Report Snapshot

Situation

The U.S. and Mexico have a history of deep trade integration, with the U.S. accounting for an increasing share of Mexico’s grain imports over the past 20 years.

Outlook

Mexican consumers’ appetite for meat has increased steadily over the years and is likely to keep rising, supported by Mexico’s growing economy and population. Increased livestock production in Mexico will support imports of U.S. feed ingredients. In particular, Mexico has a growing domestic production gap for corn and soybeans.

Finding

As Mexico boosts its port capacity, the U.S. must continue to defend its rail and truck logistical advantage to capture the expected growth in export demand.

For decades, the U.S. and Mexico have benefited from a complementary relationship: The U.S. efficiently produces feed ingredients and meat for export while Mexico focuses on growing fruits and vegetables.

Over the coming decades, Mexico will remain a key source of growth for U.S. grain and oilseed exports due to Mexico’s strong fundamentals and the U.S.’s logistics advantage over competitors like Brazil.

A Stable Historical Trade Relationship

Mexico is the top agricultural export market for the U.S., with a value of over $30 billion in 2024 (up nearly 7% from 2023), according to the USDA. Additionally, U.S. products account for 75% of Mexico’s agricultural imports, underscoring the deep trade integration.

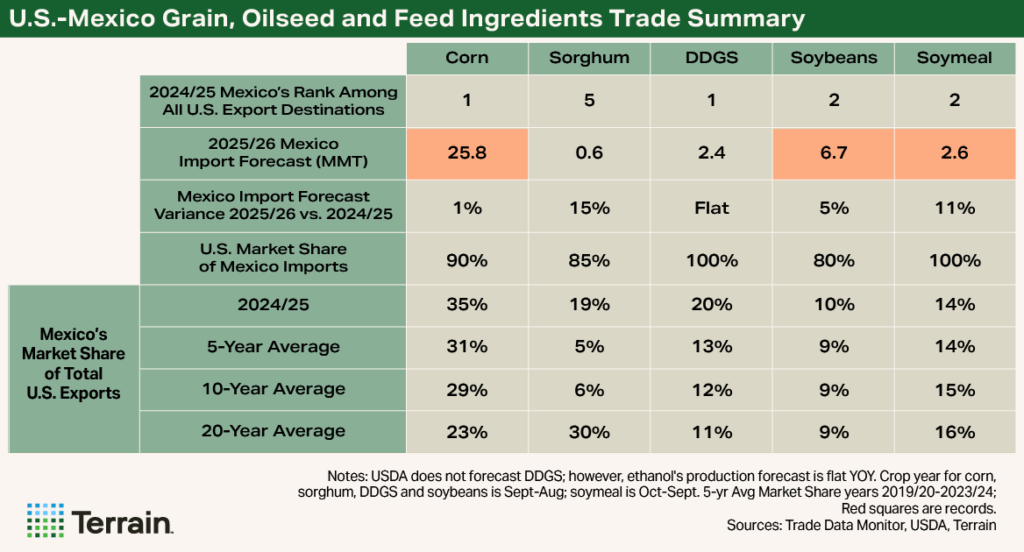

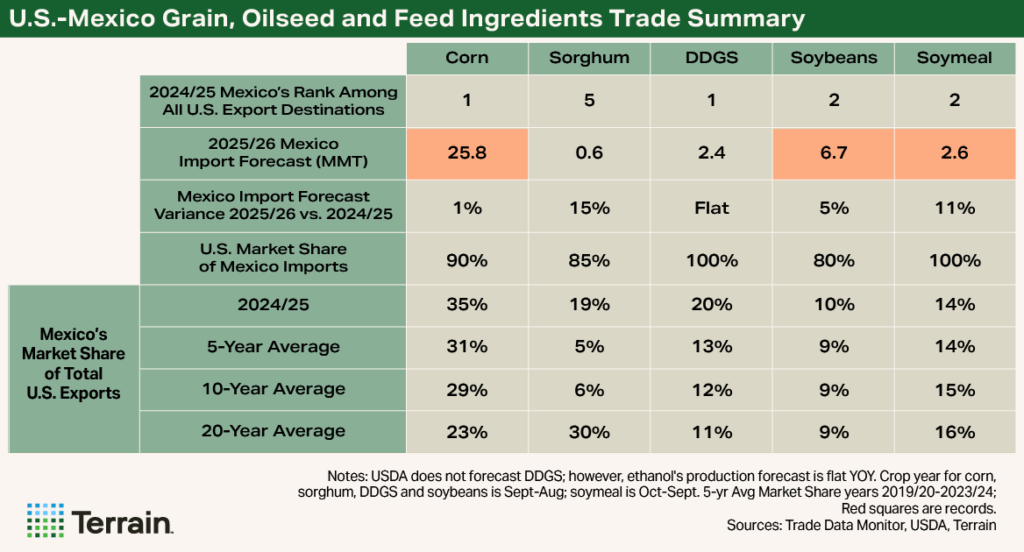

For grain and oilseed commodities, Mexico’s market share of total U.S. exports of corn, soybeans and dried distillers grains with solubles (DDGS) has risen over the past 20 years. Recurrent drought and weather conditions in Mexico limit domestic production of row crops, increasing the reliance on imports.

Trade policy has helped underpin this mutually beneficial relationship. One key component is the United States-Mexico-Canada Agreement (USMCA), which is up for review in 2026. Officials will decide whether to extend the agreement for another 16 years or renegotiate the terms before its 2036 termination.

The USMCA and its predecessor NAFTA have helped to secure market access for U.S. agricultural products by limiting trade barriers between the nations. As a result, U.S. farmers have benefited from improved exports to Mexico.

Moreover, Mexico’s demand for U.S. agricultural products should continue to grow given its positive economic and demographic outlook. As this trade relationship is set to continue over the long term, U.S. grain producers are poised to benefit from continued market access.

Mexico’s Strong Fundamentals

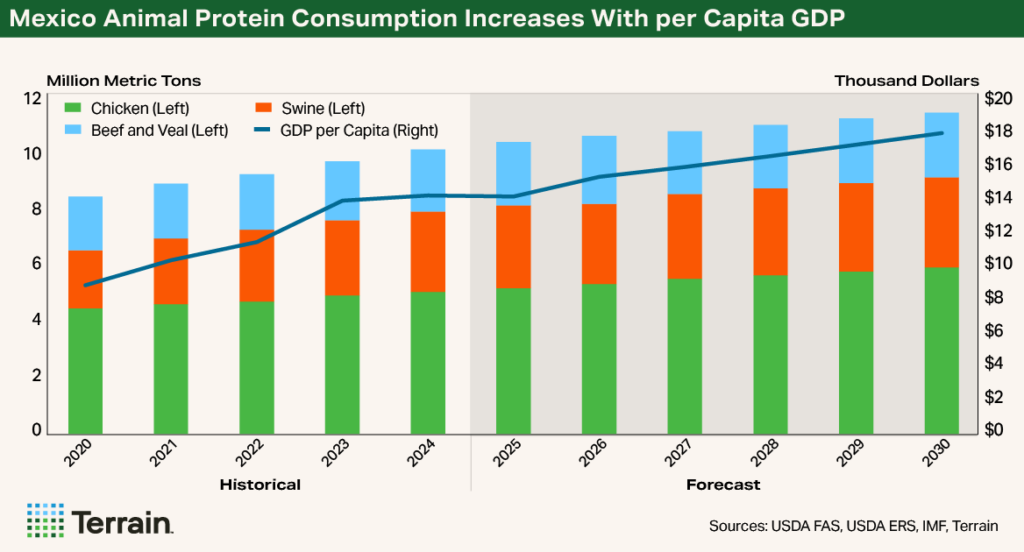

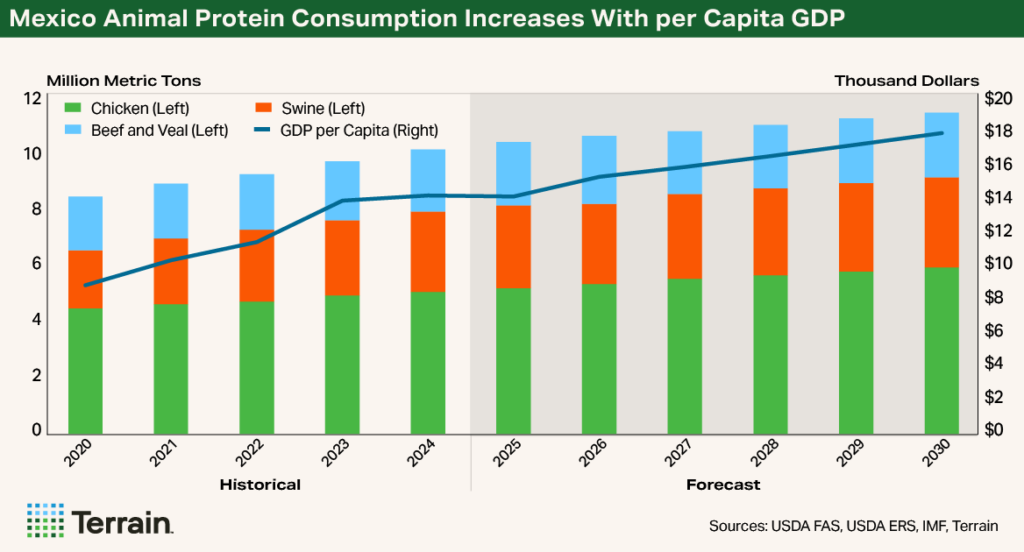

Mexican consumers’ appetite for meat has increased steadily over the years and is likely to keep rising, with Mexico’s economy growing and population expanding. That means more demand for U.S. oilseed and feed byproducts.

According to the USDA, over the past 25 years, total meat consumption in Mexico has nearly doubled — from 5.6 million metric tons (MMT) carcass weight equivalent (CWE) in 2000 to over 10 MMT CWE in 2025.

Over the past 25 years, Mexico has seen per capita GDP growth average 3% per year, even as its population has grown. The increase in per capita GDP has significantly expanded the purchasing power of its population and consequently expanded the consumption of higher-value protein products.

Looking ahead, the International Monetary Fund (IMF) estimates that per capita GDP will rebound in 2026, and nominal GDP will grow at an annual average of 4% through 2030. Based on the USDA’s international baseline forecast, Mexico’s meat consumption will increase 12% in volume by 2030 due to improving prosperity.

In addition to a growing economy, Mexico will see an expanding population over the coming decades, another key demand support for U.S. grain and oilseed imports.

Mexico’s strong economic and demographic position translates to long-term demand for U.S. feed ingredients.

Though birthrates in Mexico have declined, rising life expectancy should support future population growth. In the past 30 years, Mexico’s population has risen at a compound annual rate of 1.2%, estimated at over 132 million in 2024. The IMF forecasts the population to grow by 1 million annually at least through 2030. Terrain’s research indicates Latin America and the Caribbean’s population will continue to grow for another 30 years, meaning more consumers south of the border purchasing meat and thus rising demand for U.S.-produced feed.

Mexico’s strong economic and demographic position translates to long-term demand for U.S. feed ingredients. I project soybeans and soymeal will see the biggest growth in U.S. exports to Mexico through 2030, driven by increased feed demand to support chicken production and consumption. Corn will follow close behind due to limited domestic crop production and planted area.

Mexico’s Animal Feed Needs

According to the USDA, Mexico’s meat production is expected to increase in 2026 — beef up 2%, pork up 3% and chicken up 2%. Mexico is the world’s fifth-largest animal feed producer, with 2025 feed output expected to rise 2%, according to the National Council of Manufacturers of Balanced Feed and Animal Nutrition (CONAFAB) 2025 report.

Mexico’s total feed ingredients utilized in 2024 were:

- Corn (at approximately 50%)

- Protein meals — soymeal and DDGS (25%)

- Sorghum (over 10%)

While most sorghum utilized was domestically sourced, import reliance for the other feed ingredients is high at 75% in 2024 and projected to reach 80% in 2025. Despite the slight increase in corn feed production, Mexico is still heavily reliant on U.S. imports to satisfy its growing domestic protein production.

Over the past five years, the U.S. accounted for 80% of Mexico’s soybean imports (crushed for meal), 90% of corn imports (of which 99% is yellow corn for feed), and 100% of DDGS and soymeal imports. The heavy reliance on imported feed ingredients underscores Mexico’s growing domestic production gap — particularly for corn and soybeans — setting the stage for increased imports from the U.S. However, the delivered cost comparison among the commodities will influence Mexico’s feed ration decision-making and future imports.

Corn

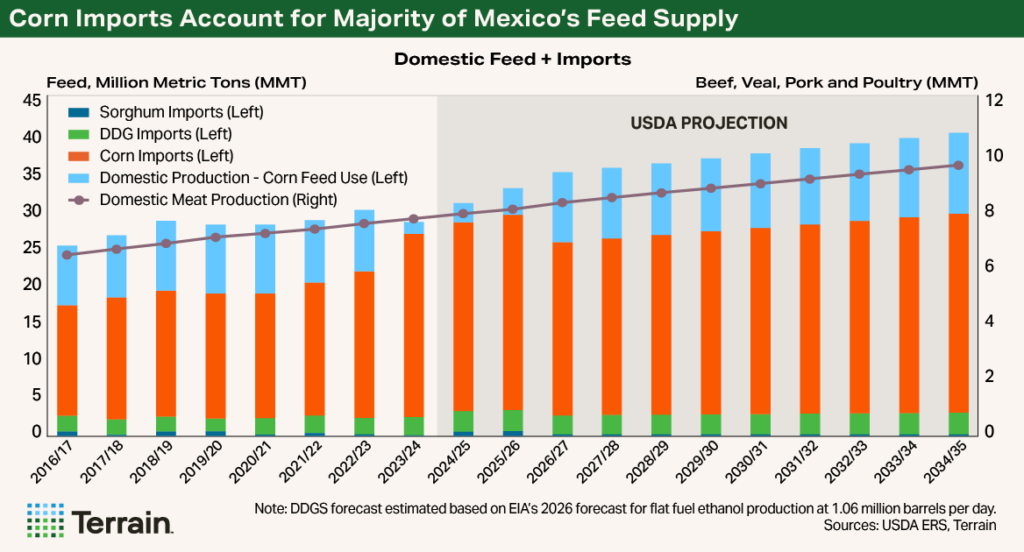

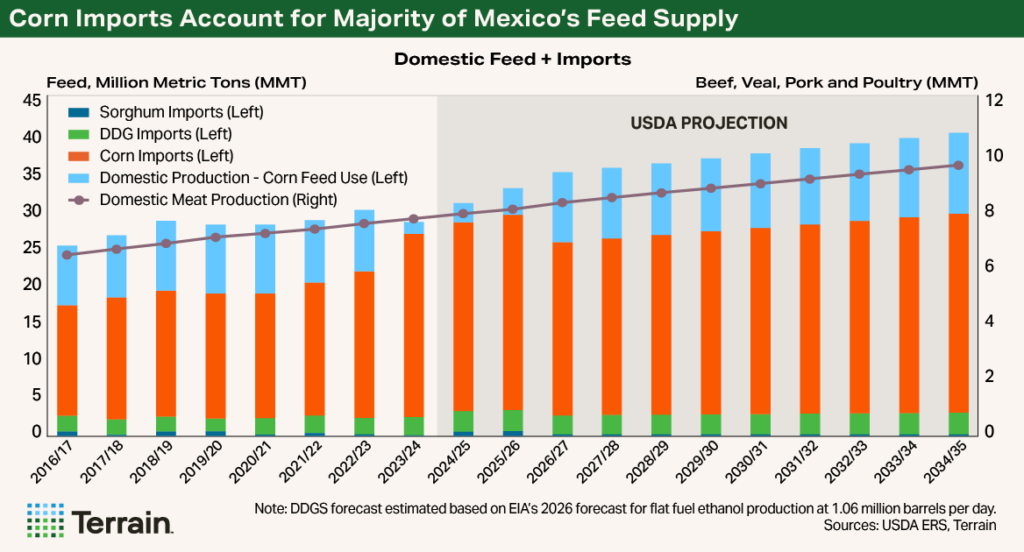

Mexico’s corn production market is split between white, non-genetically modified corn for food and human consumption and yellow corn for animal feed. In 2016/17, Mexico produced 27.6 MMT of corn domestically. But for 2025/26, the USDA forecasts production at 26 MMT, a decline of 6% from a decade ago. And of that smaller crop, according to Mexico’s National Institute of Statistics and Geography (INEGI), over 80% of the corn planted area in Mexico was white corn.

Over the same period, yellow corn imports surged nearly 80%, from 14.6 MMT to a projected record 25.8 MMT, reflecting Mexico’s growing reliance on imported yellow corn for feed. For example, the USDA projects Mexico’s corn feed use to exceed 29 MMT in 2025/26 and increase to more than 37 MMT by 2034/35, well above its domestic production. While Brazil is a major global producer of corn, its domestic consumption currently limits exportable supplies to approximately 50 MMT — making complete replacement of U.S. exports to Mexico unlikely.

Dried Distillers Grains with Solubles (DDGS) & Sorghum

Similar to corn, in the past decade, Mexico’s sorghum production has declined 7%, from 4.6 MMT in 2016/17 to 4.3 MMT forecast in 2025/26. This will present an opportunity for increased U.S. sorghum exports to backfill Mexico’s trend of reduced production, especially as China’s demand softens.

U.S. exports of DDGS have also grown, with Mexico the top buyer for the past eight years.

Soybeans and Soymeal

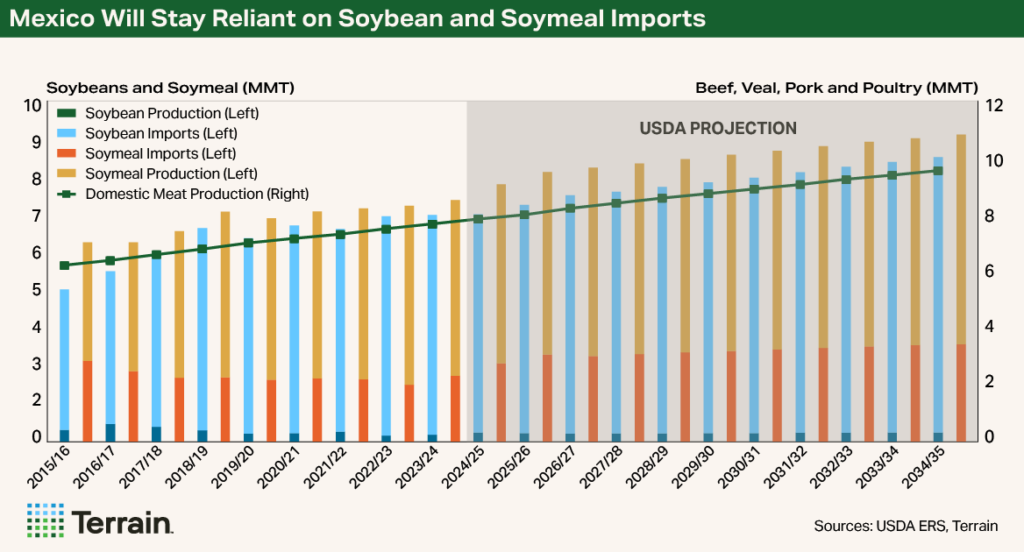

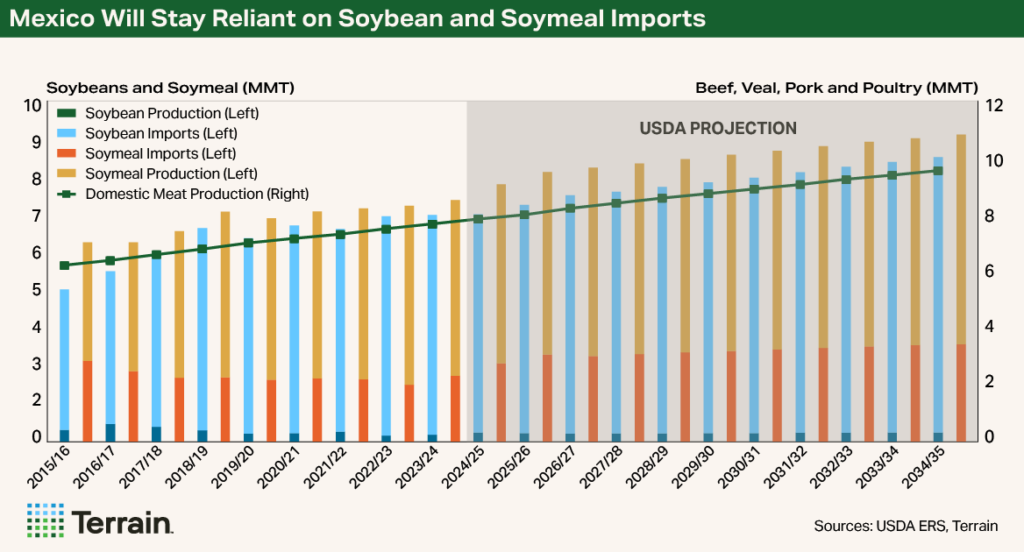

Mexico’s domestic soybean production has declined nearly 50% over the past decade, from 0.5 MMT in 2016/17 to 0.28 MMT in 2025/26, due to a shift in acres and challenging growing conditions compounded by persistent drought the past several years. In comparison, the USDA estimates 2025/26 U.S. soybean production at nearly 116 MMT.

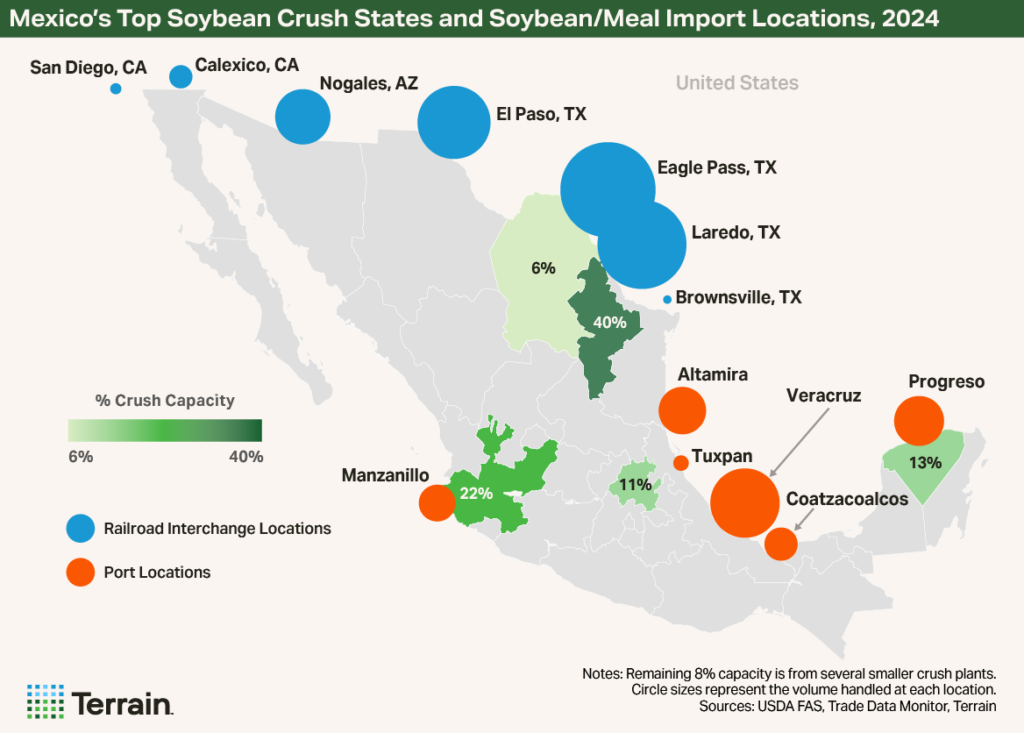

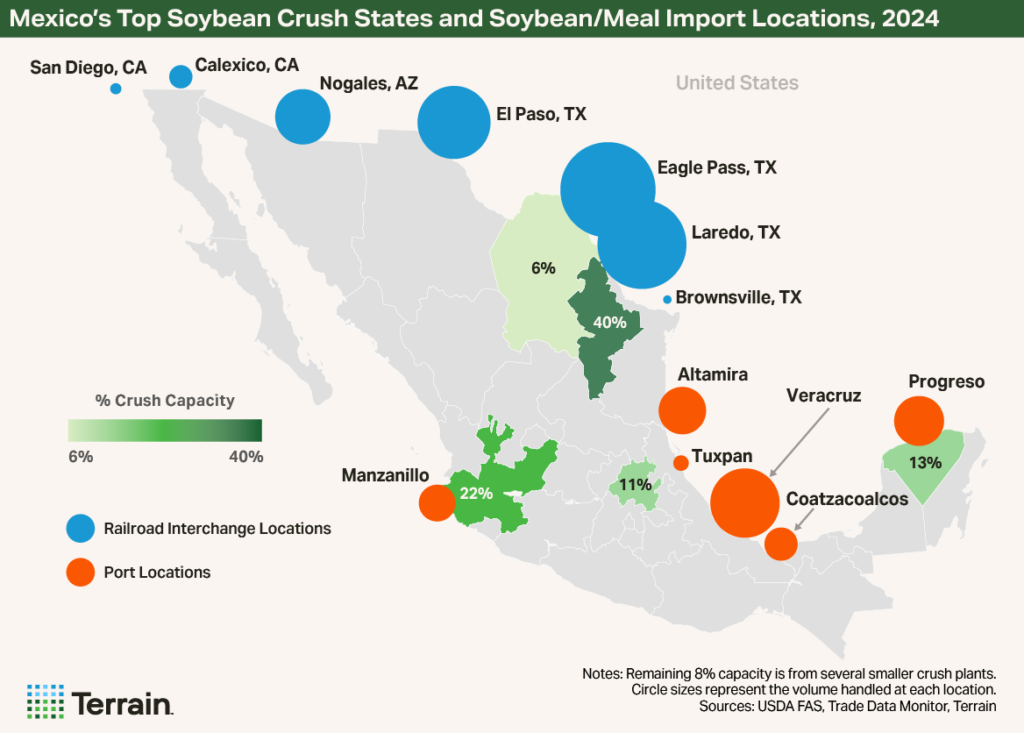

Mexico’s domestic crush capacity has increased 40% from 2016, driving soybean imports up 50% to 6.7 MMT in 2025/26.

Mexico imports 96% of its total soybean supply. Brazil (the U.S.’s largest competitor on the global market) continues to break soybean production records and poses a growing threat to U.S. market share in Mexico.

In the past few years, Mexico’s import needs have leveled off around 6 MMT of soybeans annually. This is equivalent to approximately 10% of Brazil’s total exports, indicating Brazil has sufficient supplies to meet Mexico’s import needs. As Mexico expands vessel port infrastructure, Brazil will be well-positioned to compete against the U.S. However, given the U.S. geographic and logistical advantage, the U.S. will likely remain the primary supplier of Mexico's future soybean import needs.

Mexico’s domestic crush capacity has increased 40% from 2016, driving soybean imports up 50% to 6.7 MMT in 2025/26. However, lower soymeal import prices have pressured Mexico’s domestic crush industry, which may blunt future growth expectations of domestic crush and favor stronger soymeal imports if prices remain low. Additionally, as the U.S. expands domestic processing, creating higher-value products like soymeal, the additional supply from the U.S. may continue to favor soymeal imports over soybeans.

Longer term, increased livestock production will support both soybeans and soymeal, but commodity price comparisons between the whole beans and the meal will determine the future mix of Mexico’s imports. Either way, U.S. soybean farmers will benefit long term, although farmers located near crush plants will likely have a more favorable basis.

U.S. Logistics Advantage

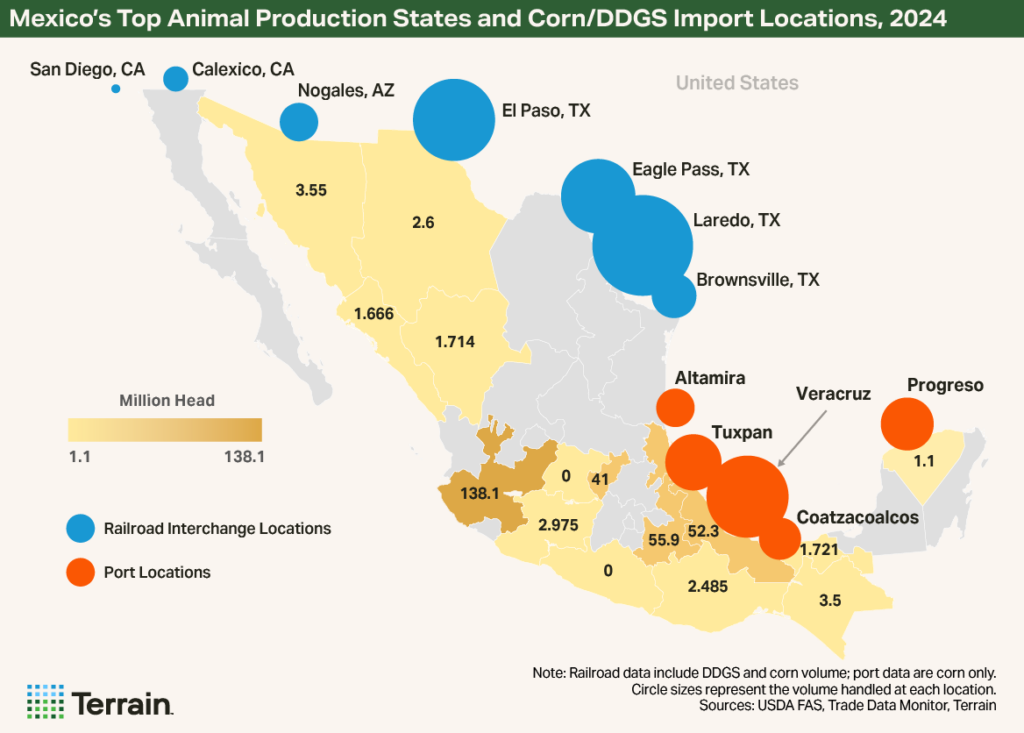

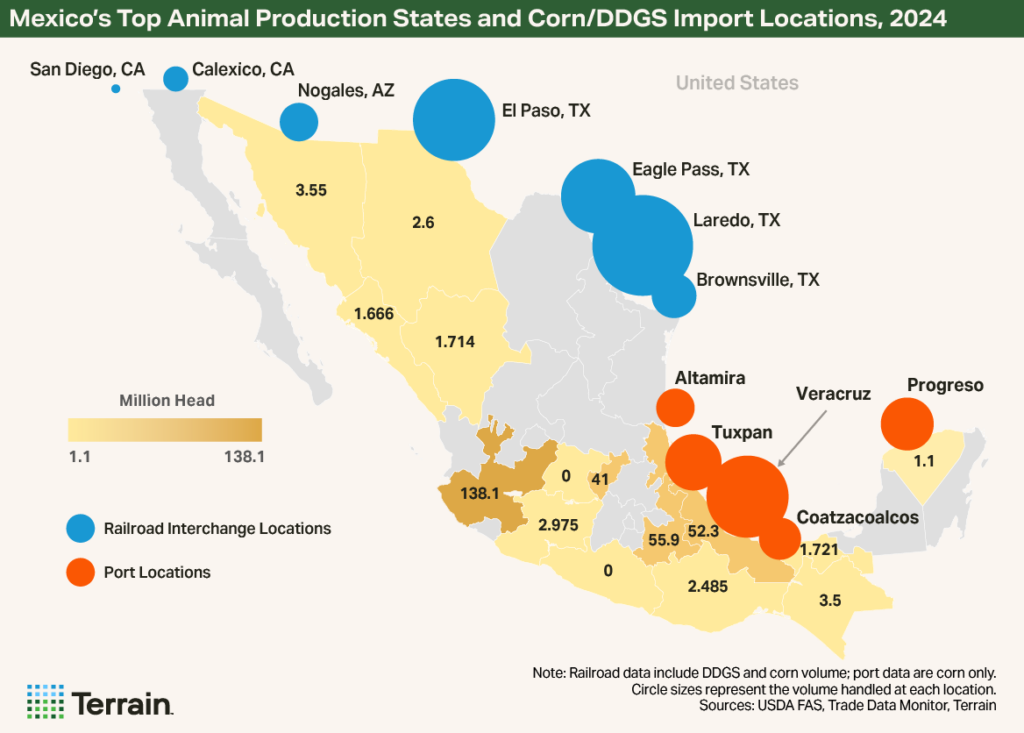

The U.S. holds a significant geographic and logistical advantage in supplying Mexico. According to Trade Data Monitor, 65% of U.S. exports destined for Mexico moved by rail, compared with 33% by vessel and 2% by truck in 2024. Seven border rail interchange locations connect major North American railroads to Mexico.

U.S. soybean, soymeal and DDGS export shipments rely more heavily on rail transportation than corn does, as 80% of those exports shipped via rail in 2024, versus 60% for corn.

Mexico’s rail network has not kept up with the growth in shipments, causing transportation bottlenecks and increased embargoes. Given the increased utilization of this transportation mode, soybeans, soymeal and DDGS are at higher risk of transit delays and reduced rail car and shuttle train availability caused by these logistics hurdles. However, rail infrastructure upgrades at interchange locations in Laredo and Eagle Pass have enhanced rail fluidity.

Rail connectivity and proximity are a competitive edge for U.S. farmers against other global suppliers.

While rail congestion eased in 2025, future disruptions could shift more volume to vessels, as unplanned delays can increase transportation costs and backup logistics issues north of the border.

In July, Mexico’s navy minister announced a $16 billion investment in nine ports (including Veracruz and Progreso), which will boost import capacity but also open doors to non-U.S. suppliers. If rail infrastructure falls behind, Brazil could achieve a competitive boost from the increase in port capacity.

To maintain its competitive edge, the U.S. (and Mexico) must continue investing in efficient transportation via both rail and ocean freight. Rail connectivity and proximity are a competitive edge for U.S. farmers against other global suppliers. While ports expand south of the border, rail remains critical for Mexico’s key border regions and interior, preserving U.S. competitiveness.

Mexico is more than just our top agricultural customer; it will be a growth engine for the next several decades.

A Growth Engine for the Future

Mexico is more than just our top agricultural customer; it will be a growth engine for the next several decades.

Mexico’s long-term fundamentals — population growth, rising incomes, limited domestic crop expansion and increased protein demand — ensure sustained reliance on imported feed ingredients, while the U.S.’s logistics advantage ensures we are set up to meet that reliance.

Should our infrastructure deteriorate, Brazil and other competitors may take market share as Mexico boosts its port capacity.

The U.S. competitive edge matters: Rail connectivity strengthens cost competitiveness and secures market access along key border demand regions and Mexico’s interior. With thoughtful trade policy, the U.S.-Mexico agricultural partnership is well-positioned to remain mutually beneficial for decades to come. Both the U.S. and Mexico must continue to improve rail infrastructure and fluidity to maintain the logistical advantage that drives U.S. grain and oilseed competitiveness to Mexico.

Should our infrastructure deteriorate, Brazil and other competitors may take market share as Mexico boosts its port capacity.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.