Outlook • August 20, 2025

Steer / Heifer Price Spread to Narrow Over Next Year

Article Originally Published in the August 2025 Issue of the National Cattlemen Magazine

Report Snapshot

Situation

The price spread between steers and heifers has widened nominally and is most prominent on weaning weight classes.

Finding

Cattle backgrounders and cattle feeders are bidding up steers due to expectations of heavier finish weights, which have a big advantage in the current high-price environment for finished cattle.

Outlook

As competition builds over the next year to two years for available feeder cattle and heifers for herd rebuilding and retention, the price spread between steers and heifers will narrow to more historical norms.

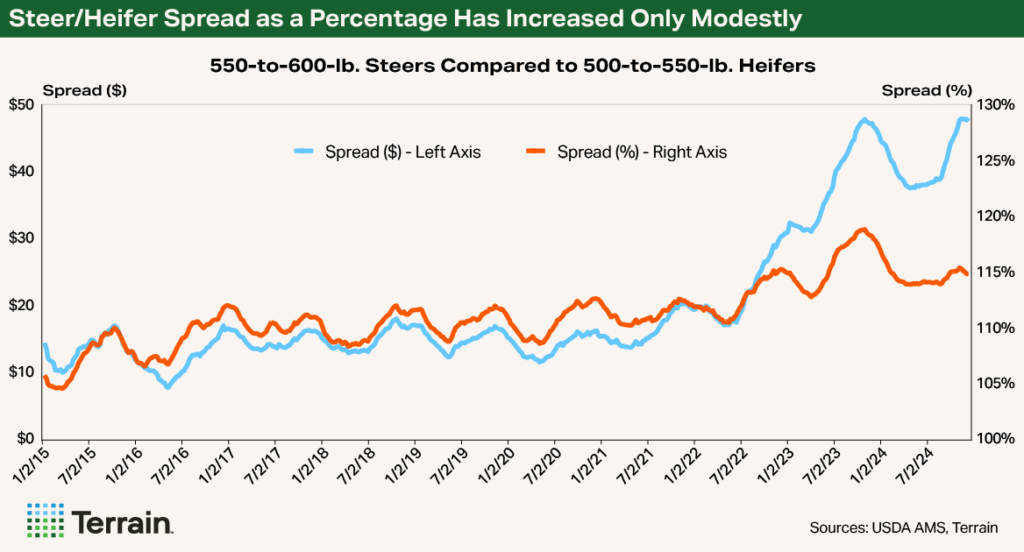

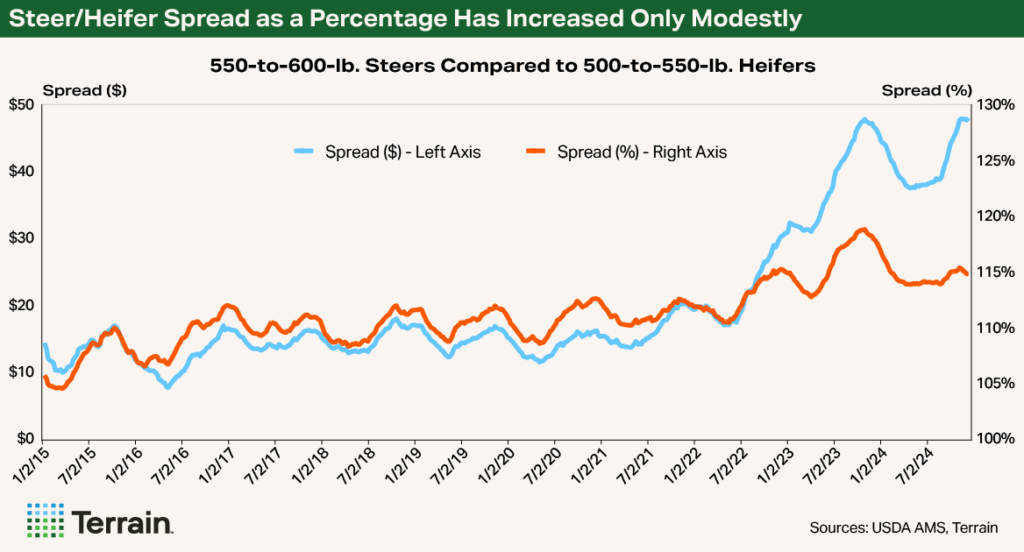

Over the past several months, I have received many questions, primarily from cow/calf ranchers, regarding the widening price spread between steers and heifers. The spread has grown the largest with calves. From late 2023 to July 2025 the price spread of steers (550-lb to 600-lb) to heifers (500-lb to 550-lb) has gone from roughly $30.00/cwt to just under $50.00/cwt.

What’s Driving the Spread: Prices

While the price advantage to steers over heifers has increased steadily since mid-2022, the largest explanation for the widening price spread recently is: higher prices.

When looking at the price spread from a flat price perspective, steer prices have escalated more than heifer prices.

However, when looking at the price spread from a percentage perspective, the relationship between steer prices and heifer prices is close to expectations. Historically steers have a 12% price advantage. The spread spiked in 2023 at 18%, but now it’s back down to 14%.

What’s Driving the Spread: Steer Performance

Changing market dynamics also are having an impact. In the current environment, when value of gain is so much higher than cost of gain, cattle feeders are incentivized to feed cattle to the largest possible weights. At a finished weight, steers can be taken to a 150- to 200-pound heavier weight than heifers. Over a long-term average steers have an advantage in average daily gain of a quarter pound to half pound.

Historically, steers held a 2- to 5-cent advantage in cost of gain. As genetics have improved, feeding technology has improved, and the use of implants and beta-agonists has become more widespread, the feedlot performance advantage has been greater with steers. Steers now have a 10-cent to 15-cent advantage in cost of gain over heifers.

That’s why the price spread is most prominent on weaning weight classes and steadily declines with heavier weight classes. Heavyweight feeders have less time to offset performance differences.

Historically heifers held an advantage to steers on quality grading (the ability to lay down intermuscular fat), but as grading percentages have escalated in recent years to consistently holding 82-83 percent choice and better, steers have become more competitive in grading consistency and have become more competitive when marketing cattle on a grid.

In short, the widening of the price spread is largely explained by the escalation in cattle prices. Cattle backgrounders and cattle feeders are not taking advantage of the market by discounting heifers. They are simply calculating performance and bidding up the steers due to expectations of performance.

More Normal, Narrow Spread Is on Its Way

Given the current, severe shortage of cattle that is exacerbated by the absence or limited movement of feeder cattle from Mexico, plus the expectation that more heifers will be retained for herd expansion, we expect to see the steer/heifer price spread narrow to more historical norms over the next year to two years.

Steers are going to be fed; there just aren’t alternatives of what to do with steers. But, as the supply of steers will not be large enough to cover the needed feeder supply, there will be escalating pressure to feed more heifers to meet feed yard occupancy and packer demand.

The residual supply in the marketplace comes from imports and, more importantly, from the domestic supply of heifers. As competition builds for available feeder cattle and heifers for herd rebuilding, the price spread between steers and heifers will narrow to more historical norms.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.