Production Forecast

- I expect hog slaughter and pork production to be even to up 0.5% in Q4 2023 versus a year earlier. Hog slaughter during Q3 is expected to be up 1.5% to 2% versus a year earlier on market hog inventories that were reported as even by the USDA in the June Hogs and Pigs report. Seasonal supply increases during the fourth quarter are likely, but at a slower pace than normal.

- Q1 2024 slaughter and production are forecast to decline versus a year earlier, as sow slaughter increased 9.4% from late April through August, driven by continued poor margins in the farrow-to-finish sector. Additional sow liquidation is expected for the balance of the year but will be limited by available slaughter capacity.

Price Forecast

- Market hog prices have worked lower since setting their summer highs in late July. Meanwhile, margin reprieve to near breakevens is quickly fading. Prices are expected to continue lower through Q4 2023 as our forecast for a smaller-than-normal seasonal supply increase (around 125,000 head per week) will still be too large to keep prices supported.

- Q4 2023 producer-sold barrow and gilt prices are expected to average $80/cwt to $84/cwt, down 4% to 5% versus a year earlier. Q1 2024 prices are forecast to trade in the $82/cwt to $86/cwt range — 3.5% to 4.5% above year-earlier levels.

- Pork cutout values are expected to perform slightly better than market hog prices during Q4 2023, averaging $92/cwt to $96/cwt, a 1% to 3% drop from Q4 2022. Q1 2024 cutout values are expected to be even to 2% higher than early 2023 levels, as they begin to benefit from some consumers trading away from record beef prices.

Production Dynamics

In August, producer-owned barrow and gilt slaughter hog weights set new five-year lows as packers out-slaughtered available supplies. Packer-owned weights have been following a similar downward trend. This suggests a cause beyond producers marketing hogs early as they try to get ahead of seasonal fall price declines. Packers seem very willing to pull hogs early and at lighter weights to keep capacity running.

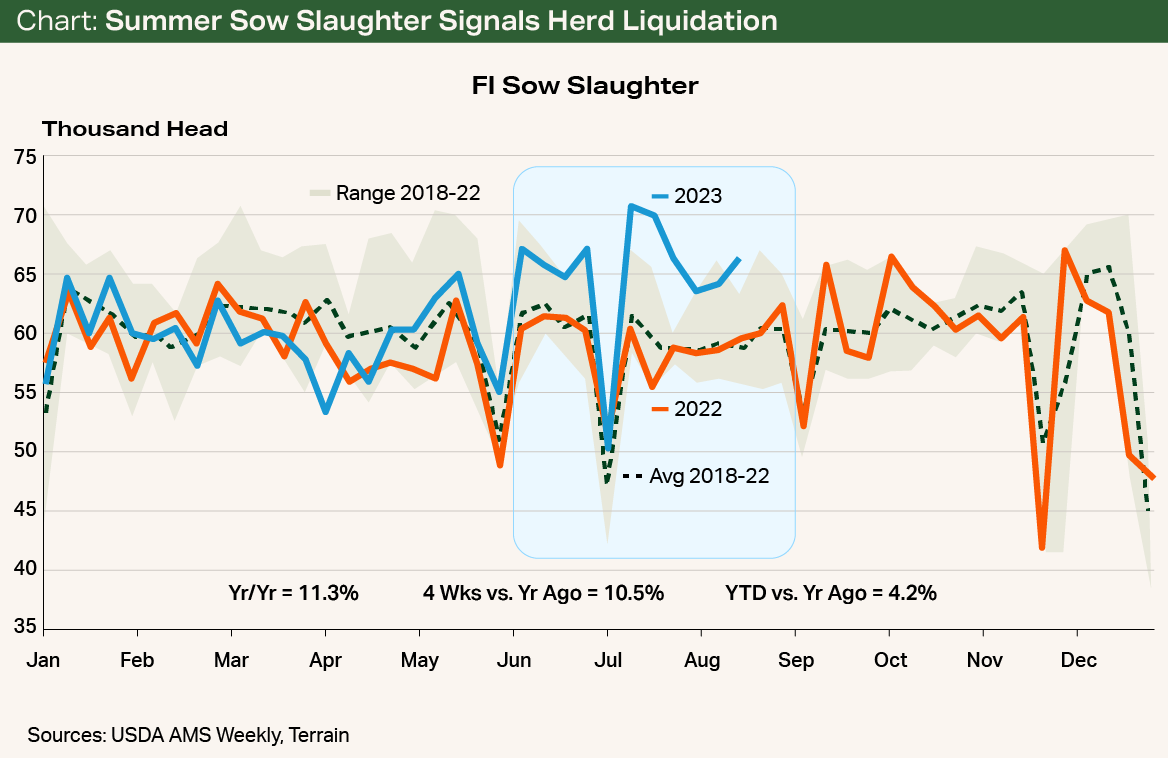

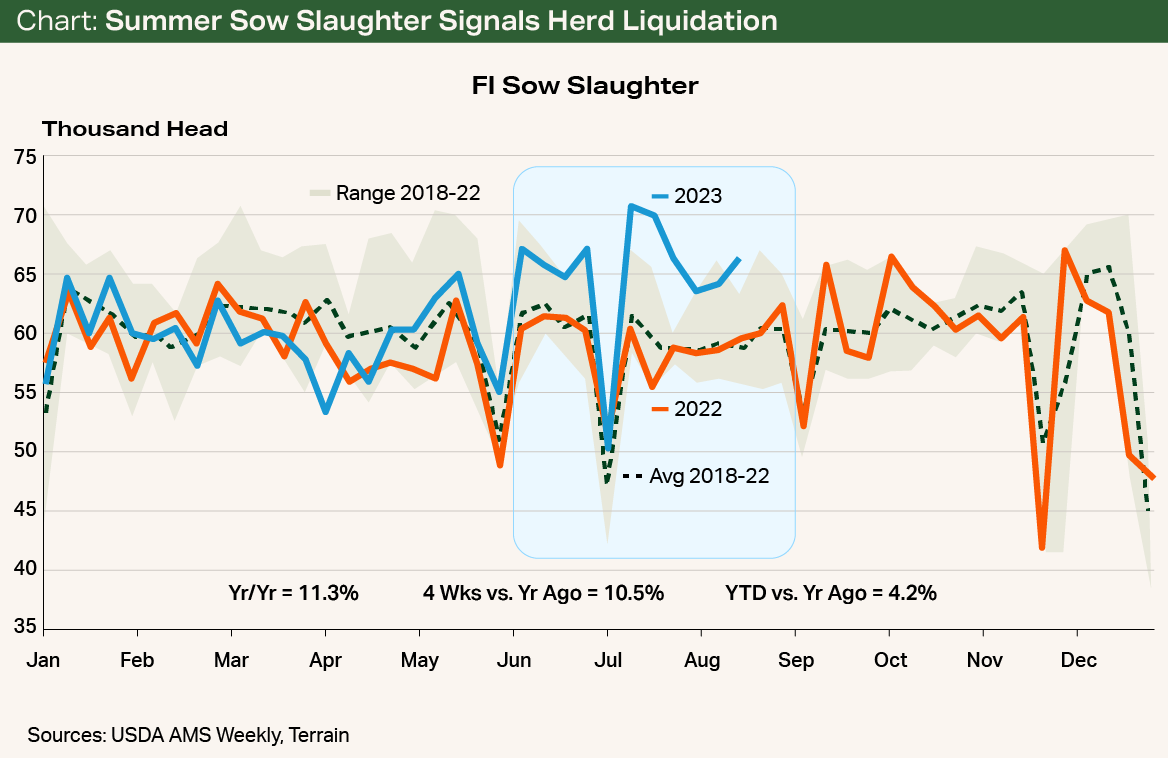

Sow slaughter has been running well ahead of year-ago levels, up 11.3% versus previous-year levels for the week ending August 18, 2023, and up 10.5% over the previous four weeks. Year-to-date (YTD) sow slaughter was up 4.2% through the end of August (see chart).

If the swine industry stays on current YTD pace for sow slaughter for the balance of 2023, then sow slaughter will increase 128,000 head (5% to 6%) versus a year earlier. If (in a more likely scenario) slaughter continues at the pace of the past four weeks, the industry will end the year slaughtering 200,000 head, or 8% to 9% more head than a year ago. This is about 4,850 head per week more than required to maintain a stable sow herd.

If (in a more likely scenario) slaughter continues at the pace of the past four weeks, the industry will end the year slaughtering 200,000 head, or 8% to 9% more head than a year ago. This is about 4,850 head per week more than required to maintain a stable sow herd.

In addition to producers deciding to liquidate sows, very hot weather in mid-July increased sow mortality. Some industry observers think it may have cut up to 1% of the sow herd.

I expect that with continued farrow-to-finish losses, the pace of sow slaughter will continue or even accelerate to completely fill sow-slaughter capacity.

This loss could add another 60,000 head (or one week’s slaughter) to sow herd reduction. Gilt slaughter and reduced replacement-gilt retention will add to a decline in the sow herd.

I expect that with continued farrow-to-finish losses, the pace of sow slaughter will continue or even accelerate to completely fill sow-slaughter capacity.

U.S. pork exports were up 8.9% YTD through the end of July 2023. July exports were disappointing at up 4.3% versus a year earlier. Only NAFTA trading partners Canada and Mexico made gains, while shipments to key Asian trading partners Japan, South Korea and China were sharply lower, down 8%, 24% and 13%, respectively.

Currency exchange rates have played a large part in these recent trends.

As the U.S. dollar performs better than Asian trade partner currencies, our goods become relatively more expensive. At the same time, the U.S. dollar has been weak relative to the Canadian dollar and Mexican peso.

EU pork production has been running 9% below year-earlier levels in recent months. Combined with rising prices and African Swine Fever trade restrictions, the EU pork industry has had limited export opportunities.

EU exports are down 17% for January through June 2023 versus a year earlier. This trend is expected to keep U.S. and Canadian pork exports above year-ago levels for the balance of 2023.

Back in the U.S., some pork industry experts say current farrow-to-finish losses are worse than the losses in 1998.

This trend is expected to keep U.S. and Canadian pork exports above year-ago levels for the balance of 2023.

If lean hog futures prices from September to April are correct, there is another $20/head of farrow-to-finish losses on the way. However, sow herd reductions are likely to dampen this trend and may bring the loss number lower.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.