Following a period of steady expansion in the mid-2010s, vineyard values have flattened throughout much of the North Coast in recent years. Over the past year, market sentiment has become decidedly negative in light of declining wine sales, a surfeit of grapes, and concerns about the future course of wine consumption.

Buyers are both fewer and more cautious. At the same time, the number of available properties has soared.

Consequently, buyers are both fewer and more cautious. At the same time, the number of available properties has soared. Activity has paused as buyers and sellers try to make sense of the current market environment and struggle to agree on price.

Demand has held up best for marquee vineyards in the prime areas of Napa, Sonoma and Mendocino counties, according to American AgCredit’s appraisal team. There is currently little interest in properties in Inland Mendocino and Lake County — particularly those with uncontracted fruit, because of the difficulty in securing grape contracts, or those nearing the end of their economic life, because of escalating replanting costs.

The most momentous change over the past six months is a surge in available properties throughout much of the North Coast. The surge includes actively listed properties as well as quiet listings and exclusive offerings. The increase in inventory has been heaviest in the Lake and Inland Mendocino areas.

Few transactions have closed over the past six months. A growing disconnect between buyers’ and sellers’ price expectations has contributed to the pause in activity. Buyers are holding firm to their target price, which typically reflects lower prices than have been paid in recent years. Most sellers haven’t yet adjusted their expectations.

We expect activity to pick up once the trajectory of wine sales becomes clearer and wineries have a better handle on their inventory situation and future grape needs.

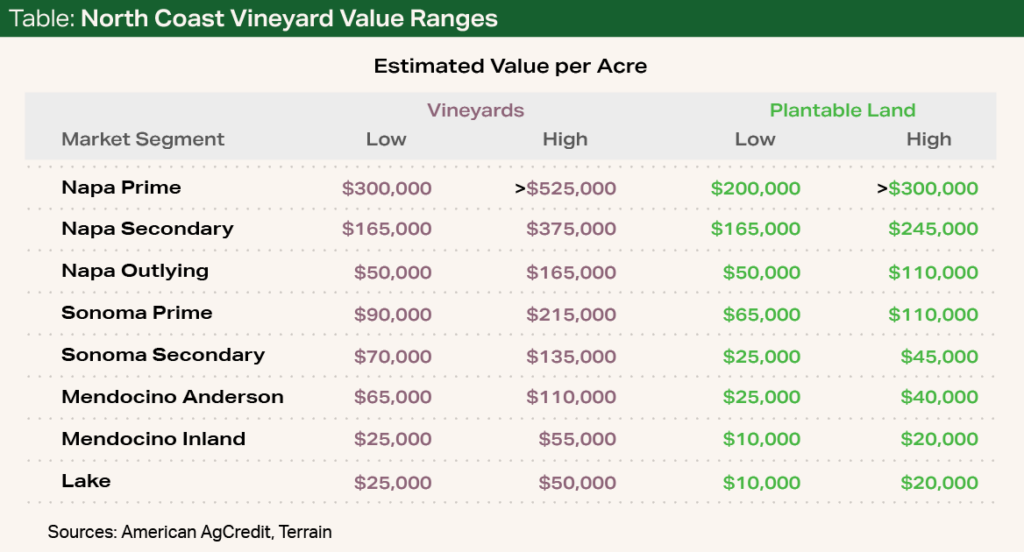

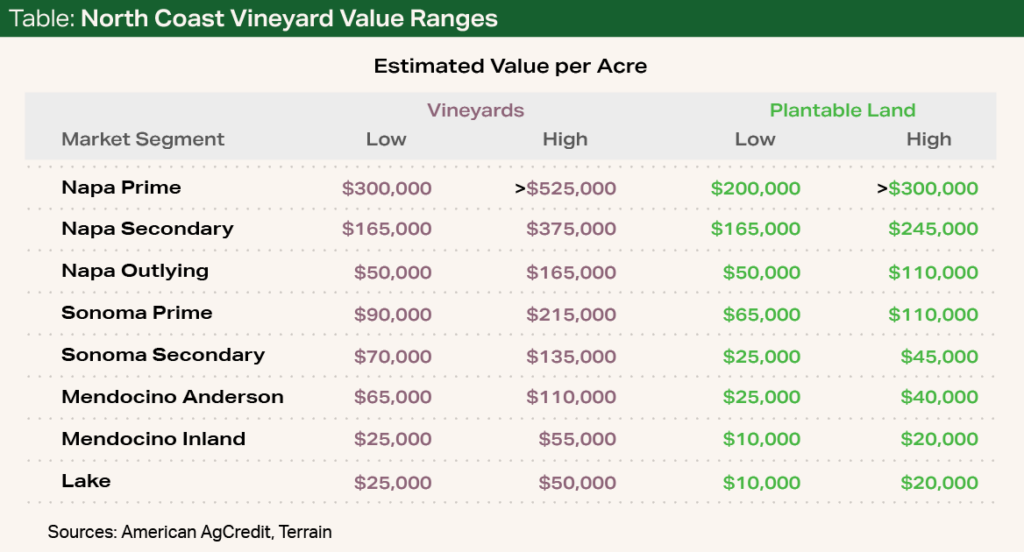

Vineyard Value Estimates and Outlook

American AgCredit’s appraisal team has provided estimated value ranges for each of the North Coast market segments as of the first quarter of 2024 (see Table). Given the lack of activity, it is difficult to get an accurate pulse on where North Coast vineyard values stand today. Buyers clearly have the upper hand now, but the value estimates remain unchanged because there is not enough transactional evidence to lower them.

I see several compelling reasons that vineyard values are poised for a downward adjustment.

I see several compelling reasons that vineyard values are poised for a downward adjustment. Headwinds include:

- Softening grape prices

- Rising farming and planting costs

- A muted outlook for wine sales

- High interest rates

- A growing imbalance between the number of buyers and sellers in the market

These headwinds are almost certain to depress North Coast vineyard values in the near term. While the direction is clear, the magnitude and duration of the decline will depend on the trajectory of wine sales and how quickly the imbalance between supply and demand in the grape market is resolved.

Properties in the prime segment of Napa are best positioned to hold their value.

The severity of the slump will also vary widely across the North Coast. I believe the general pattern will be similar to that of the past downturn that began in 2008. Vineyards in core areas are likely to hold their values better than those in outlying areas, and values for top-tier vineyards in the most desirable areas may not fall at all.

Much Depends on the Market Segment

Properties in the prime segment of Napa are best positioned to hold their value, and any decline is likely to be minimal so long as luxury Cabernet Sauvignon sales continue to hold up. The secondary and outlying areas of Napa are more exposed to the oversupplied grape market. Therefore, potential exists for a more sizable decrease in outlying areas such as the Pope Valley.

Values in the prime areas of Sonoma are also likely to hold up relatively well.

Values in the prime areas of Sonoma are also likely to hold up relatively well. However, grape price appreciation has been more modest in Sonoma than Napa, so a modest adjustment is likely. The secondary areas of Sonoma, which are less sought after, will likely see a more pronounced decline.

Within the outlying counties, vineyards in the Anderson Valley are best positioned to hold their value.

Like the past downturn, values in Lake County and Inland Mendocino are poised to take a bigger hit in the near term. The inventory of available properties stands near record levels, and the grape market will remain depressed for longer as these areas face stiff competition with other oversupplied regions.

Competitive Advantages

Throughout the North Coast, vineyards in the early stages of their economic life should see stronger demand and pricing than their older counterparts given the high costs of replanting. Grape contracts with a substantial remaining term will also have an advantage in the current market environment.

The North Coast is the premier wine-growing region in the U.S., and its future remains bright despite the murky outlook for overall wine consumption. Vineyard values in the core areas should continue to appreciate over the long run, albeit at a more modest pace than in the past.

The market slump presents opportunities for wineries seeking to acquire vineyards. For those who need to sell, having realistic expectations on pricing is crucial. Both sides should keep in mind that each property has unique circumstances, and discounts will not always be warranted.

For more analysis of the North Coast vineyard market and an update on the wine and grape markets, visit Winescape.com.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.