Quarterly Outlook • September 2023

Large Planted and Harvested Acres for Corn Blunt Effects of Low Yield

The 2023 corn growing season has no analogue to past years. The fast, dry start produced large plantings. Just when June dryness appeared to finish the crop, most farmers got adequate July rains before the faucet switched back off and the heat arrived in August. Meanwhile, the small cattle herd and modest export demand drained enthusiasm for the marketing year.

As we move through harvest, I expect to see a battle in basis waged as low river levels weaken basis and farmers rely on their liquidity positions to delay sales into 2024. Futures prices for the remainder of the quarter will turn on realized yield and export prospects.

Price Scenarios

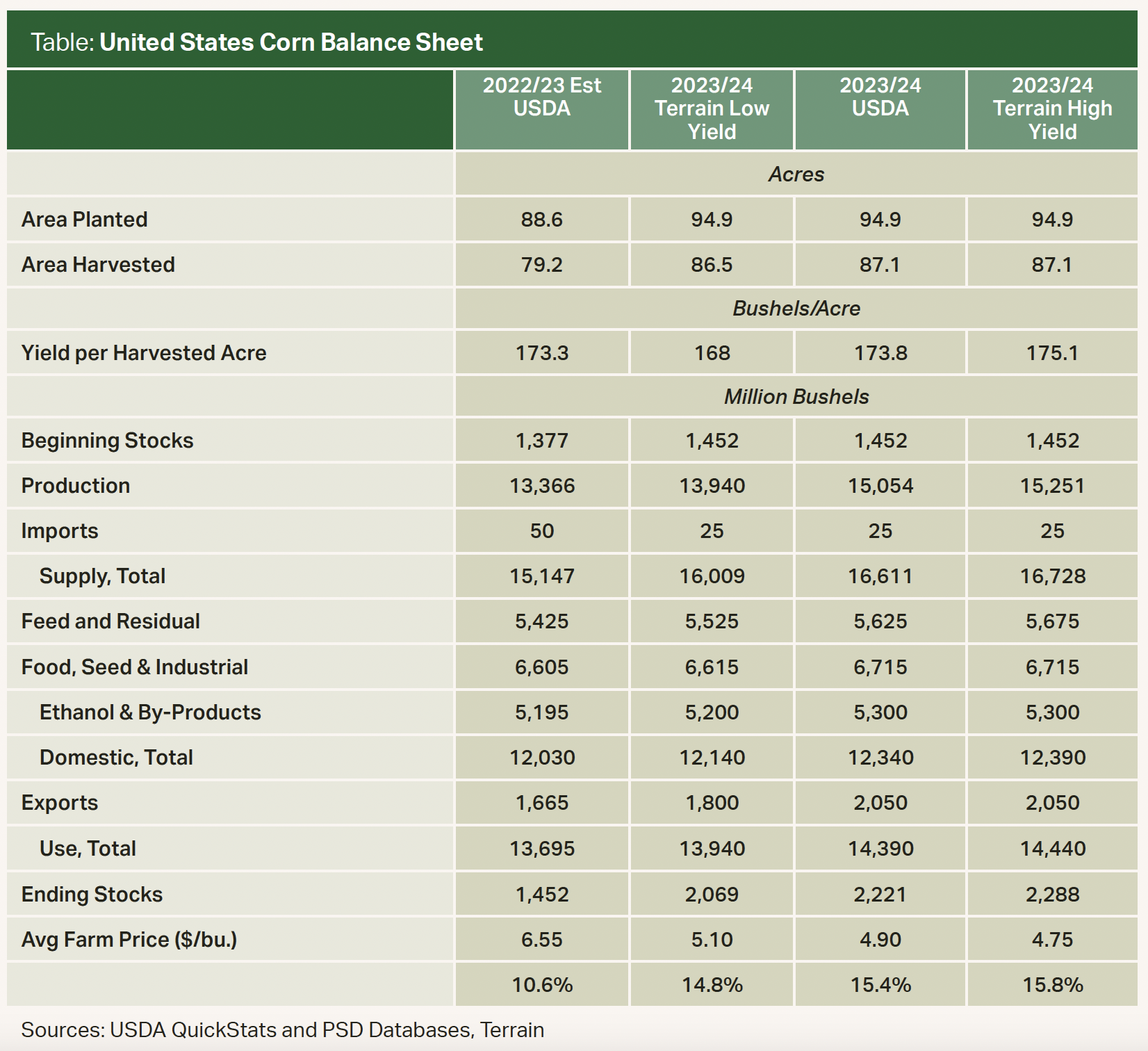

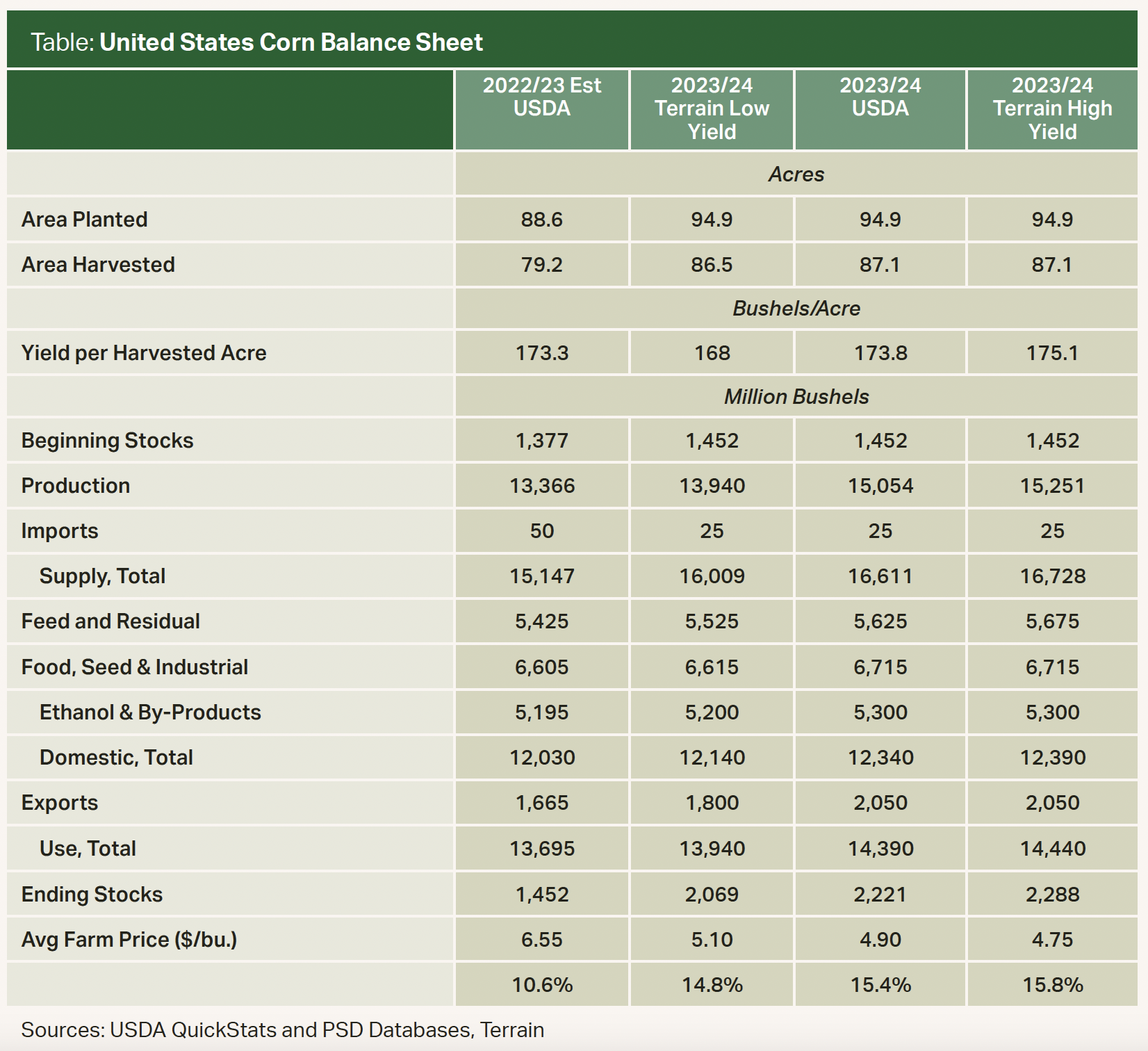

We have more yield uncertainty than is typical by the start of harvest, owing to the unusual weather patterns this year. Still, the 94.9 million planted acres of corn have served to blunt any price moves higher, which in most years is what you’d expect with the poor weather we’ve had since the June 30 release.

Even with a yield of 168 bu./ac. — and I don’t expect final yield to be that low — 2023 would be the fifth-largest harvest on record…

Even with a yield of 168 bu./ac. — and I don’t expect final yield to be that low — 2023 would be the fifth-largest harvest on record and ending stocks would struggle to get below 2 billion bushels. This would result in a market-year average price of $5.10, but again, this is an overly optimistic scenario (see table).

A more likely scenario is that final yield is approximately 172.5 bu./ac., resulting in production of 15.02 billion bushels and a final market-year average price of $4.85.

A more likely scenario is that final yield is approximately 172.5 bu./ac., resulting in production of 15.02 billion bushels and a final market-year average price of $4.85.

I further expect that in any monthly USDA World Agricultural Supply and Demand Estimates (WASDE) report in which total production is cut, exports will be cut by similar amounts until they are more reflective of the actual export pace. Therefore, for the remainder of 2023, I don’t expect to see much downward movement of ending stocks even if yield estimates fall.

One difference, however, between now and then is that the price improvement required for storage to be profitable has grown over the past 18 months with higher interest rates.

Implications for Storage Costs

As we are returning to a historically more normal level of stocks, with a stocks/use ratio of 14.8%, compared with the post-2000 average of 12.5%, cash price behavior should also move back toward normal, with storage returns coming from both basis improvements and futures market carries. One difference, however, between now and then is that the price improvement required for storage to be profitable has grown over the past 18 months with higher interest rates.

Using 2.5 cents/bu. per month as the basic cost of on-farm storage (shrinkage, aeration, labor, etc.), the interest charge for storage is somewhere between 2.2 cents/bu. per month for the opportunity cost of cash at 5.25%, and 3.75 cents/bu. per month if the storage is being financed with an operating line at 9% interest. At a minimum, storing corn costs 4.7 cents/bu. per month, and it might be as high as 8.75 cents/bu. per month for commercial storage financed with an operating line.

If river levels stay low through harvest, storage will almost certainly be profitable, but this will probably be because of declines in nearby basis more than increases in deferred basis.

Outlook

Looking toward 2024, sharply lower fertilizer prices should keep acreage allocations corn-friendly. Current forecasts continue to indicate an early harvest and conditions favorable to fieldwork. However, after a year of 94.9 million planted acres, these will not be enough to prevent a reduction in corn acres. Although very premature, my estimate for 2024 planted acres is 92.5 million for corn.

Looking toward 2024, sharply lower fertilizer prices should keep acreage allocations corn-friendly.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.