Global oversupply and flat global demand have driven January 2025 soybean futures down 30%, to $9.95/bu., from last year’s $12.95/bu. The bearish trend is currently projected to continue into 2025, as favorable weather in Brazil is setting the stage for a record crop. Unless there is a weather scare curtailing production in Brazil and thus increasing export demand, global and U.S. biofuel policies will be the soybean demand driver in the new year.

Higher Stocks, Lower Demand

Global soybean production is set to reach a record 15.7 billion bushels in 2024/2025, with Brazil producing 40% more soybeans than the U.S., according to the USDA. The U.S. was also on track for a record crop, though dry weather in August reduced yields. U.S. beginning stocks are up 30% year over year, adding to high-supply pressures. Ending global stocks sit at 4.8 billion bushels, the highest on record.

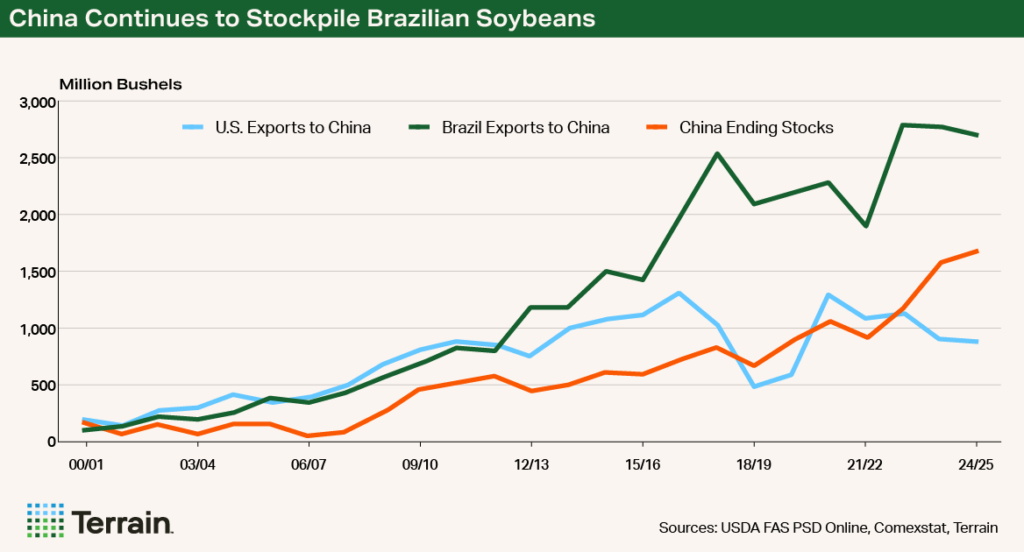

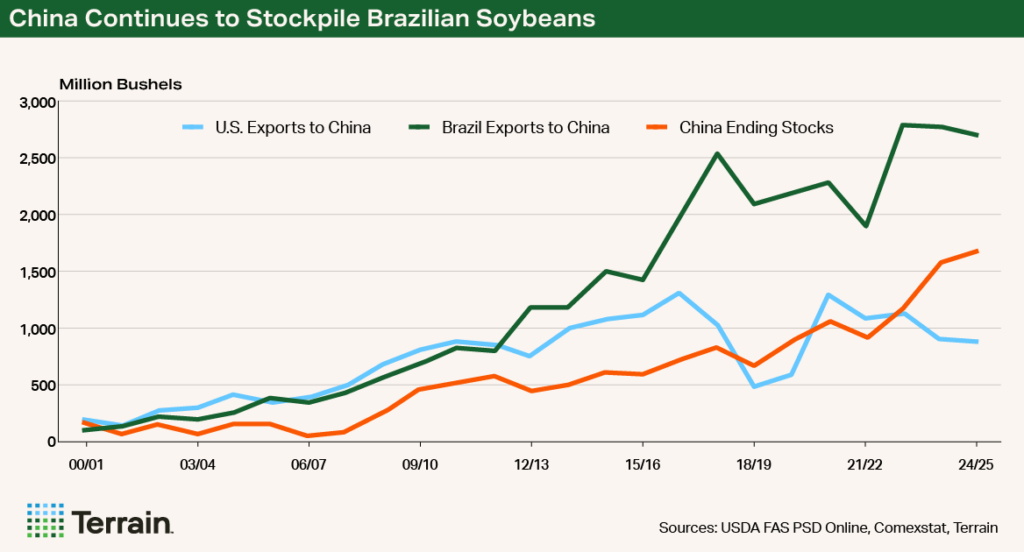

China's economic struggles and years of stockpiling have reduced demand for U.S. soybeans. Its 2024/2025 imports were down 3% to 4 billion bushels of U.S. soybeans. If China reinstates 25% tariffs on U.S. soybeans, it’s unlikely that U.S. soybean prices will fall further, as they likely already bottomed in August.

A rebound in soybean prices in the first part of 2025 will depend solely on weather disruptions to production in Brazil.

A renewed trade deal would offer false hope. Brazil has been busy feeding China soybeans (supplying nearly three times as much as the U.S. in 2022/2023). China met only 60% of its prior commitment in the Phase One agreement in 2020/2021, is now aligned with Brazil and has been for years, and has stagnant demand.

While the U.S. is currently priced competitively globally, since September the dollar has appreciated 6%, making U.S. exports that much more expensive. During the same time, the Brazilian real has reached an all-time low, down nearly 11% versus the U.S. dollar, increasing Brazil’s export competitiveness. A rebound in soybean prices in the first part of 2025 will depend solely on weather disruptions to production in Brazil, limiting the amount it can export.

Biofuel Buzz Could Benefit U.S. Crushers

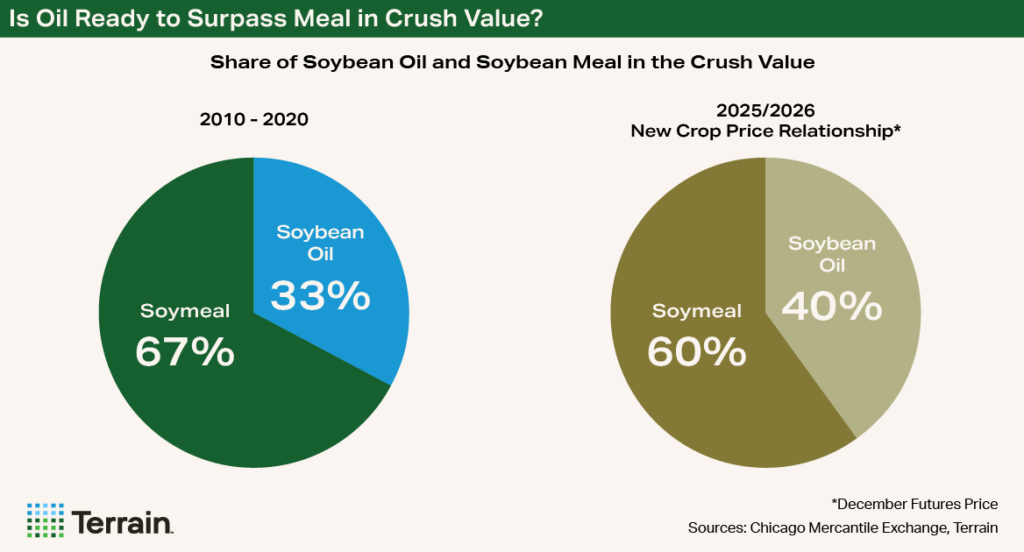

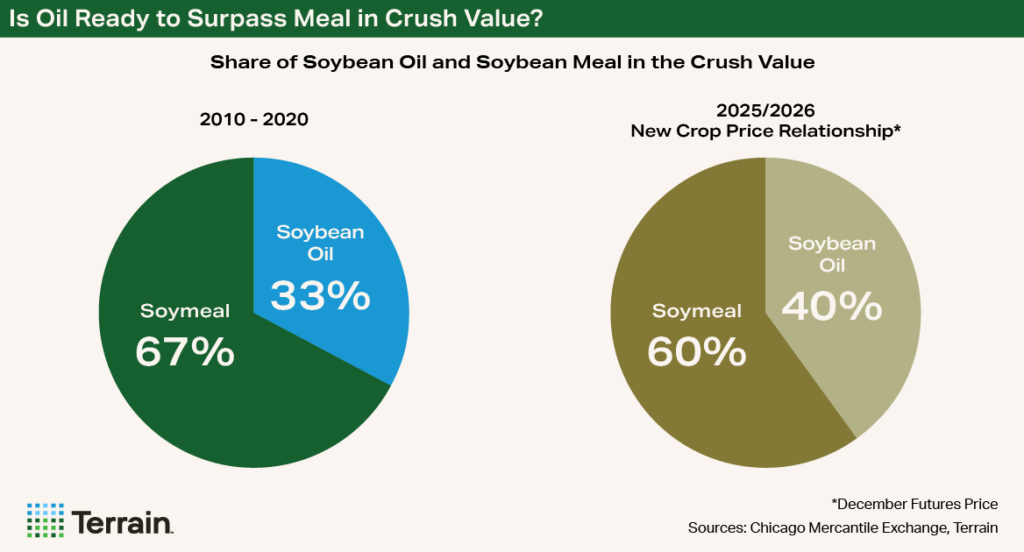

Traditionally, soymeal has driven U.S. crusher margins. However, growing biofuel demand is shifting this dynamic.

Improved soybean oil demand would likely increase crushers’ margins and provide an incentive to expand crushing capacity in the U.S.

Global vegetable oil stocks are tightening, with several countries such as Indonesia and Brazil increasing biofuel mandates. Because of unfavorable weather conditions, the market expects production for palm in Malaysia to decline, and the USDA foresees declines in canola in Canada and the EU. Additionally, sunflower seed production will likely decline amid the ongoing Russia-Ukraine war.

All these factors will increase global demand for other vegetable oil substitutes and could benefit U.S. soybean crushers. Improved soybean oil demand would likely increase crushers’ margins and provide an incentive to expand crushing capacity in the U.S.

While the biofuel sector is growing, profitability remains reliant on government policies, including tax incentives.

Tax Credit Confusion

In the U.S., the transition from the $1 per gallon 40B blenders tax credit to the 45Z producer tax credit beginning in January 2025 is creating uncertainty.

The IRS has not finalized credit details, which is causing confusion among producers on what sustainable practices will qualify. In 40B, the climate smart practices must be bundled: cover crops, no-till and enhanced fertilizer, with less than 20% of soybean acres eligible. The 45Z has not outlined if these practices will be “unbundled” to reward producers for adopting some of these practices, or how the carbon program credits will be calculated, putting feedstock buyers on the sidelines and prompting biofuel producers to reduce production.

Meanwhile, California's 20% cap on seed oils (soybean, canola and sunflower seed) for Low Carbon Fuel Standard credits may increase demand for alternative, imported feedstocks like Brazilian tallow and used cooking oil (UCO) from China.

China’s removal of the UCO 13% export tax rebate incentive will make exporting UCO more costly, reducing its competitiveness. If the current threat of increased U.S. tariffs is implemented by the Trump administration, the competitiveness of imported feedstocks would decrease.

The outcome of these policies will continue to shape the biofuel industry and U.S. soybean demand.

While soybean oil alone cannot supply all feedstock for the expected biofuel growth in the U.S., the proposed Farmer First Fuel Incentives Act would:

- Limit tax incentives to U.S.-produced feedstocks, reducing import competitiveness.

- Extend the term from three to 10 years, providing the market better certainty.

Additionally, the Environmental Protection Agency's investigation into two renewable diesel producers using fraudulent UCO could lead to stricter feedstock regulations.

The outcome of these policies will continue to shape the biofuel industry and U.S. soybean demand.

While biofuels offer demand opportunities, they won’t drive significant price increases in the short term.

Outlook: A Lot of Long-Term Movement, Not Much for Short-Term Markets

Despite bearish soybean fundamentals, geopolitical and biofuel policy changes will continue to create price volatility. While biofuels offer demand opportunities, they won’t drive significant price increases in the short term.

…Soybean producers should be prepared to hedge against downside risks and quickly capitalize on potential price rallies in 2025…

Unless a black-swan weather event hinders Brazil’s production prospects, soybean producers should be prepared to hedge against downside risks and quickly capitalize on potential price rallies in 2025, as they may be short-lived.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.