Quarterly Outlook • December 19, 2024

Macadamia Prices Expected to Recover for Hawaii Growers

Macadamia nuts in Hawaii are recovering from the lowest prices seen in a decade. Short-term price increases are expected to continue, but medium- and long-term challenges will require building out processing capacity and leaning into Hawaii’s reputation for quality.

Hawaii Must Protect Its Quality Throne

The COVID-19 pandemic had varied effects on commodity markets, but nut crops seem to have suffered universally because of inventory buildup that lowered prices. The macadamia market is no exception.

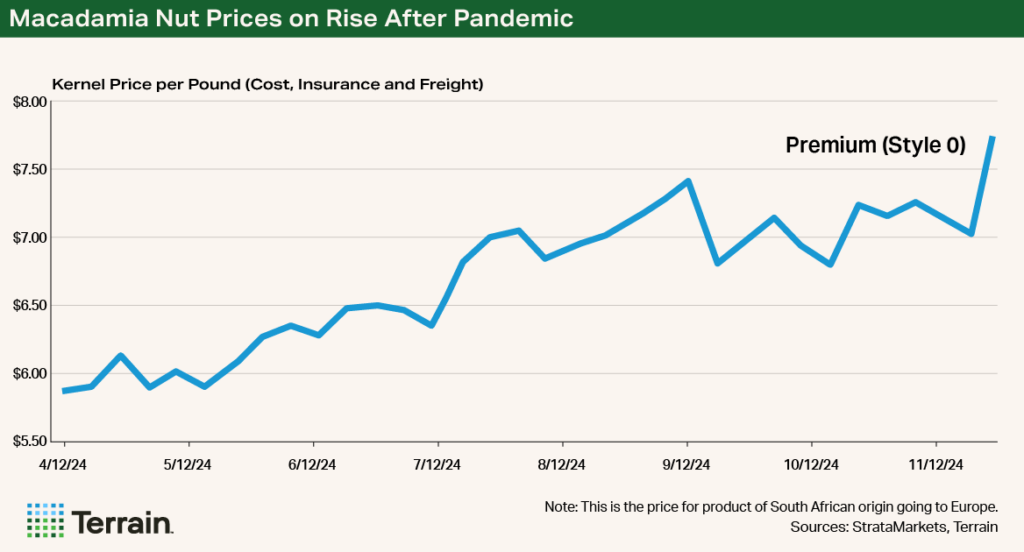

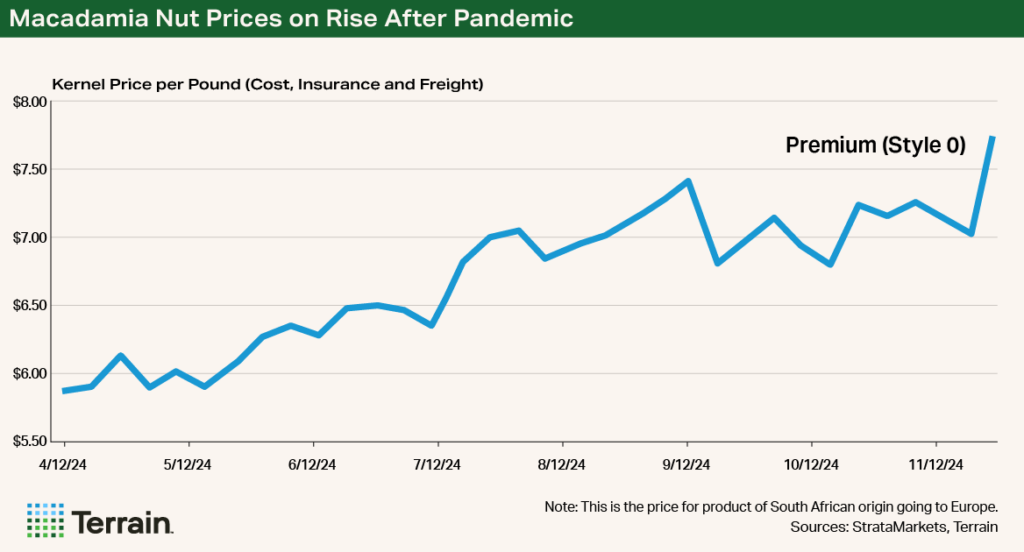

More recent data suggest the global wholesale price is recovering.

Although data on beginning stocks are unavailable, several reports indicate stocks have weighed down prices in recent years. Grower prices of Hawaiian macadamias, for instance, rose steadily from 60 cents per inshell pound in 2007 to $1.24 in 2020 before falling to 84 cents in 2023 during the pandemic, according to the USDA.

While current price information on the market is limited, more recent data suggest the global wholesale price is recovering.

The wholesale price (plus shipping and insurance) has shown a price turnaround for premium nuts (Style 0). Less premium nuts used for packaged goods and value-added products (Style 4) have seen price declines in recent weeks but have generally been moving up. Both movements suggest a global market that, like for many other nut commodities, is improving from pandemic lows, which should put upward pressure on the grower price.

Hawaii's relative decline in production can be attributed to unique challenges associated with farming in the state.

Despite some price movement in the right direction at the global level, growers in Hawaii have other challenges. Once a powerhouse in macadamia nut production, Hawaii has seen a steady decline in its global share. It now accounts for only about 5% of the global supply, whereas it produced roughly half in the 1990s. Today, South Africa, Australia and China dominate the market, accounting for over 60% of global production.

Hawaii's relative decline in production can be attributed to unique challenges associated with farming in the state. These include the limitations of mechanical harvesting due to volcanic rock, and the high overall cost of production due to its distance from the mainland. The industry relies on expensive and sometimes scarce labor for crop collection.

This combination of factors has resulted in decreasing acreage and production.

Imports of macadamia nuts to the U.S. increased by almost a factor of three from just 2011 to 2021.

While total acreage was once nearly 20,000 acres, it has now declined to approximately 16,000 acres, according to the USDA’s most recent estimate. Additionally, yields have declined as the industry contends with issues such as wild pigs, disease and pests.

Because of the availability of cheaper nuts from overseas, imports have gradually made their way into Hawaii, where they are often marketed as local product, undercutting local producers.

According to data from the International Nut & Dried Fruit Council, imports of macadamia nuts to the U.S. increased by almost a factor of three from just 2011 to 2021. This development appears to have been exacerbated by a recent decline in processing capacity for local growers, making the use of local production that much more challenging.

Recent legislation may change the current market equilibrium. The Hawaii State Legislature enacted House Bill 2278, which requires packages of the nuts to disclose whether they contain foreign macadamia nuts starting in 2026 — though nuts that contain other ingredients that aren’t flavorings or seasonings are exempt. The Legislature passed a similar bill to prevent foreign coffee from being marketed as Kona coffee.

Leaning into the Hawaiian brand, quality and processing capacity must continue to be priorities for the industry.

While this may improve market conditions for growers, leaning into the Hawaiian brand, quality and processing capacity must continue to be priorities for the industry.

Improving Conditions on Horizon, but Long-Term Investments Needed

Looking ahead, it is likely that the price of macadamia nuts will continue to improve as the impacts of the pandemic diminish and the supply-demand ratio becomes more balanced. Moreover, with inflation cooling (albeit at elevated consumer prices) and consumer sentiment improving, macadamia nuts, which are often thought of as a premium product, could see a boost in demand.

In the medium and long term, Hawaii’s macadamia nut industry may continue to be challenged by other, larger global producers who are ramping up production. Ways to compete will likely require more processing capacity as well as more marketing that leans into the state’s reputation for quality, the nut’s inherent health benefits, and how the macadamia nut has become synonymous with Hawaii all around the world.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.