The premium and luxury segments saw smaller losses than the value segment.

For the fourth consecutive year, wine sales volumes fell in 2024. However, the pace of the decline has moderated gradually over the past three years. Off-premise wine sales fell 3% by value and 4% by volume in 2024, based on my analysis of NIQ data. However, the overall figures mask a bifurcation in performance between the lower and upper price tiers.

The premium and luxury segments saw smaller losses than the value segment (under $11). More importantly, substantial improvement was evident in the higher price tiers relative to sharp declines in 2023, particularly in the $50+ segment.

Distributor depletions continue to lag retail sales, and they deteriorated a bit in 2024 based on my review of SipSource data. The ongoing disconnect between depletions and retail sales indicates that retailers and restaurants continued to reduce inventory levels in 2024.

On-premise depletions weakened in 2024 and are now falling at the same rate as off-premise depletions. This may be due in part to more aggressive price taking in a time of heightened consumer price sensitivity. According to Bureau of Labor Statistics data, wine prices in bars and restaurants have risen 24% over the past five years, compared with an increase of just 8% for the off-premise channel.

Unfortunately, there were no signs of improvement in the direct-to-consumer (DtC) channel in 2024.

DtC shipment volume, as measured by Sovos ShipCompliant, was off by 10%, versus a 7% decline in 2023. Likewise, shipment value fell by 5%, versus a flat reading a year earlier. Community Benchmark figures, which include carryout sales and non-wine DtC revenue, indicate that total DtC sales fell by 3% in 2024 across the 500+ West Coast wineries that contribute to it. This represents a slight deterioration versus a 1% decline in 2023.

Softening visitor counts continue to be a pressing problem. They slumped by 7% in 2024 for Community Benchmark wineries, and no region saw more visitors than in 2023. Lower visitation is impacting both tasting room sales and wine club acquisition rates.

The post-pandemic surge in foreign travel, which has yet to abate, continues to be a factor. But I believe that elevated DtC bottle prices and high tasting and travel costs are taking a bigger bite out of DtC sales.

Outlook Shows Incremental, Choppy and Uneven Improvement

The economy softened a touch in 2024 as higher interest rates bit. Nonetheless, it was an above-average year by most measures, though it did not necessarily feel like that to consumers.

Under our base-case scenario, we still expect the economy to grow at a moderate pace.

The data paint a picture of an economy on reasonably solid footing heading into 2025. But that was then, and this is now. Progress on inflation has stalled and there is a new administration in town that has a very different policy agenda and style of doing business.

Under our base-case scenario, we still expect the economy to grow at a moderate pace and only modest softening in the labor market. However, we have less conviction that inflation will continue to abate, which puts further interest rate cuts in doubt. We are also less sanguine about the prospects for improvement in consumer sentiment, which has slipped in early 2025.

Given the ambiguous economic backdrop and unpredictable trade picture, the outlook for the wine market in 2025 has become less foreseeable as well. Nonetheless, I still expect incremental improvement in 2025, though it is likely to be choppy and uneven.

Under our base-case economic scenario, I expect:

- Premium and luxury retail sales to stabilize this year, mainly because the comparisons will be easier following the three years of decline.

- More attractive pricing to stimulate demand, so there could be some improvement (meaning a smaller decline) at the low end as well.

- The rate of decline in DtC sales to moderate due to easier comparisons, though high costs are likely to continue to deter some potential tasting room visitors.

The shortfall in the crush varied widely across regions and grape varieties.

While I am cautiously optimistic that there will be more improvement in 2025, the risks are clearly slanted to the downside, and it will continue to be a competitive market environment in all sales channels and price segments. Inventory reductions by distributors will likely also constrain wine shipments this year.

The Grape Market Remains Challenging

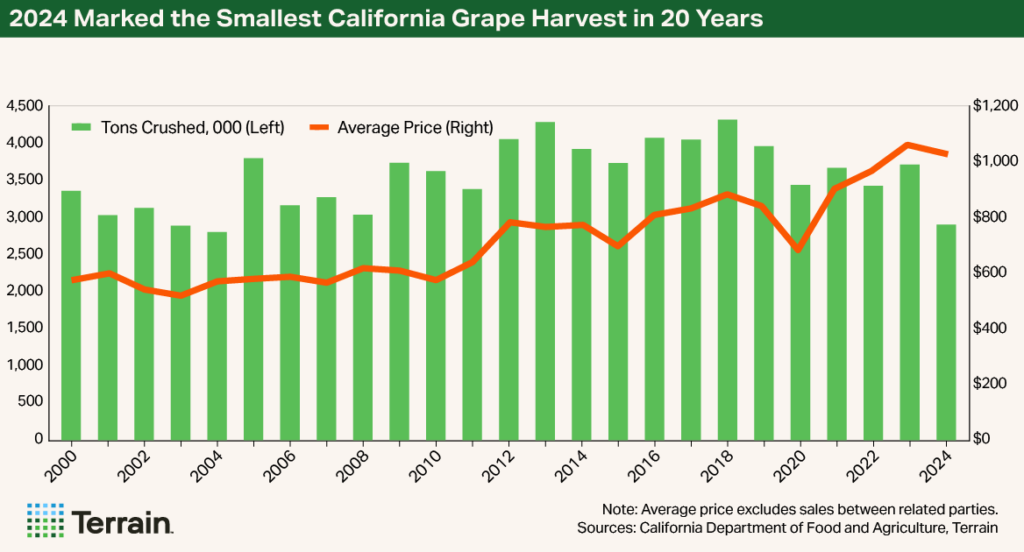

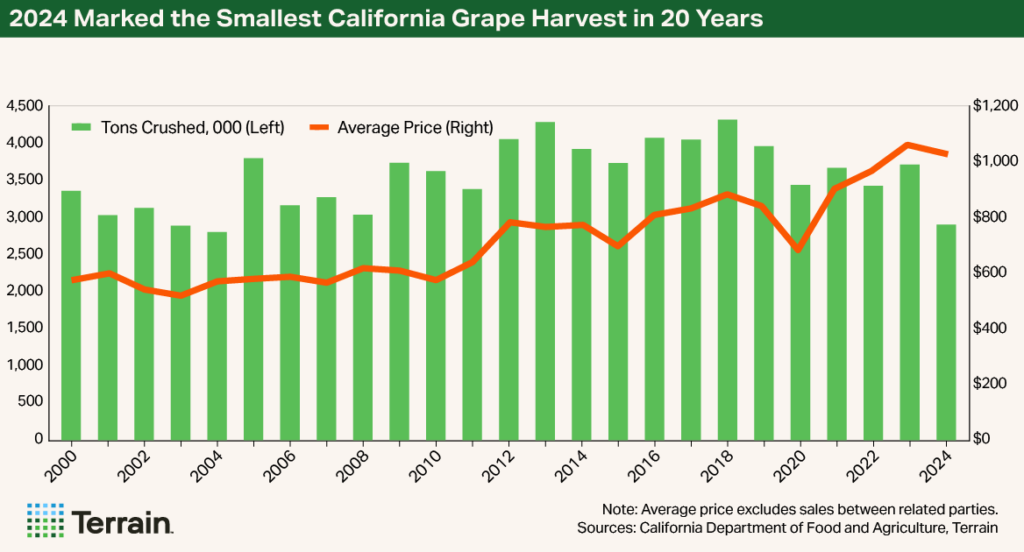

2024 was a challenging year for California grape growers to say the least. The crush came in at just 2.88 million tons — the smallest since 2004 — and nearly 800,000 fewer tons were harvested than in 2023. The shortfall was due to a combination of lower yields, vineyard removals and, more ominously, a deficit of buyers that resulted in a substantial quantity of grapes going unpicked.

Growers with contracts in place fared reasonably well in 2024.

The shortfall in the crush varied widely across regions and grape varieties. The North Coast harvest was close to its five-year average, while the Central Coast and Interior were well below their historical benchmarks. White varieties generally saw smaller declines in tonnage than reds, representing 49.2% of the crush — their highest share since 1997.

Growers with contracts in place fared reasonably well in 2024, as pricing had not yet fully adjusted to the new market realities in most districts. Those without contracts generally saw deeply discounted prices or received no value at all for their fruit.

Despite the diminutive 2024 crush, bulk wine availability is higher now than it was at this time last year, according to the Ciatti Company, particularly for red varieties. Thus, attractively priced bulk wine will continue to bring stiff competition for grapes.

The Interior grape market looks to be closer to balance at this point than the coast, due primarily to more aggressive vineyard pullouts.

However, there is some positive news on the bulk front. Brokers indicate that there has been some improvement in activity in early 2025, particularly for white varieties. This may be due in part to a tighter global bulk market. Indeed, prices have firmed due to smaller crops and vineyard removals in some regions of key supplier nations such as Australia, Chile and France.

Activity on 2025 grapes remains slow, though there has been a tentative uptick in inquiries recently, mainly on whites. Grape buyers will continue to hold the upper hand in most cases this year unless there is a very short crop or upside surprise in domestic wine sales.

The Interior grape market looks to be closer to balance at this point than the coast, due primarily to more aggressive vineyard pullouts. Nonetheless, the coastal region looks to be better positioned from a longer-term demand perspective, as it mainly produces grapes for the premium and luxury segments of the wine market. The market in both regions is likely to continue to be challenging for some time unless wine sales pick up or there are more vineyard removals than anticipated.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.