Report Snapshot

Situation

The first Farm Credit Cattle Customer Survey on Herd Expansion Plans provides one of the clearest pictures yet of where the beef cow herd stands, what drove changes in 2025, and how producers are approaching decisions for 2026 and 2027.

Finding

About half of operations bred more females in 2025 than in 2024. Nearly half of respondents also plan to increase breeding females in 2026, and just over a quarter plan to do so in 2027. Respondents who said they were not expanding breeding herd numbers indicated range and pasture conditions and drought forecasts as major limiting factors.

Impact

Because expansion is happening slowly, I expect calf and feeder cattle supplies to stay tight during the next several years. Reduced numbers outside feedlots will likely support strong prices for cow-calf producers, and margins will stay compressed for feeders and packers. High-quality bred cows and heifers will also remain expensive.

After years of contraction, it appears beef cow herd expansion has begun at a modest rate, according to a first-of-its-kind survey conducted in December by Terrain and 10 Farm Credit associations.

With more than 1,000 producers participating across 28 states, the first Farm Credit Cattle Customer Survey on Herd Expansion Plans provides one of the clearest pictures yet of where the beef cow herd stands, what drove changes in 2025, and how producers are approaching decisions for 2026 and 2027.

Key Findings

- Adding cows was a more common practice to grow breeding female numbers during 2025. I estimate this limits the total beef cow herd increase on January 1, 2026, to a maximum of 1.5% to 2.5%.

- Range and pasture conditions and drought forecasts are major limiting factors to herd recovery/expansion.

- Nearly half of survey respondents plan to increase breeding females in 2026 and just over a quarter plan to do so in 2027, signaling continued shrinking of feeder cattle and calf supplies outside feedlots and available for placement.

- Tight calf supply could result in continued upward pressure on prices, benefiting the cow-calf producer and keeping margins tight up the chain.

Who Participated and Why That Matters

Age, experience and operation size all play a role in the risk tolerance and decision-making behind cow herd expansion.

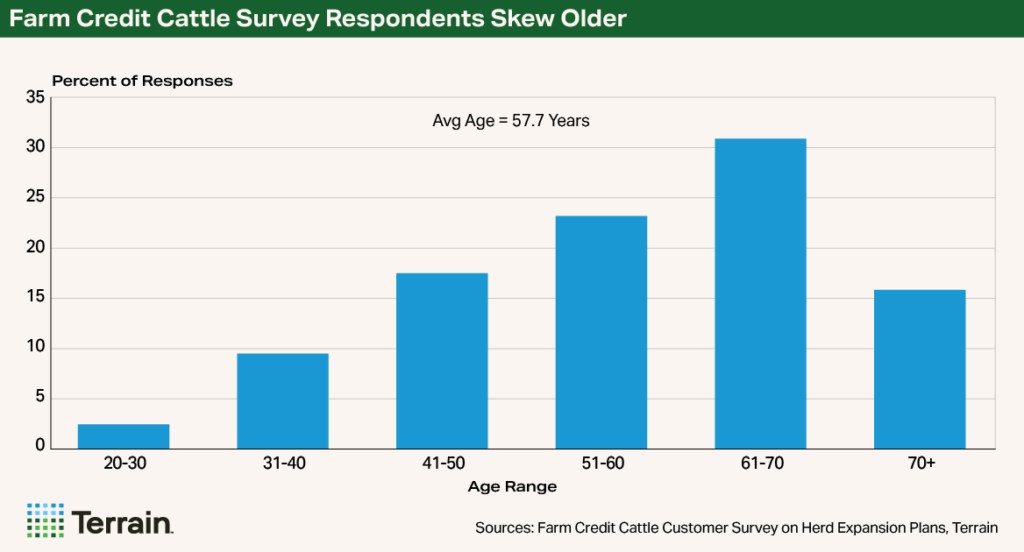

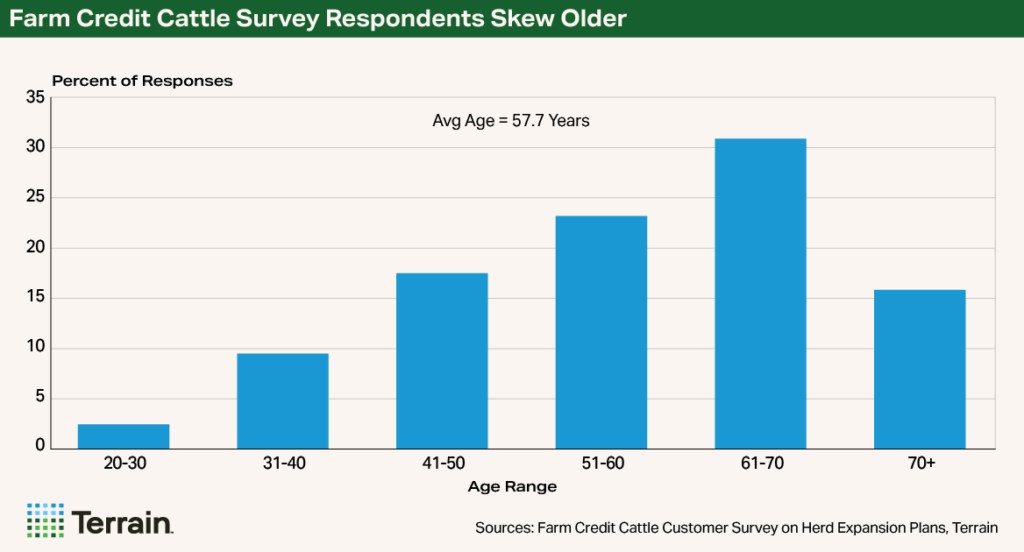

The average age of a survey respondent was 57.7 years, nearly identical to the most recent Census of Agriculture (2022). The most selected age range was 61 to 70, at 31% of participants. The next most common age range was 51 to 60, followed by 20 to 30.

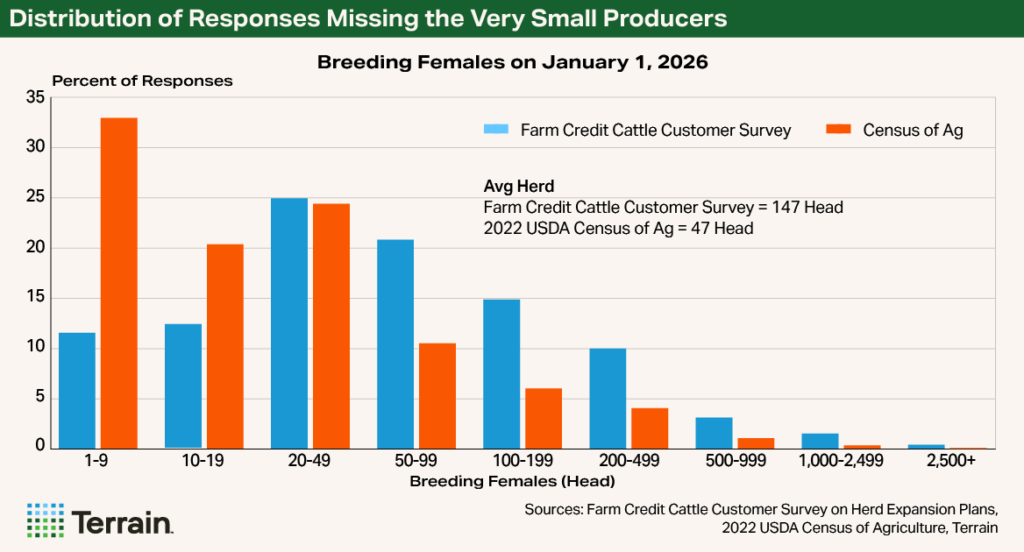

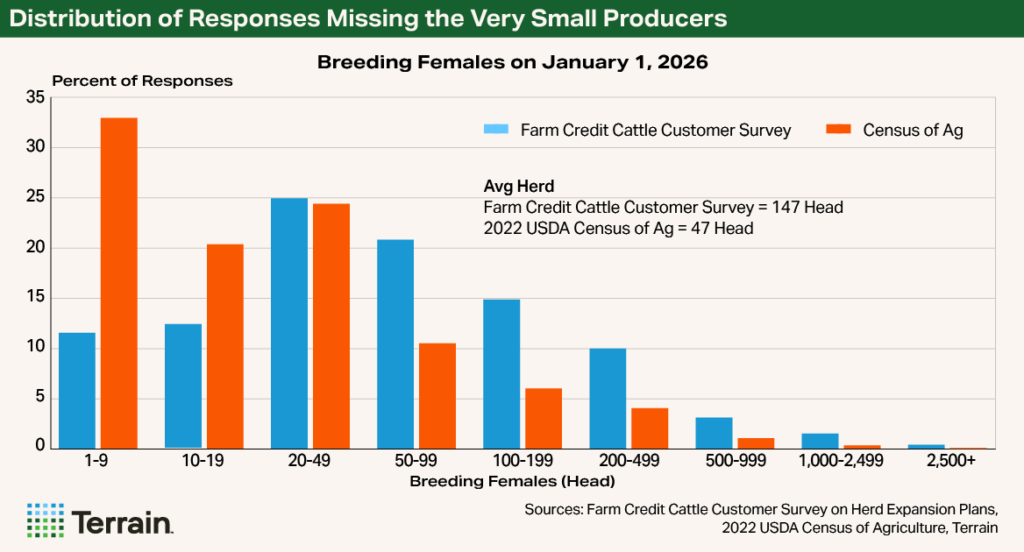

The average breeding herd inventory in the survey was 147 head. Most operations ran between 20 and 199 head, aligning with national herd size patterns. The smallest producers (one to nine head) appear somewhat underrepresented, likely because many hobby- or youth project-type herds fall outside Farm Credit customer bases.

The distribution of survey responses was similar to the most recent Census of Agriculture, with the exception that the census collected data from a far larger percentage of producers in the one-to-nine head category.

I suspect that even many of the small operations that took the survey are part of a larger farming or agriculture endeavor.

Producers in the survey generally confirmed that trend: Expansion has begun, but at a mild pace.

Rebuilding Begins — Slowly

One of the survey’s primary goals was to determine if any beef cow herd expansion took place in 2025, which marked an important turning point. After seven years of herd liquidation, beef cow slaughter finally fell sharply enough — down 16.7% from the previous year — to stabilize national herd numbers and set the stage for early rebuilding.

Producers in the survey generally confirmed that trend: Expansion has begun, but at a mild pace.

One of the biggest questions entering 2025 was whether ranchers would start retaining more heifer calves for breeding. We have suspected that many growing operations would opt to buy proven cows versus having the extra costs and labor of breeding and calving heifers.

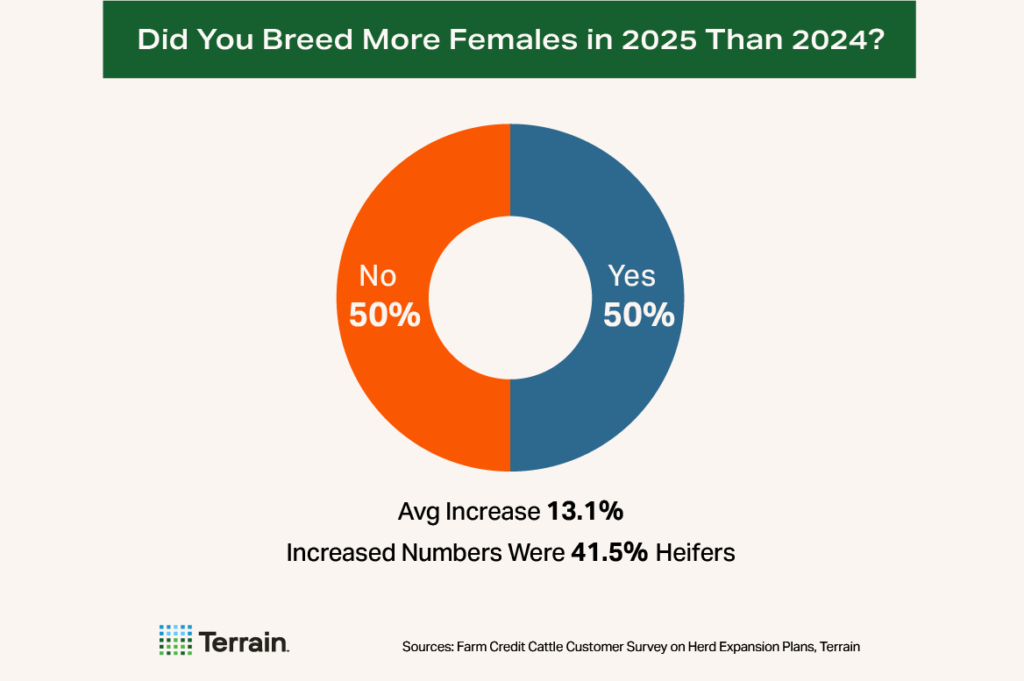

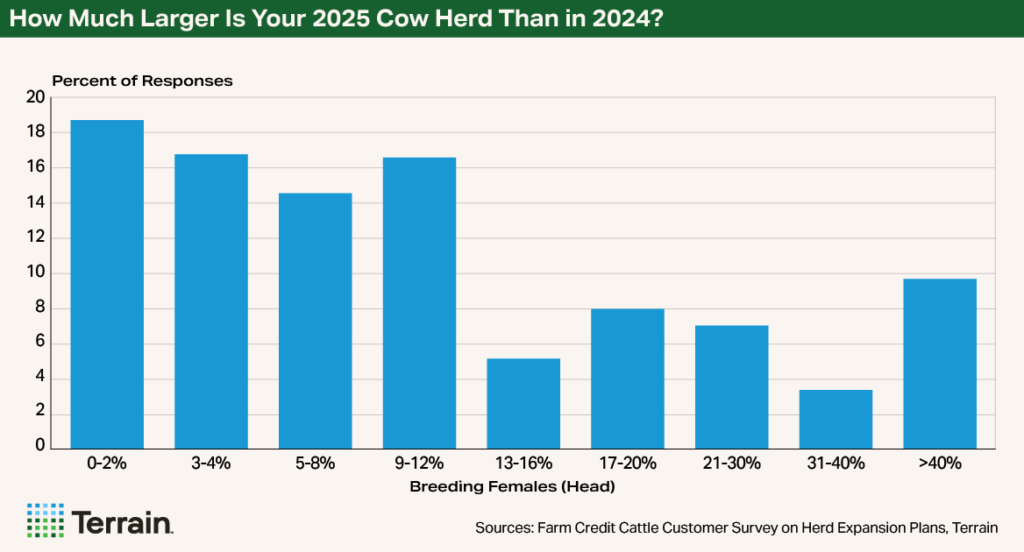

Survey responses suggest this assumption was largely true. About half of operations bred more females in 2025 than in 2024, and for those who increased breeding activity, the average bump was roughly 13%. But more of that increase came from adding cows (58.5%) rather than raising heifers (41.5%). That distinction matters because buying cows shifts animals between operations without adding new cattle to the national total.

The distribution of responses was interesting:

- 43.6% of growing operations increased breeding females using a mix of 81% to 99% cows and 1% to 19% heifers

- 23.9% of growing operations used only heifers

- 7% of growing operations used only cows

Because the survey results skewed toward buying cows as opposed to heifers, the impact on the change in total herd size is less pronounced.

Heifers as a percentage of the cattle on feed remain elevated relative to previous periods of herd expansion. This survey’s results show that many producers who elected to grow have done so in a way that should maximize operational revenue: by selling heifer calves and adding older females that could add to the following year’s calf crop.

The data suggest the national beef cow herd likely grew slightly heading into 2026, perhaps by 1.5% to 2.5%.

Still, taken together — slower slaughter, some heifer retention, and the movement of cows between herds — the data suggest the national beef cow herd likely grew slightly heading into 2026, perhaps by 1.5% to 2.5%.

It’s a cautious start to recovery.

Expansion Plans for 2026 and 2027

We also surveyed producers about their growth plans for 2026 and 2027. Producers are cautiously optimistic but not leaning aggressively into growth.

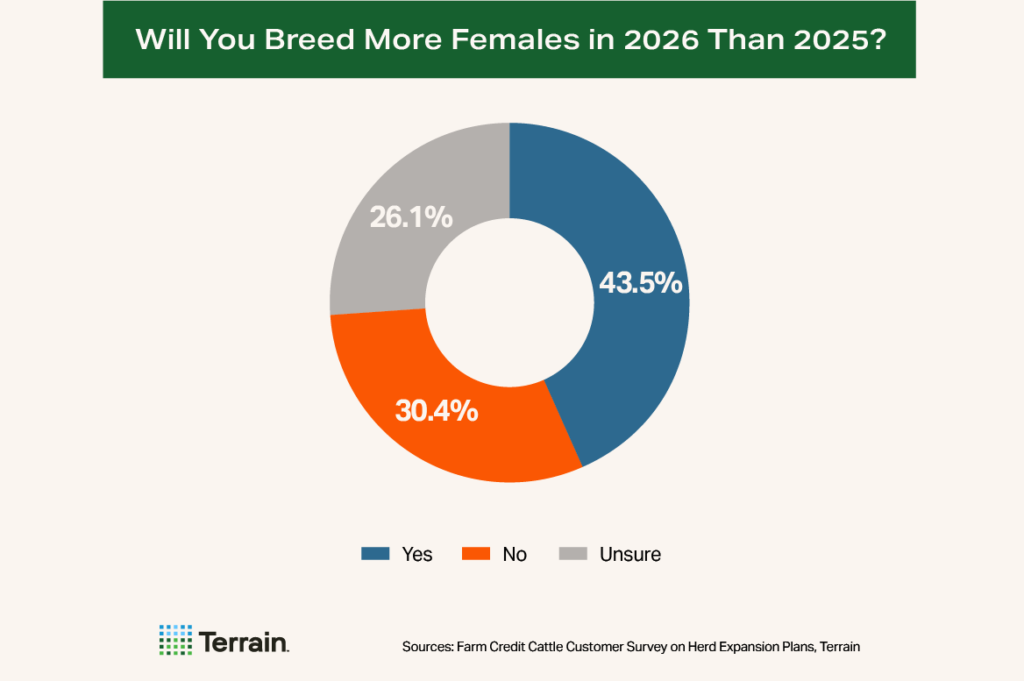

For 2026:

- 43.5% plan to breed more females than in 2025

- 30.4% plan to breed the same or fewer than in 2025

- 26% are unsure

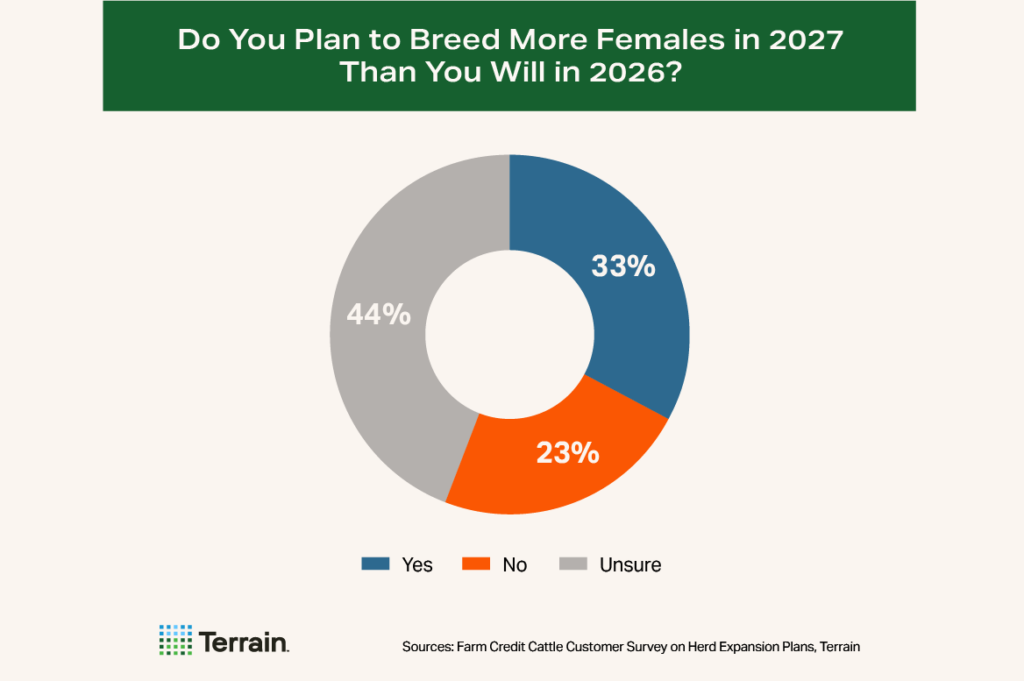

By 2027, uncertainty grows:

- 33% expect to increase bred heifers from 2026

- 23% expect to hold steady or decrease from 2026

- 44% are unsure

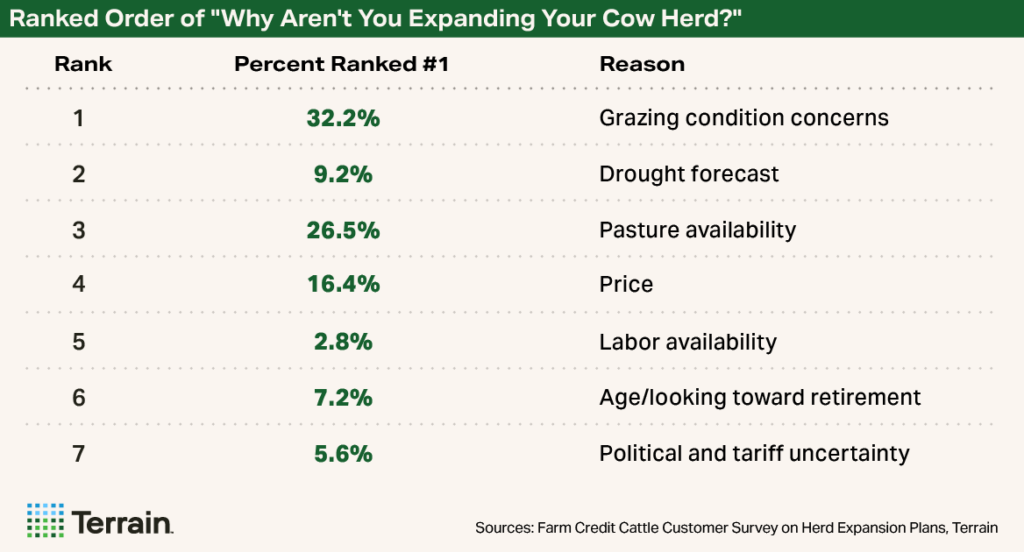

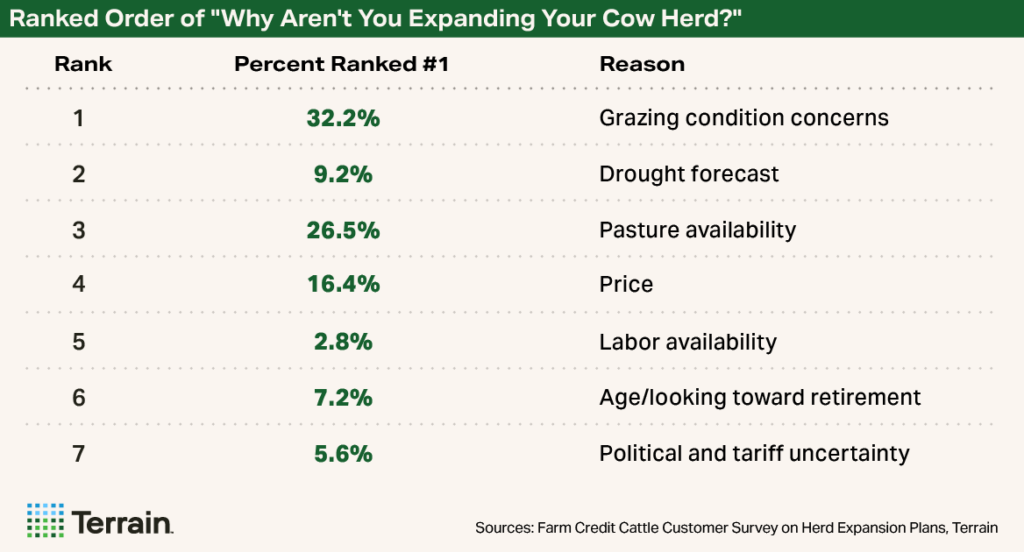

Survey respondents who said they were not expanding breeding female numbers were asked to rank a list of reasons that contributed to their decision. The top reasons weren’t surprising:

- Grazing condition concerns

- Drought forecasts

- Pasture availability

However, producer age ranked sixth, which was a little surprising, as an estimated nearly 25% of respondents were at or beyond retirement age. Political and tariff uncertainty fell to the bottom of the list of reasons.

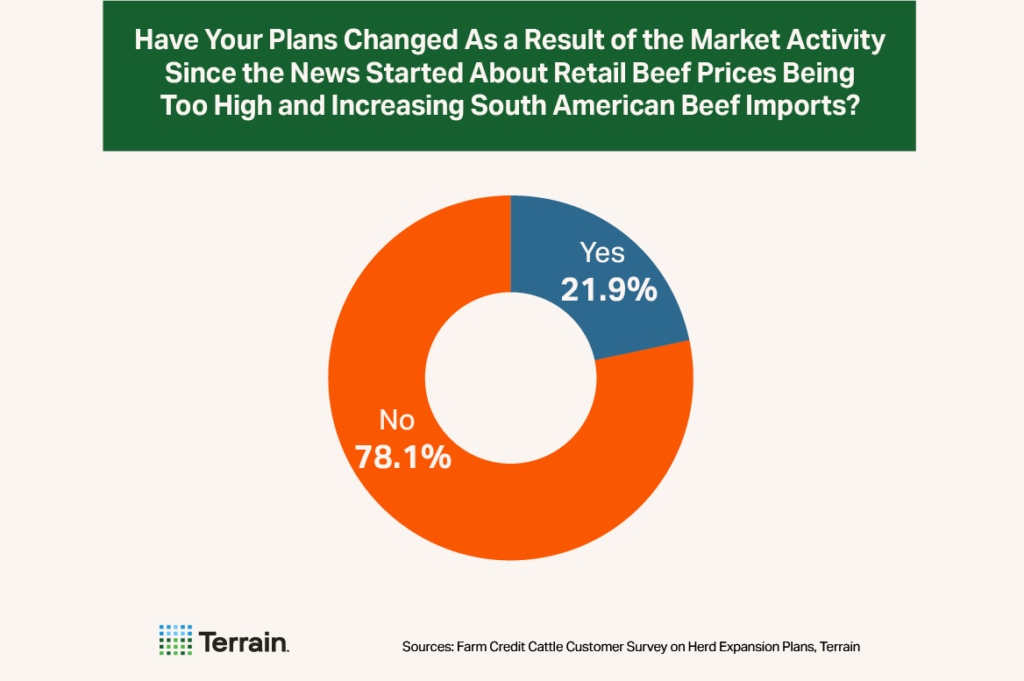

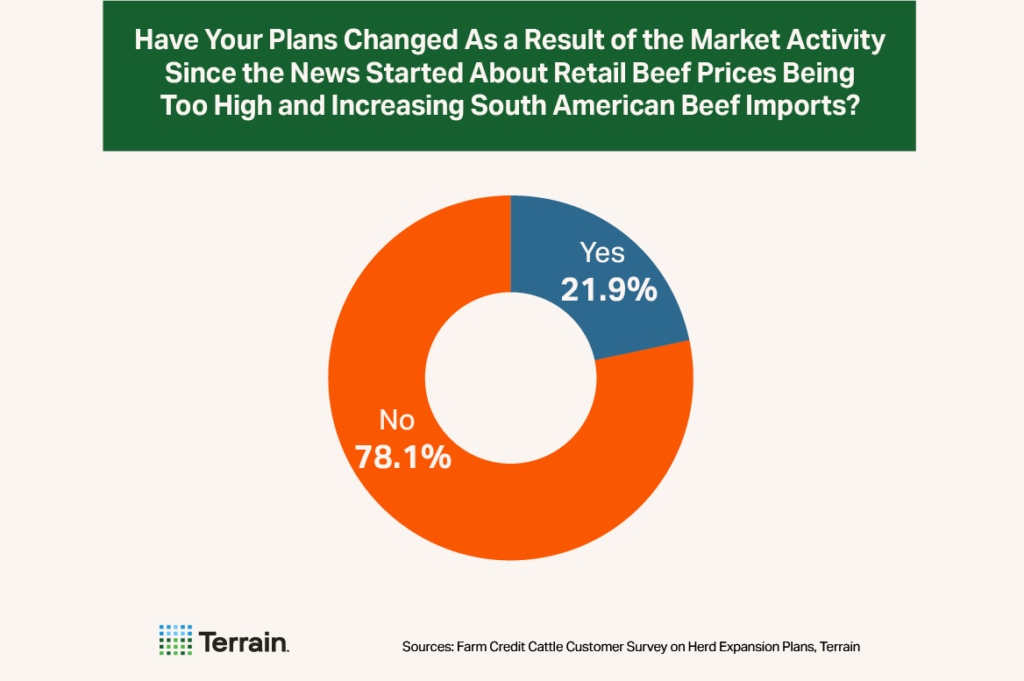

Of note, our request for survey responses immediately followed the fall break in cattle prices after President Trump claimed U.S. beef prices were too high and changed tariff rates for South American countries to stimulate larger imports of ground beef raw material. We asked if operations had changed their plans as a result of these issues. The majority (78.1%) said these actions didn’t cause them to make changes to their plans, while 21.9% of operations responded “Yes.”

What Does the Survey Mean for the Current Herd Size?

Total beef cow slaughter for 2025 was 16.7% smaller than a year earlier. As a percentage of the January 1, 2025, herd, total slaughter was 8.7%, down 1.7% from the previous year. By my calculations, beef cow slaughter was small enough to stabilize beef cow numbers and mark the end of a seven-year cow herd liquidation. The survey results indicate that producers added enough cows to offset the slaughter numbers.

I estimate the beef cow herd total on January 1, 2026, will increase a maximum of 1.5% to 2.5%.

Ranchers also kept some heifers, albeit a smaller share than cows purchased. The aggregate share of heifers on feed was 39.4% in 2024 and 38.1% in 2025. While the percentage of heifers on feed has declined, history suggests that it needs to be 36% or less to substantiate significant expansion.

As a result of slower slaughter, more cows purchased, and the reported heifers-on-feed inventory, I estimate the beef cow herd total on January 1, 2026, will increase a maximum of 1.5% to 2.5%, with revisions to year-ago totals likely.

A Transition, Not a Surge

The survey paints a picture of an industry in transition — moving away from liquidation but not yet confident enough for large-scale growth. Producers appear willing to expand, but only when conditions like moisture, the grazing outlook and forage availability are good.

Reduced numbers outside feedlots will likely support strong prices for cow-calf producers.

Continued monitoring of expansion plans and industry conditions will be essential as the sector navigates this pivotal period of transition. If expansion continues to happen slowly, I expect calf and feeder cattle supplies to stay tight during the next several years. Reduced numbers outside feedlots will likely support strong prices for cow-calf producers, and margins will stay compressed for feeders and packers. High-quality bred cows and heifers will also remain expensive.

Ranchers looking to expand their current operation should actively communicate with their Farm Credit partner on financial plans and needs.

Thank You

We would like to thank all the producers who were willing to participate and share details about their operations and their viewpoints on current and future cow herd expansion. We also extend our sincere appreciation to the following Farm Credit associations for their efforts in making this survey successful:

- AgCountry Farm Credit Services

- AgTexas Farm Credit Services

- American AgCredit

- Capital Farm Credit

- Farm Credit Illinois

- Farm Credit Mid-America

- Farm Credit of Central Florida

- Farm Credit Services of America

- FCS Financial

- Frontier Farm Credit

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.