Tension is ratcheting up in dairy markets as multiple structural shifts approach in 2025. A shift in trade policy has captured headlines recently with some early pronouncements from President-elect Trump about tariffs. Federal orders will be voted on shortly with the future of pricing formulas hanging in the balance. Avian influenza is hitting California hard and new, long-anticipated large-scale cheese plants are beginning to receive milk, which could shift milk flows away from other uses.

Time will tell which way the balance will fall, but these factors have been gradually winding tension into markets like a spring, storing energy that could release in the form of volatility in 2025.

Milk Production Ticks Up as Cheese Plants Ramp Up

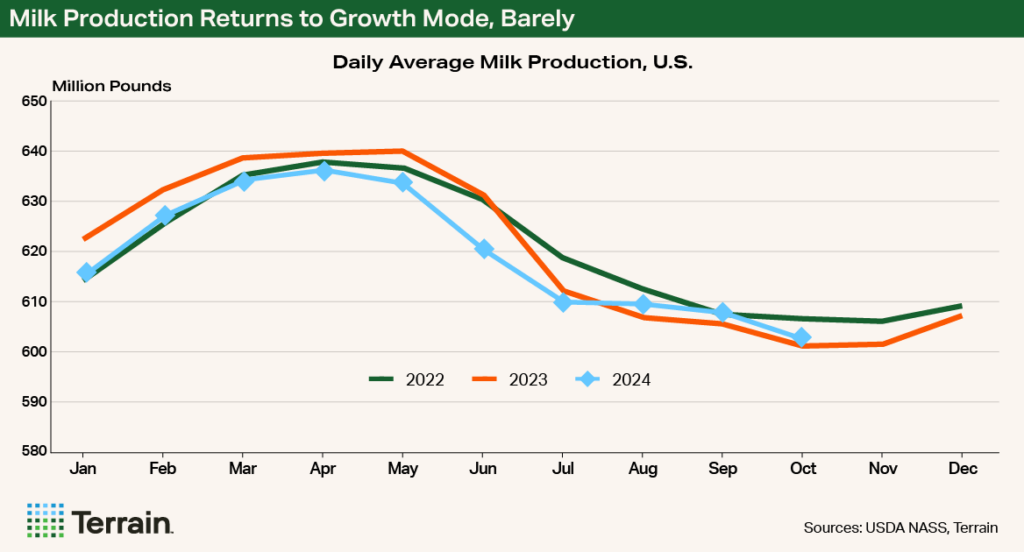

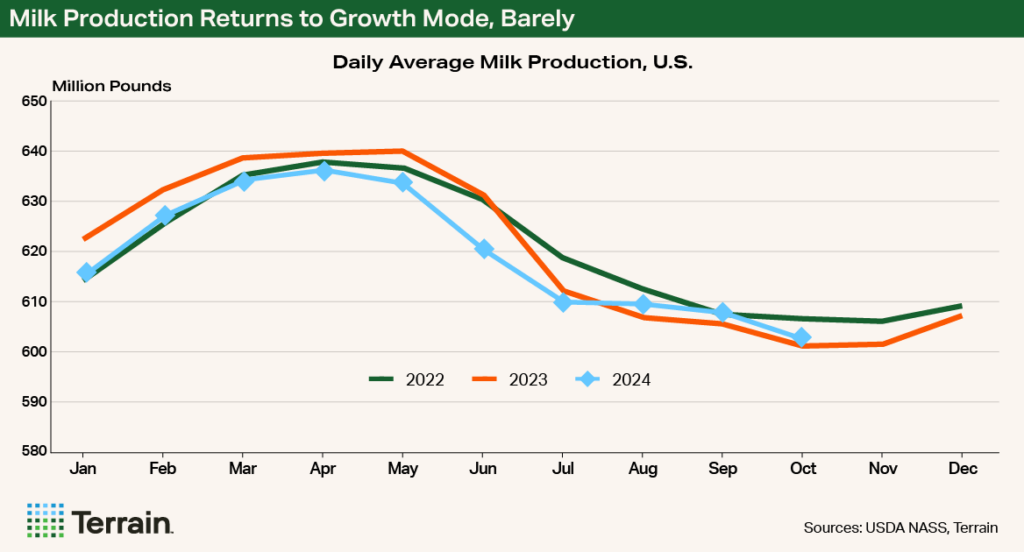

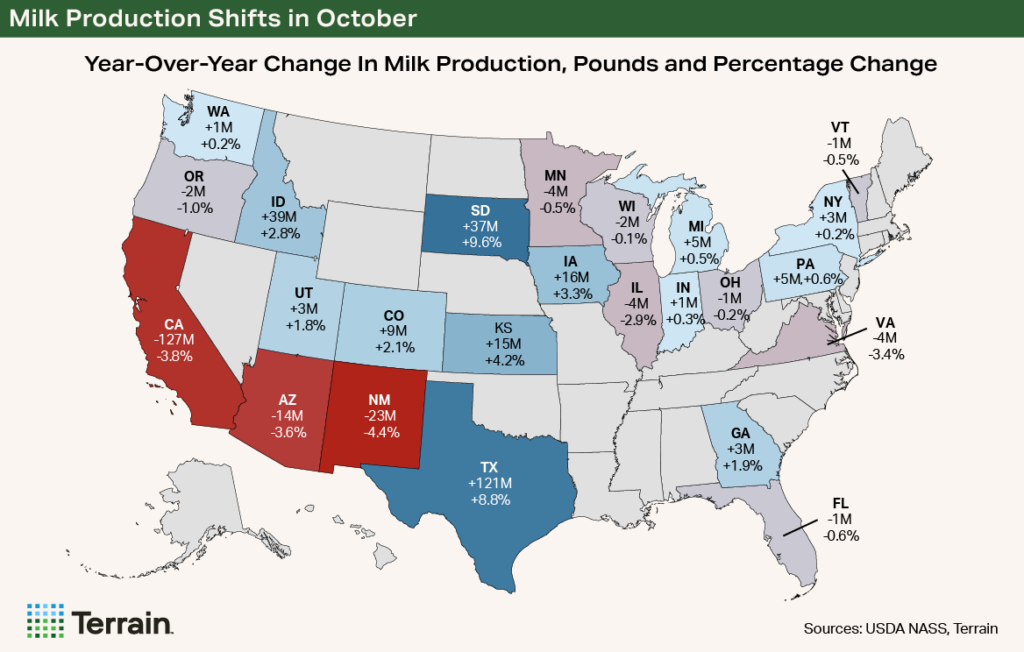

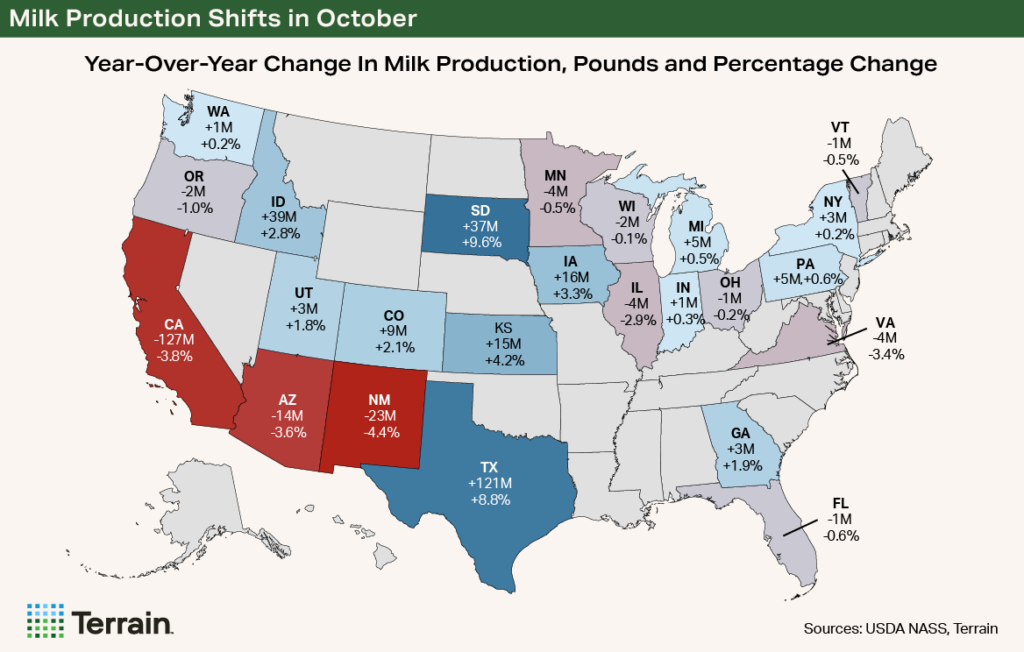

Milk production has been showing signs of life with three months of positive year-over-year (YOY) gains, albeit following 13 months of losses. Total U.S. milk production managed to eke out a 0.2% YOY increase despite major avian influenza-induced setbacks in California that held the state’s production nearly 4% below year-ago levels. The YOY decline in California is equivalent to about 0.7% of total U.S. production.

At a regional level, and in the near term, the need to fill these new plants should lead to a more competitive market for milk, benefiting producers.

Strong beef markets are still enticing many producers to breed heavily to beef, but others are expanding to fill new cheese plants as they begin to take milk. Cow numbers have been climbing since July, adding an additional 46,000 head to the total herd, but many more will be needed with a processing capacity of more than 25 million additional pounds of milk per day on the way.

Class IV prices have maintained a premium over Class III prices in recent years, and I don’t expect that trend to reverse in 2025.

At a regional level, and in the near term, the need to fill these new plants should lead to a more competitive market for milk, benefiting producers. At the same time, as these plants ramp up cheese output, it could weigh on Class III and protein prices. Initially, I expect the need for milk to overcome this weight. So, while printed milk prices and component values may be lower, expect premiums to work their way onto milk checks in other areas to keep milk flowing to the new plants.

Milk will also likely be pulled from what otherwise would have been flowing to Class IV (butter and milk powder) manufacturing plants, providing a boost to those prices by constraining supply. Class IV prices have maintained a premium over Class III prices in recent years, and I don’t expect that trend to reverse in 2025.

Trade will, perhaps, be the most critical driver of dairy markets in 2025.

All Eyes on Trade in 2025

Trade will, perhaps, be the most critical driver of dairy markets in 2025. The strength or weakness of exports has delineated the profitable years from the challenging ones recently. Much of the strength in 2024 and 2022 can be attributed to strong growth in exports. Especially when those exports are in the form of higher-value products like cheese.

2025 will see heightened uncertainty around trade. The incoming Trump administration has already proposed several potential tariffs with the top three dairy export destinations: Mexico, China and Canada. What form the tariffs will take, or whether they will be negotiated away before being implemented, remains to be seen, but markets wisely appear to be taking a wait-and-see approach for now. In the meantime, the strengthening dollar could cause some mild headwinds to exports.

I expect the FMMO referendum will pass, and new rules will be implemented sometime in the second quarter of 2025.

Finally, the long-anticipated referendum to amend the Federal Milk Marketing Orders (FMMO) is going to a vote, with ballots due to be postmarked by the end of 2024. Each of the 11 marketing order areas will vote to either adopt new pricing rules if the referendum passes by a two-thirds majority (in either producer numbers or milk volume) or do away with the order if it does not pass.

I expect the FMMO referendum will pass, and new rules will be implemented sometime in the second quarter of 2025. This will lower protein and Class III values but increase Class I values. On balance, the price impact should be neutral, but there is some concern that producers will fare worse in areas with heavy Class III utilization compared with more fluid-heavy Class I markets. With Class I location differentials increasing sharply in areas of the country, it’s also unknown how that will affect consumer demand for fluid milk at higher prices, or the competitive position among Class I fluid plants bidding for school milk contracts.

Given the uncertainty on the trade front, ongoing challenges with avian influenza, and FMMO reform around the corner, risk management is important going into 2025.

The important thing to keep in mind is that federal order prices do not mandate the value of milk, only the minimum price that a pooled handler must pay. In a market where multiple cheese manufacturers have recently invested billions of dollars in new facilities in an undersupplied market, they are going to have to compete for the milk to fill those facilities, regardless of the minimum, or statistical uniform, price.

Considering Risk Management

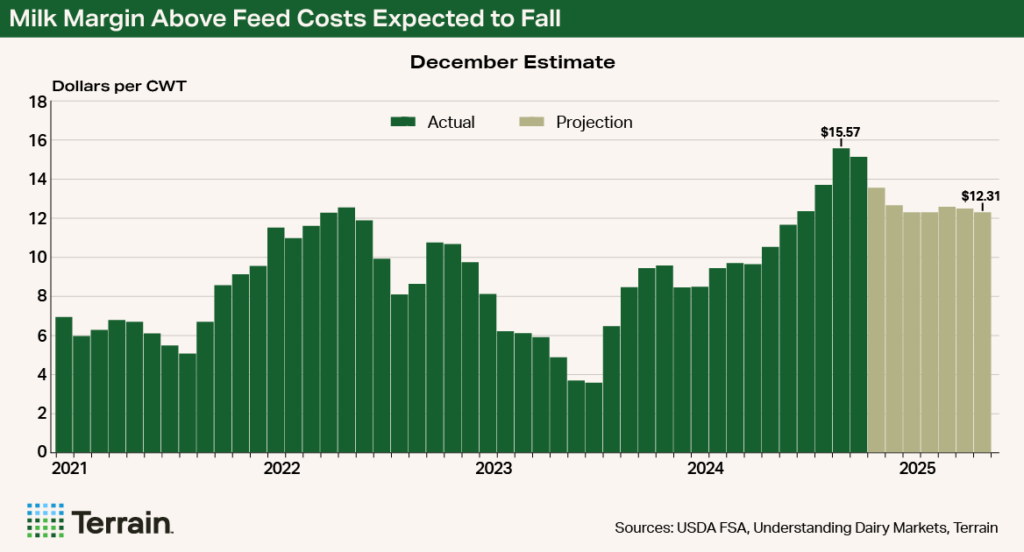

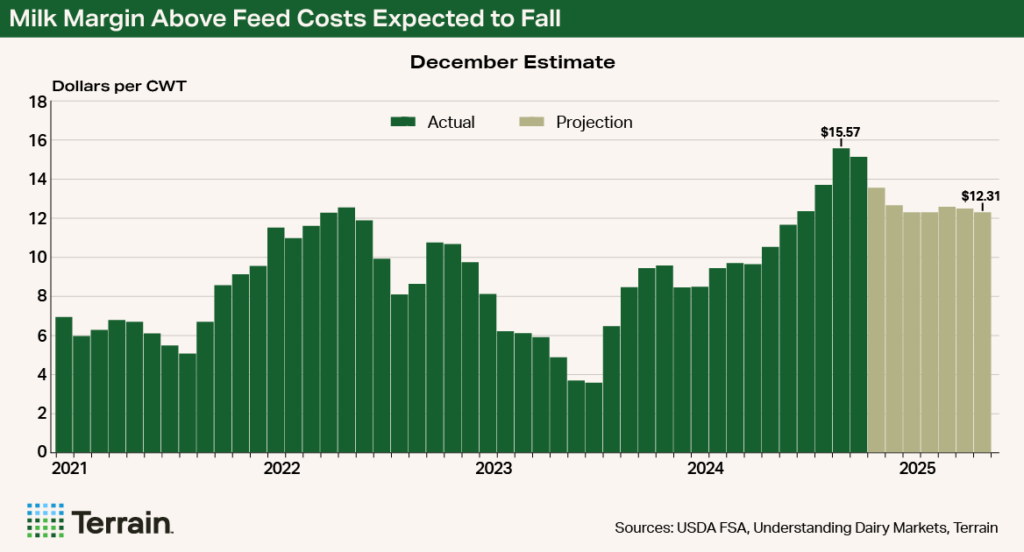

Given the uncertainty on the trade front, ongoing challenges with avian influenza, and FMMO reform around the corner, risk management is important going into 2025. The Dairy Margin Coverage (DMC) milk margin above feed costs reached a record high of $15.57/cwt but is expected to erode by 21% through the first half of 2025 to reach $12.31/cwt. While that remains above the maximum coverage of $9.50/cwt, it signals the uncertainty ahead for milk prices and feed costs — which are also facing many of the same uncertainties on the trade and demand fronts.

While DMC may provide little risk protection in 2025, based on current projections, Dairy Revenue Protection (DRP) and Livestock Gross Margin (LGM) allow for current prices and margins to be insured well into 2026. Dairy farmers insured nearly 50 billion pounds of milk in DRP during 2024 and have already insured more than 20 billion pounds for 2025. Slightly less than 10% of those volumes have been insured under LGM. Should milk prices face additional pressure, or should feed costs increase unexpectedly, these federal crop insurance products can help dairy farmers manage the economic uncertainty they face going into 2025.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.