Despite growing optimism, beef cow herd expansion remains uncertain. Beef cow slaughter is down, but with limited replacement heifers, the 2025 calf crop will likely be smaller. The discovery of New World screwworm in Mexico has halted cattle imports, reducing feeder cattle supplies in the U.S.

Tighter Supplies Boost Fed Cattle Prices

Tightening fed cattle supplies are leading to higher prices. The fed cattle supply situation leading into Q4 2024 had been ample by historical standards and punctuated by record-heavy carcass weights on a weekly basis since early March.

Cattle-on-feed mirrored this trend for more than 180 days, until the beginning of October when front-end supplies of market-ready cattle finally began to tighten. October 2024 supplies were up just 9% versus a year earlier and posted a 16% year-over-year (YOY) decline for November 1. As a result, 5-Area fed cattle prices have firmed substantially relative to a year ago.

The 2024 fall rally hadn’t lived up to the normal seasonal trend that suggests prices should rally $5/cwt to $7/cwt from August to December. But prices rallied sharply in early December, pushing the increase to nearly double the normal seasonal fall rally. The current market action is certainly a better scenario, with prices about $25/cwt higher than a year earlier.

Meanwhile, optimism for 2025 fed cattle prices is growing, small grain crop grazing conditions in the Southern Plains are improving, and feeder cattle and calf supplies outside feed yards are tightening. From January through October, feeder cattle and calf placements were down 1.1% YOY, despite starting the year with feeder cattle and calf supplies that were 4.2% lower than a year earlier. This implies feed yards have overplaced cattle relative to available supplies.

Also take into account the number of days on feed that feed yards have added in order to boost weights and reduce break-even selling prices. The result is a record-large number of cattle on feed in November.

In the meantime, the trade disruption should support feeder cattle and calf prices in the U.S.

Pest Discovery Likely to Support Feeder Cattle Prices

The late-November discovery of New World screwworm in a cow in southern Mexico has caused the U.S. to suspend imports of all cattle from Mexico. As a result, about 30,000 head fewer feeder cattle and calves are moving north to the U.S. on a weekly basis. The closure is expected to last into at least mid-December.

The USDA Animal and Plant Health Inspection Service and its Mexican equivalent are currently in negotiations to establish inspection and treatment protocols necessary to reopen borders and re-establish trade flows between the two countries. In the meantime, the trade disruption should support feeder cattle and calf prices in the U.S.

I expect beef cow numbers to decline during 2024, leading to a smaller calf crop for 2025.

Will Herd Expansion Begin?

Beef cow herd expansion still appears to be a decision to which cow-calf operations are not yet ready to fully commit. 2024 year-to-date beef cow slaughter is down 18.2% versus a year ago, but given the limited number of beef replacement heifers that were bred last year and calved this year, I expect beef cow numbers to decline during 2024, leading to a smaller calf crop for 2025.

Dairy replacement heifer numbers remain in a tight supply situation. This is driving up prices as dairy product processing capacity is increasing and dairy facility expansions are short cows in the milking string. Some dairies have already started to shift out of beef-on-dairy crosses to heifer-sexed matings to grow replacement heifer numbers. This trend will further tighten feeder cattle and calf supplies outside feed yards ahead of beef heifer retention, which will drive prices for replacement feeder cattle even higher.

The large number of beef heifers that ranches had retained last fall but were placed into feedlots during spring 2024 has bolstered fed supplies for Q4 2024 and will likely lead to further declines in the beef cow inventory going into 2025.

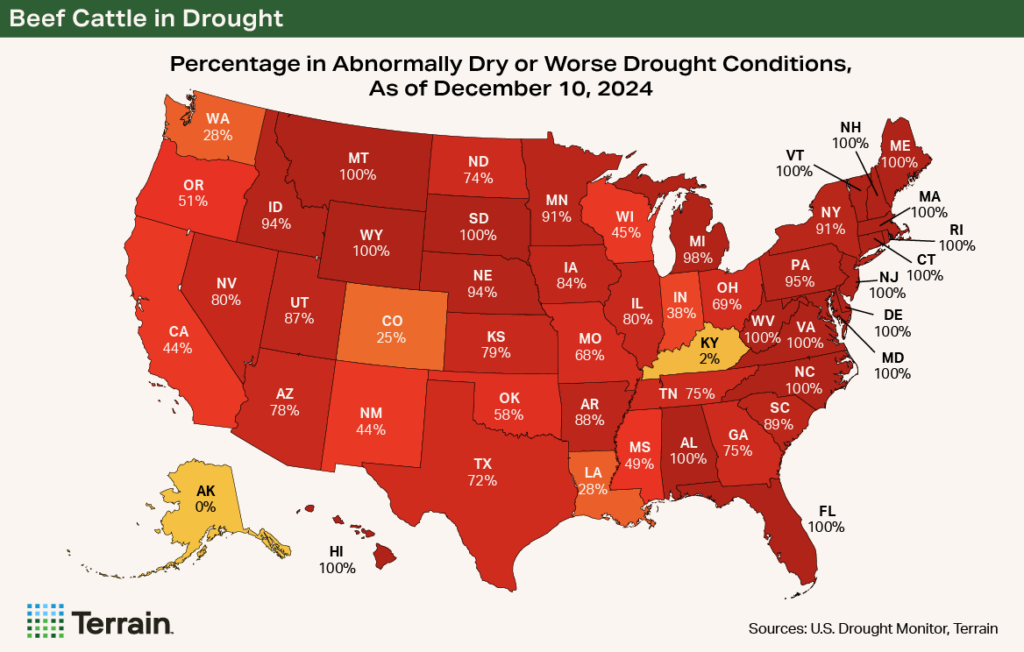

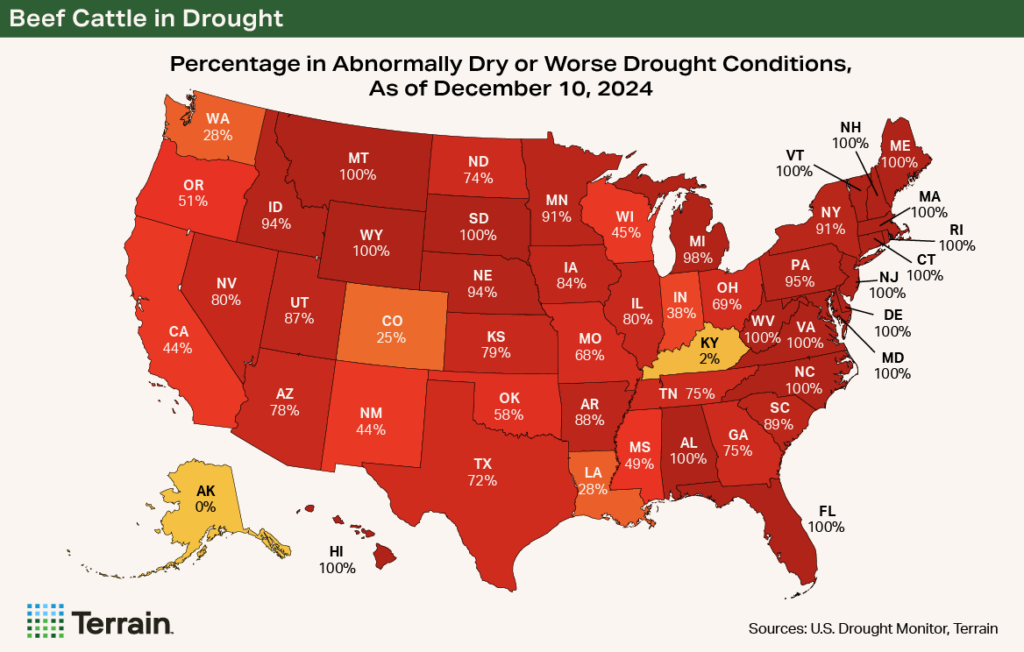

Drought conditions currently exist in about 74% of land area of the continental U.S., up 19% from a year ago.

For much of the U.S., October was the driest or near driest on record. Drought conditions currently exist in about 74% of land area of the continental U.S., up 19% from a year ago. Even areas hit by Hurricane Helene are now reported to be in moderate drought conditions.

Major storms eliminated drought conditions across much of the Southern Plains during November. Areas that benefited the most were the Panhandle areas of Texas and Oklahoma, southwest Kansas and southeast Colorado. Meanwhile, the Northern Plains (WY, NE, SD, ND, MT) are in moderate to extreme drought, according to the December 5, 2024, U.S. Drought Monitor.

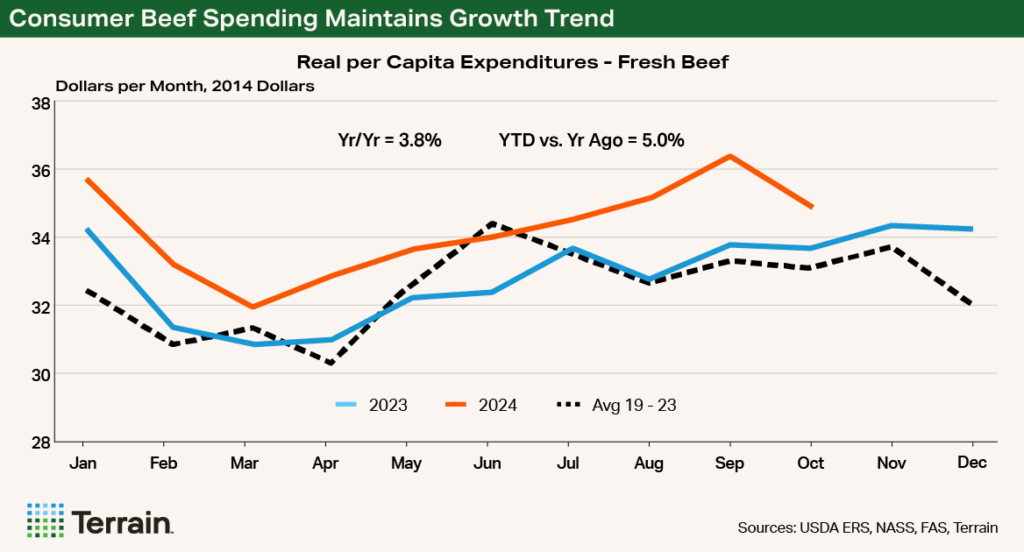

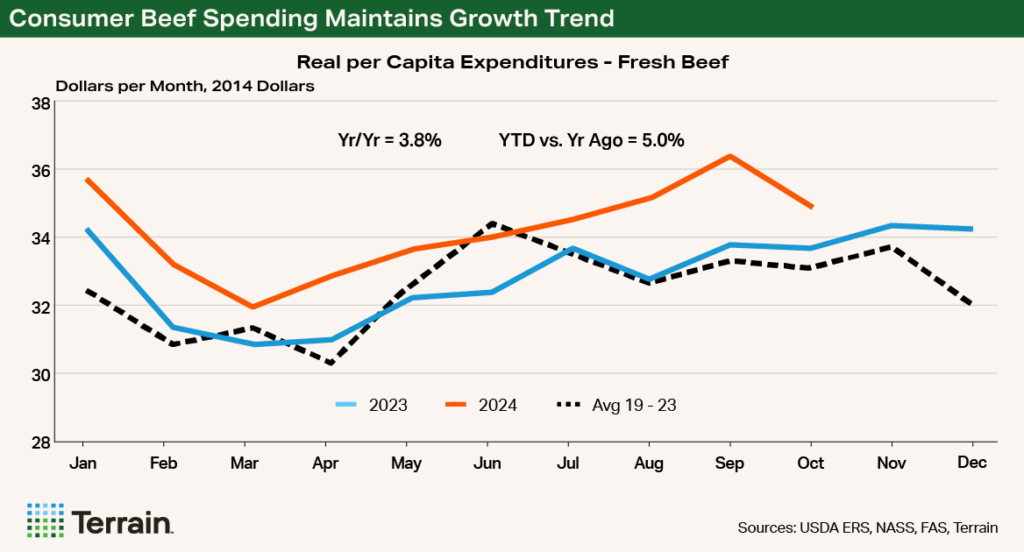

U.S. consumer-level beef demand and spending remain robust and well above year-ago levels.

All top five U.S. beef cow states are in some form of drought, which I believe is limiting ranch-level interest in beef heifer calf retention. I expect beef cow numbers as reported by the USDA in the January cattle inventory report to be down 0.5% to 1% (-150,000 to -275,000 head) versus a year earlier, totaling 27.9 million to 28.1 million head. That would be the lowest beef cow inventory number ever for the second year in a row.

Beef Still Winning With Consumers

U.S. consumer-level beef demand and spending remain robust and well above year-ago levels. From January through October, all-fresh beef demand was up 4.3% from a year earlier while real (deflated) per capita expenditures for beef using the all-fresh retail beef price were up 5%.

For perspective, from January through October, chicken real per capita expenditures were down 3.2% while pork was down 1.6%. Real per capita expenditures for both proteins have struggled for the past 15 months while beef has been winning with consumers. Continued strong beef and cattle prices depend on strong consumer spending.

Prices Set to Rally

I expect the availability of market-ready fed cattle to remain 2% to 3% below year-ago levels through at least March and decline at about the normal seasonal rate from January through March. Early-winter storms across the Panhandle of Texas and Oklahoma and southwest Kansas created muddy pens, challenging feed yard performance and doubling typical death losses in the region. I forecast the number of cattle placed against and expected to be marketed in Q1 2025 to be 0.5% to 0.75% smaller than a year ago.

I forecast 5-Area fed steer prices to average $186/cwt to $188/cwt in December and then average in the mid-$180s/cwt in Q1 2025.

I expect this to continue to help the feeding industry manage the carryover of unmarketed cattle. Combined with the effects of winter weather, this might get weights in check by the end of the year. If that all comes to fruition, feeders could regain market leverage.

I forecast 5-Area fed steer prices to average $186/cwt to $188/cwt in December and then average in the mid-$180s/cwt in Q1 2025, with noted seasonal strength entering Q2 2025. CME Feeder Index prices are likely to be rangebound near $250/cwt to $255/cwt, as negative basis limits feeders’ willingness to pay higher prices and bet on even higher breakevens.

If the border closure situation with Mexico is resolved, I expect the resumption of cattle crossing the border to limit upside potential for feeder cattle and calf prices during January and maybe early February. Oklahoma City 450-pound calf prices will likely stay in the $375/cwt to $390/cwt range through the end of 2024 as seasonal calf-run supplies tighten and demand for late-turnout cattle extends into late 2024. Lower feed grain prices, tightening yearling supplies, and any heifer calf retention will further support prices.

The two largest risks to beef and cattle prices going into 2025 are a pullback in consumer spending (possibly driven by a slowing U.S. economy, though there are no signs of this yet), and a pullback in export demand by our trading partners in retaliation for tariffs levied by the incoming U.S. administration.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.