Situation

The 2024 new-crop corn market rode a strong run from early March through May that was partly fueled by two types of weather concerns: not enough rain and then too much, both in the U.S. and abroad. The market gave back most of those gains at the start of June.

Moving forward, the focus will center on the U.S. corn crop’s ability to hit the USDA’s original and lofty 181 bu./ac. yield estimate on 90 million acres. On June 28, the USDA will release a second estimate of both acres and yield, which could be the next thing that triggers a market-moving event.

The market picked up additional momentum as continued drought in the U.S. began to call into question planting intentions, stand establishment and the top-end yield possibilities.

A Roller-Coaster Run

In the first few months of 2024, market sentiment was very bearish. Large corn inventories and a record market short position weighed against decent demand for corn. The market began to shrug off some of the bearishness as the USDA estimated that U.S. farmers would plant only 90 million acres of corn, down 5% from a year earlier, and made minor downward revisions to the South American corn crop.

The market picked up additional momentum as continued drought in the U.S. began to call into question planting intentions, stand establishment and the top-end yield possibilities.

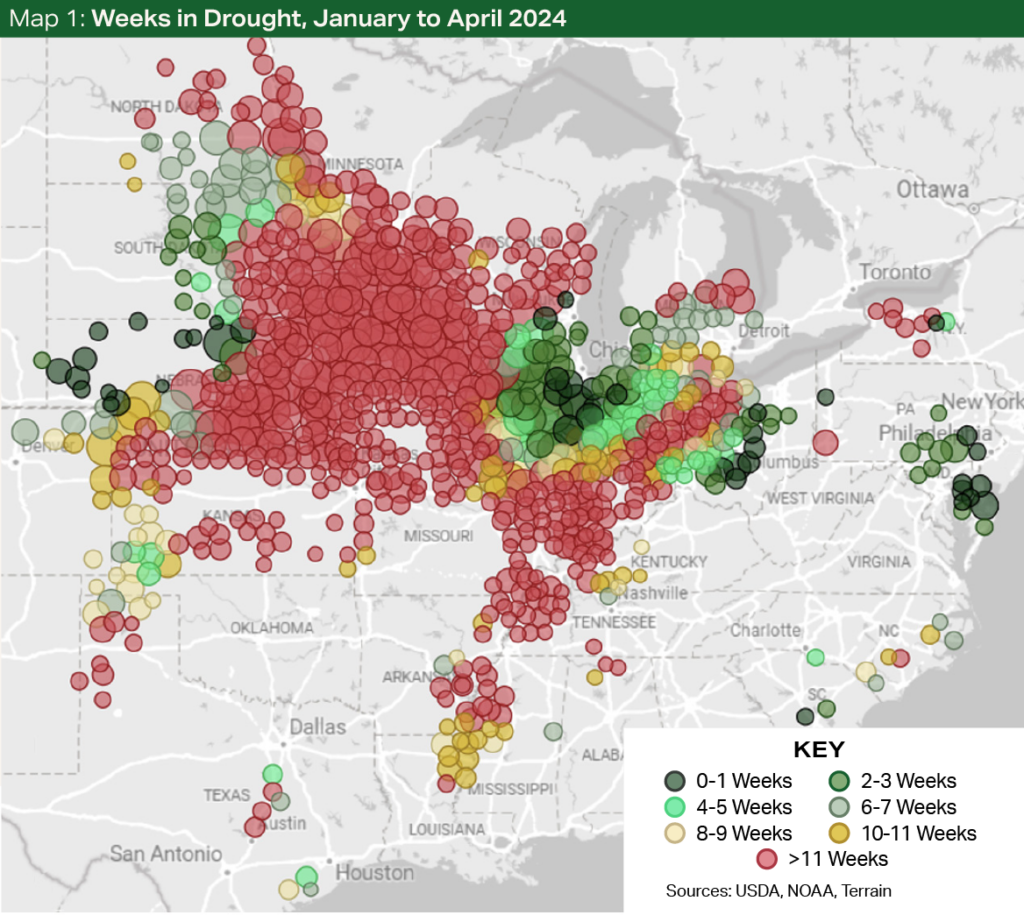

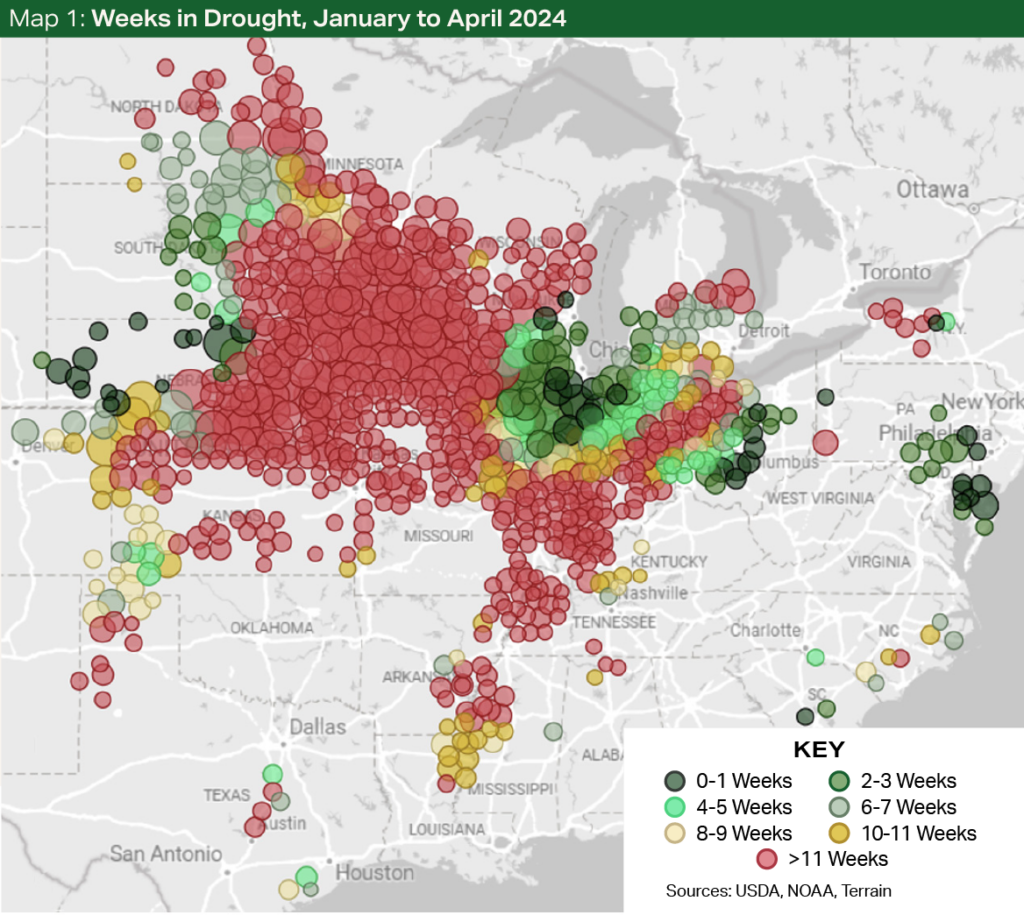

For example, in the first week of March, the USDA reported that 70% of historical corn acres were in a drought, the fourth-highest amount for that week since 2000. Map 1 highlights the number of weeks most of the top corn-producing counties in the U.S. were in a drought from the first week of January through the last week of April.

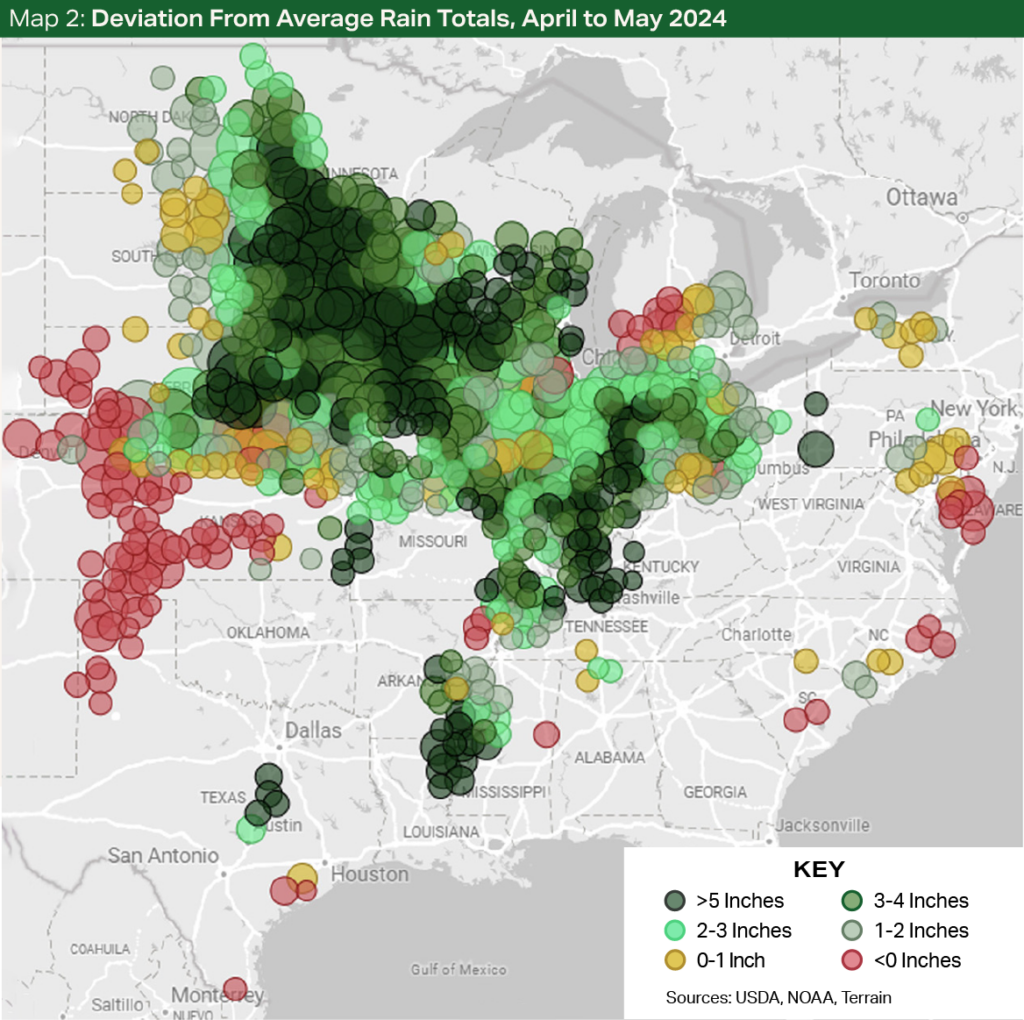

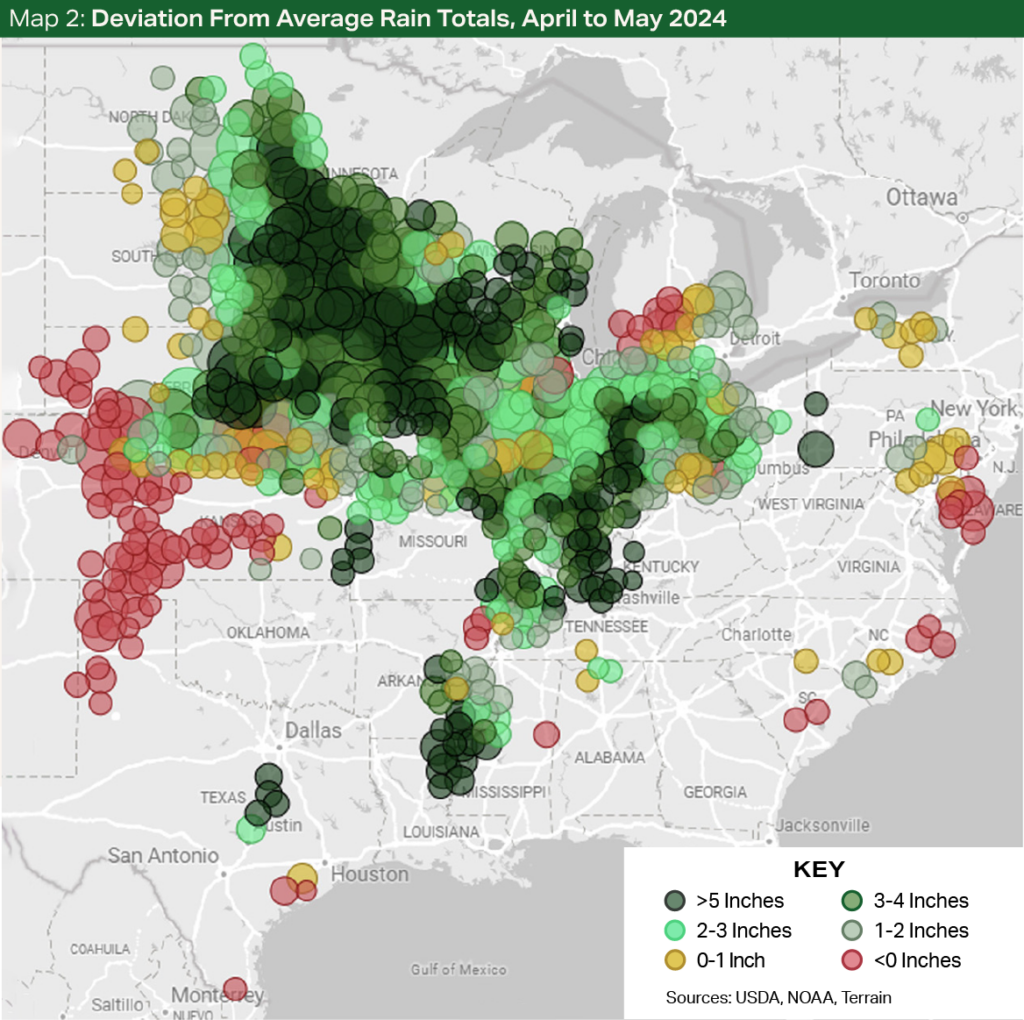

Then heavy rains drenched much of the corn-producing regions from late April through May. By the last week of May, only 15% of historical corn acres were in a drought, the eighth-lowest amount for that week since 2000.

During this period, the script flipped from not enough rain to too much to plant the corn crop. The possibility of a smaller crop led to fund managers dropping their record short position, and the December 2024 corn contract rallied to about 45 cents/bu. above the late-February/early-March lows. Map 2 highlights the difference in April and May rain totals from the historical average for the top corn-producing counties.

To complete the roller coaster, the American farmer got after it, and by early June the USDA estimated that 91% of the crop had been planted, with 74% already emerged and about 75% in good to excellent condition — all consistent or slightly better than recent averages. The market then promptly gave back a hefty chunk of the early-May gains.

What Will Move Prices Next?

The USDA’s June estimate of corn production held steady. The season average price also held steady at $4.40/bu., sharply below recent years. Ending stocks for all countries except China tightened about 2%, which gave the market a very minimal boost.

The focus now turns to the following two questions.

The USDA would need to massively cut production estimates for corn prices to rise to the levels observed in 2022/2023.

First, will the USDA revise its total production estimate with the June 28 acreage report? If either acreage or yield is revised down, the market could recoup some of the earlier loss. If the La Niña weather pattern develops earlier or stronger than expected, the USDA may also revise yields down. However, given the substantial beginning stocks for the 2024/2025 crop, the USDA would need to massively cut production estimates for corn prices to rise to the levels observed in 2022/2023.

Second, can the positive demand story continue? Total corn use is currently expected to increase about 0.7% from the previous year, according to the USDA, and could benefit from production issues in South America and the Black Sea region. However, the strong demand story will need to continue to overcome a strong U.S. dollar, potential geopolitical issues and flat gasoline demand. So far, so good.

The strong demand story will need to continue to overcome a strong U.S. dollar, potential geopolitical issues and flat gasoline demand. So far, so good.

It is too early to speculate on either question. If you have unpriced new-crop corn, establish specific price targets to protect profitability, understand what conditions would need to develop to hit those targets, and look into what grain marketing strategies can be used to execute at those price targets.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.