Report Snapshot

Global Demand

Demand remains strong, but questions about China’s growth prospects mean that their imports are unlikely to grow as fast as in the past.

Domestic Demand

By late 2023, the effect of the new or expanding crushing plants will start to show up in oil demand.

Profitability

Assuming trendline South American crops, 2023 should be a below-average year of profitability for soybeans.

While the soybean markets watch South America’s crop prospects, the size and outlook for the renewable diesel market remains a hot topic in the farming community. And for good reason. Weather and the South American crop will drive prices in the short-term, but the renewable diesel market will drive the soybean complex for the long-term and starting soon.

Export and Acres Potential

South American prospects are for a record-large crop in 2023. While planting was dry in late 2022, rains did arrive in Brazil, though less in Argentina. Neither area is optimal, but there is ample time before harvest for rains to arrive. By most accounts, high input prices were not enough to deter planting in Brazil, and area is expected to increase again in 2022-2023. As always, weather prospects in South America will dominate price movements throughout Q1, with U.S. exports at the end of the export window receiving some attention, too.

To date, U.S. exports have been in a range that corresponds with USDA WASDE estimates, indicating that even if South America has a record crop, the U.S. is likely to end up near current USDA estimates.

The projections of the large crop will have significant implications for the 2023-24 marketing year, of course, and as Q1 proceeds, prospects of the South American crop will be a primary driver in the soybean-to-corn price ratio. These prospects appear to already be overwhelming the higher input costs, which many analysts thought would lead to a relatively more favorable climate for soybean plantings in 2023.

Soybean Oil Taking Over

U.S. use of soybean oil for biofuels has been accelerating in the past few years, as biodiesel has become the primary means for advanced biofuels compliance in the U.S. The growth of the renewable diesel industry – fueled by an increasing number of Low Carbon Fuel Standards (LCFS) coming into force – will place further demands on the soybean oil market.

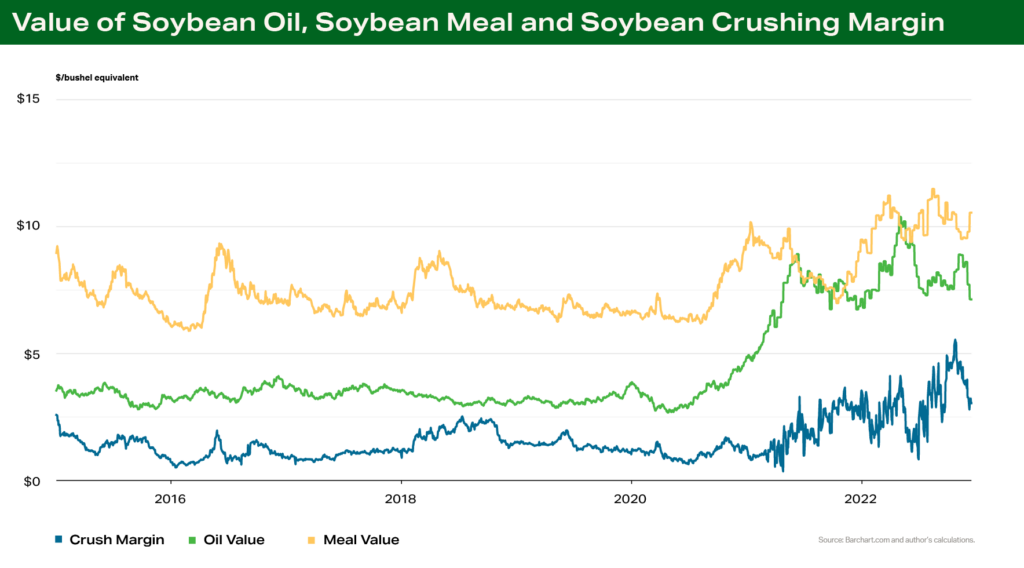

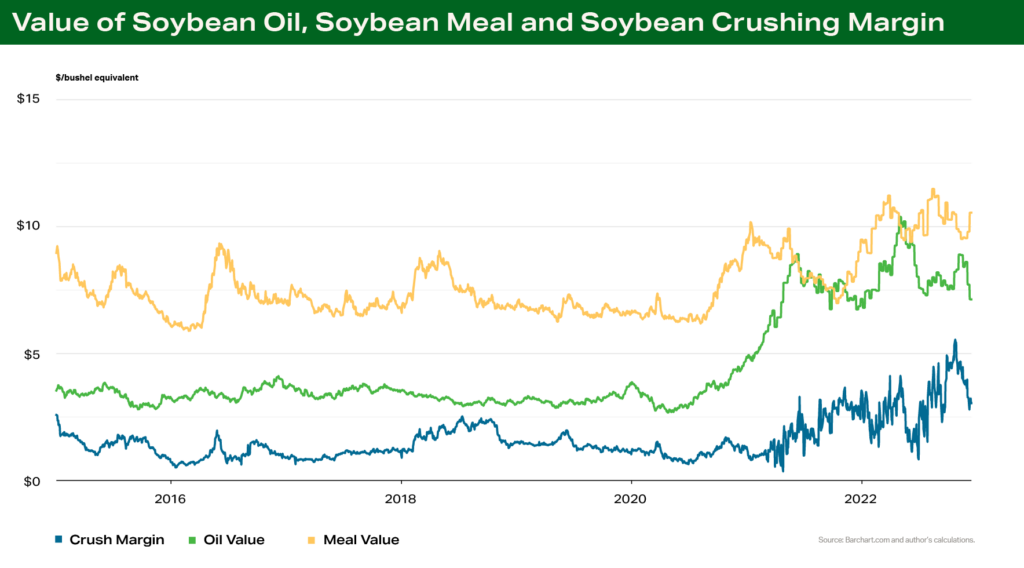

Figure 1 shows how, since early 2020, the value of soybean oil has risen to nearly that of soybean meal. By the end of 2024, the soybean oil value is likely to permanently exceed that of soybean meal. Also note that although some of the LCFS and sustainable aviation fuel definitions either preclude or place strict limits on the usage of foodstuffs, requiring ‘waste’ fats and oils be utilized, there is no significant source of unused fats or oils in the U.S. Increased demand for yellow grease or tallow will likely displace current users of those products, and the demand should ultimately show up in the one place that can meet additional demand. That’s in the soybean oil market.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.