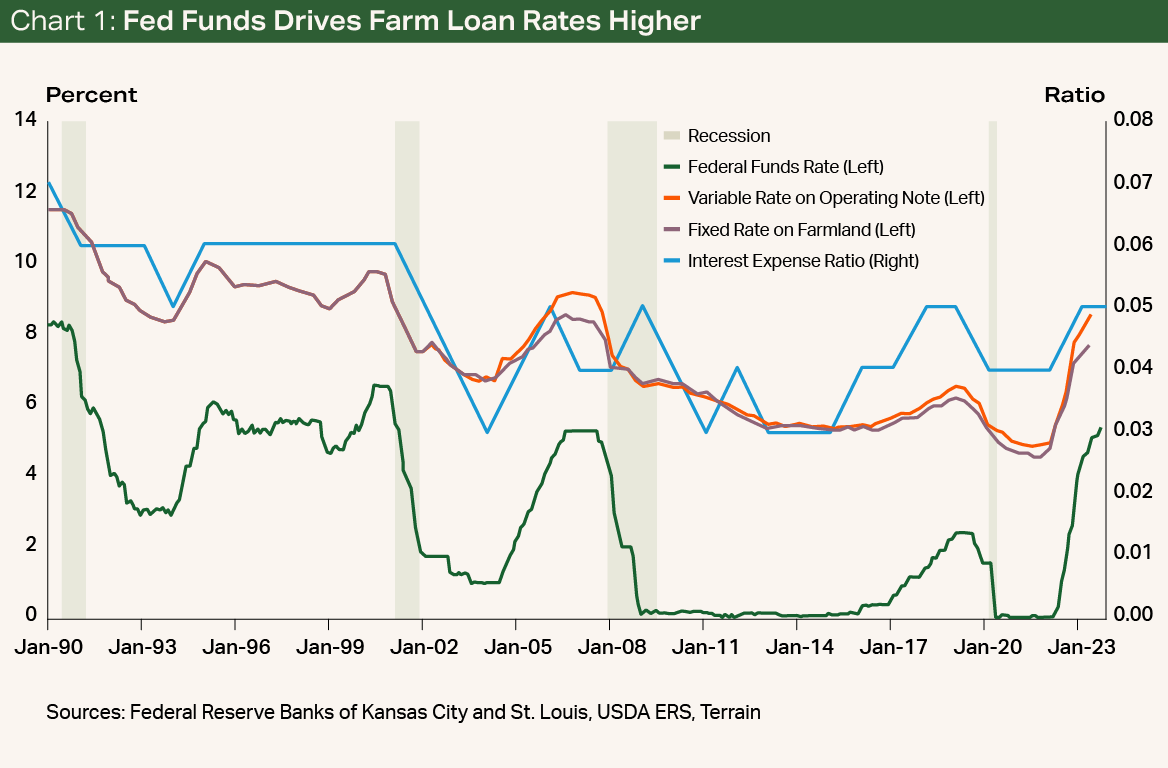

The Federal Reserve Bank of Kansas City reported that in 2023, both variable rates on operating loans and fixed rates on farmland reached levels last observed in 2007, driven largely by the increase in the fed funds rate. Moreover, the USDA’s measure of the proportion of production used to make interest payments on debt — the interest expense ratio — also ticked higher in 2023 (see Chart 1).

The current interest expense ratio is on par with levels last observed in 2018 to 2019, mostly likely because of the opportunity to fix rates at extremely low levels in 2020 to 2021. For producers that have taken on more debt or had to reprice debt in the last 12 months, the interest expense ratio is likely above the industry average. The ratio is also likely to increase in 2024 as operating notes renew at higher interest rates than a year ago.

Looking Forward

The Federal Reserve Open Market Committee (FOMC) will meet two more times in 2023 (November 1 and December 13). Coming out of the Kansas City Fed’s Jackson Hole Symposium, a meeting for leading economists to discuss macroeconomic policy, many of the FOMC members restated a willingness to keep rates “higher for longer” and a dependency on incoming data to continue to curb inflation. Chairman Jay Powell reiterated this sentiment at the September FOMC press conference.

The inflation fight has also become somewhat more complicated because of an accelerating economy, still relatively low unemployment, and recent increases in energy costs.

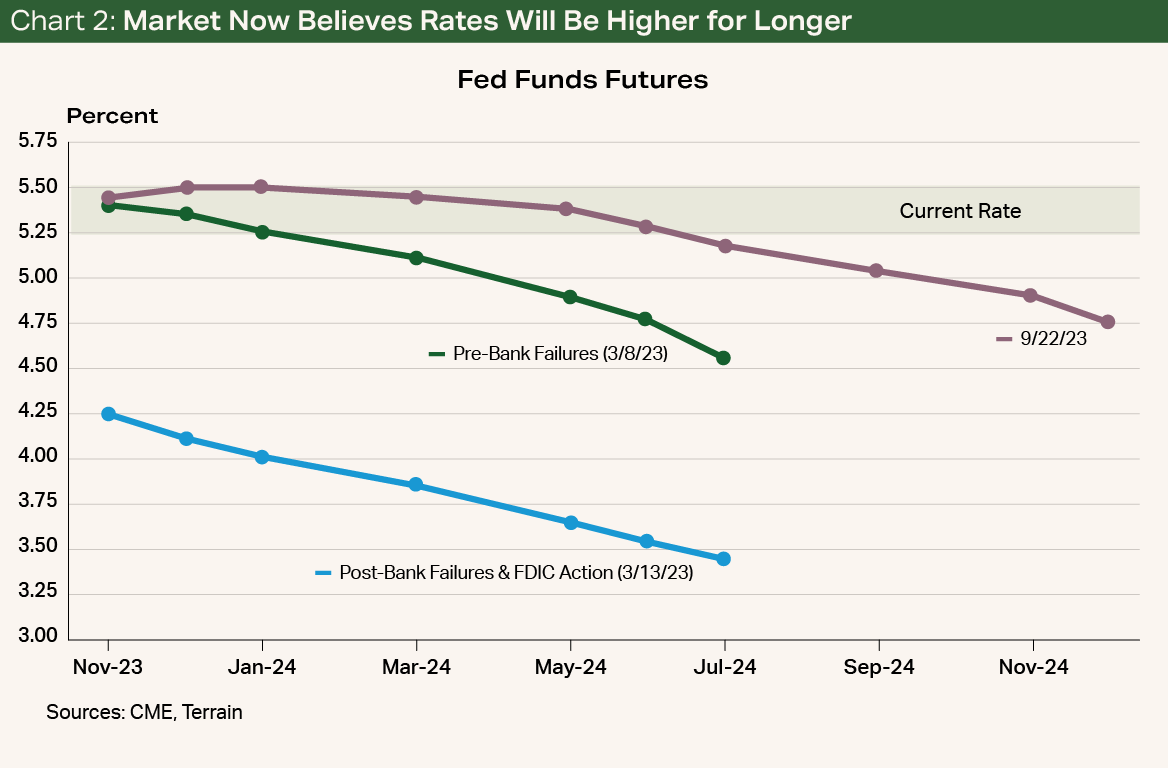

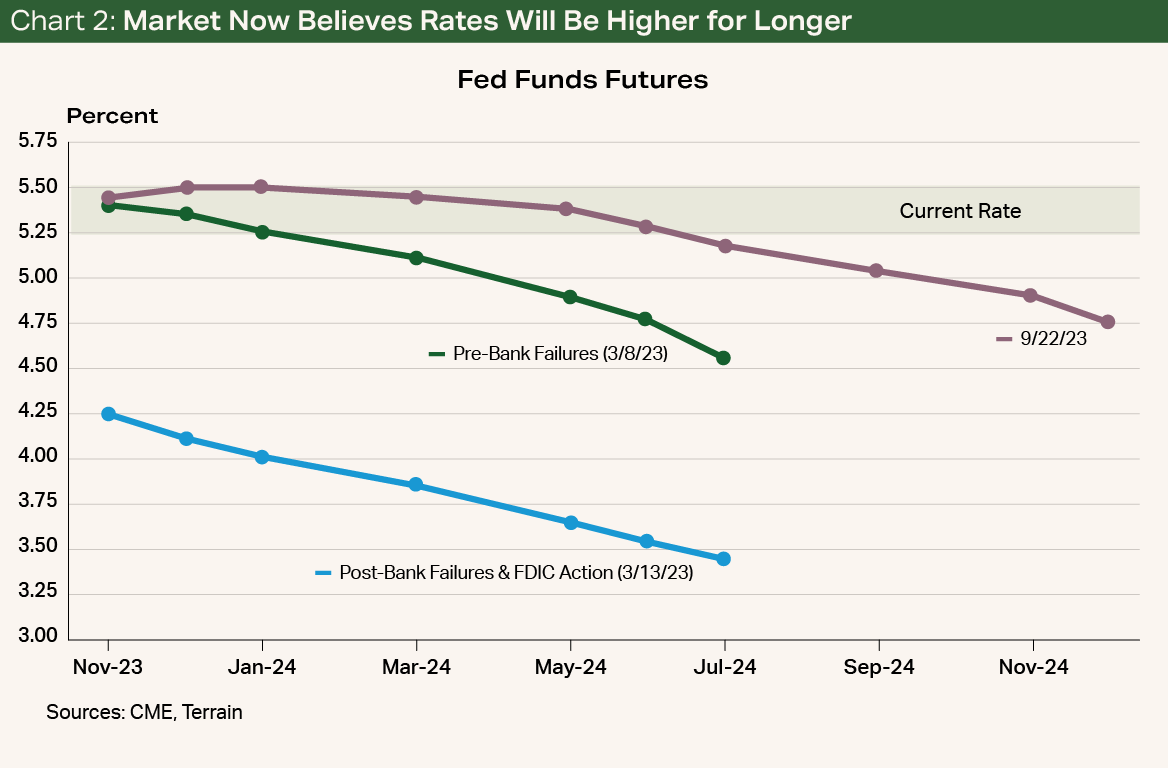

Consequently, both the language of the FOMC members and the recent economic data have suspended the market odds for an interest rate cut in 2023 or early 2024.

…The market has slowly evolved into an expectation of “higher for longer,” with some possible cuts in late 2024.

For example, Chart 2 shows how immediately following the failures of several prominent banks in March, the market went from expecting a cut in early 2024 (green line) to expecting many cuts (blue line). As the FOMC has stayed true to its mission and messaging, the market has slowly evolved into an expectation of “higher for longer,” with some possible cuts in late 2024 (purple line).

Planning for Success

So, what does this mean for farmers as they head into tax planning and loan renewal season?

Roll up your sleeves and do the hard math with your Farm Credit loan officer: Stress-test your variable-rate loans for both “higher for longer” steady rates and potential rate increases. Develop a plan of action for how you will finance any unexpected opportunities such as land coming up for sale, and when you would potentially fix an interest rate should rates decline in 2024.

Also, be sure to work with your accountant for tax planning purposes, as your interest expense will likely be larger in 2023 than in past years, and the interest cost of prepaying inputs on a line of credit may outweigh the upfront price benefit.

As the cost of interest begins to take a larger bite out of the bottom line, the effort in making a solid business plan to manage interest rate risk has a much higher return…

Understandably, these suggestions are neither novel nor easy. However, as the cost of interest begins to take a larger bite out of the bottom line, the effort in making a solid business plan to manage interest rate risk has a much higher return and importance for the success of your operation.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.