Persistently tight milk supply created an opportunity for strong exports to drive prices to new heights for the year. But the new price level could be just enough to push us out of export competitiveness, leading to choppiness and the possibility of a downward correction later in the year.

The spring flush, the seasonal peak in milk production, has been marred by ongoing cow and heifer shortages along with the curveball of avian influenza. Milk production levels through April were down 0.7% compared with 2023. So far, in terms of milk production, 2024 looks much closer to 2022 than 2023.

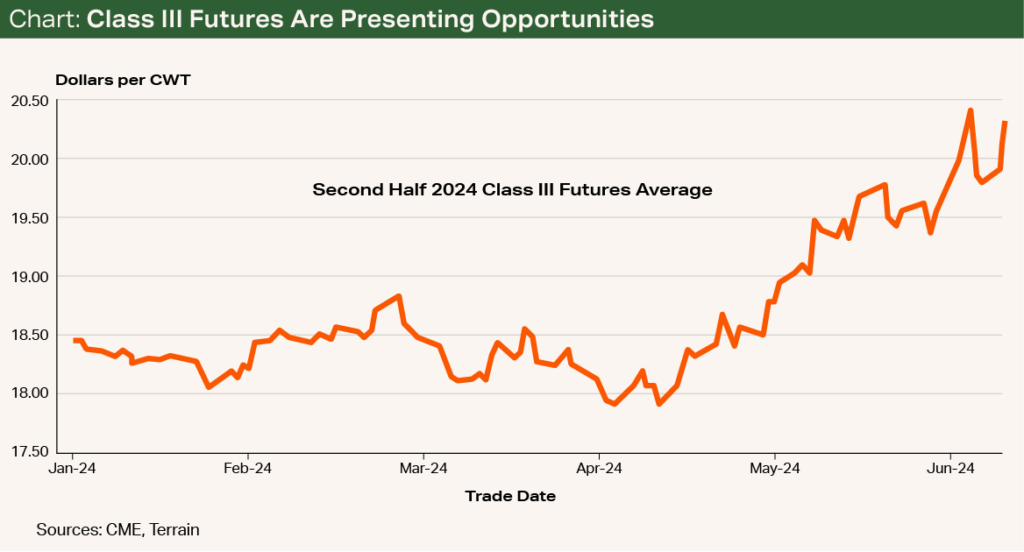

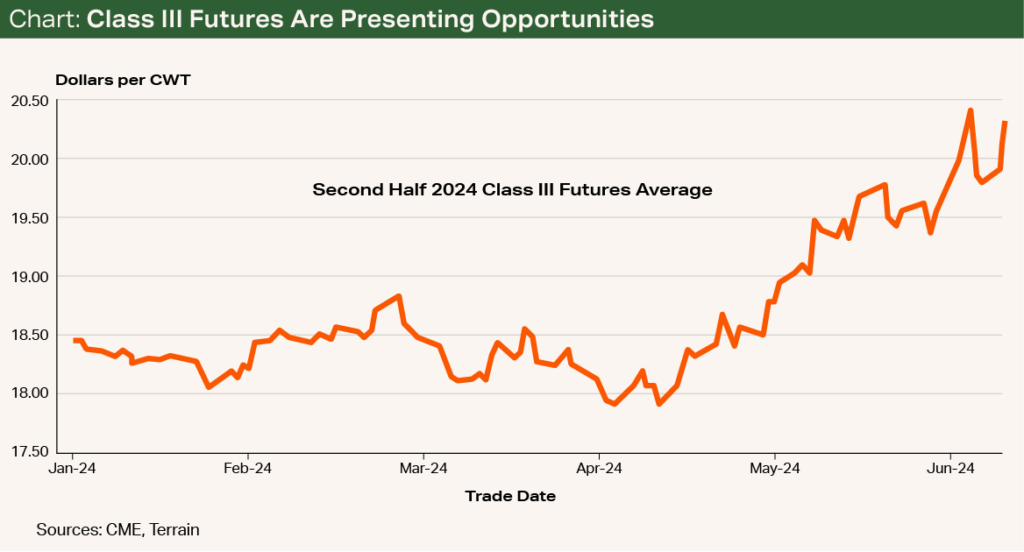

Can dairy markets summon some of the price strength of 2022? The rally seen across Class III markets from April to May suggests they’re willing to try (see Chart). Domestic demand continues to do well, but shaky exports might not be ready to play along.

A Mixed Story for Exports

In terms of total milk solids, domestic demand was flat in the first quarter versus Q1 2023 and up 1.7% from Q1 2022. February and March both showed slight declines in domestic demand (down 0.1% and 1%, respectively), which could hint at some of the long-anticipated pushback against elevated prices.

However, the down months come at the end of a 12-month streak of positive gains averaging 3%. Whether recent months mark the beginning of a true slowdown in demand for American consumers (unlikely) or a brief pause to catch their breath will be an item to watch in the months ahead.

The real price driver on the demand side has been and will continue to be export markets. Largely uninspired in 2023, exports have perked up in recent months and brought commodity prices with them.

Class III milk prices bottomed out at $15.50 in April. By May, they climbed more than $3 to $18.55, and they appear poised to climb another dollar to the mid-$19 range by June. Prices in the summer months have been trading in the $20 to $21 range. Much of this is due to a pickup in exports, particularly cheese.

I expect a downward price correction to come if we start seeing slower export reports for May and June.

Total cheese exports in April were up 27% year over year (YOY). Mexico has been a strong buyer throughout recent history, even at points when other major customers such as Japan and South Korea have held back. Cheese exports to Mexico were up 53% YOY in April, and South Korea came back with a 69% YOY increase. Cheese exports to Japan were up a less dramatic but still respectable 11%.

But there’s a catch: The strong export sales were booked when U.S. prices were much cheaper than in the rest of the world. That $15.50 Class III milk price in April was due to a cheese price of $1.55 — a bargain on the world market. Ironically, the surge in exports helped push cheese prices to $2, which is probably enough to snuff out most of that interest from world markets. I expect a downward price correction to come if we start seeing slower export reports for May and June.

Price Outlook

In my previous Quarterly Outlook, I suggested that producers tied to Class III should watch for upside surprises in Class III values to opportunistically lock in some protection. Those opportunities have materialized in the wake of encouraging exports. However, looking ahead to the second half of the year, I expect the downward pressure to be stronger than further upside potential.

Futures markets currently indicate Class III milk prices averaging $20.25 and Class IV milk prices averaging $21.80 in the second half of 2024. While I am hopeful that prices can remain supported at those levels, my expectation is for a downward correction from here.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.