Report Snapshot

Situation

Agricultural software firm Bushel has released its 2025 State of the Farm Report, providing an in-depth look at how farms of all sizes are navigating the evolving agricultural landscape. The report shares insights from 1,300 farms located primarily in the Midwest, representing mostly corn and soybeans but other crops as well.

Impact

Regardless of your plans for your operation’s future, it can be beneficial to know what those around you are doing and thinking. In particular, understanding the priorities of larger farms could offer ideas when scaling up, making improvements, or navigating a period of increased financial pressure and consolidation.

Larger farms today are prioritizing technology and software as well as operational efficiency. And, despite increased financial pressure in the agricultural economy, they’re still planning to grow. That’s according to Bushel’s 2025 State of the Farm Report, which provides an in-depth look at how farms of all sizes are navigating the evolving agricultural landscape, particularly in the areas of technology, growth and key opportunities.

Though farms of all sizes were surveyed, the insights from larger operations are particularly useful for farms that intend to grow, as they reveal how bigger farms think and operate and what topics are most important to them.

The report shares insights from 1,300 farms across primarily Midwestern states. Though these farmers grow corn and soybeans primarily, many other crops are represented as well, including cotton, rice, alfalfa, dry edible beans, millet, pulse crops, sugar beets and sunflowers. The farms range from small (less than 500 acres) to very large (over 10,000 acres), offering a broad perspective on the state of farms.

The largest farms revealed that technology was the second-highest priority for them — likely a key to scaling for any smaller operation with an eye on growth.

Opportunities

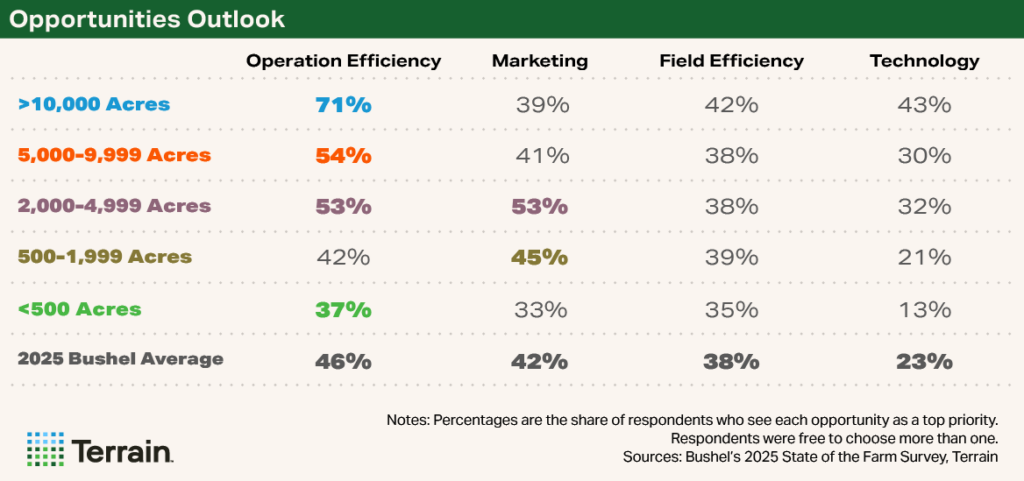

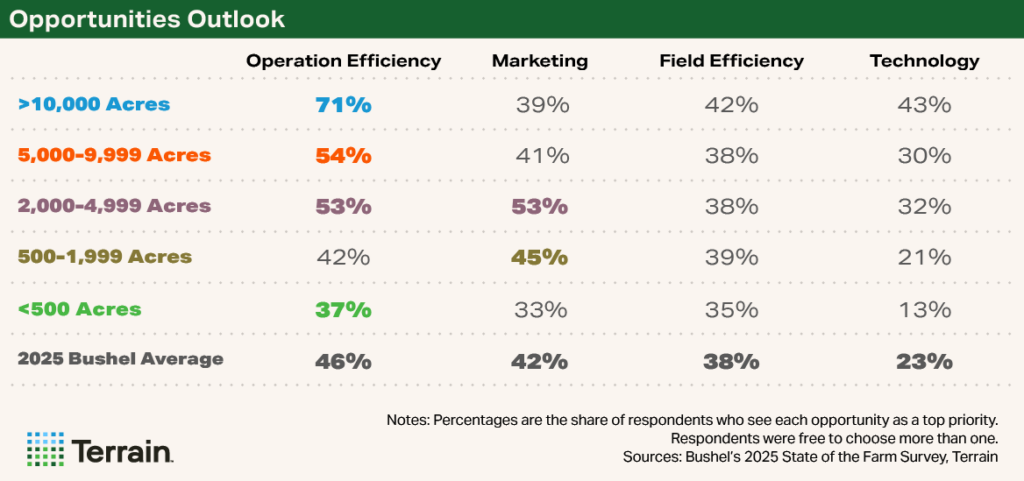

When it comes to opportunities, increasing operational efficiency ranks high as a top priority among all farms. However, it is even more of a top priority among the largest farms, with 71% indicating it as such.

Midsize farmers see room for improvement in their marketing strategies more so than the largest farmers. And farmers in the smallest category have less of an emphasis on technology as an opportunity for their operation. However, the largest farms revealed that technology was the second-highest priority for them — likely a key to scaling for any smaller operation with an eye on growth.

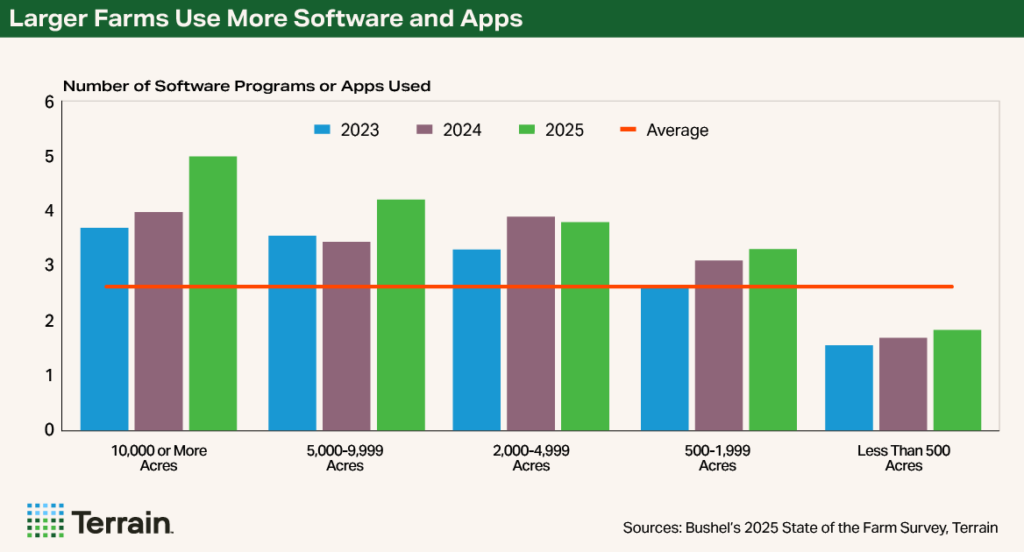

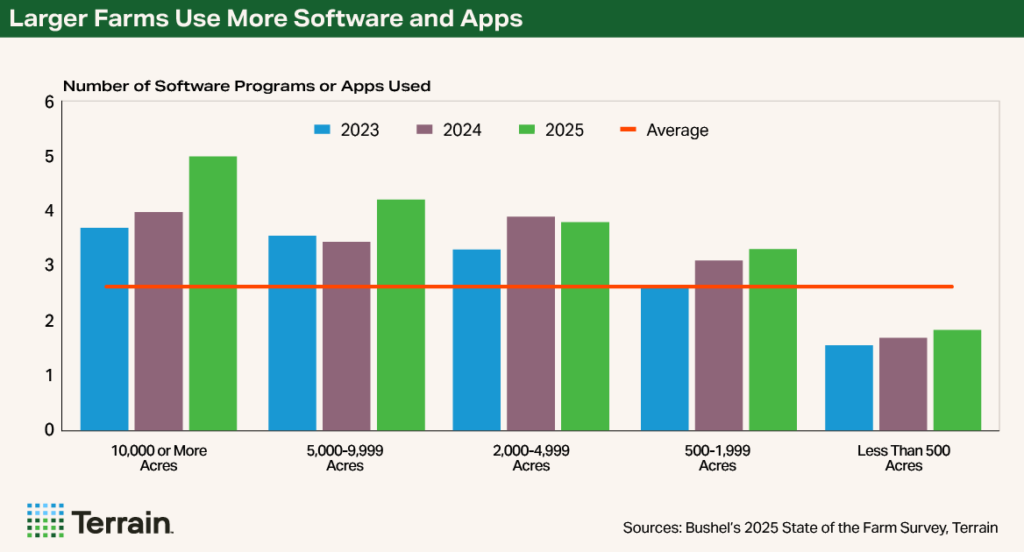

In 2025, use of software programs or applications accelerated among the largest farms (over 5,000 acres).

Recordkeeping and Farm Management Software

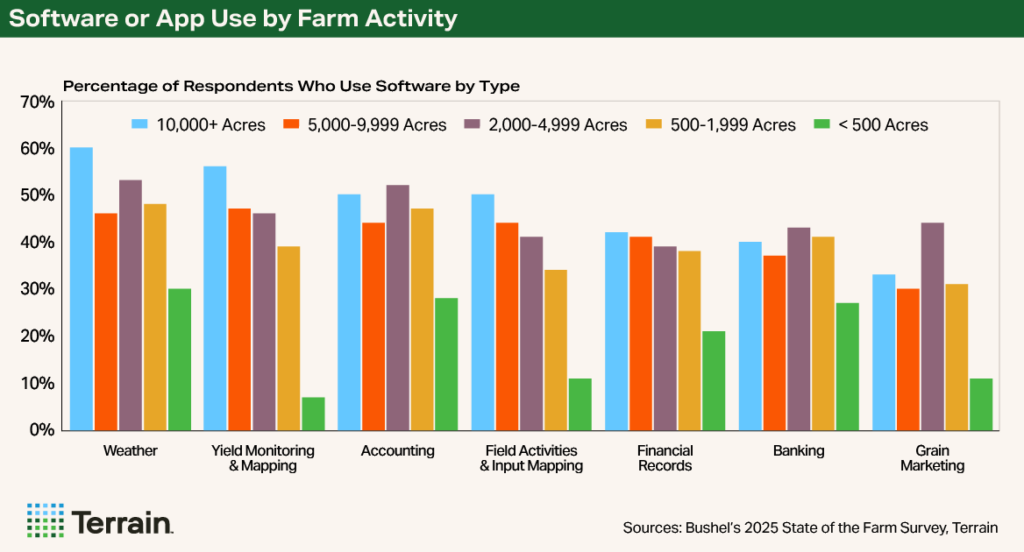

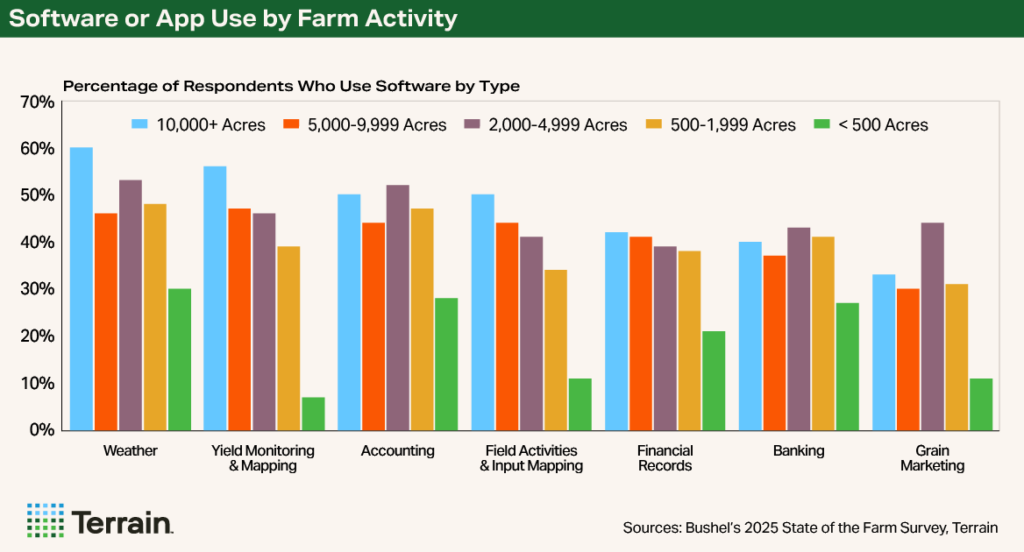

In 2025, use of software programs or applications accelerated among the larger classes of farms (those over 5,000 acres). Specifically, each reported using about one additional software or app this year compared with the past two years. Overall, larger farms are using one or two more software programs or applications than the average farm in 2025.

A higher proportion of larger farms report using software or apps for a wide range of farm-related activities, from accounting and financial recordkeeping to weather and grain marketing. This highlights the importance of incorporating technology to make operations more informed and more efficient.

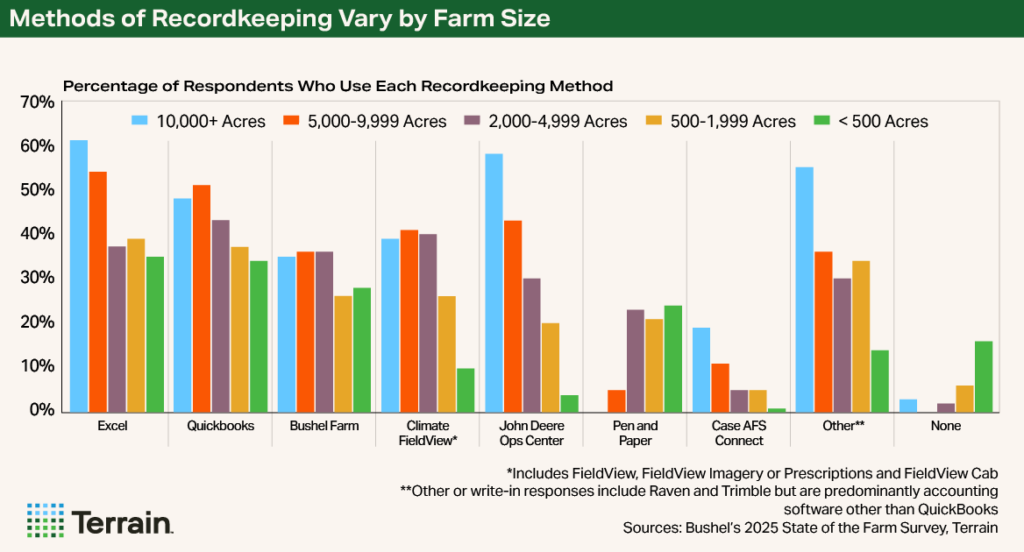

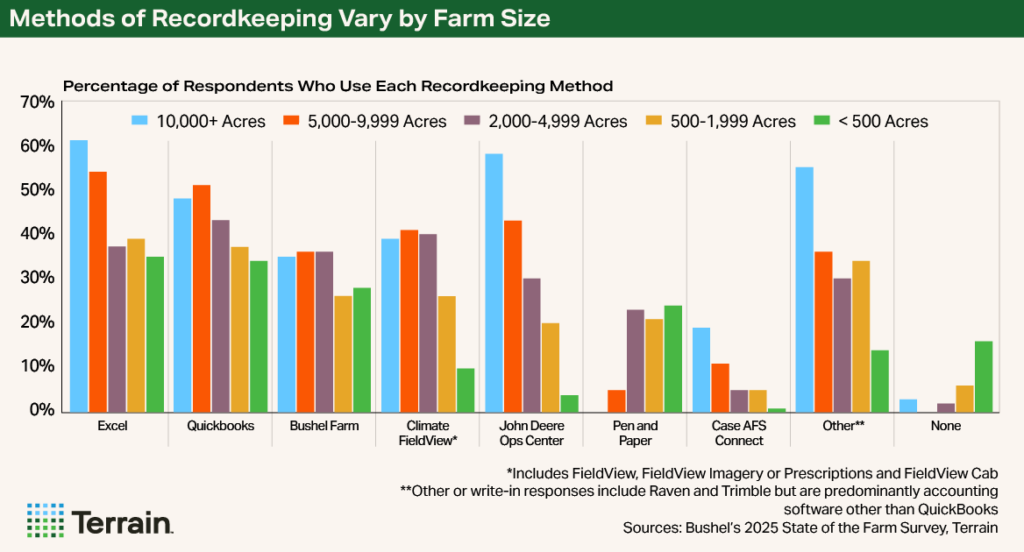

When it comes to recordkeeping, the largest farms indicated they use more software and connected systems to keep their records than smaller farms. None of the large farms surveyed reported using the pen-and-paper method of recordkeeping. As operations scale, there tend to be more people involved in management or operations or external service providers. Digital tools — whether connected systems, software or even Excel — make getting the right information to the right people at the right time more efficient.

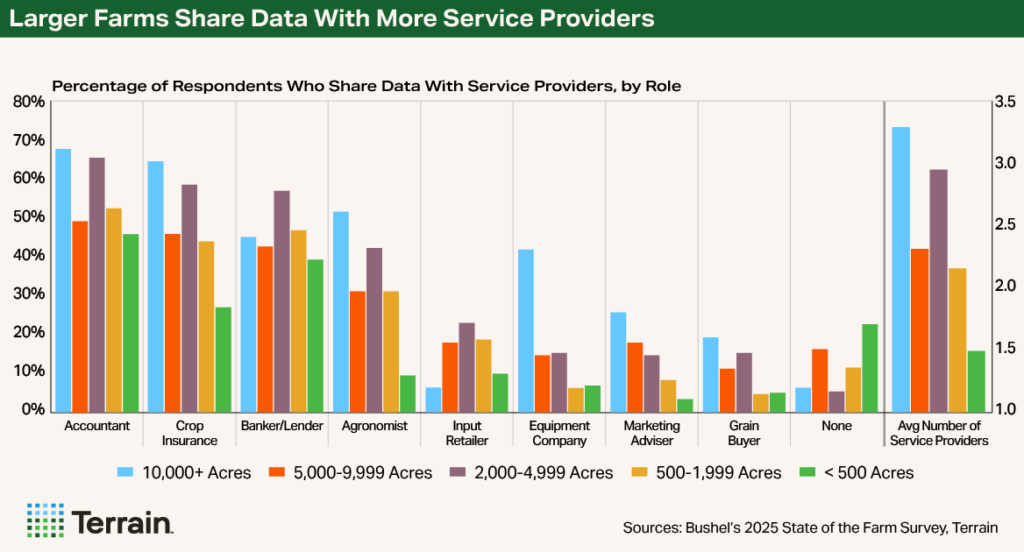

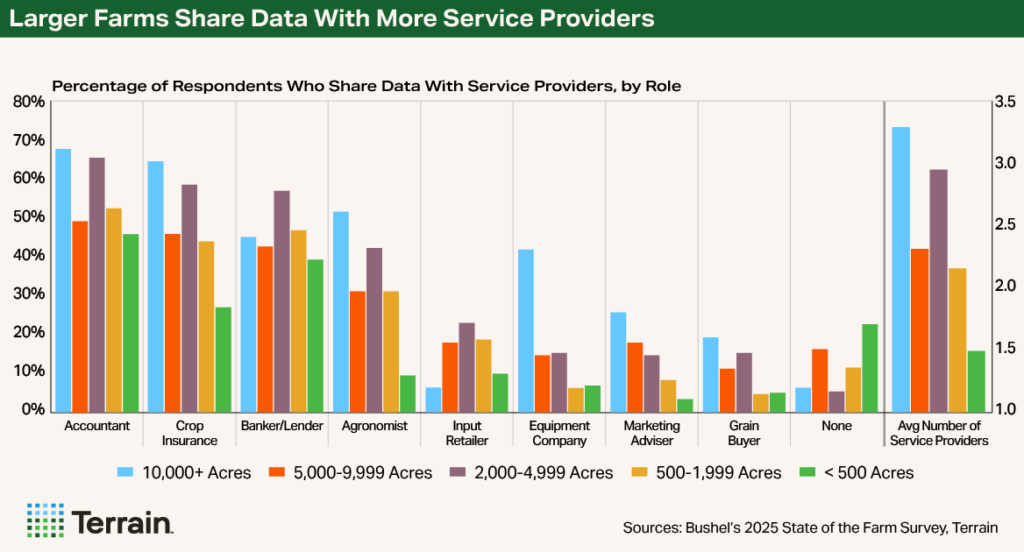

When looking at the number and type of service providers that data is shared with, the larger farms tend to share data with more service providers. This may indicate that larger farms tend to operate more as a team, relying on more specialized individuals or teams to accomplish specific tasks such as accounting, agronomy or marketing.

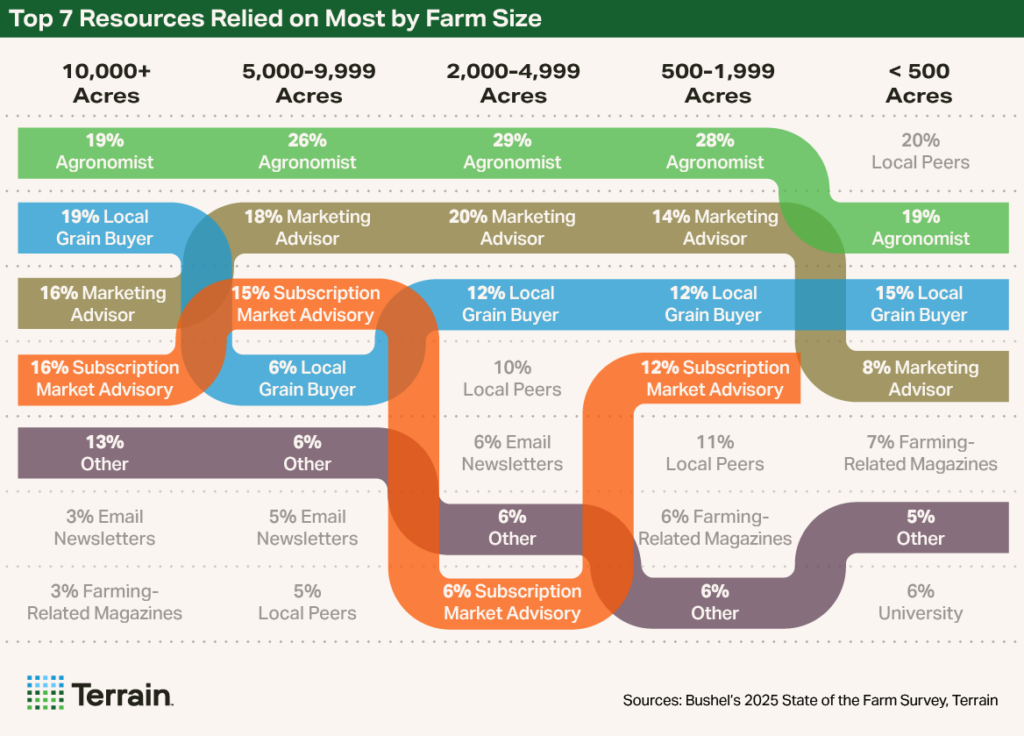

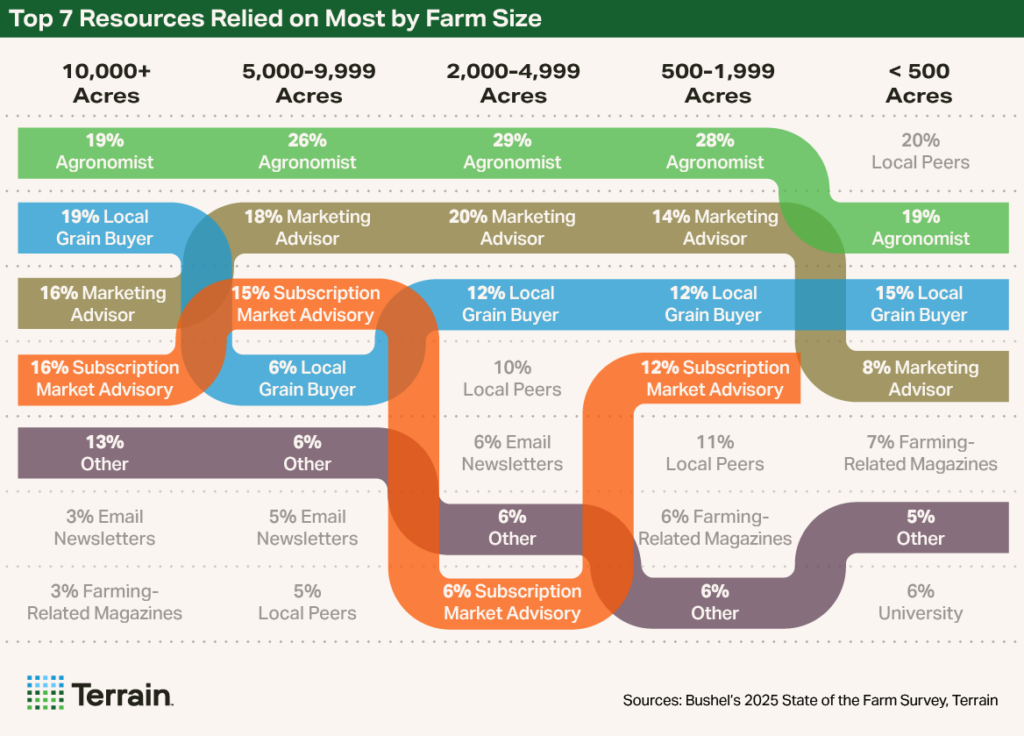

Across all aspects of farm operations and farm management, one theme is recurring: Larger farms consume more data, use more software applications, and rely on more outside services and resources. This highlights the importance of building a trusted team of services, resources and software regardless of whether you are positioning your operation for growth or looking for ways to improve.

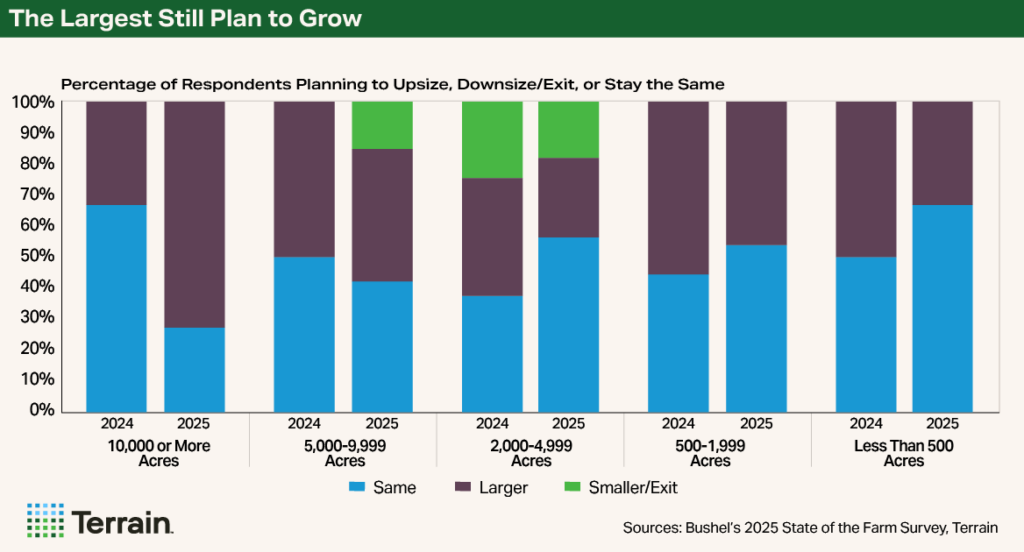

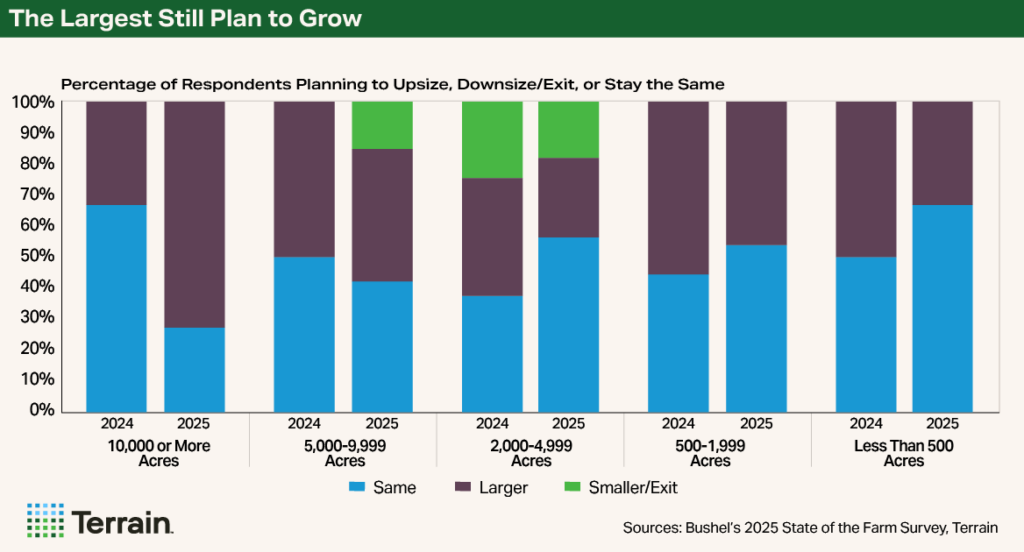

Among the producers in the largest category surveyed, the share of respondents who indicated they intend to grow increased sharply from 30% in 2024 to 70% in 2025.

Looking to the Future

Growth plans have scaled back in 2025 as farmers have readjusted their plans to a tighter financial environment. (See “Tailwinds Needed: An Early Look at 2026 Farm Income.”) This was observed across almost all size classes surveyed, with one exception: the largest farmers. Among the producers in the largest category surveyed, the share of respondents who indicated they intend to grow increased sharply from 30% in 2024 to 70% in 2025.

Interestingly, this group of farmers also had a lower level of concern for input costs, machinery costs and land values in 2025 than in 2024. This suggest they may have found a profitable strategy and are now returning to their plans for growth.

Farmers growing crops outside the big four (corn, soybeans, wheat and sorghum) have scaled back expansion plans noticeably in 2025, with 73% indicating they plan to stay the same size, compared with 42% in 2024. Just 13% indicated they plan to expand, down from 50% the year before. These results potentially reflect lingering financial issues among the other eight crops of cotton, rice, alfalfa, dry edible beans, millet, pulse crops, sugar beets and sunflowers.

Understanding the priorities of larger farms could offer ideas when scaling up, making improvements, or navigating a period of increased financial pressure and consolidation.

A Smart Strategy

Regardless of your plans for your operation’s future — to size up, size down or stay the same size — it can be beneficial to know what those around you are doing and thinking. In particular, understanding the priorities of larger farms could offer ideas when scaling up, making improvements, or navigating a period of increased financial pressure and consolidation. For example:

- Larger farms see opportunity in improving operational efficiency and a higher-than-average share view technology as an opportunity (43% for the largest farms versus the full sample average of 23%).

- Larger farms use more software tools and share data with more external service providers, emphasizing the importance of assembling the right team for farm success.

- The very largest are still planning to grow. They have either achieved significant economies of scale, have a management strategy that works in a tough economic environment, have a robust risk management strategy, or possibly a mix of these and other factors.

To read a full copy of the original report, see https://bushelfarm.com/state-of-the-farm-report/.

About Terrain:

Terrain’s expert analysts distill vast amounts of data to deliver exclusive insight and confident forecasting for a more resilient agricultural economy. Terrain is an exclusive offering of AgCountry Farm Credit Services, American AgCredit, Farm Credit Services of America and Frontier Farm Credit.

About Bushel:

Bushel is an independently owned software company and leading provider of software technology solutions for farmers, grain buyers, ag retailers, protein producers and food companies, headquartered in Fargo, North Dakota.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.