The price story for beef is all about consumer demand, not supply. Ranchers have not yet begun to rebuild the U.S. beef herd, so the supply of U.S. beef will only nominally increase with carcass weights and imports. The real story is the dominance of beef at the meat counter and consumers’ ability to pay up. For beef prices to remain elevated, U.S. consumers must remain financially healthy.

Should We Worry About Supply?

The beef industry has been on a historic run over the past 12 to 18 months, particularly for the cow-calf rancher. It is natural to wonder what could put a stop to this run. Much of the concern is that a quick rebuild of the beef herd would shift the market from undersupplied to oversupplied and suppress prices. Most ranchers painfully recall the last sharp supply build starting in 2013, which resulted in dismal profit margins in the second half of 2015 through 2019.

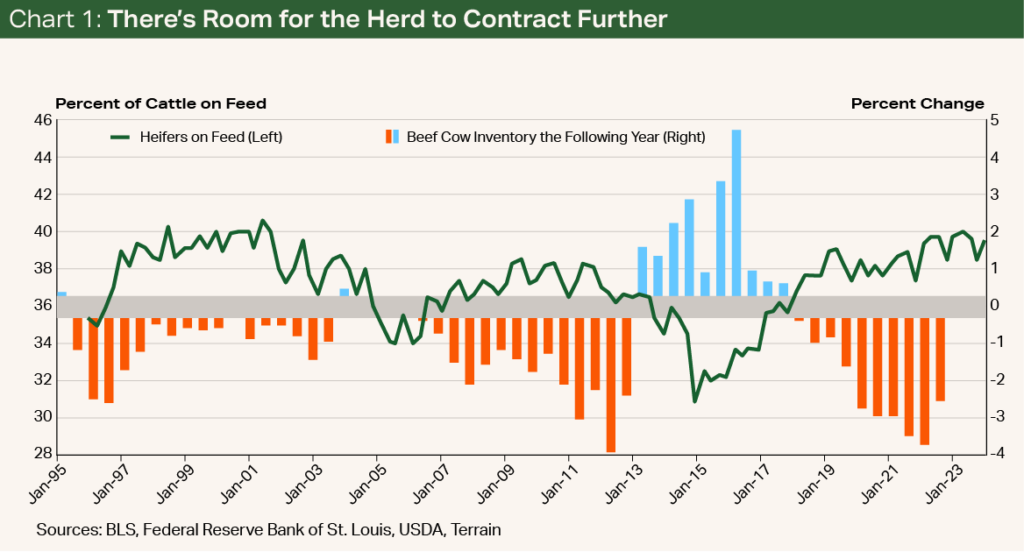

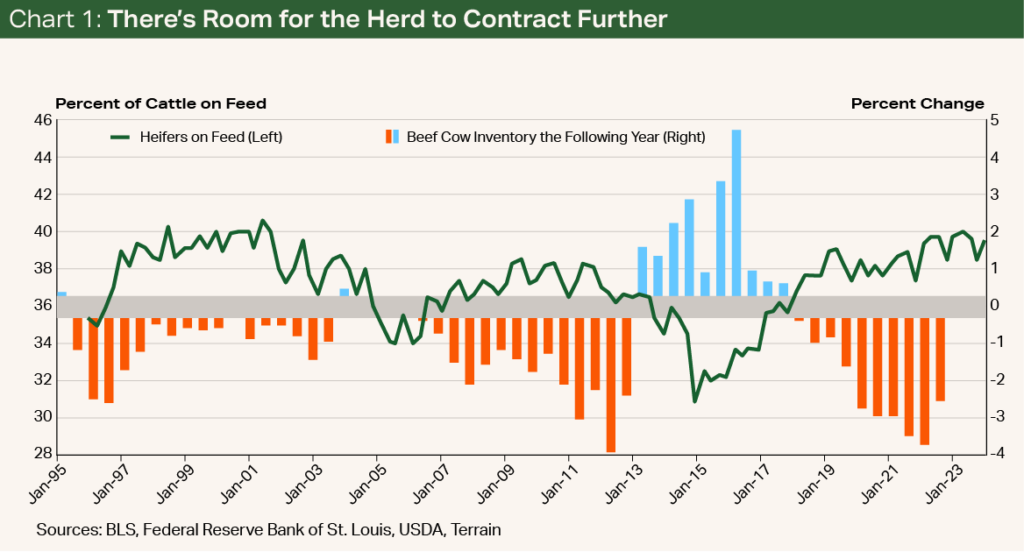

The current data indicate that ranchers have not yet begun to expand the beef herd en masse. The most prominent evidence is that heifers have averaged more than 39% of cattle on feed over the last year, the highest share since 2001 (see Chart 1). Typically, when the share of heifers on feed is over 37%, the U.S. beef herd contracts the following year, indicating that we haven’t yet reached the bottom of the herd contraction.

Factors influencing the slow herd rebuild include:

- The sharp increase in expansion costs

- Ranchers’ desire to right themselves financially before taking on more risk

- The older average age of the U.S. rancher

- The efficiency of the current herd

- The lack of available pastureland

Given current prices, it is easy to understand why a producer would much rather collect a $2,400+ check for a finished heifer than pay the cost to carry a heifer 2½ years before her first calf is eligible to sell.

In the immediate future, the total supply of beef in the U.S. is likely to increase only through imports and carcass weights.

In the immediate future, the total supply of beef in the U.S. is likely to increase only through imports and carcass weights.

Beef imports from January to May rose 19% from year-earlier levels, driven mainly by a spike in imports from Australia. Current import data would indicate that Australian beef is coming in at a 70- to 80-cent discount. We expect strong imports from Australia through the rest of 2024. Imports from Brazil and Uruguay have also started the year hot but will likely slow significantly because of quota limits.

Additionally, year to date, carcass weights have increased around 2.7% compared with a year ago.

Still, despite larger carcasses and a sharp increase in imports, the total beef supply in 2024 is expected to be only 0.1% above year-ago levels and smaller than in 2021 and 2022. The USDA currently projects the total supply of beef in 2025 to shrink about 5%, to the smallest amount since 2017, as the herd rebuild begins in earnest.

Demand Dictates and Beef Prices Are ‘OK’

With supply likely to remain constrained in the coming months and into 2025, demand will clearly dictate beef prices moving forward.

The chief question is whether the consumer will continue to demand beef at the current historically high prices.

To start, demand for beef is not just strong; it is very strong. In fact, Terrain analyst Dave Weaber’s measurement of real per capita expenditures for fresh beef has shown positive gains every month this year. Year-to-date fresh beef real per capita expenditures, which includes ground beef, was up nearly 5% over a year ago. Similar measures for pork and chicken were down 3.2% and 3.1%, respectively.

Moreover, consumers have shown a willingness to pay high prices for beef at the counter. For example, willingness-to-pay measurements from Kansas State University indicate that consumers’ willingness to pay for ground beef and ribeye steaks has accelerated in 2024. In fact, the estimate of willingness to pay for ribeye steak in June was the highest since the survey began. The June estimate for willingness to pay for ground beef was the highest since early 2022.

One reason that consumers have been willing to pay a high price for beef at the counter is that beef is priced well against consumer income.

The strong willingness-to-pay measurements from survey results are also backed up by retail prices. On a year-over-year (YOY) basis, the Bureau of Labor Statistics’ (BLS) retail price for “all steaks” has increased for 16 consecutive months, and the ground beef retail price has increased for 14 consecutive months. The average YOY increase for retail prices has also outpaced the increases in willingness-to-pay results, perhaps implying that once at the store, the U.S. consumer is even more willing to pay up than survey results indicate.

One reason that consumers have been willing to pay a high price for beef at the counter is that beef is priced well against consumer income. That may come as a bit of a shock given the prices at the meat counter, but the U.S. consumer has experienced a relatively strong financial position.

For instance, weekly median income in the first quarter of 2024 increased 4% from year-ago levels. After factoring out inflation, we estimate that real median income has increased for seven consecutive quarters and is about 0.6% above the last quarter in 2019, before the COVID-19 pandemic.

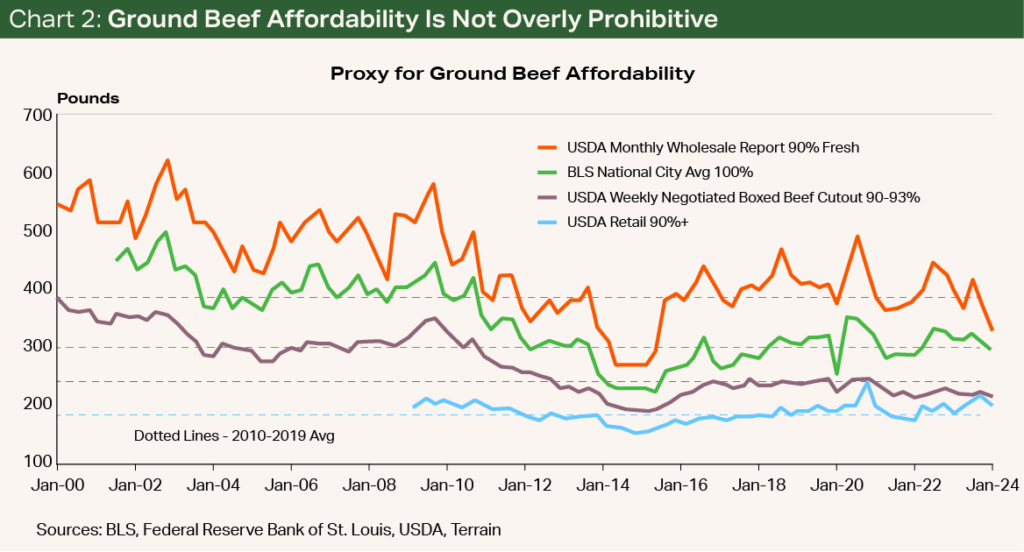

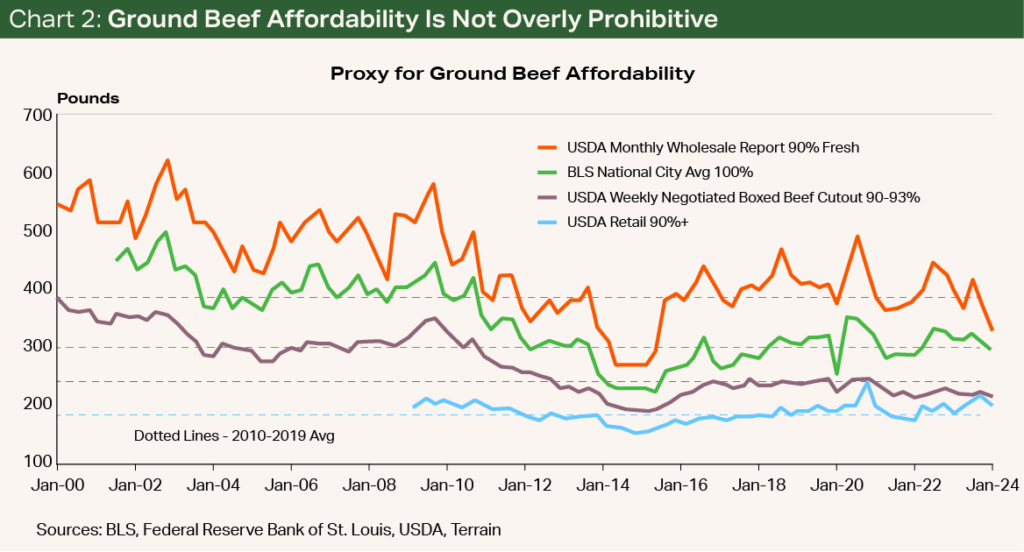

The steady increase in real weekly income has allowed the consumer to buy into (literally and figuratively) higher beef prices. As a proxy for affordability, we divided the weekly income by the price of beef to get an idea for how many pounds of beef a weekly income could purchase. We used multiple measurements of both wholesale and retail prices from the USDA and the BLS to get a fuller picture of the beef market and to recognize the variances in reporting.

Using this proxy for ground beef, we found that affordability is only slightly below 2010 to 2019 levels, a period of both good and bad times for ranchers, and well above the 2013 to 2015 average, which was an extremely unprofitable period (see Chart 2). Interestingly, the affordability proxy is actually stronger than the long-term average when using the USDA’s weekly retail report. Overall, despite the sticker shock of high ground beef prices, the affordability of product is not overly prohibitive to the consumer. The results were also similar for round roast and sirloins.

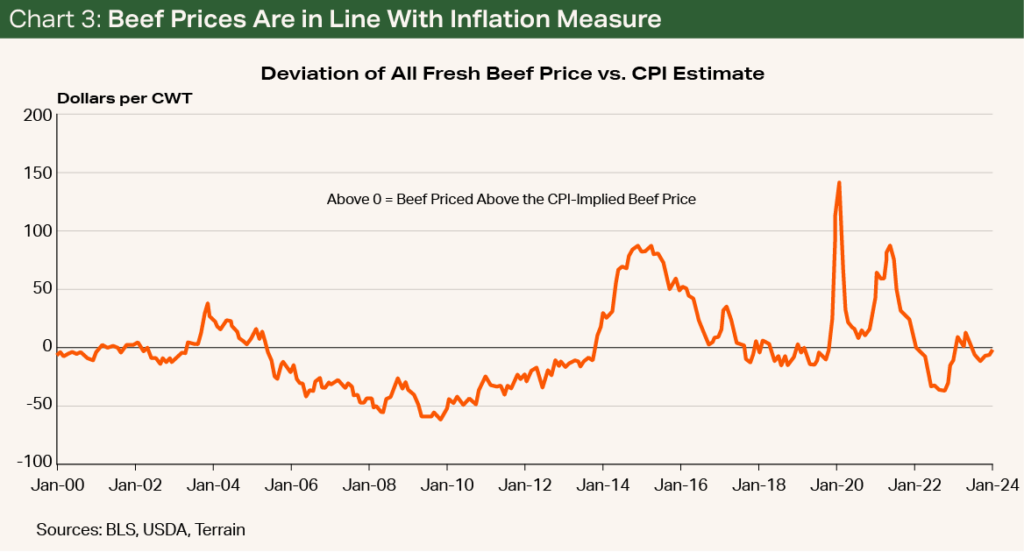

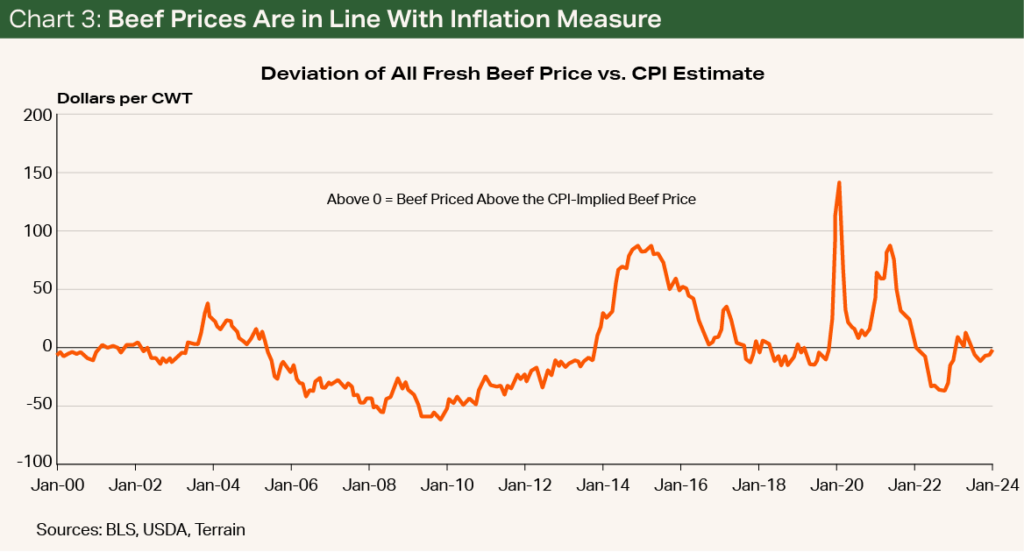

Finally, beef prices today are priced evenly with the price economists would expect simply by looking at the Consumer Price Index (see Chart 3). This implies that in some way, the consumer has readjusted to the elevated level of beef prices. As the beef industry has continued to produce a high quality, desirable product, the price at the counter has been justifiable for the consumer.

The real question now is, can the consumer keep up?

It's All About Consumer Financial Health

The real question now is, can the consumer keep up? There are certainly headwinds against the consumer, including rising consumer credit, higher mortgage rates, and an increase in credit delinquencies. But unemployment rates remain relatively low, though ticking slightly higher; wages have finally caught up with inflation; and general measures of asset wealth such as the stock market and real estate assets remain high. So it is likely that consumers will continue to be picky for big-ticket items but should have the financial stability to continue to afford purchasing beef.

Beef Prices Likely to Remain High

The supply of beef should increase only marginally in 2024 because of higher imports and larger carcass weights. In 2025, supply is likely to decline to the lowest level in several years as the herd rebuild begins. At the same time, demand for U.S. beef is extraordinarily strong, and beef prices are in line with historical relationships to consumer income and inflation. Provided that the U.S. does not fall into a recession and damage consumer financial health, it is likely that beef prices can remain at these elevated levels.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.