Situation

The 2024 extension for the 2018 farm bill has expired. Without an extension or a new farm bill, we revert to “permanent law” from 1949.

Impact

Reverting to the 1949 law is intended to be so disruptive to markets that it forces Congress into action.

Outlook

Falling off the dairy cliff is a low-probability event. However, it makes a bargaining chip out of dairy producers and supply chains and is worth understanding.

The expiration of a farm bill is becoming a tradition that triggers a flurry of coverage and discussion about the “dairy cliff” — a term coined when the farm bill was tied up in negotiations around the “fiscal cliff” of 2013. The dairy cliff refers to the fact that an expired farm bill reverts to the Agricultural Act of 1949, aka “permanent law.” If that were to happen, obsolete price-support programs would kick in, which would require the government to purchase huge amounts of dairy products until milk prices more than double their already-high levels.

But before producers get excited about $50/cwt milk checks, there are two things to keep in mind. First, it almost certainly won’t happen. Second, if it did happen, it would likely mean one amazing milk check followed by dairy markets falling into complete disarray.

Why Now? Why Milk?

The 2018 farm bill expired on September 30, 2023. On November 19, 2023, it was extended for one year to September 30, 2024. Each farm bill that is passed suspends the permanent law and replaces it with law that more closely reflects the realities of modern era. When a farm bill expires, the law reverts to the 1949 Act.

There are several programs that are authorized and funded in the farm bill that would be impacted to varying degrees over different timelines depending on crop and marketing years. Milk becomes the center of attention because the daily nature of production makes it the first “crop” to be “harvested” in the 2025 crop year on January 1.

Why Would Milk Prices Skyrocket?

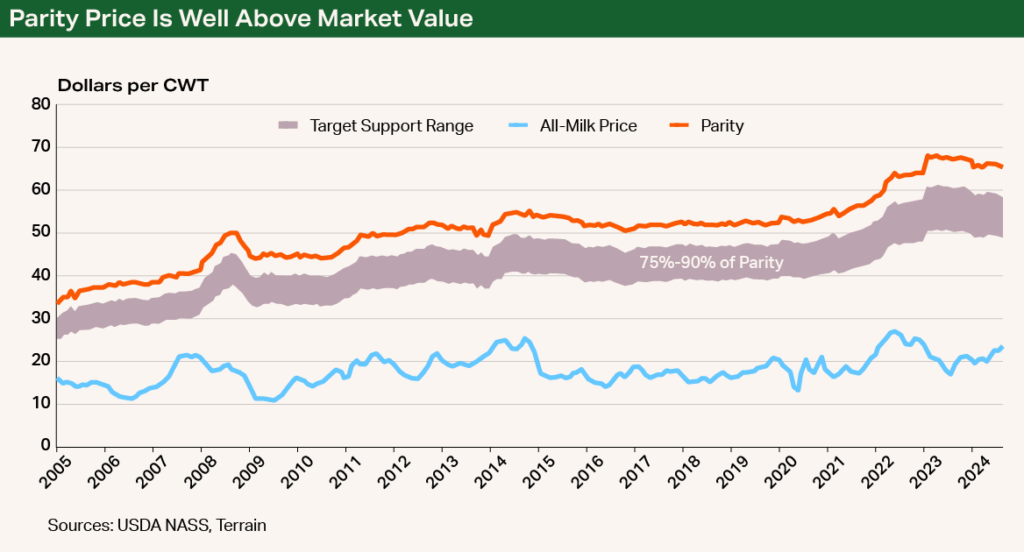

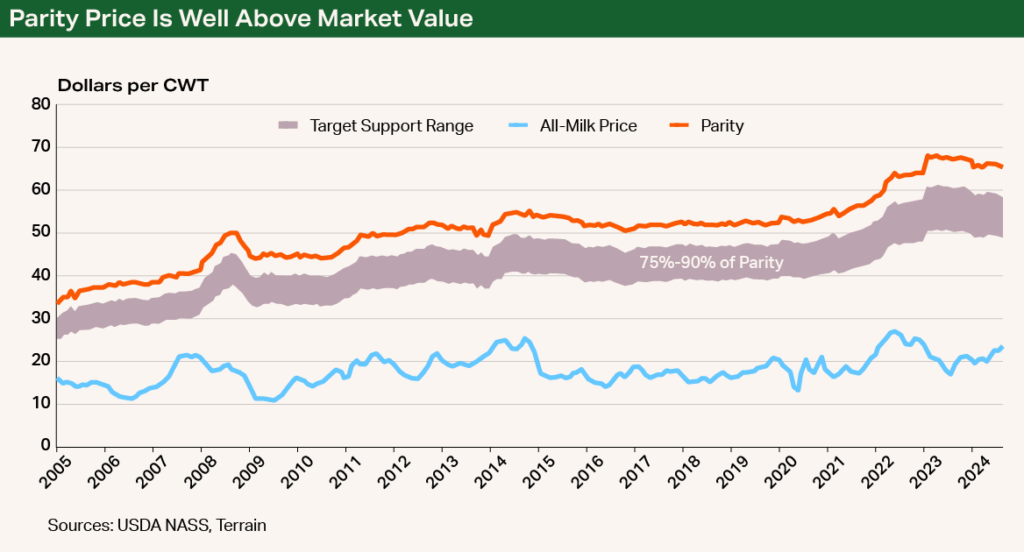

The permanent law lays out support prices for a variety of agricultural commodities. If the market price of milk falls below the support level, the government will purchase dairy products until the market price reaches 75% of the parity price. Based on August 2024 prices, that would be about $49/cwt, compared with a market (all-milk) price of $23.60/cwt.

One theoretical combination of product prices that could get us there would be $6 butter (a 95% increase), $3 nonfat dry milk (a 144% increase), $4.25 cheese (a 108% increase), and $1 whey (a 100% increase). This would result in a Class III price of $46.20, a Class IV price of $49.06, and an all-milk price around the target of $49.

What’s a Parity Price?

Parity prices are calculated commodity prices published monthly in the USDA Agricultural Prices report. They once represented a fair value to base support programs on but today mostly serve to create the doomsday scenario we currently face. Parity prices are calculated using a base period that took place from 1910 to 1914. Using several indexes, ratios and rolling averages, a parity price for milk attempts to answer the question, “What price would milk need to be in order to give a dairy producer the same purchasing power they had in 1914 in terms of their inputs to production (e.g., wages, commodities, interest, etc.)?”

Not considered in the parity price calculation is the fact that technology and efficiency have advanced quite a bit in the last 100+ years. Producers today need significantly fewer inputs to make much more milk. However, parity is inherently assuming we would be milking cows with technology from the 1910s. The parity price needed to justify doing that is significantly inflated and decoupled from reality.

What’s So Bad About $50 Milk?

While $50 milk may sound appealing to producers at first glance, it doesn’t take long to see the downsides.

For starters, the buyer of that $50 milk would be the USDA, and it could cost billions of dollars each month to buy enough dairy products to hit those prices. Prices in restaurants and store shelves would skyrocket, and consumers may shift away from dairy altogether. Low-income families and the elderly participating in USDA nutrition assistance programs would likely be priced out of consuming dairy products.

Meanwhile, knock-on effects would spill through the economy, and exports would come to a halt. Volatility in futures markets would explode, which would lead to high premiums in insurance products like Dairy Revenue Protection and give pause to the insurance providers writing the policies.

Even if short-lived, the damage would take months or years to repair. And on the other side of the government purchases would be enormous government stockpiles of dairy products that would hang over the market and weigh on prices for a prolonged period.

What’s Likely to Happen?

The purpose of having the permanent law lurking behind the current farm bill is not to have a feasible fallback plan, but to create the dire situation we currently face and force Congress to act. The likelihood of falling off the dairy cliff is very low, as Congress still has time to reauthorize or extend the farm bill by the end of the year.

See Expiration of the 2018 Farm Bill and Extension for 2024 from the Congressional Research Service for more background information on the farm bill and permanent law.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.