Report Snapshot

Situation

The Federal Reserve is likely to push the federal funds rate even higher in the near term to continue to combat inflation pressures amid a generally strong labor market.

Impact

Interest rates on agricultural loans will creep higher alongside the federal funds rate.

Action

Agricultural producers should consider stress testing their financial position to account for an elevated rate environment in 2023.

Near-term Rate Outlook

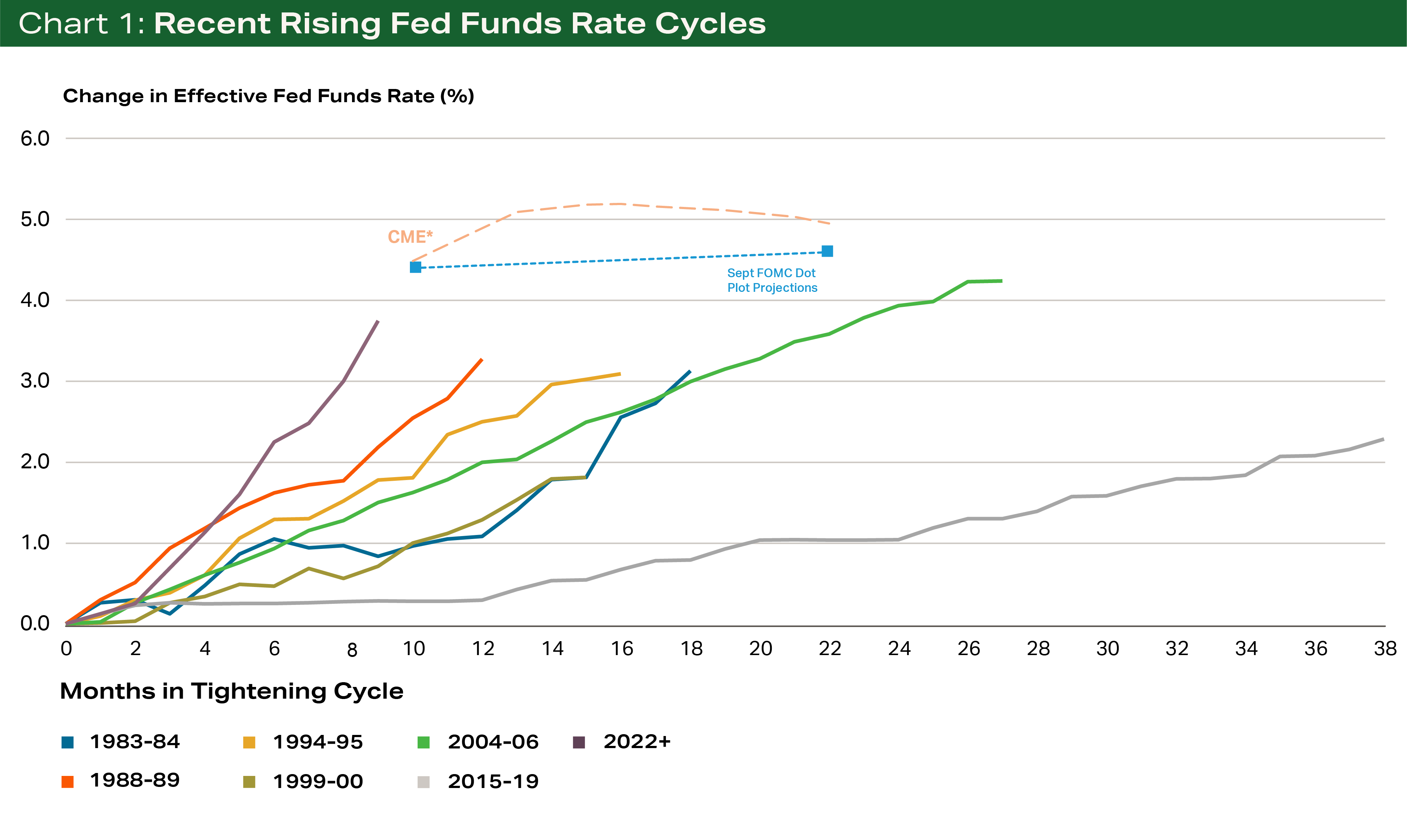

From March to November 2022, the Federal Reserve has raised the federal funds rate at a quicker pace than other recent monetary tightening cycles, or periods when the Fed increased the federal funds rate consistently (Chart 1). The last time the effective federal funds rate reached the current level was in early 2008. I believe the federal funds rate will continue to increase in the near term as the Federal Reserve exerts its influence to dampen demand and bring inflation in line with their 2-percent target.

The market currently expects the federal funds rate to settle around the 425-to-450 basis point mark by the end of December, which is consistent with the Federal Reserve’s September Summary of Economic Projections median dot plot estimate. A federal funds rate in the 425-to-450 basis point range would represent an additional increase of at least 50 basis points. An additional increase would exacerbate the sharpness of monetary tightening and increase the cost of borrowing for farmers.

Notably, the market’s current projection is more aggressive than the most recent Federal Reserve dot plot, which may also indicate further tightening as noted in Chart 1.

Sources: CME, Federal Reserve Bank of St. Louis FRED, Federal Reserve Board of Governors, and Terrain Ag.

In the near term, it is unlikely that the Federal Reserve will deviate too far from the current projections as inflation remains well above the Federal Reserve’s 2-percent target.

Between November 2nd and the December 14th Federal Reserve Open Market Committee meeting there will be two additional Consumer Price Index (CPI inflation) releases and one Personal Income and Outlays (PCE inflation) release. As the CPI is currently above 8 percent and the current PCE is above 6 percent, both are unlikely to decline at a rapid enough clip to give the Fed a full stop on interest rates hikes, though a decline in inflation could slow the Federal Reserve’s projected pace of rate hikes in 2023.

In addition to inflation estimates, economic indicators of consumer health and employment will be important data points to follow. For example, the Bureau of Labor Statistics will release estimates of unemployment on November 4th and December 2nd, both ahead of the December 14th Federal Reserve Open Market Committee meeting. If the labor market remains strong, the Federal Reserve will have additional available latitude to raise rates.

Conversely, if the labor market, and general consumer health, show signs of distress, the Federal Reserve may be less inclined to aggressively raise rates.

A Different Kind of Loan Renewal Season

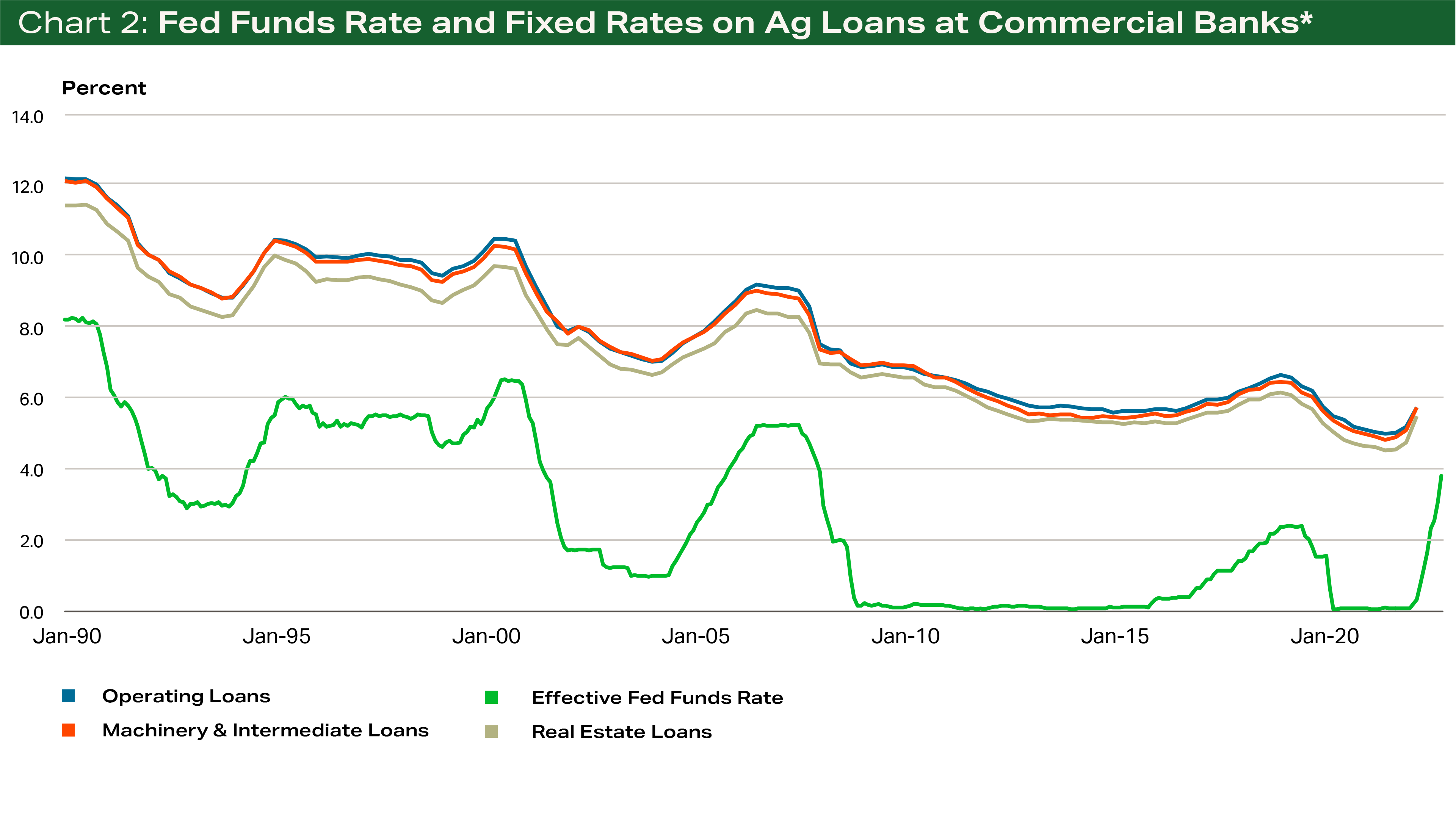

As it relates to agricultural borrowers, the federal funds rate tends to act like a fly wheel on agricultural loan rates. The historical relationship between the movement in the average rate on agricultural loan products and the federal funds rate is nearly tit-for-tat as indicated by Chart 2. As such, producers should expect the cost of borrowing to continue to increase moderately in the near term as the Federal Reserve increases the federal funds rate. Additionally, borrowers are likely to notice a very sharp increase in rates as compared to a year ago during the upcoming annual renewal season.

Sources: Federal Reserve Banks of Kansas City and St. Louis FRED, Federal Reserve Board of Governors, and Terrain Ag.

It is highly probable that by early 2023, rates on nearly all agricultural loans will be well above pre-Covid levels, especially variable rate loans, a sharp difference from the historic lows observed just a year ago. Before producers go into the annual loan renewal season they should stress test their financial position to gauge the amount of interest rate risk they are willing and able to accept.

Additionally, in times of rate uncertainty loan products that are less commonly used tend to resurface in conversations. In that event, borrowers should carefully work with their lenders, accountants, and financial team to understand the benefit and risks of each loan product.

The impact of the higher rate environment may also be augmented by higher input prices driving larger borrowing needs.

The Additional Cost of Optionality

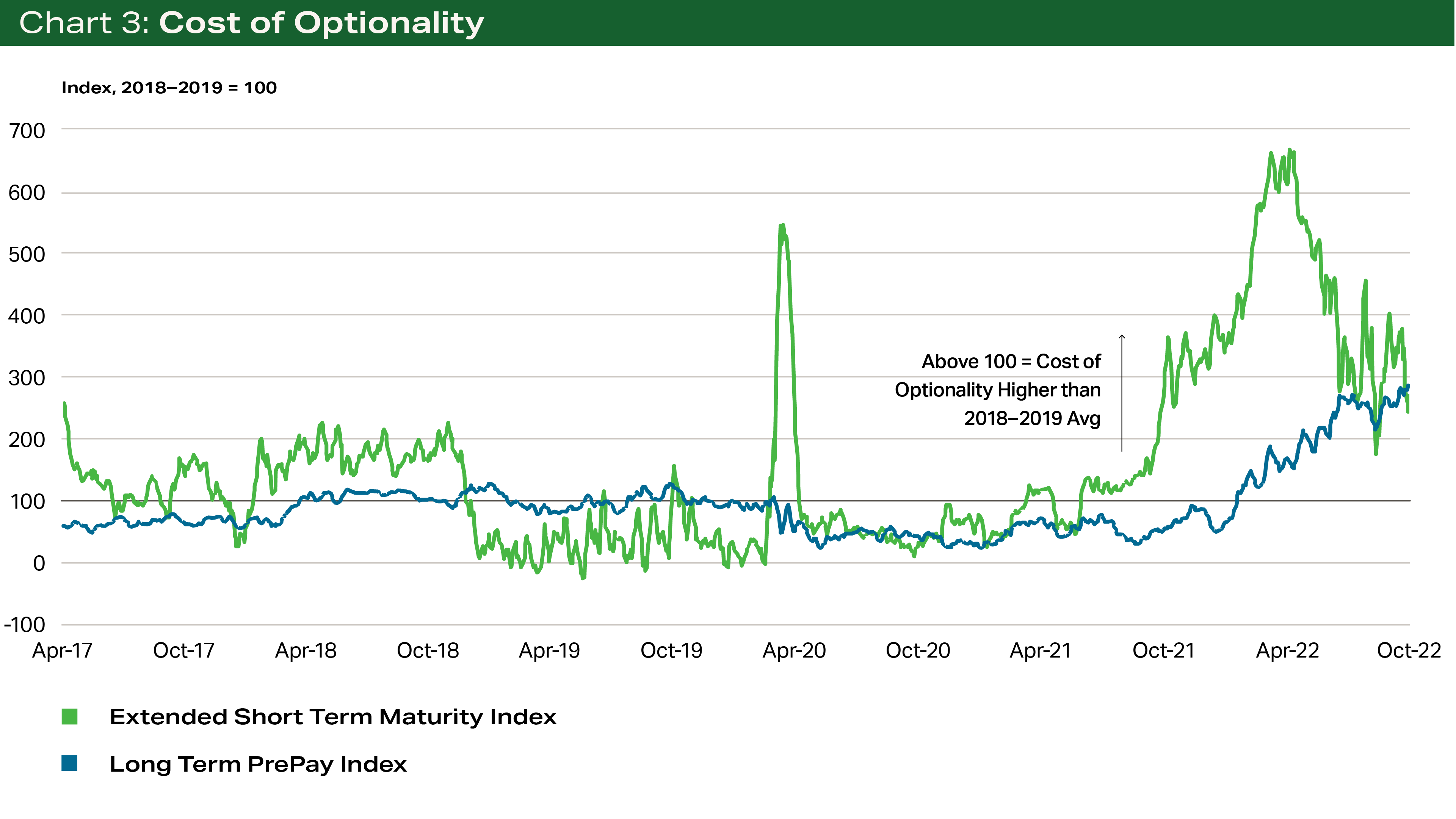

In addition to an expected increase in the level of rates, the cost of purchasing additional optionality in loan products is also likely to remain elevated in the near term.

For example, the cost to add an additional prepayable year of maturity to a short-term loan, all else equal, has increased above pre-Covid levels (Chart 3, green line). Likewise, the cost of purchasing a prepayable vs a non-prepayable long-term product, same tenor, has increased sharply in recent months (Chart 3, blue line). The cost of other forms of optionality are also likely to remain elevated in the near term.

Borrowers should carefully calculate the cost and terms of these options with their lenders, accountants, and financial team and weigh the costs against the benefits of different loan products. Likewise, given that the expected cost should remain elevated in the near term, borrowers should know their personal breakeven rate, when they are comfortable purchasing additional optionality given their rate outlook, and be ready to execute should the opportunity present itself.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.