In the News • February 11, 2025

Examining the Economic Crisis in Farm Country

Testimony to the U.S. House Committee on Agriculture as Presented on February 11, 2025, by John Newton, Ph.D., on Behalf of Terrain

Chairman Thompson, Ranking Member Craig, and Members of the Committee, thank you for inviting me to testify before you today.

My name is John Newton, and I am the Executive Head of Terrain. I am honored to appear before the Committee to provide insights on factors contributing to the health of the U.S. farm economy. Terrain is tasked with researching agriculture, food, risk management and macroeconomic areas for our partnering Farm Credit associations, which are AgCountry Farm Credit Services, American AgCredit, Farm Credit Services of America, and Frontier Farm Credit. The service areas of these Farm Credit associations span from Iowa, North Dakota and Wisconsin to New Mexico, California and Hawaii, with many states between.

I hold a Ph.D. in agricultural and applied economics from The Ohio State University and have over two decades of experience in economic and policy analysis and development. I recently served as Chief Economist on the U.S. Senate Committee on Agriculture, Nutrition, and Forestry for Senator Boozman of Arkansas. Before that, I was the Chief Economist for the American Farm Bureau Federation, an organization representing nearly 6 million family and farm members on Capitol Hill.

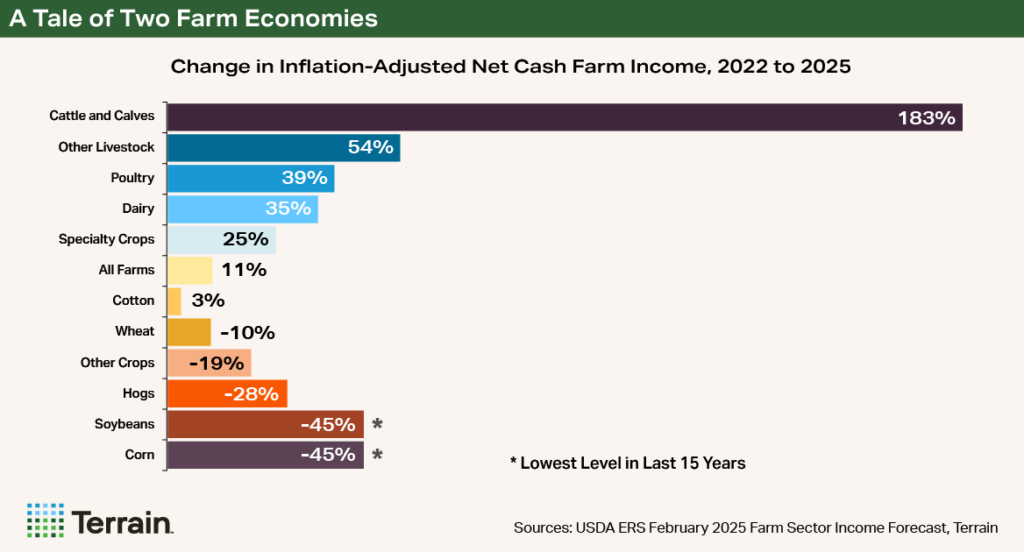

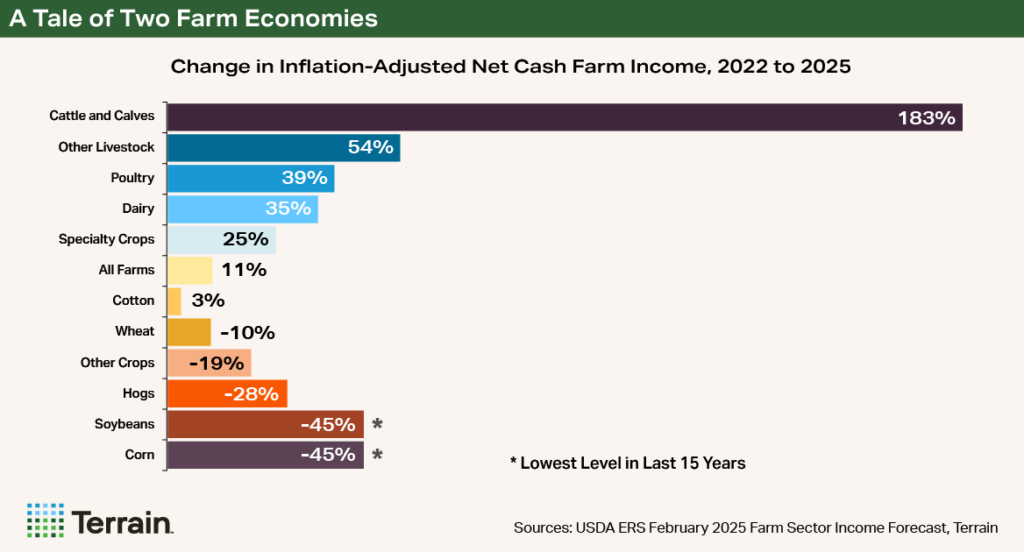

Thankfully, due to the foresight of leaders of this Committee, as well as your colleagues in the Senate, the ad hoc assistance provided in the American Relief Act of 2025 will bring much-needed relief to farmers who have experienced multiple years of declining revenues and farm income, as well as those who have faced catastrophic natural disasters on their farm. However, since the high-income environment of 2022, we have seen a tale of two farm economies: Crop producers have experienced significant challenges due to low prices and high inputs, while some livestock producers have benefited from high cattle and milk prices, helping to offset elevated input costs.

For example, since 2022, inflation-adjusted net cash farm income for corn and soybean farmers has dropped by 45% to its lowest levels in a decade and a half. Meanwhile record cattle prices have contributed to higher levels of income since 2022, providing an opportunity for those farmers and ranchers to finally rebuild their balance sheets from the pandemic-era lows.

Farm Economic Conditions

The flagship measurement of the overall health of the U.S. farm economy is the USDA’s net farm income, which measures the difference between total gross farm income and total production expenses and is a broad measure of the financial conditions across the U.S. farm sector.1

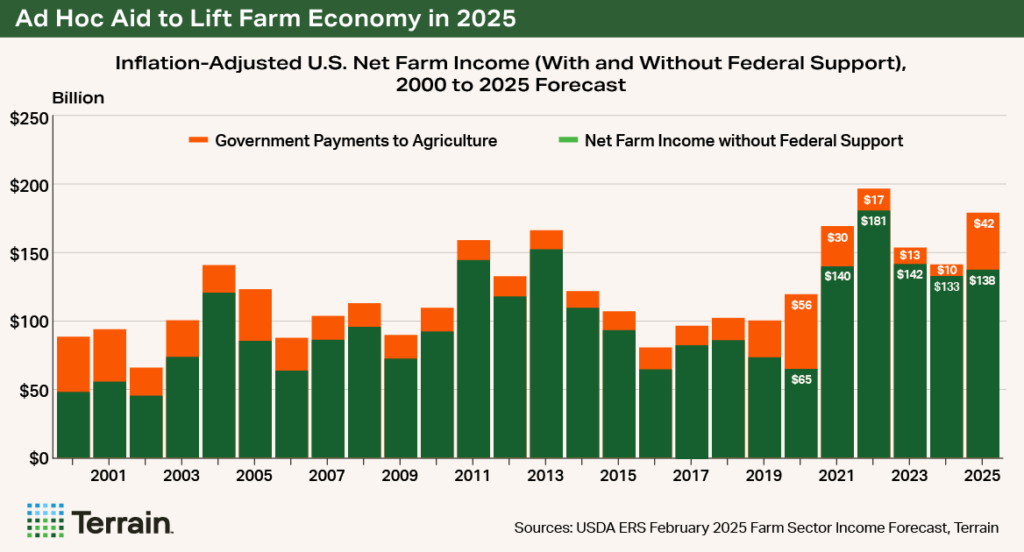

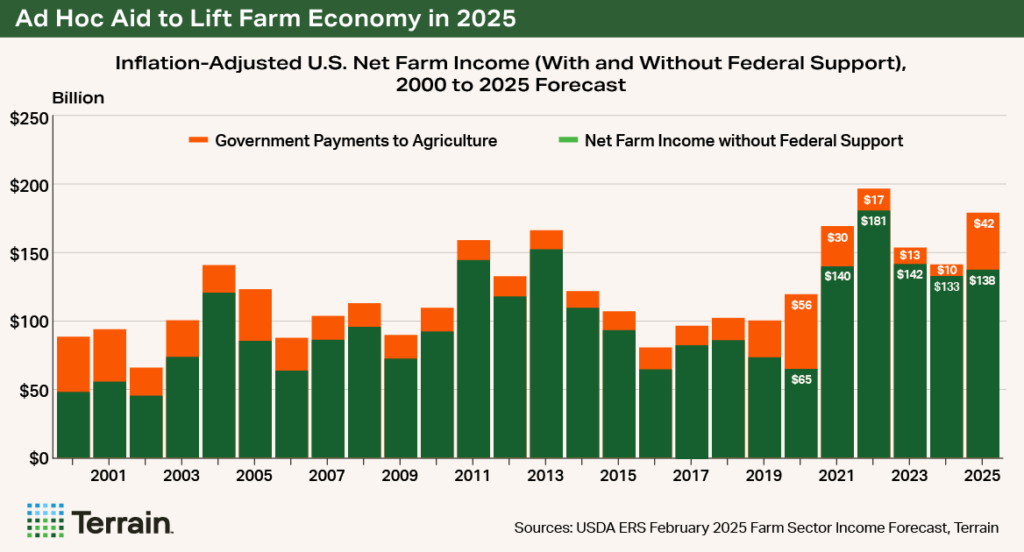

Driven by record agricultural export sales, increased domestic demand, and pandemic-related federal support, inflation-adjusted net farm income reached a record high in 2022 at $198 billion. The rise in farm income, however, coincided with historic inflation as post-pandemic supply chain disruptions and reduced labor availability drove up costs across all sectors of the U.S. economy. For food- and energy-related products, Russia’s invasion of Ukraine further reduced global stockpiles of critical grains and oilseeds; disrupted global trade flows; and drove food, energy and fertilizer prices to record highs.

Nominal farm production expenses reached a record of $462 billion in 2022 and remain near those historically high levels as input costs have not eased for farm families across the country. For example, crop production costs are projected to be higher this year for seed, chemicals, custom work, repairs, maintenance and taxes, while lower costs are projected for fertilizers, energy and interest.

With input costs slow to decline, pressure has been mounting for three consecutive years across the farm economy — specifically for crop and specialty crop farmers. Many farmers have worked through their working capital and are now faced with tough decisions on how to reduce expenses without giving up hard-earned access to land or compromising productivity. The reality on the ground is that between 2022 and 2025, and driven by lower crop prices and elevated input costs, the USDA’s Farm Sector Income Forecast shows that:

- Since 2022, and excluding government payments to agriculture, U.S. inflation-adjusted net farm income has fallen by $43 billion or 26%. U.S. net farm income (excluding government support) is projected at $138 billion in 2025, up slightly from 2024 when adjusted for inflation.

- When including the ad hoc federal support provided by members of this Committee and your colleagues in the Senate during the last Congress, alongside traditional government support from commodity and conservation programs, U.S. inflation-adjusted net farm income is projected at $180 billion, up 26% from last year.

The USDA’s Farm Sector Income Forecast shows that U.S. crop farmers have experienced three consecutive years of declining cash receipts, falling from an inflation-adjusted value of $307 billion in 2022 to $240 billion in 2025 — a decline of $67 billion, or 22%. For many farmers — and depending on their management, marketing, land ownership and risk management decisions — margins may have been tight, or returns may have been below breakeven, for several years because of inflation in farm production expenses and lower farm-gate prices.

Inflation-adjusted cash receipts for livestock have fallen $7 billion since 2022 and those producers continue to face new challenges. Input costs remain elevated, and goals to capitalize on higher cattle or milk prices face headwinds due to issues with drought conditions, low inventory levels, and rising animal disease risks. Despite these challenges, for some, cash receipts for livestock, dairy, and poultry farmers have remained stable, preventing a much wider economic crisis in farm country.

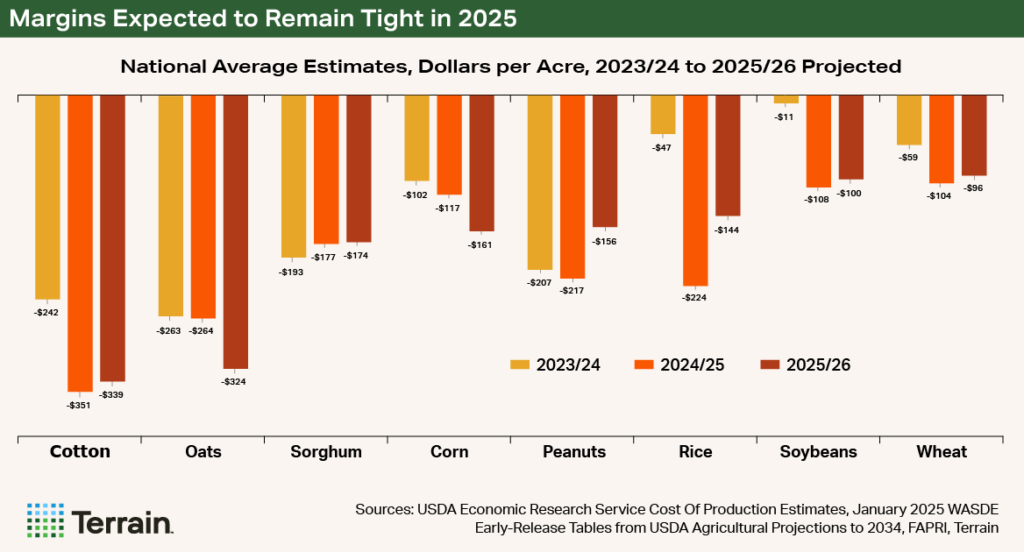

Crop Farm Prices, Input Costs and Margins for 2025

Last year, the USDA provided an early release of supply, demand and price projections to 2034 for select commodities.2 Terrain analysis of the data revealed that for the upcoming 2025/26 crop year (that is, the crop that farmers will plant this spring), the national marketing year average corn price is projected at $3.90/bushel (bu.), down 40% from the recent high of $6.54/bu. Soybean prices are projected at $10/bu., down 30% from two years ago. All major crops except wheat are expected to see lower or flat prices for the upcoming crop year. This upcoming crop year, wheat prices are projected to climb to $5.80/bu., yet wheat prices will remain 34% lower than the price farmers received just a few short years ago.3

As I have indicated, input costs have been slow to adjust, and this spring the cost of production for major field crops is expected to remain elevated.4 Crop input costs this year are expected to be the highest for rice at more than $1,300/acre (ac.). Next come peanuts, then cotton. For cotton, the cost of production is forecast at $900/ac. The cost to produce an acre of corn is projected at $871/ac., and for soybeans the projected cost of production is $625/ac. To put these costs into perspective, according to the USDA Census of Agriculture, the average-sized corn farm in the U.S. is 279 acres, which equates to nearly $250,000 in total costs to plant a crop, with no guarantee that Mother Nature will do her part.5

Given these high input costs and expectations for crop prices to mostly move lower again in 2025, it is no surprise that another year of margins at or below breakeven is on the horizon. Even the University of Illinois’ 2025 Crop Budgets confirm crop prices and revenues will be below breakeven for high-productivity farmland in Central Illinois.6 The most recent crop market outlook from the Agricultural and Food Policy Center at Texas A&M University reveals that many farms in each of their four commodity types (feed grains, cotton, rice and wheat) are not expected to have a positive cash flow over the next five years and there is no crop rotation that yields a positive return.7

Based on Terrain's analysis of current price and yield expectations, for the 2025/26 marketing year, the revenue shortfall is expected to be the largest for cotton at $339, or 38% below breakeven. Other crops such as grain sorghum are projected at $174, or 40% below breakeven, and corn at $161, or 19% below breakeven. Importantly, for every major U.S. field crop, the projected revenue in 2025 is below the projected cost of production, marking the third year in a row of low or negative economic returns, on average, for crop farm families.

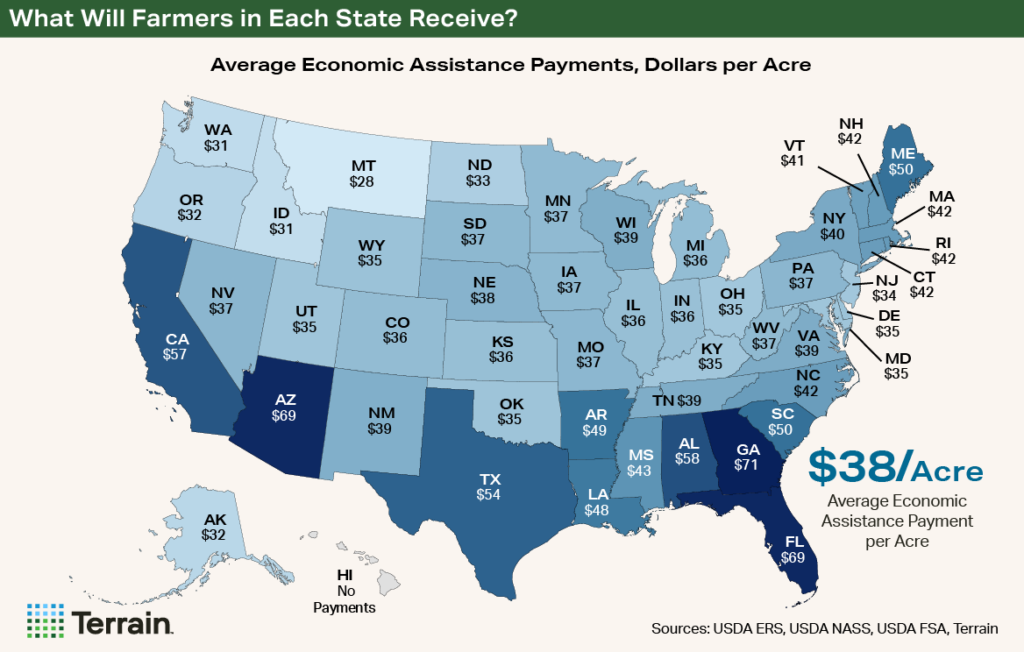

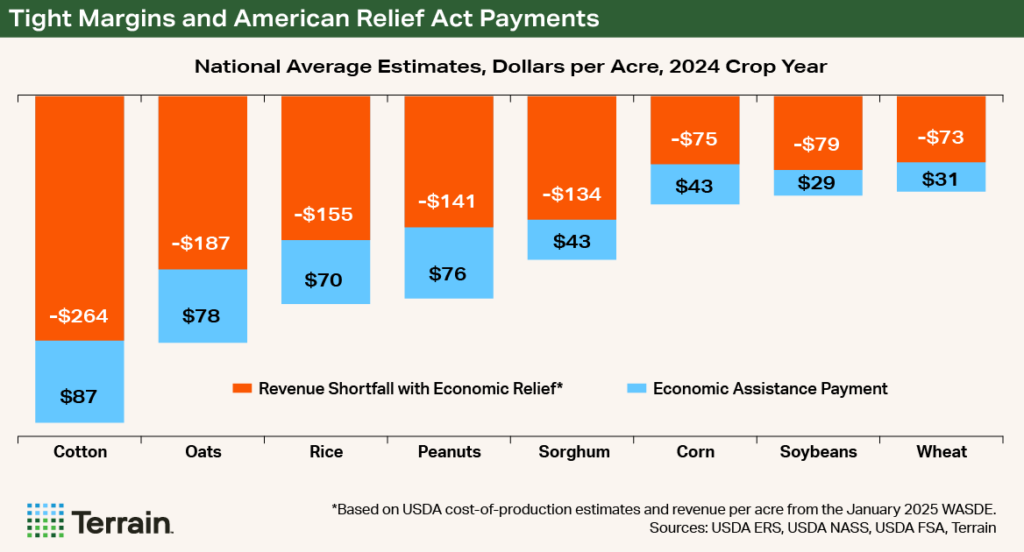

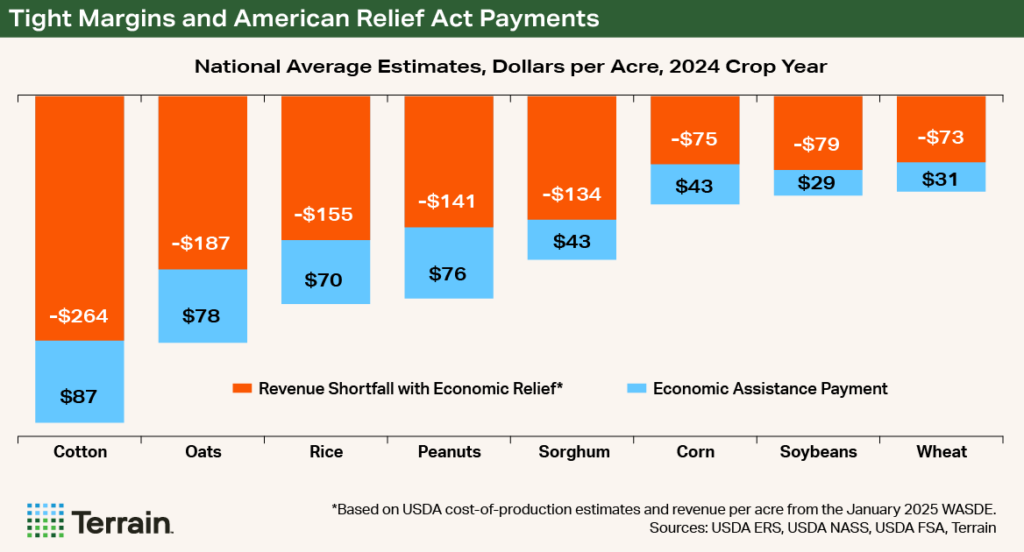

The Impact of Bridge Economic Assistance for Farmers

In response to this historic and ongoing decline in the farm economy, and through the foresight of leaders of this Committee, the American Relief Act of 2025 provided the USDA with nearly $10 billion to deliver ad hoc financial assistance to crop farmers experiencing economic disasters as well as more than $20 billion to help farmers recover from catastrophic natural disasters such as hurricanes, wildfires and drought.8 According to the American Farm Bureau Federation, in recent years, catastrophic natural disasters have resulted in agriculture-related losses in the tens of billions of dollars.9

Terrain's analysis indicates that for major crops such as corn, soybeans, wheat, sorghum, oats and cotton, the estimated economic assistance payments (excluding payments related to natural disasters) offset only a portion of a crop farm's negative margin.10 Terrain’s estimates further indicate that these economic assistance payments could range from a high of $87/ac. for cotton to a low of $29/ac. for soybeans, and nationally will average approximately $38/ac. Unfortunately, in no case do these program payments bring farm cash flow levels even close to breakeven.

These economic assistance payments are only a bridge until a new five-year farm bill can be authorized by Congress. These dollars are much needed as farmers prepare for the upcoming growing season. However, while these one-time payments will help to improve working capital, based on crop price and yield projections from the January 2025 World Agricultural Supply and Demand Estimates, many farmers are still projected to experience tight or negative margins after accounting for the economic assistance payments, amplifying the need for a new five-year farm bill with enhanced risk management tools.11

Agricultural Trade and the Farm Economy

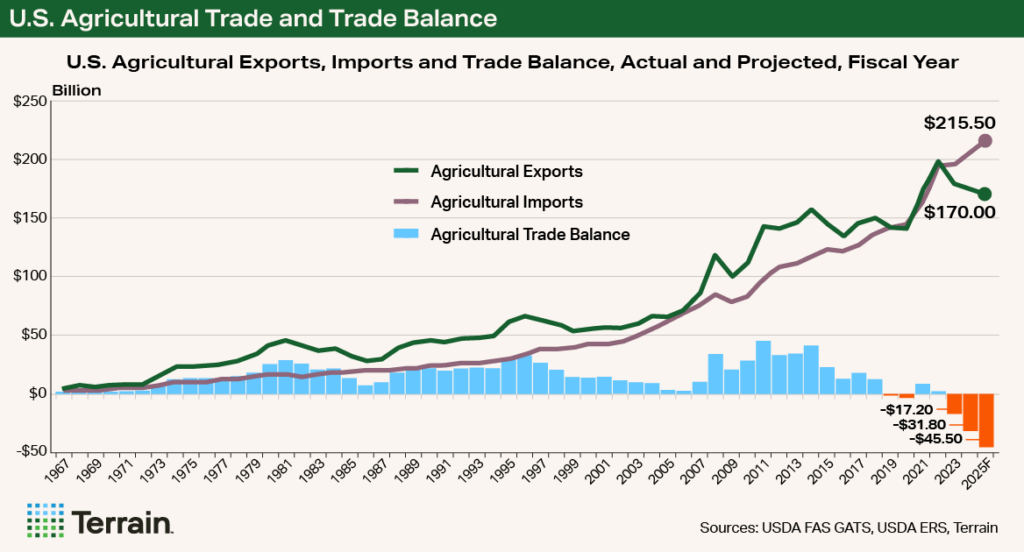

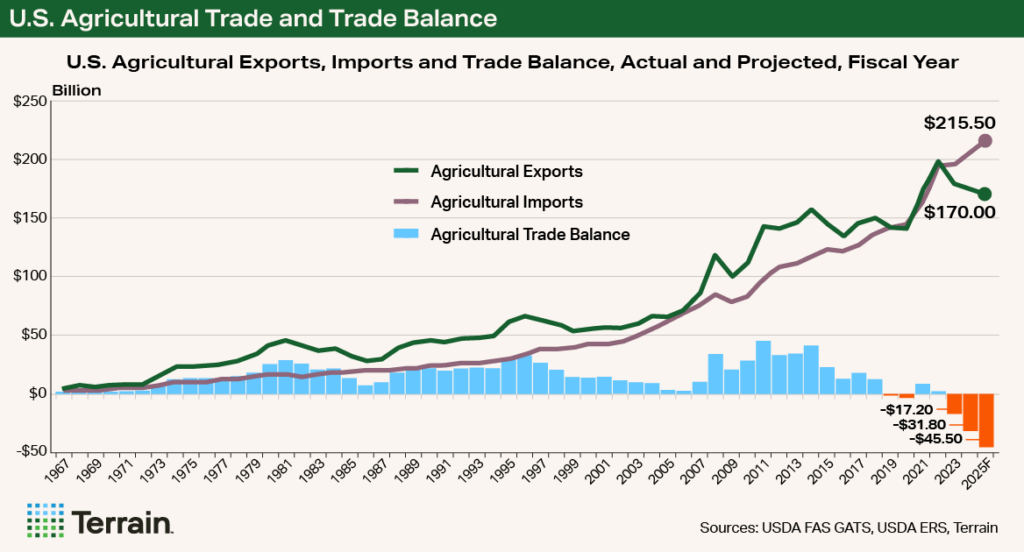

In the years preceding the high-farm-income environment, several new trade agreements were negotiated and agreed upon with countries around the world that impacted the economic success of U.S. agriculture. These included the Economic and Trade Agreement Between the United States of America and the People’s Republic of China, the United States-Mexico-Canada Agreement, and the U.S.-Japan Trade Agreement.12,13,14

By fiscal year (FY) 2022, the value of U.S. agricultural exports had reached a record high of $196 billion and contributed to the financial success of many farm families across the country.15 While food and agricultural imports were also on the rise, the U.S.’s agricultural industry remained mostly in a position of positively contributing to the U.S. trade balance with the rest of the world — a position that U.S. agriculture until only recently had held for the better part of five decades.

Now, in FY25, the U.S. agricultural trade deficit is projected to be the largest in history at nearly $46 billion, according to the USDA’s Economic Research Service. While the value of the dollar, demand for year-round access to fruits and vegetables, and demand for imported alcoholic beverages contribute to record food and agricultural imports, the value of U.S. exports has fallen sharply — projected at $170 billion in FY25 and down $26 billion from FY22’s record.16

The ripple effect of slower U.S. agricultural exports hits the farm economy, farm families and rural Main Street, and is a large contributor to the decline in crop cash receipts and overall net farm income since 2022.

To reverse the record-large trade deficit in agriculture, a priority should be placed on finding and developing new markets for U.S. agriculture, reducing non-tariff barriers to trade, accelerating the adoption of science-based production practices, and improving existing market access in the major economies with which U.S. agriculture does business and those we desire to do business with.

To assist in export market access and development, the USDA allocated $174 million through the Market Access Program (MAP) and allocated $27 million through the Foreign Market Develop Program (FMD) to collaborating organizations in FY24, but more can be done. The Farm, Food, and National Security Act of 2024, passed out of Committee in the 118th Congress, would have doubled funding to MAP/FMD — providing increased opportunities for farmers, ranchers and their collaborating organizations to close the gap in our agricultural trade deficit in the years to come.17

Under the current administration, tariffs are either in effect or under consideration in major U.S. agricultural export markets. Although none of these markets has enacted retaliatory measures directly affecting U.S. agriculture or farmers and ranchers, it is crucial to closely monitor economic implications of these tariffs on farm-level income, supply chains, and the consumption of food and agricultural products. This evaluation will be essential if Congress ultimately needs to contemplate market interventions or ad hoc support measures to protect farmers and their rural communities from retaliation.

Enhanced Risk Management Is Critical in Farm Country

Farm Credit has been a partner with the USDA for decades in the delivery of federal crop insurance to our nation’s farmers and ranchers. Since 2014, the USDA’s Risk Management Agency has worked with the industry to make over 300 crop insurance modifications, including the introduction of new policies through the 508(h)-development process to manage new risks. Notable developments include:

- New policies to manage the risk of rising input costs on farm margins

- New area-based plans of insurance with higher levels of coverage

- Expanded options for livestock producers such as Dairy Revenue Protection (Dairy-RP)

- Higher premium cost-sharing for cattle and hog farmers

Through various modifications and enhancements, Farm Credit aims to provide the necessary tools and insights, including those offered by Terrain, to assist farmers in managing the risk associated with price declines or crop losses through crop insurance. Several Farm Credit associations have invested in new technologies to help crop and livestock farmers make informed crop insurance decisions. For example, Optimum uses a simulation process that combines prices, yields, and federal crop insurance policy frameworks to determine how different combinations of crop insurance products can perform in helping farmers manage their risk. Through Optimum, farmers can better take advantage of market opportunities before the growing season to maximize revenue and reduce risk, providing them the financial security to better market their crop during the growing season.

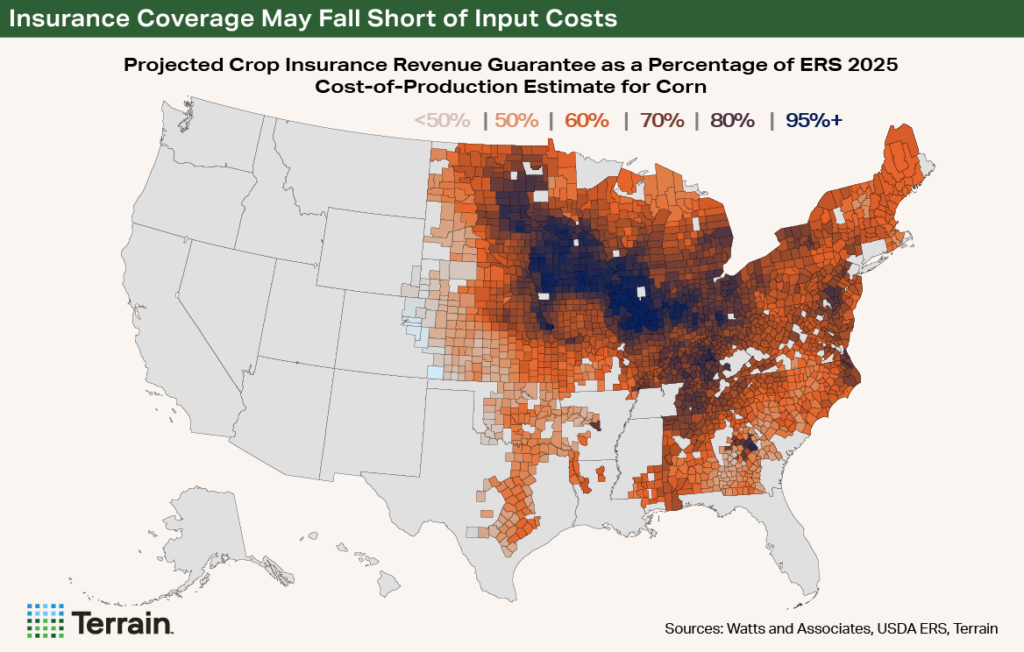

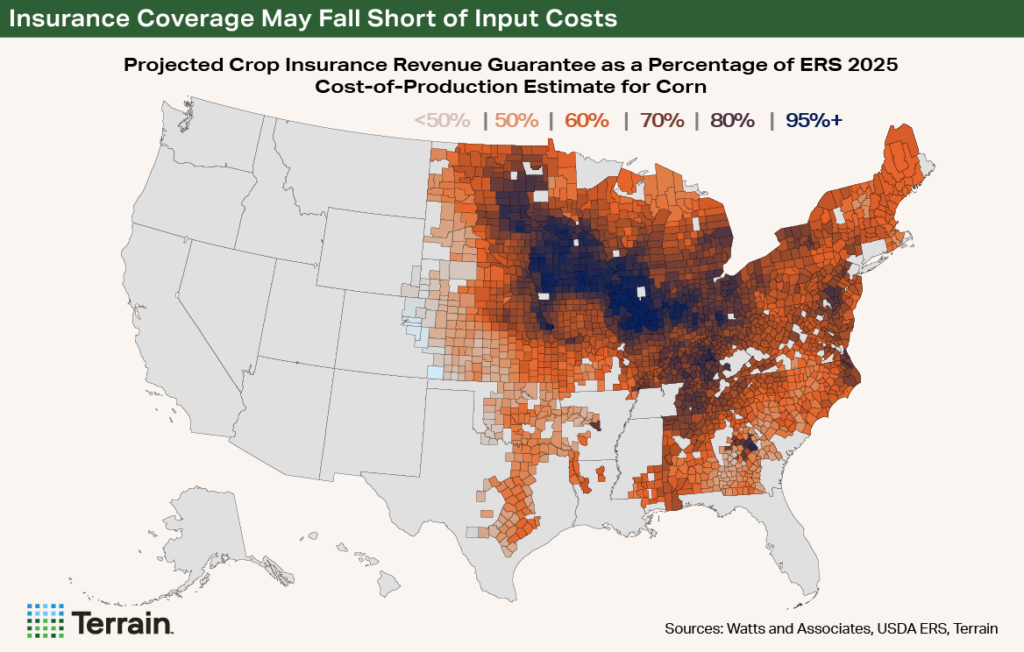

Even with all the opportunities and tools the federal crop insurance program and Farm Credit provide, my research suggests that the most common crop insurance policies for managing risk will not cover breakeven expenses for most crop farmers in 2025. For example, using county-level non-irrigated yield information from the USDA’s Risk Management Agency, Chicago Mercantile Exchange settlement price for new-crop corn of $4.60/bu., and the most common crop insurance policy purchased in each county, crop insurance guarantees cover 70% of USDA Economic Research Service production costs in just over 60% of corn-producing counties. In about one-fourth of these counties, insurance guarantees cover only 50% of the USDA's estimated production costs.

Endorsements like the Enhanced Coverage Option, created at the direct request of growers, enable farmers to buy higher coverage levels. The USDA's recent premium cost-share improvements make it a viable risk management option. However, in 2024, slightly more than 15 million acres were insured across 30 crops. Increasing education and awareness of these endorsements and changes to these endorsements — alongside other improvements in policy options such as Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) — will help farmers collaborate with their insurance agents and other stakeholders to create effective risk management strategies for their farm operation.

State of the Dairy Industry

Dairy is one of the largest portfolios financed by our partner Farm Credit associations, prompting us to closely monitor the health of the dairy economy. The number of dairy farms in the U.S. has declined significantly. According to the most recent Agricultural Censuses, farm numbers decreased from 39,303 in 2017 to 24,082 in 2022.18 Although the total number of milk cows also fell, it was a less pronounced decline, from 9.5 million to 9.3 million head, underscoring the rapid consolidation within the industry.

Dairy profitability has been highly uncertain due to the volatility of managing milk and feed prices alongside rising input costs beyond feed. Dairy Margin Coverage (DMC) margins, which serve as an overall indicator of U.S. dairy farm profitability, have fluctuated dramatically, ranging from an all-time low of $3.52/hundredweight (cwt) to an all-time high of $15.57/cwt within 15 months from July 2023 to September 2024.19

In addition to market-driven volatility, U.S. dairy producers faced an outbreak of Highly Pathogenic Avian Influenza (HPAI) in 2023 that has persisted into 2025. Affected milking herds can experience a significant reduction in milk production, ranging from 20% to 30% during the primary month of infection, with minor reductions continuing in the following months. Since March 2023, there have been 937 confirmed cases in 16 states. Notably, California — the top milk-producing state in the country — has reported 720 cases and experienced state-level milk production declines in both November and December 2024, resulting in a shortfall of hundreds of million pounds of milk.

The impact of animal diseases, geopolitical risks, and fluctuations in supply and demand ultimately affect the mailbox milk price checks that dairy farmers receive. With slightly more than a quarter of the U.S. milk supply purchasing livestock insurance, there is an ongoing need for increased education and awareness regarding the availability and affordability of risk management tools such as Dairy-RP and Livestock Gross Margin insurance.

State of the Beef Cattle Industry

Alongside dairy and row crop portfolios, financing for beef cattle production makes up another large share of the portfolio of our partnering Farm Credit associations. There are various segments of the beef cattle industry that we monitor closely, including cow-calf producers, stocker/backgrounder operations, feed yards and processing.

Drought conditions, the early pandemic-era financial pressures felt across many segments of the beef cattle supply chain, and the ongoing decline in the cattle numbers have contributed to a substantial decline in the number of farms with beef cows. Over the last five years alone, feeder and fed cattle prices have rallied from cycle lows to record highs. Simultaneously, beef cow and feeder cattle and calf inventories have continued to decline to more than 60-year lows. As reported in the USDA’s recent cattle inventory report, beef cow numbers, as of January 1, 2025, total 27.9 million head. This is down 0.5%, or 150,000 head, versus a year earlier. Compared with the most recent cycle peak that occurred in 2019, beef cow inventories are down 3.8 million head, which represents a decline of 12%. The report also revealed that cow-calf operations retained and bred 2% fewer beef replacement heifers during 2024 and retained about 1% fewer heifer calves to grow and breed during 2025. This will make it extremely difficult for any herd rebuilding to occur before 2027.20

Even though most beef cow-calf operations have returned to profitability during this contraction phase of the cattle cycle, escalating costs have kept record prices from returning record profits. According to the USDA’s Economic Research Service Estimated Costs and Returns for Cow-Calf Producers, the total cost of production reached a record high of $1,729/head in 2024, while the average returns over variable operating costs are approximately half of what returns were a decade ago when cattle prices reached similar levels.21

Emerging forecasts for a return to drought conditions across much of the major cow-calf production areas, high operating costs, higher interest rates due to inflation, and advancing average producer age are holding most cow-calf producers back from thinking of breeding herd expansion. Many operations are using the opportunity of high prices and relatively higher revenues to deleverage their financial position and improve balance sheets. A return to profitability and a positive outlook for continued high calf prices has most cattle producers evaluating the multiple factors that could make or break their successful herd rebuilding.22 The reduction in beef cow and beef replacement heifer numbers that occurred during 2024 and was confirmed in the cattle inventory report suggests the beef cow herd may only stabilize during 2025 and 2026. The current rally in prices for all classes of cattle and beef has been driven by a simultaneous decline in cattle numbers and continued year-over-year increases in beef demand. Cattle and beef producers’ focus on consumer tastes and preferences and delivering a consistent improvement in beef quality has been a winning strategy.

Current cattle price cycle lows for feeder and fed cattle occurred in April 2020, during the onset of the COVID-19 pandemic. Now, less than five years later, feeder and fed cattle prices are setting record highs. Since setting their lows, feeder cattle prices are up 142% ($117/cwt to $277/cwt) and fed cattle prices have rallied 121% ($95/cwt to $210/cwt).

Improved grazing opportunities and declining feed grain prices resulted in modest profitability for the margin-driven stocker and feed yard cattle operations that grow cattle they have purchased from other cattle producer segments. However, the record-high prices they paid for replacement cattle during the fall and winter of 2024 — when the number of available cattle was historically low — may yield financial losses during the second half of 2025 when they sell those animals.

The record value of the inventory on cattle operations has underscored the continued and growing need for functional and efficient risk management tools for all sizes of operations. Producers’ access to tools like Livestock Risk Protection (LRP) and Livestock Gross Margin (LGM) plans is increasingly important, as they serve backgrounding and feed yard operations well. Recent enhancements to the programs will make them even better tools for farmers and ranchers. Some cow-calf operations are participating in LRP but have additional exposure to weather, driving poor ranch-level reproductions and reducing calf growth. The Weaned Calf Risk Protection pilot program could be a valuable tool for ranchers and farmers, but ongoing education on program functionality is needed to enhance program adoption.

Specialty Crop and Wine Grape Challenges in California

Specialty crop production in California has faced significant challenges since the onset of the COVID-19 pandemic. While some crops have fared better than others, most have experienced either a rapid increase in costs, a sharp decrease in prices, or both. These developments have compounded existing challenges in the state's agriculture sector, such as rising regulatory compliance costs and the Sustainable Groundwater Management Act (SGMA), which restricts groundwater pumping and leads to the repurposing of many acres of production.

Tree nuts, a major portfolio of our partner Farm Credit associations, have been hit particularly hard. The pandemic disrupted global shipping lanes, causing inventories of almonds and walnuts to accumulate in warehouses, which put immediate downward pressure on prices. Combined with increased costs due to inflation, this resulted in the lowest profitability on record, according to Terrain research.23 This has forced many farmers to remove acreage, with bearing walnut acreage already in decline for the first time since 1999, according to the USDA. Almond bearing acreage is also expected to decline soon.

Weather challenges and economic headwinds contributed to a smaller wine grape crop in 2024.24 U.S. wine grape growers continue to face growing risk of financial loss due to the increasing prevalence of wildfires in key West Coast growing regions. Growers suffered substantial losses in both 2017 and 2020 due to vine damage as well as the rejection of contracted fruit stemming from actual and perceived smoke taint. Many estate wineries used only a portion of their fruit or did not make wine at all, and some smoke-impacted grapes were made into bulk wine and sold at below-market prices. The estimated financial loss to California wine grape growers was over $600 million in 2020 alone. Reflecting the severe losses that occurred in the California grape industry in 2020, more than $300 million in indemnities were made to California grape growers, a record high and a clear reason why recent developments such as Fire Insurance Protection – Smoke Index is much needed for grape growers subject to fire risks.25

Farm Bill Is a Five-Year Contract with Agriculture

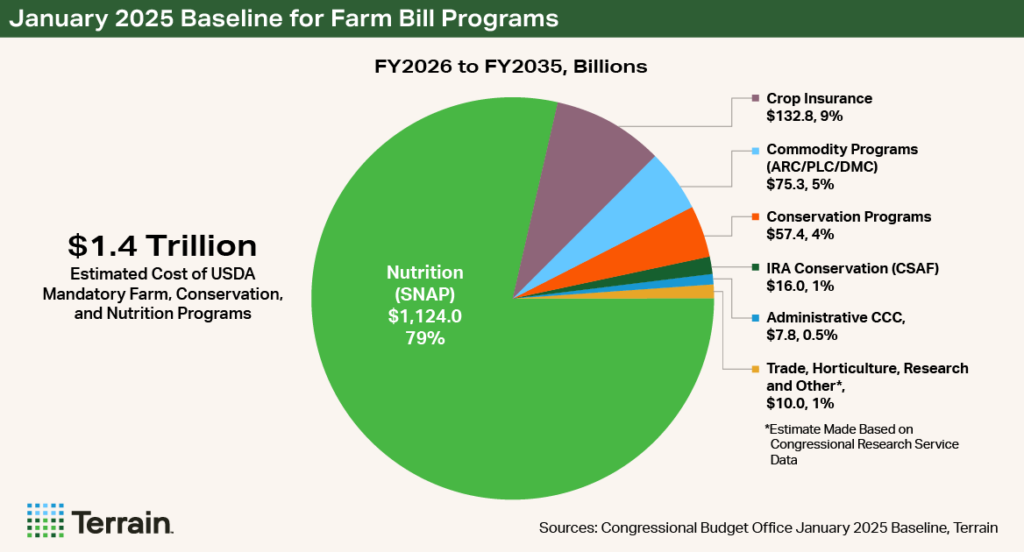

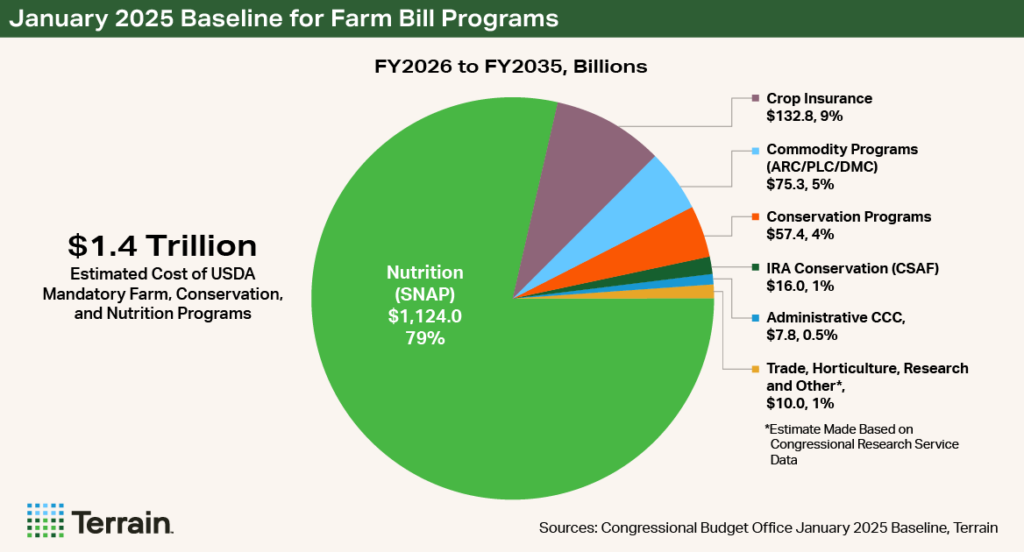

The Congressional Budget Office’s January 2025 baseline for mandatory farm and nutrition programs projected total farm bill spending at $1.4 trillion over 10 years.26 Of that total, approximately $300 billion is projected for mandatory USDA farm programs such as crop insurance, commodity income support programs, livestock disaster programs, conservation and working lands programs, and trade promotion programs. These critical programs are currently operating on a one-year extension through the end of FY25, with no certainty thereafter.27

Many of the linchpin farm bill programs that farmers depend upon need modernization. Since the last five-year farm bill reauthorization in 2018, the farm bill baseline has increased by $556 billion, or 64%, with only 17% of that total driven by farm-related programs. Simultaneously, U.S. agriculture has faced down unprecedented economic challenges associated with increased catastrophic natural disasters, disruptions related to COVID-19, and increased price volatility due to geopolitical risks — challenges that traditional farm bill programs were ill-equipped to face.

As a result, Congress has intervened on several occasions to provide ad hoc support, most recently with the American Relief Act of 2025. Since 2018, I estimate that ad hoc support to farmers and ranchers has totaled more than $132 billion, compared with slightly more than $20 billion from direct income support programs such as ARC, PLC or DMC. Ad hoc support has been more than six times higher than the support from farm bill commodity support programs. While ARC and PLC are expected to deliver higher levels of support for the 2025/26 crop year, this is temporary, as support levels will gradually decline each crop year in a low-price environment.28 For other crops like rice or peanuts, their farm bill support has not materially changed in over a decade.

The farm bill is a five-year contract with agriculture and rural America, and it is time to update that contract with our farmers and ranchers, given the significant federal support coming from outside the farm bill. With nearly 350 million people in the U.S. (hopefully consuming three meals per day), the cost of critical farm risk management and conservation programs is less than 8 cents per meal. Ask anyone in America if they would pay 8 cents per meal to ensure a safe, abundant, sustainable and affordable food supply. The answer will be a resounding yes.

Farm Credit is there for the farmer through the highs and the lows of the farm economy; we know firsthand that the sense of urgency is real in farm country and the opportunity to enhance the five-year contract with agriculture and rural America is now, before it is too late.

I have spent my entire career working with farm families and deeply understand the challenges and potential opportunities that lie ahead. Actions by the Agriculture Committees and administration play a key role in the success of U.S. agriculture, our food security and our national security. Healing an ailing farm economy with a new five-year farm bill would be an important first step.

Thank you very much for the opportunity to offer testimony before you today. I am thankful to every member of this Committee for your time and attention, and I look forward to answering any questions you may have.

Endnotes

1USDA Economic Research Service, “Farm Sector Income & Finances,”

https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances

2“Early-Release Tables from USDA Agricultural Projections to 2034,”

https://www.usda.gov/about-usda/general-information/staff-offices...

3John Newton, “Crop Margins Likely to Remain Tight in 2025,” December 2024, Terrain,

https://www.terrainag.com/insights/crop-margins-likely-to-remain-tight-in-2025/

4USDA Economic Research Service, “Cost-of-Production Forecasts for Major U.S. Field Crops, 2024F-2025F,"

https://www.ers.usda.gov/data-products/commodity-costs-and-returns

5USDA Census of Agriculture, https://www.nass.usda.gov/Publications/AgCensus/2022/index.php

6Farmdoc University of Illinois, “Revised 2025 Illinois Crop Budgets Including Breakeven Corn and Soybean Prices,”

https://www.youtube.com/watch?v=WSDcsi0IwLE

7Joe L. Outlaw and Bart L. Fischer, “Why the Current Economic Downturn Is So Troublesome,” Southern Ag Today, January 30, 2025,

https://southernagtoday.org/2025/01/30/why-the-current-economic-downturn...

8The American Relief Act of 2025, https://docs.house.gov/billsthisweek/20241216/ARA%2012.20.pdf

9Daniel Munch, “Natural Disaster Relief for Farmers: Incomplete Since 2022,” November 8, 2024, American Farm Bureau Federation,

https://www.fb.org/market-intel/natural-disaster-relief-for-farmers-incomplete...

10John Newton, “What Farmers Can Expect From the American Relief Act,” January 2025, Terrain,

https://www.terrainag.com/insights/what-farmers-can-expect-from...

11USDA World Agricultural Outlook Board, World Agricultural Supply and Demand Estimates,

https://www.usda.gov/about-usda/general-information/staff-offices...

12United States Trade Representative, “Economic and Trade Agreement Between the Government of the United States of America and the Government of the People’s Republic of China Text,”

https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples...

13United States Trade Representative, “United States-Mexico-Canada Agreement,”

https://ustr.gov/trade-agreements/free-trade-agreements/united-states...

14United States Trade Representative, “Fact Sheet on U.S.-Japan Trade Agreement,”

https://ustr.gov/about-us/policy-offices/press-office/fact-sheets/2019...

15USDA Economic Research Service, “U.S. Agricultural Trade - Outlook for U.S. Agricultural Trade,”

https://www.ers.usda.gov/topics/international-markets-us-trade...

16USDA Economic Research Service, “U.S. Agricultural Trade - Outlook for U.S. Agricultural Trade,”

https://www.ers.usda.gov/topics/international-markets-us-trade...

17House Committee on Agriculture, “Farm, Food, and National Security Act of 2024,”

https://agriculture.house.gov/farmbill/

18USDA Census of Agriculture, https://www.nass.usda.gov/Publications/AgCensus/2022/index.php

19Ben Laine, “Structural Shifts Ahead in 2025,” December 2024, Terrain,

https://www.terrainag.com/insights/structural-shifts-ahead-in-2025/

20USDA National Agricultural Statistics Service, “Cattle Inventory,” January 2025,

https://usda.library.cornell.edu/concern/publications/h702q636h?locale=en

21USDA Economic Research Service, “Commodity Costs and Returns,”

https://www.ers.usda.gov/data-products/commodity-costs-and-returns

22Dave Weaber, “Growing Optimism for 2025 Fed Cattle Prices,” December 2024, Terrain,

https://www.terrainag.com/insights/growing-optimism-for-2025...

23Matt Woolf, “Low Profitability Likely to Continue for Nut Crops in 2023/2024,” October 2023, Terrain,

https://www.terrainag.com/wp-content/uploads/2023/10/Terrain...

24Chris Bitter, “Some Light at the End of the Tunnel,” December 2024, Terrain,

https://www.terrainag.com/insights/some-light-at-the-end-of-the-tunnel/

25USDA Risk Management Agency, Summary of Business Report Generator,

https://public-rma.fpac.usda.gov/apps/SummaryOfBusiness/ReportGenerator

26Congressional Budget Office January 2025 Baseline,

https://www.cbo.gov/data/baseline-projections-selected-programs#23

27The USDA’s Federal Crop Insurance Program operates on permanent authority.

28John Newton, “ARC and PLC to Offer Higher Support (for Some) in 2025,” January 2025, Terrain,

https://www.terrainag.com/insights/arc-and-plc-to-offer...

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.