The $50+ market segment has shown the greatest improvement this year.

Sales Improve Most for High End of Market

Sales volumes are down across all market segments in 2024, but the premium category ($11 to $29.99) is still holding up best. However, the $50+ market segment has shown the greatest improvement this year, followed by the $30 to $50 price tier. Conversely, sales in the under-$11 segment are falling at a faster rate, and there has been little improvement in 2024.

The pace of decline in off-premise wine sales has moderated a bit, driven mainly by improvement in the higher price tiers. Based on my analysis of NIQ data, year-to-date (YTD) sales were down 4% from January to September, compared with a 5.4% decline in volume in 2023.

Distributor depletions are still declining at a faster rate because of inventory reductions by retailers and deterioration in the on-premise channel, which is not captured in the NIQ figures. According to SipSource data, depletions were down 8% from January to September, compared with a 6% decline in 2023.

Direct-to-Consumer: Soft Visitation Still a Challenge

There is, as of yet, no light at the end of the tunnel in the direct-to-consumer (DtC) sales channel. The rate of decline in both visitor counts and DtC sales accelerated during the first nine months of 2024.

Sovos/ShipCompliant data indicate that shipment volume fell by 11% in the third quarter versus the same period last year, with a 4% decline in value. This compares with a 7% loss in volume and flat value during 2023. Third-quarter sales figures from Community Benchmark indicate that total DtC revenue fell 5%, deteriorating from 2023’s flat reading.

Under Terrain’s base-case economic scenario, wine sales should improve in 2025.

Tasting room visitation continues to be a challenge. Visitor counts at the approximately 500 wineries that participate in Community Benchmark are down 8.5% YTD, and wineries in all major West Coast regions have seen fewer visitors this year.

Outlook for Wine Sales a Bit Brighter in 2025

Under Terrain’s base-case economic scenario, wine sales should improve in 2025. The bottom is likely nearing for the premium and luxury segments, as the recent slump looks to be largely the product of abating short-term factors. I see less potential for progress in the value tier, as the decline here appears to be chiefly structural.

The DtC channel should follow a similar trajectory of improvement, though some unique factors such as a travel-abroad wave that has yet to subside may mean sales take a bit longer to stabilize.

Improvement in wine shipments will lag as distributors work through excess inventory, and competition is likely to be heightened in all market segments in 2025. Price-taking will be difficult. Thus, I expect to see some consolidation and attrition in the industry.

It is more important than ever for wineries of all sizes to have up-to-date, well-thought-out business plans in place so they can capitalize on opportunities when they arise and maximize their odds of success in 2025 and beyond.

2024’s Smaller Grape Crop Still Exceeded Demand

The 2024 California growing season was relatively uneventful, though heat waves and vineyard removals ultimately reduced the size of the crop. Even so, there were still more grapes than needed to satisfy demand, and spot market pricing was generally not favorable to growers.

While firm numbers will not be available until the Grape Crush Report is released in February, the crop looks to have been considerably lighter than last year, though yields varied widely by region and variety. For example, late-ripening grapes such as Cabernet Sauvignon were most impacted by an October heat spike, and the North Coast looks to have been closer to average than the Central Coast and Central Valley.

The crush is likely to be significantly below the long-term average of nearly 4 million tons.

Bearing acreage was down by an estimated 15,000 to 20,000 acres, or around 3%, from 2023 because of vineyard removals, and some uncontracted fruit went unpicked for lack of a buyer. Thus, the crush is likely to be significantly below the long-term average of nearly 4 million tons. The number being discussed is 3.2 million tons, which would be the smallest California crush since 2008.

Spot market activity was limited. Wineries were hesitant to purchase fruit, even at bargain basement prices, because of excess inventory from prior vintages and uncertainty regarding the trajectory of wine sales. An abundance of attractively priced bulk wine also weighed on demand.

Prices were depressed, even for the most desirable grapes such as Napa Cabernet Sauvignon and Russian River Pinot Noir and Chardonnay. Lower prices in 2024 will result in a downward adjustment in prices in 2025 on multiyear contracts that are tied to Grape Crush Report prices.

The Grape Market Recovery Will Take Some Time

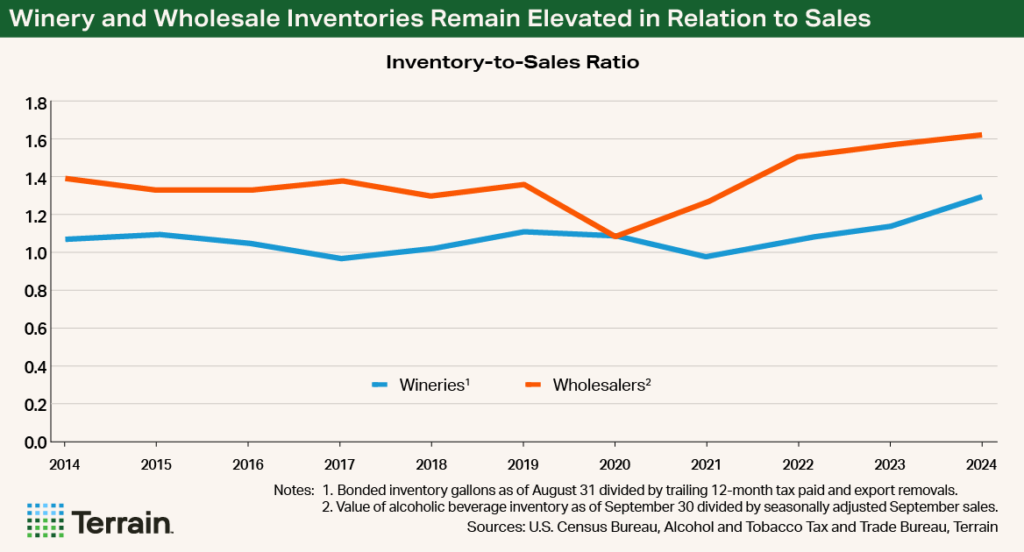

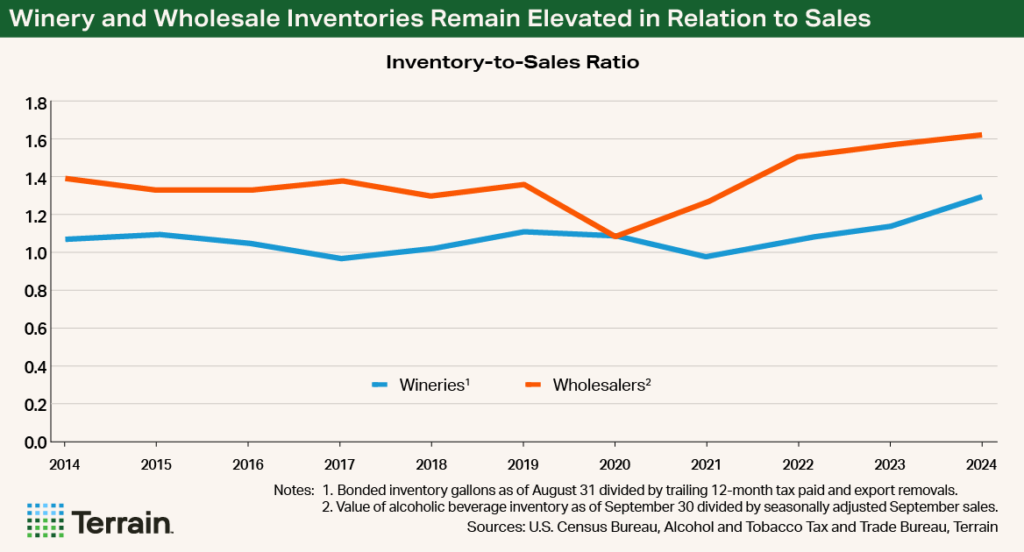

Given the muted outlook for wine sales and excess inventory at wineries and distributors, grape demand and prices are not likely to rebound quickly. Inventories remain elevated in relation to sales at both wineries and alcoholic beverage wholesalers.

Coastal regions producing for premium and luxury bottlings should see the swiftest recovery, as the outlook for these segments of the wine market looks brighter. However, even if wine sales stabilize, it could be several years before the grape market is back in balance in some areas unless there are short crops or more vines are removed than anticipated.

Coastal regions producing for premium and luxury bottlings should see the swiftest recovery.

The recovery is likely to take more time in the interior regions. While there could be a temporary bump in demand once inventory destocking has been completed, the interior regions are likely to continue to see a gradual reduction in demand. Thus, the supply side will be the primary lever of adjustment — and the pace of vineyard removals will dictate the speed at which the market recovers.

The recovery is likely to take more time in the interior regions.

Given that the market is likely to remain challenging for some time, growers will need to be resourceful in their approach to cost-cutting and securing grape commitments. They should not hesitate to remove older or diseased vineyards in marginal areas that are no longer economically viable.

Growers will need to be resourceful in their approach to cost-cutting and securing grape commitments.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.