Quarterly Outlook • March 2024

Prices Rally Despite Slaughter Totals Exceeding Pig Crop Trend

Production Summary

Slaughter totals are far outpacing USDA pig crop estimates, and I expect that the USDA will again make a large revision to pig crop numbers in the next Hogs and Pigs Report.

For the December-February quarter, slaughter surpassed the pig crop by 250,000 to 300,000 head per month. I continue to think that limited gilt retention is playing a role in the decline of the breeding herd and is partly behind the discrepancy between the slaughter and pig crop totals.

Meanwhile, sow herd liquidation continues at an aggressive pace. Year to date, sow slaughter is up 4.7% year over year (YOY) through the first seven weeks of 2024, resulting in the removal of an extra 20,000 sows from the breeding herd compared with last year.

When combined with December 2023’s 16,000-head increase versus December 2022, sow slaughter has risen by 36,000 head since the USDA’s December 1 Hogs and Pigs Report. This alone would reduce total sow numbers by 0.6% from the December 1 total to March 1, 2024.

Feed costs are expected to decline an additional $10/head during the next four to six months, further improving margin prospects.

Price Summary

Feed prices have nearly reached four-year lows, with February corn futures down almost 38% versus a year earlier and soybean meal prices down 19% during the same period. This translates to about $28/head lower feed costs over the past 12 months. Feed costs are expected to decline an additional $10/head during the next four to six months, further improving margin prospects.

The rally in lean hog futures contract prices that began in early January 2024, when the summer contracts were trading in the high $80s/cwt to low $90s/cwt, had given producers a little hope that as the summer approached, the staggering losses that the industry had suffered during the previous 16 months would narrow to near break-even levels.

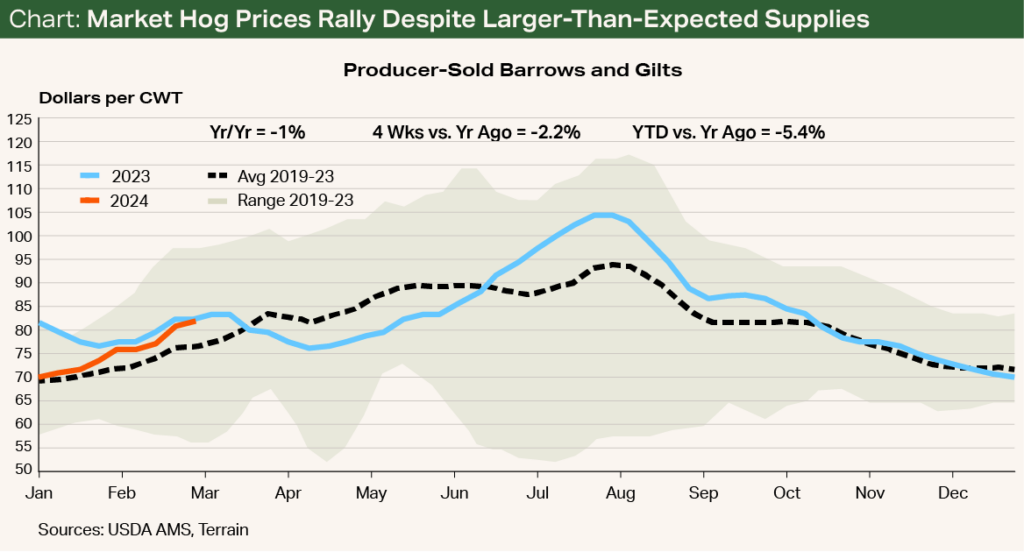

The rally has pushed summer lean hog contracts into the $102/cwt to $104/cwt range. When combined with lower-trending feed costs, it puts average forecast profits using the Iowa State farrow-to-finish models in the low to mid-$30s/head range. I expect Q2 2024 producer-sold barrow and gilt prices to average about $93/cwt, ranging from $82/cwt in early April to more than $104/cwt in late June

(see Chart).

I expect that the normal seasonal price pattern will play out again in the second half of 2024.

By mid-July, pork wholesale cutout values are expected to rally to the low $120s/cwt, 7% to 9% above year-earlier levels. This is likely to push producer-sold barrow and gilt prices higher as well, to around $110/cwt to $115/cwt.

I expect that the normal seasonal price pattern will play out again in the second half of 2024. After peaking in the summer, prices will likely trade lower to levels that will result in breakevens or losses, depending largely on corn market trends in the second half of the year.

Production and Price Dynamics

The industry consensus holds that sow slaughter totals above 57,000 head per week result in sow herd liquidation. During the 11 weeks since the last Hogs and Pigs Report sow herd total, the industry has removed more than 56,000 head, or 0.9% of the breeding herd.

The lack of gilt replacements and increased on-farm sow mortality will lead to a larger YOY decline in the breeding herd. Industry sources indicate that sow mortality levels are at record highs, exceeding 15%. This is likely because of a combination of seasonally increased disease pressure and reproduction-related sow deaths.

I expect that we could see another 3% or greater decline in breeding herd numbers in the March 2024 USDA Hogs and Pigs Report. The biggest challenge and risk for the industry will be if the report shows further productivity gains in pigs per litter that offset the decline in potential litters born.

As you evaluate strategies, consider that there could be more news of bullish factors entering the spring and summer market.

The recent rally in lean hog futures contract prices has pushed summer contracts (June, July and August 2024) to levels where many producers can lock in forward profits through hedging using futures or options or purchasing government-subsidized Livestock Risk Protection insurance policies.

Producers evaluating risk management strategies need to weigh their options on programs that can protect equity and summer profits while establishing a solid floor price to limit losses for the late third and fourth quarters. As you evaluate strategies, consider that there could be more news of bullish factors entering the spring and summer market.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.