Report Snapshot

Outlook

Congress allocated $30.78 billion to cover losses related to natural disasters in 2023 and 2024. The Supplemental Disaster Relief Program, which will provide $16.1 billion of the disaster-loss funding, is now rolling out in two stages to offer compensation to farmers for part of these losses. The USDA Farm Service Agency (FSA) is now accepting applications for the first stage.

Impact

Farmers should be on the lookout for prefilled applications for payments related to these losses or contact their FSA office if they believe they have a qualifying loss under this program.

On December 21, 2024, Congress passed the American Relief Act (ARA) of 2025, authorizing economic assistance to producers and disaster assistance to farmers facing losses from natural disasters and related events. The Supplemental Disaster Relief Program (SDRP) is now being rolled out to assist farmers facing loss from natural disasters in 2023 and 2024.

This program is funded with $16.1 billion of the overall $30.78 billion authorized by the American Relief Act of 2025 to cover a portion of losses to crops, trees, bushes and vines due to wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze (including polar vortex), smoke exposure, excessive moisture, qualifying droughts, or similar conditions.

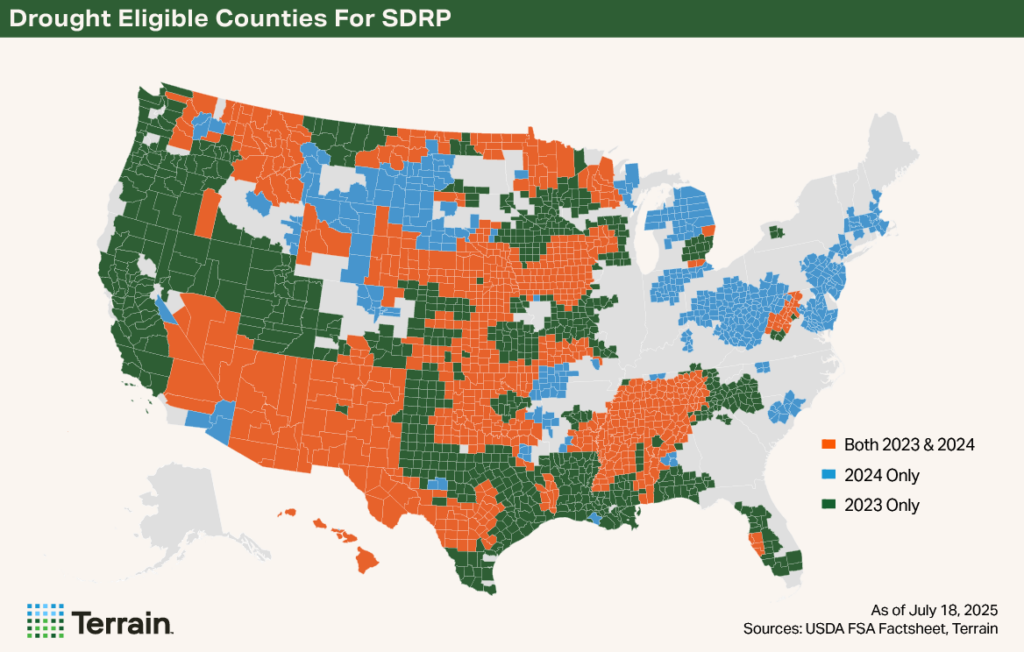

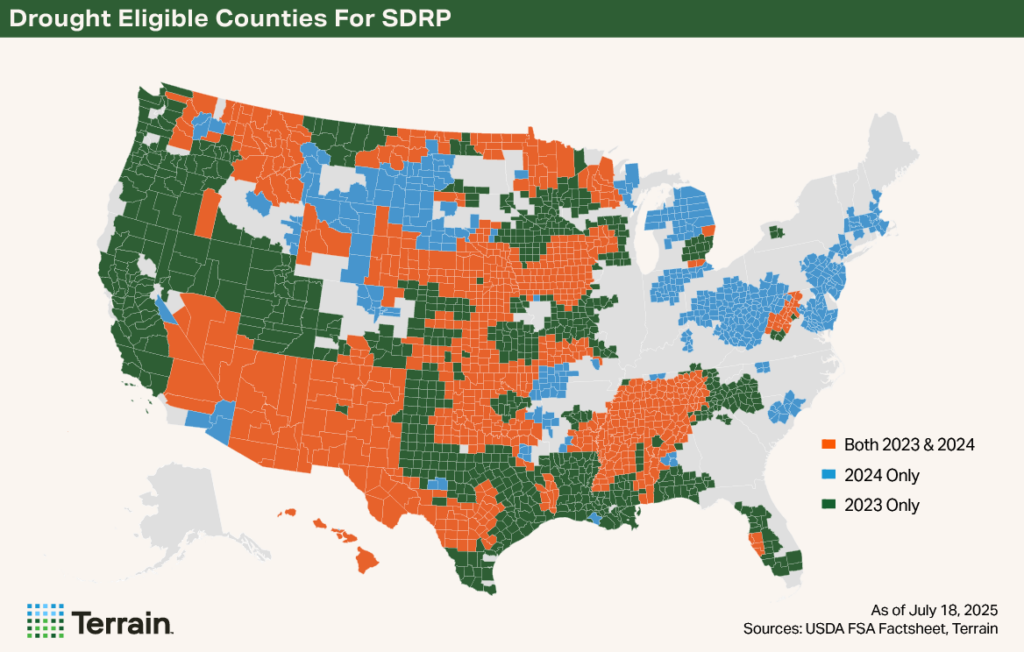

Drought losses must have occurred in a county that, according to the U.S. Drought Monitor, was rated D2 for eight consecutive weeks, or D3 or greater intensity during 2023 or 2024. The FSA has published a list of counties meeting these criteria and mapped below.

This program is rolling out in two stages. Stage 1 addresses losses that are quantifiable with existing data from either crop insurance indemnities or Noninsured Disaster Assistance Program (NAP) payments.

Stage 2 for other uncovered losses will be rolled out later, with a current target of September 15, 2025, for signups to begin. This later stage is for producers who had losses but did not receive indemnity payments for those losses, including those with shallow losses or no insurance coverage.

What Losses Are Covered in Stage 1?

Eligible losses must:

- Occur in calendar year 2023 or 2024.

- Be related to a qualifying disaster event.

- Be for crops, trees, or vines that were insured under federal crop insurance or covered by NAP.

Examples of eligible losses:

- Crop production, quality, or revenue losses.

- Tree and vine losses (e.g., orchard trees, grapevines).

Ineligible losses include:

- Losses already compensated under the Emergency Relief Program 2022.

- Losses in Connecticut, Hawaii, Maine, or Massachusetts, which are covered by separate state block grants from the $220 million allocated in the ARA for this purpose.1

- Losses under Controlled Environment policies, Margin Protection Plans, or Puerto Rico-issued policies.

- Supplemental policy endorsements based on county- or area-level losses when purchased with a base policy (ECO, HIP-WI, SCO, and STAX)

- Losses for crops intended for grazing or covered under livestock policies.

Receiving a pre-filled application does not guarantee eligibility. You must still meet all criteria and confirm that your losses were due to a qualifying disaster event.

How to Apply for Stage 1

FSA will send a pre-filled FSA-526 application if you received a qualifying indemnity or NAP payment. You can also request it from your local FSA office after July 10, 2025.

Receiving a pre-filled application does not guarantee eligibility. You must still meet all criteria and confirm that your losses were due to a qualifying disaster event. For example, you could have losses related to drought that occurred in a county not designated as eligible.

Stage 1 payments are calculated and made using already existing data. Farmers should not alter the pre-filled data. If you believe the prefilled data is incorrect, contact your crop insurance agent or FSA office to correct it and a new prefilled application will be generated.

Steps to Apply:

- Review the pre-filled application.

- Certify the disaster event that caused your loss.

- For certain producers, allocate (and verify with documentation) the percentage of expected revenue from specialty or high value crops.

- Sign and submit the application by the deadline (to be announced).

- Be prepared to purchase either federal crop insurance or NAP coverage for the next two available crop years at the 60% level or above and file the required reports.

To receive payments, the following forms must be on file with FSA. Most farmers will already have these on file with FSA from participation in other programs.

- AD-2047 (Customer Data Worksheet)

- CCC-902 (Farm Operating Plan)

- CCC-901 (Entity Member Info)

- AD-1026 (Conservation Compliance)

- SF-3881 (Direct Deposit)

- FSA-510 (if requesting higher payment limits)

Payment Limits

There are two separate payment limits, one for specialty and high value crops (combined) and another for other crops.

- Up to $125,000 if less than 75% of your average adjusted gross income is from farming.

- Up to $900,000 if 75% or more of your average adjusted gross income is from farming (requires certification).

For other Crops:

- Up to $125,000 if less than 75% of your average adjusted gross income is from farming.

- Up to $250,000 if 75% or more of your average adjusted gross income is from farming (requires certification).

Payment limits apply separately for each program year but apply jointly for both Stage 1 and Stage 2 payments. Thus, if a farmer reaches the payment limit for losses on a given year for Stage 1, they will not receive a Stage 2 payment.

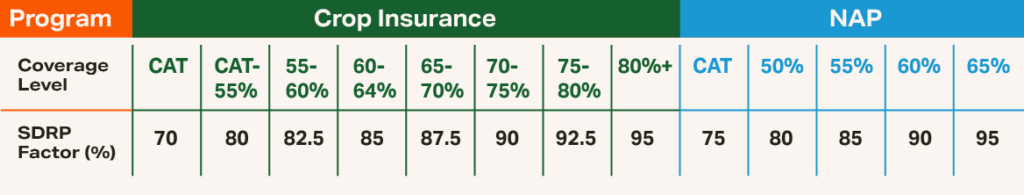

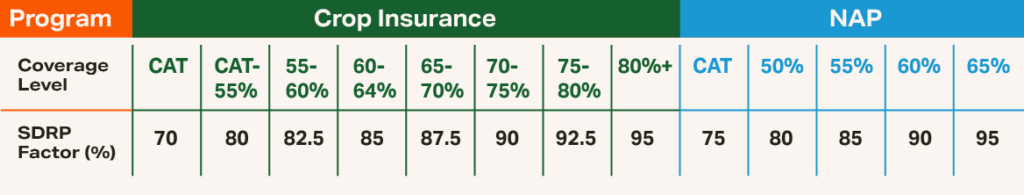

SDRP Factors by Coverage Level:

Calculating Payments

For Stage 1, payments will not exceed 90% of the loss and a payment factor of 35% is applied to all Stage 1 payments in part to ensure payments remain below the amount of money allocated by Congress for this program. A second payment may be issued later if funds remain.

Calculating a Payment

- Determine Expected Value: Based on your insured yield, acres, price, etc., and calculated consistent with the guidelines for the underlying policy.

- Apply SDRP Factor: A percentage based on your purchased coverage level (see table below).

- Subtract Net Indemnity: Your insurance or NAP payment minus fees and premiums.

- Apply Final Payment Factor: Multiply the result by 35%.

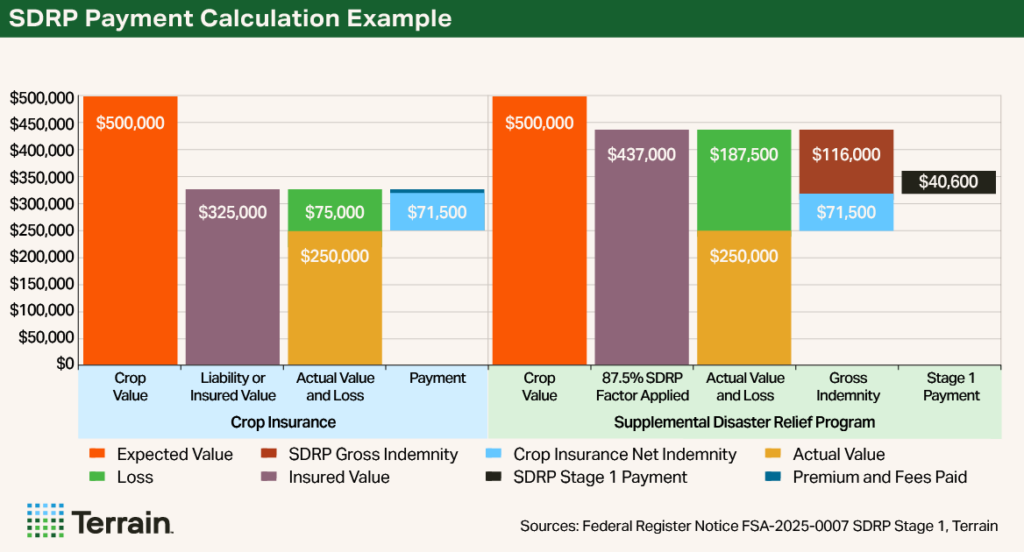

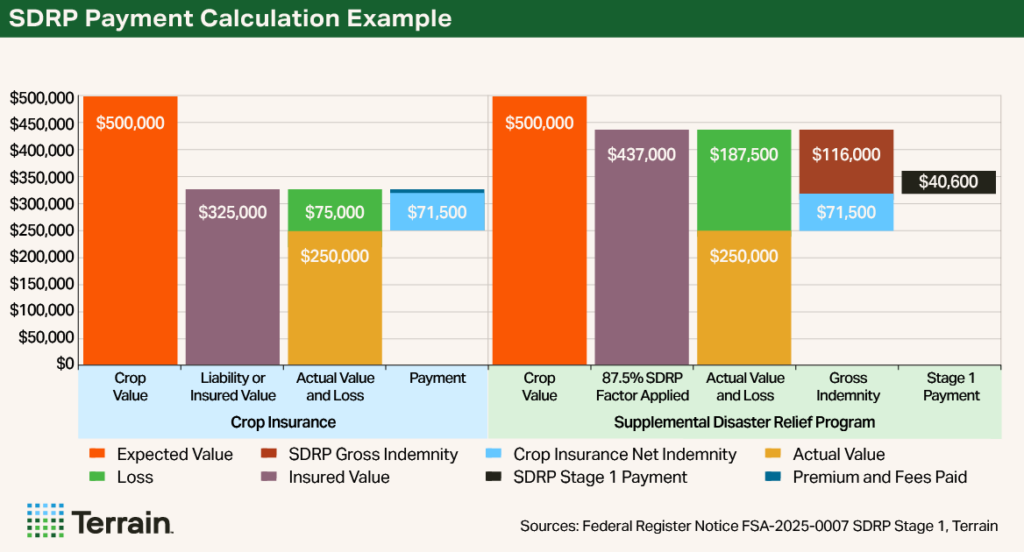

While a farmer’s individual specific calculations will vary by the type and specifics of the insurance purchased, the following example provides a general overview of how Stage 1 payments are calculated:

A farmer purchases a crop insurance policy with a 65% coverage level, costing $3,500 in administrative fees and premiums. Based on the specifics of the insured crop and policy (such as approved yield, acres, and price), their expected value was $500,000 with an associated insurance liability of $325,000 (65% of expected value). The farmer experiences a loss and their production was subsequently valued at $250,000. A gross indemnity was paid of $75,000 ($325,000 - $250,000).

For SDRP Stage 1, a similar calculation will be performed, but replacing the elected coverage level of 65% with the 87.5% SDRP factor (from the table), and consequently recalculating the liability. The new liability is now $437,500 (87.5% of $500,000), resulting in a gross indemnity for SDRP Stage 1 purposes of $187,500 ($437,500 - $250,000). The crop insurance net indemnity ($71,500 = $75,000 - $3,500) already received from the crop insurance policy is then subtracted, resulting in a gross Stage 1 payment of $116,000 ($187,500 - $71,500).

This gross payment is then multiplied by the SDRP final payment factor of 35%, resulting in a final payment of $40,600. This factor ensures that total payments do not exceed total available funding. This final payment amount would be subject to the payment limitation rules.

What You Should Do Now

If you’re a farmer who suffered losses in 2023 or 2024 and received a crop insurance or NAP payment, you may be eligible for SDRP Stage 1 payments. Watch for a pre-filled application to arrive by mail or contact your local FSA office to request one. Review and certify your losses, remembering that just because you received an application does not necessarily mean you qualify. If you receive a payment, don’t forget to purchase crop insurance or NAP coverage at the 60% level or higher and file the required reports for the next two years. Watch for a Stage 2 signup later this fall (targeted for September 15, 2025) that will address losses not covered under this Stage 1.

This overview is intended to give a general understanding of how this program operates. For specifics to your individual application and other program details contact your local FSA office or visit the official USDA SDRP page where a payment calculator tool and fact sheet are also available.

Endnotes

1 This can include losses outside of these states in the cases where a county inside that state is listed as the county by the farmer when purchasing certain insurance policies such as Apiculture, PRF, and WFRP. These losses are intended to be addressed in SDRP Stage 2.

2 Specialty crops including fruits, tree nuts, vegetables, culinary herbs and spices, medicinal plants, and nursery, floriculture, horticulture crops, and common specialty crops identified by USDA AMS.

3 High value crops include trees, bushes, vines, aquaculture, hemp, grass for seed, vegetable seed, and tobacco.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.