The recent rally in lean hog futures contract prices has pushed summer contracts (June, July and August 2024) to levels where many producers can lock in forward profits through hedging using futures or options or purchasing government-subsidized Livestock Risk Protection insurance policies.

The rally that began in early January 2024, when the summer contracts were trading in the high-$80s/cwt to low-$90s/cwt, had given producers a little hope that as the summer approached, the staggering losses that the industry had suffered during the previous 16 months would narrow to near break-even levels.

Continued year-over-year (YOY) increases in sow slaughter, higher-than-expected on-farm sow mortality, and lighter barrow and gilt slaughter weights have the supply side of the business looking more bullish. Wholesale pork and slaughter hog prices combined with lower feed prices have improved farrow-to-finish operation margins.

Sow Slaughter Picks Up the Pace

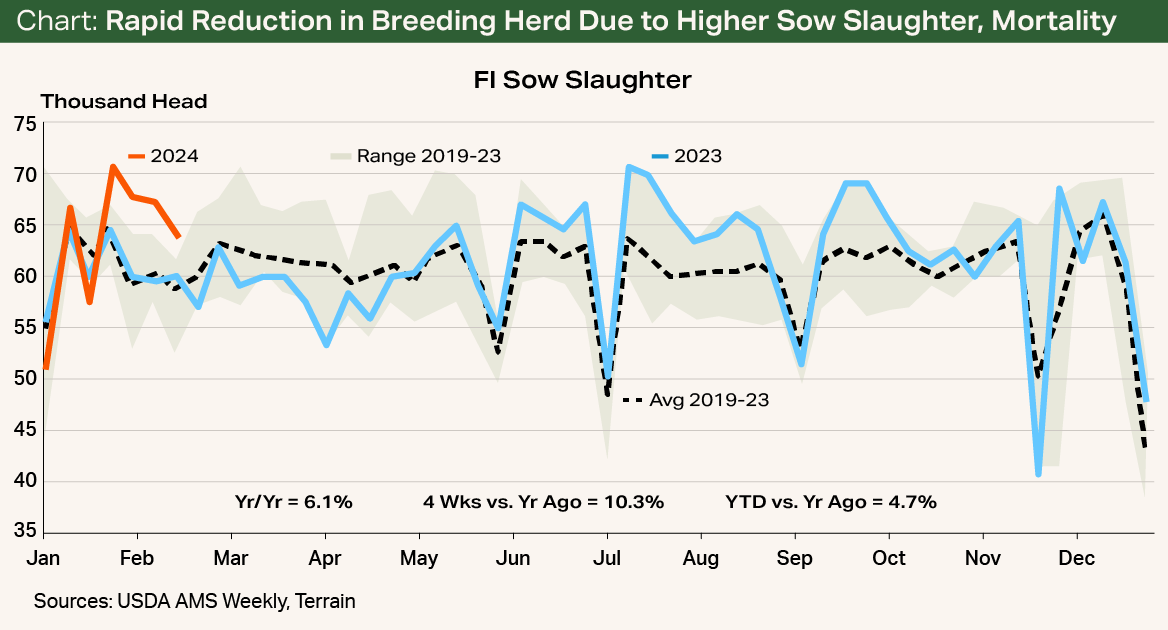

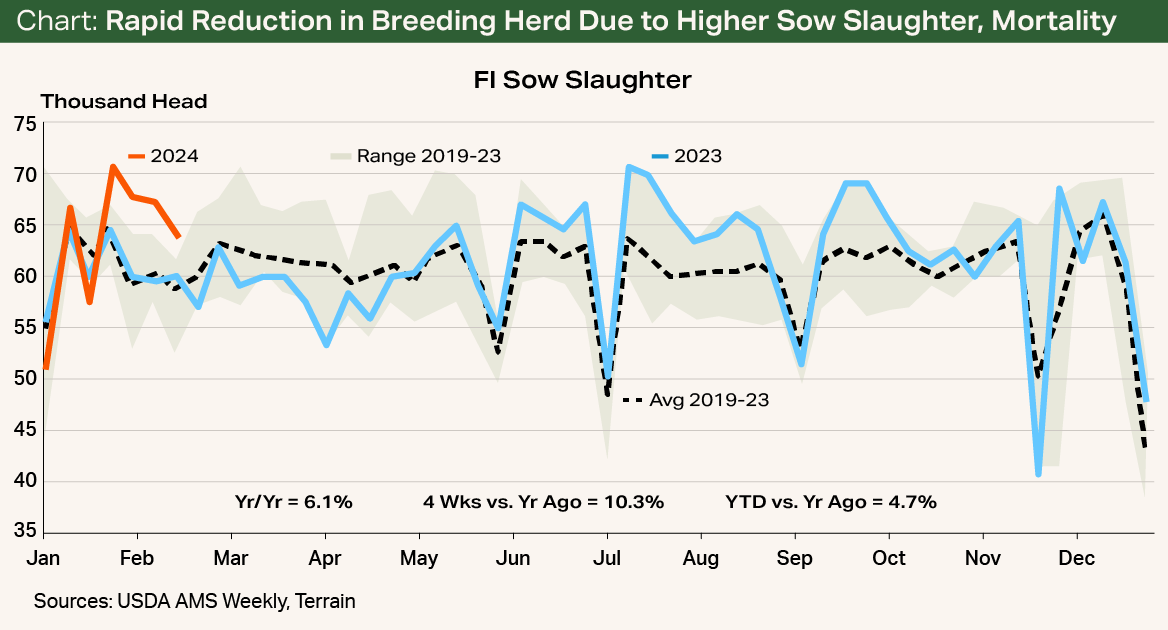

Sow herd liquidation continues at an aggressive pace. Year to date, sow slaughter is up 4.7% YOY through the first seven weeks of 2024, with an extra 20,000 sows removed from the breeding herd compared with last year (see Chart). When combined with December 2023’s 16,000-head increase versus December 2022, sow slaughter has risen by 36,000 head since the USDA’s December 1 Hogs and Pigs Report. This alone would reduce total sow numbers by 0.6% from the December 1 total to March 1, 2024.

The industry consensus holds that sow slaughter totals above 57,000 head per week result in sow herd liquidation. During the 11 weeks since the last Hogs and Pigs Report sow herd total, the industry has removed more than 56,000 head, or 0.9% of the breeding herd.

The lack of gilt replacements and increased on-farm sow mortality will lead to a larger YOY decline in the breeding herd. Industry sources indicate that sow mortality levels are at record highs, exceeding 15%. This is likely because of a combination of seasonally increased disease pressure and reproduction-related sow deaths.

I expect that we could see another 3% or greater decline in breeding herd numbers in the March 2024 USDA Hogs and Pigs Report. The biggest challenge and risk for the industry will be if the report shows further productivity gains in pigs per litter that offset the decline in potential litters born.

Protecting Summer Profits

Feed prices have nearly reached four-year lows, with February corn futures down almost 38% versus a year earlier and soybean meal prices down 19% during the same period. This translates to about $28/head lower feed costs over the past 12 months. Feed costs are expected to decline an additional $10/head during the next four to six months, further improving margin prospects.

By mid-July, pork wholesale cutout values are expected to rally to the low-$120s/cwt, 7% to 9% above year-earlier levels. This is likely to push producer-sold slaughter barrow and gilt prices higher as well, to around $110/cwt to $115/cwt.

I expect that the normal seasonal price pattern will play out again in the second half of 2024. After peaking in the summer, prices will trade lower to levels that will result in breakevens or losses, depending largely on corn market trends in the second half of the year.

Producers evaluating risk management strategies need to weigh their options on programs that can protect equity and summer profits while establishing a solid floor price to limit losses for the late third and fourth quarters. As you evaluate strategies, consider that there could be more news of bullish factors entering the spring and summer market.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.