Quarterly Outlook • June 2023

Fed Cattle Prices Rally to Record Levels Ahead of Expectations

Production Forecast

U.S. cattle slaughter was down about 3.9% year over year in the first five months of 2023, resulting in lower beef production by about 4.9% YOY. Although down from last year, year-to-date cattle slaughter averaged about 2,300 head per week above the previous five-year average. We expect annual cattle slaughter and beef production in 2023 to be down 4.5% to 5% versus 2022.

Price Forecast

All classes of cattle are rallying in response to tighter available supplies. Feeder cattle and calf prices are moving higher because of unexpected strength in spot fed cattle prices, rallying futures, expected lower grain costs, and heifer calf retention beginning in earnest. Cow and replacement heifer values are expected to keep pace with the rally in fed cattle on a $/head basis.

- We expect 700- to 900-pound steers in the central plains and West to trade in the $235 to $270/cwt range during 2023 and fall delivery 500- to 600-pound steer calves to trade at $275 to $300/cwt depending on quality.

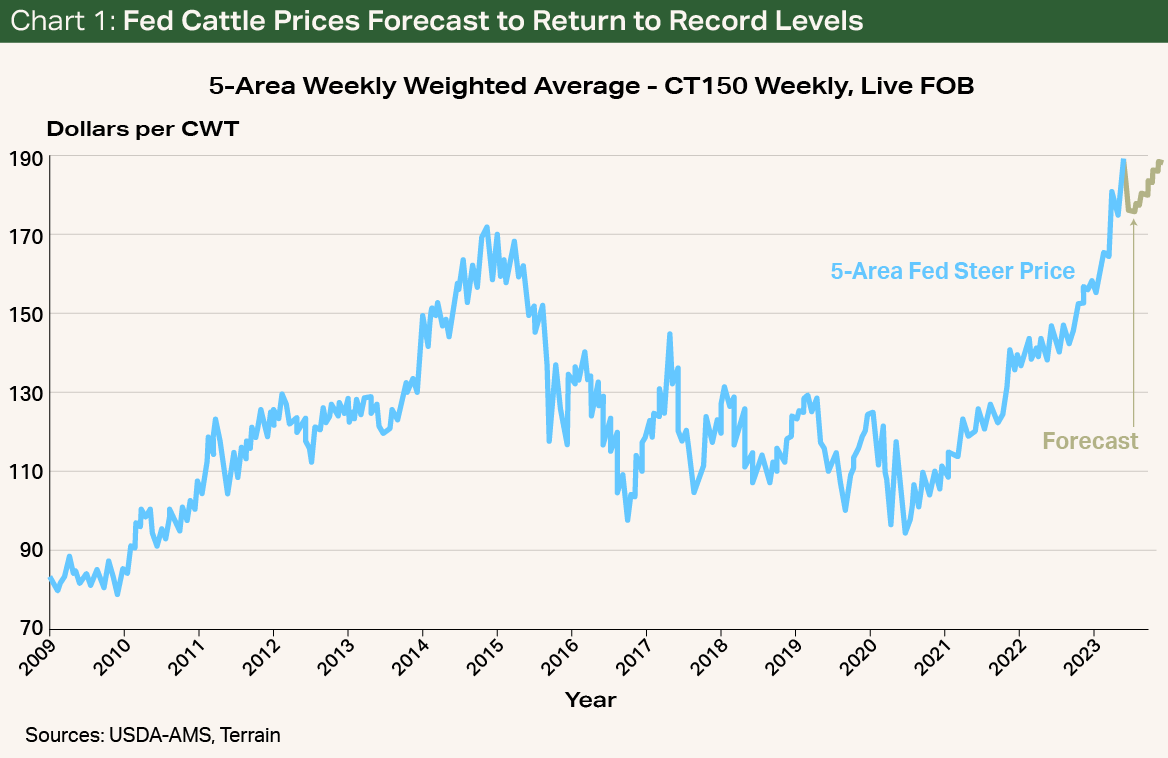

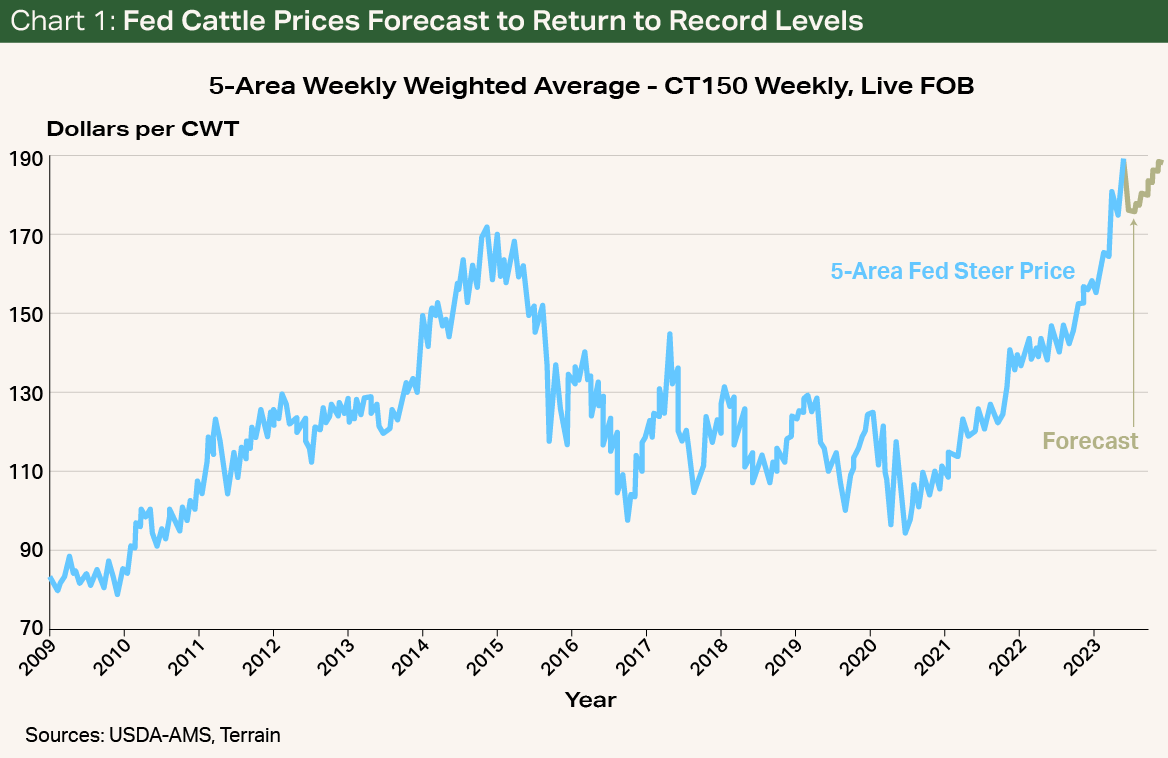

- Our expected range for 2023 annual average fed cattle prices has been raised to $169 to $174/cwt from $160 to $165/cwt.

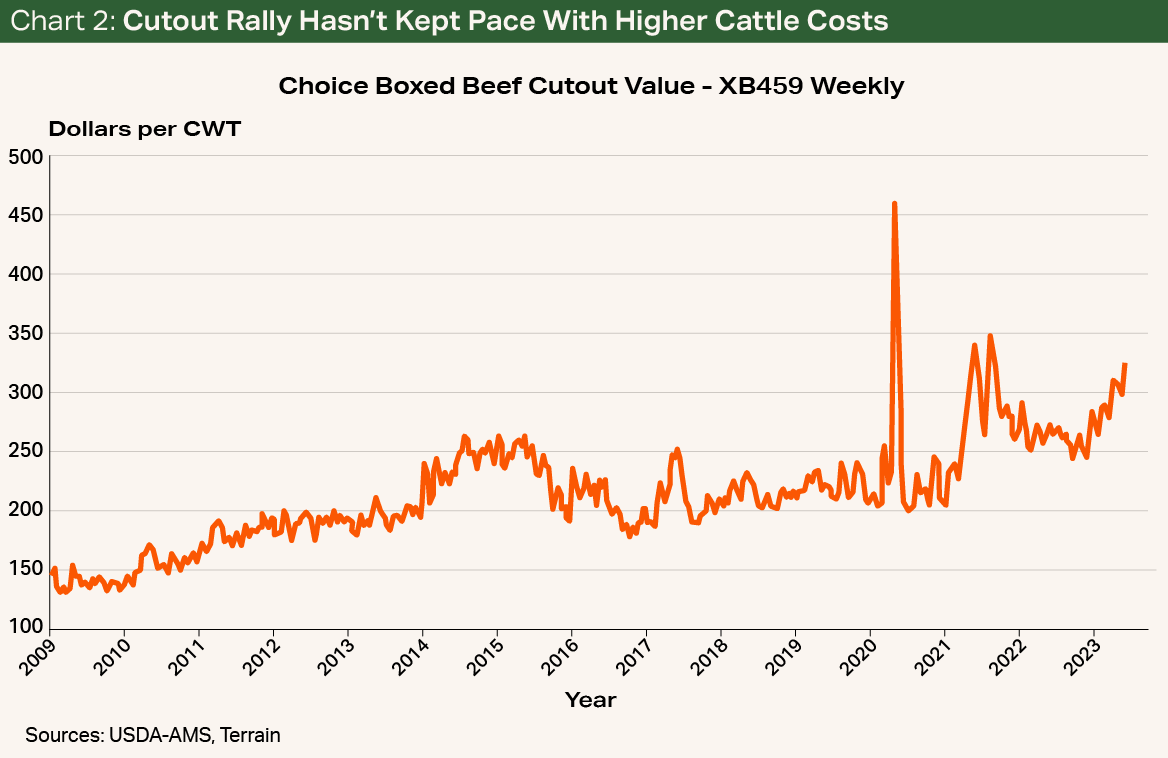

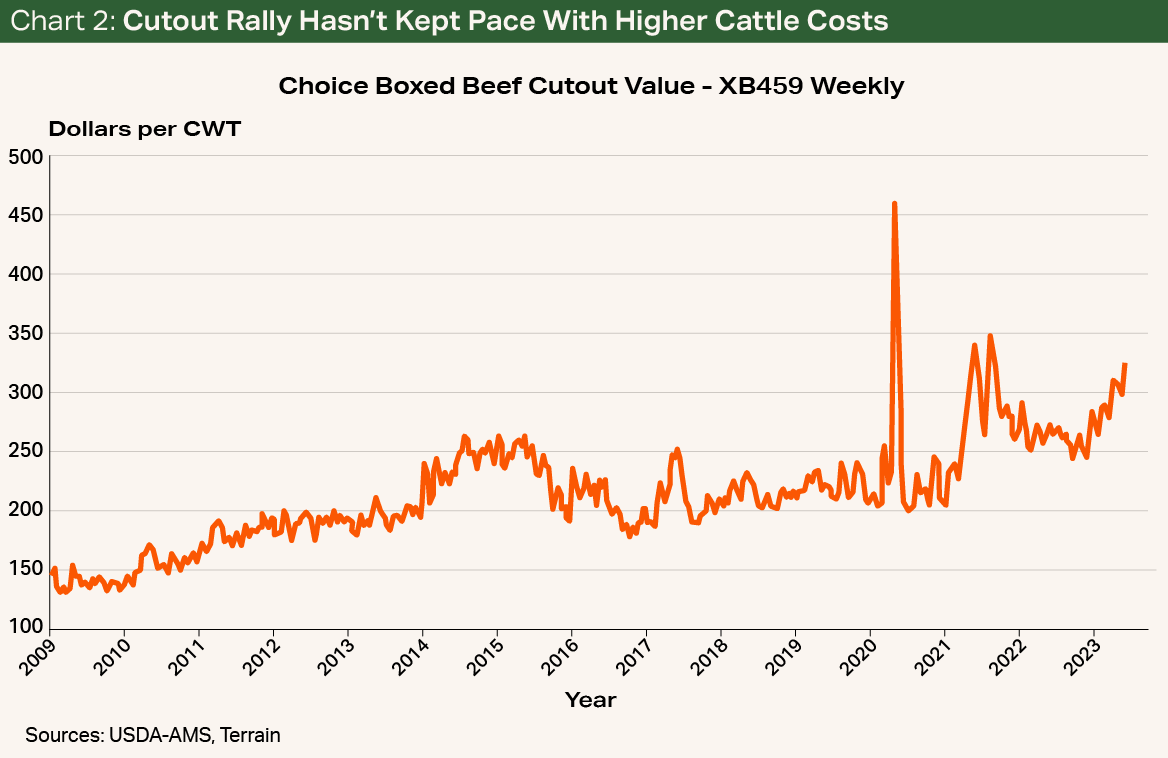

- Choice and Prime beef demand remains on solid footing, with cutout values expected to average 7% to 9% above year-ago levels and 23% to 25% above the highs set in 2014 to 2015. Packer and retailer margins will remain compressed as cyclical leverage moves back through the system to cattle producers.

Fed cattle prices in the second quarter of 2023 set a record high, with weekly average five-area prices exceeding the previous cycle and all-time highs set in late 2014 (see Chart 1). The late March and early April rally was driven by tightening supplies, the result of some delayed marketings of winter weather-impacted cattle in eastern Nebraska and eastern South Dakota while southern plains cattle outperformed closeout projections.

Furthering the rally was the fallout from the U.S. Supreme Court ruling on California Prop 12. The regulations around sow housing and handling requirements are set to take effect July 1, 2023. The California Department of Food and Agriculture is far from being able to implement and enforce the regulations and has issued statements that producers, processors and distributors could use a self-certification process through the end of 2023. It also intends to allow noncompliant products that arrive in California prior to July 1 to flow through commerce in an orderly fashion. Retail grocers and food service outlets in California don’t appear to be waiting around and are seeking only compliant products for delivery after July 1. Consequently, grocery companies and food service outlets are looking to other species to fill their customers’ needs.

The pork industry consensus is that the system can cover only about 25% of California pork needs. This is expected to equate to a deficit of about 12% or more of U.S. commercial pork production and could translate to a 3.2 billion-pound annualized shift to beef and chicken consumption within California. Conversely, the change will leave that much extra pork in the rest of the U.S. market until more compliant pork becomes available. If an integrated pork production system already had the facility construction or remodeling complete and only needed to make a few production changes at the time of sow breeding to become compliant, additional supplies of compliant pork are at least 11 months away. In other words, the market impacts of Prop 12 will be far-reaching and, at least in the near term, positive for beef and chicken as grocers and restaurants strive to meet unfilled consumer pork needs with beef and chicken through at least the end of 2023. For the balance of 2023, we expect wholesale beef and fed cattle prices to overperform our previous expectations as California meat demand transitions and must compete with the rest of the market for beef supplies amid an already tightening supply situation (see Chart 2). Two headwinds already apparent are the discounting of noncompliant pork in the other 47 states and how well California consumers can transition to higher average beef prices.

We expect further tightening of feeder cattle and calf supplies during the second half of 2023. Improving moisture conditions across much of the central plains and West combined with now-record fed cattle prices have feed yards chasing replacement cattle and driving prices markedly higher. Early video auction results bear this out, with Northern and Western early- and mid-summer delivery feeder steers bringing $240 to $265/cwt. Lots of Northern fall delivery unweaned steer calves weighing 500 to 600 pounds have traded for $280/cwt and higher. Program-eligible weaned calves of similar quality traded for $300/cwt or more. During early June, average prices for five-weight and six-weight steers and heifers for fall delivery were about $400/head above year-ago levels. This kind of price activity is expected to further drive expansion plans at many cow-calf operations and create even tighter feeder cattle and calf supplies. We expect feeder cattle and calf supplies outside of feed yards to be down 5% to 7% during the second half of 2023. The reduction is a function of 4% fewer beef cows calving and 5% fewer beef replacement heifers expected to calve in 2023 combined with accelerating beef replacement heifer calf retention at the ranch level.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.