Small Adjustments Coming for Beef-on-Dairy Calf Supplies

Article Originally Published in the March Issue of the National Cattlemen Magazine

In a time of tight supplies for beef cattle and slim margins on dairies, dairy producers saw an opportunity to breed more of their cows to beef genetics and capture record-high prices for day-old cross calves. The boom in beef-on-dairy breeding has been a lifeline for dairy producers, and it has led to a meaningful flow of dairy-origin cross cattle into beef supply chains.

But with billions of dollars being invested in new dairy processing plants, the market needs more milk. To make it, we’ll need more dairy cows. Does that mean an end to the dairy-beef cross supply?

Probably not. The incentives are still strong for dairies to breed to beef, and it’s not an all-or-nothing proposition. We’ll likely see some shifts in calf supplies as more are bred to dairy genetics, but I expect beef-on-dairy is here to stay.

Economics Drove the Evolution

Beef-on-dairy crosses emerged in the mainstream several years ago as an opportunity for mutual benefit to both the beef and dairy sectors. For dairy producers, incorporating beef genetics brought higher values for beef-sired calves compared with the low-to-negligible value for male dairy-breed calves. It also enabled dairies to reduce the number of heifers they retained when feed was expensive and the cost to raise or buy a replacement was high. On the beef side, beef-on-dairy provided a more consistent, higher-quality animal compared with the traditional straight dairy supply.

It’s important to bear in mind that all cattle eventually end up in the beef supply, and dairy cows aren’t having additional calves because of these programs. These are just changes to the quality and the timing of where dairy-origin animals enter the beef supply chains.

More Dairy Heifers Needed

A major development in dairy markets in 2025 is that several new or expanded dairy product (especially cheese) processing plants are coming on line. These plants will need to be filled with milk. But with stagnant milk cow inventories and low heifer numbers, it’s hard to see where the milk is going to come from.

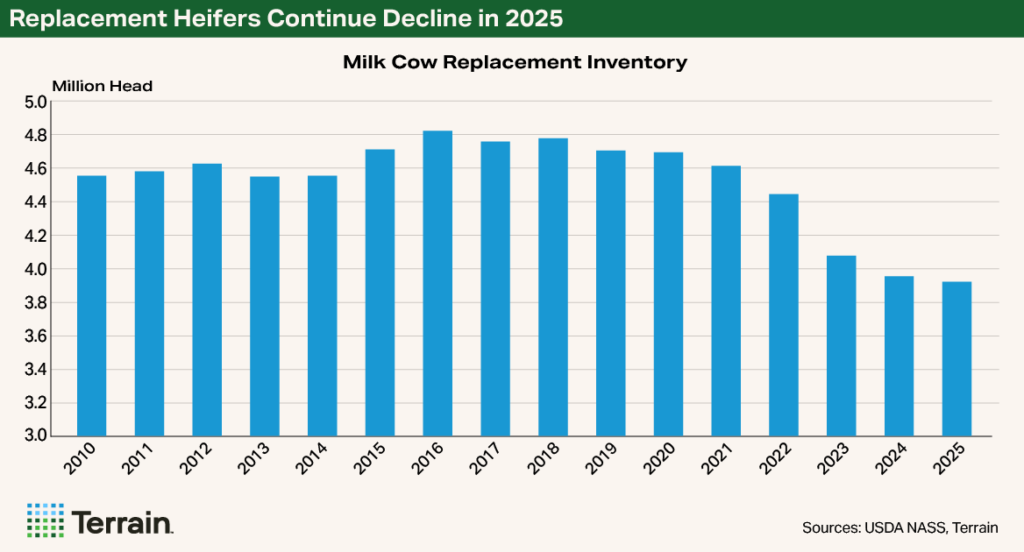

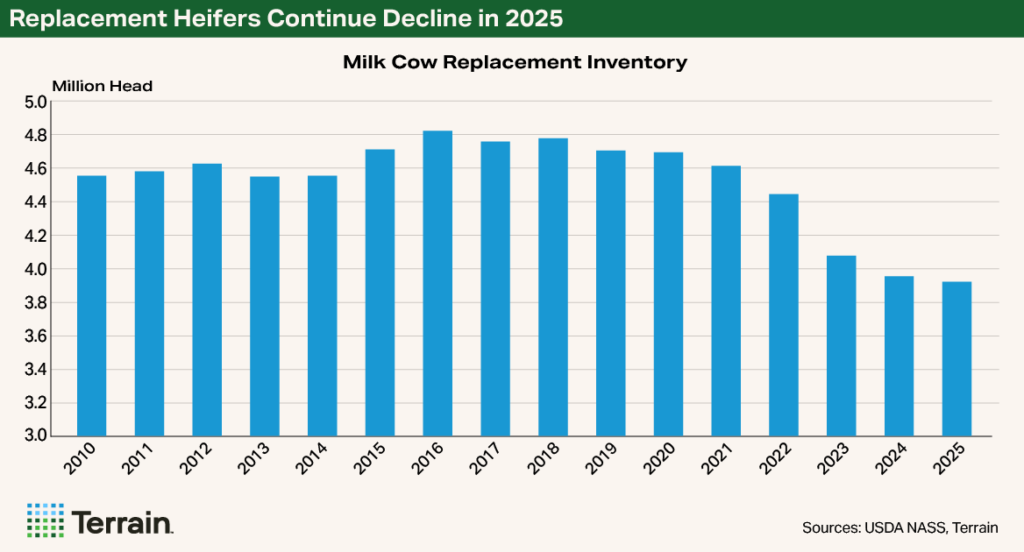

The number of milk cows in the U.S. experienced a recent-history peak in 2021 just above 9.5 million cows. We’re starting 2025 with just under 9.35 million. With fewer cows, and more of them being bred to beef, we’re starting 2025 with the smallest number of milk replacement heifers since the 1970s at 3.9 million.

One of the benefits of breeding more heavily to beef is that dairies have focused on more selectively retaining the genetics of only their highest-performing milk cows. As a result, milk cows today produce more milk and, more importantly, more of the valuable components like milkfat and protein that manufacturers need to meet the growing demand for products like cheese and butter.

While we might not need quite as many cows today as we would have in years past to produce the amount of components we need, we’ll still need more cows. That will require a shift back toward breeding more dairy replacement heifers and fewer beef-on-dairy crosses.

Impact on Beef Markets

Some dairy producers in 2025 will consider the choice between continuing to capture exceptionally high beef-cross calf prices or forgoing that quick-cash option in favor of starting to rebuild their replacement supply with an eye toward expansion in the long term. However, I don’t expect this to dramatically alter the course of beef supply from dairy in a negative way.

Any impact to the beef supply will be minor. The decision for a dairy to breed to beef is not about whether to do it at this point; it’s more about what portion of their herd will be bred to beef versus sexed dairy semen. Many may marginally shift toward breeding more dairy heifers, but they will not abandon their lucrative beef-on-dairy programs.

Long-Term Outlook

Cycles will come and go. Milk will become more profitable and beef cattle prices will cool off. But the potential for beef-on-dairy to provide a win-win situation for both sides of the equation will continue.

The dairy industry will continue to be an important partner to beef. That partnership is becoming more strategic and mutually beneficial, but dairy is a long way from tilting the scales on total beef supply.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.