Report Snapshot

Situation

The USDA released a recommended decision on new Federal Milk Marketing Order price formulas. Industry participants have until September 13 to provide feedback and concerns on the decision.

Impact

It is important for anyone who may be affected by this rule to consider what the new pricing will mean for them — not just the initial price movements up or down but also the unintended consequences that could result.

Outlook

The USDA’s recommended decision appears to balance the primary effects in a way that should have a minimal impact on prices. The benefits and risks of modernizing the federal order system are in the secondary effects, which are key to the industry's ability to grow to meet the needs of both the U.S. and global markets.

Milk will soon be priced differently than it is today. Before the end of the year, milk producers pooled in the Federal Milk Marketing Orders (FMMOs) will have the opportunity to vote on whether to adopt new FMMO price formulas. A negative vote would eliminate FMMOs. Either way, the status quo is not an option.

Producers and handlers pooled within the FMMO system will feel the most direct impacts. But the entire industry will see indirect impacts, many of which are difficult to model or impossible to foresee.

It is important for anyone who may be affected by this rule — from the dairy-consuming public to producers and processors — to consider what the new pricing will mean for them.

The USDA released a recommended decision that was published in the Federal Register on July 15, 2024, which triggered a 60-day public comment period ending September 13, 2024. This comment period is the opportunity for industry participants, whether pooled in federal orders or not, to provide feedback and concerns on the recommended decision. The USDA will then take that feedback and release a final decision. That final decision is what will ultimately be voted on.

It is important for anyone who may be affected by this rule — from the dairy-consuming public to producers and processors — to consider what the new pricing will mean for them. When doing so, it is critical to consider not only the first-degree price movements up or down but also the less obvious, unintended consequences that could result.

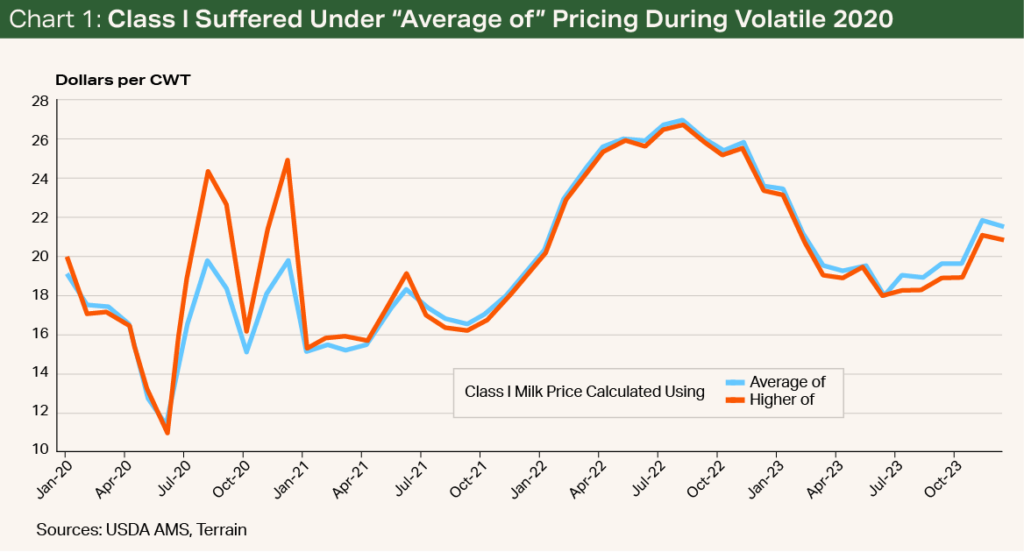

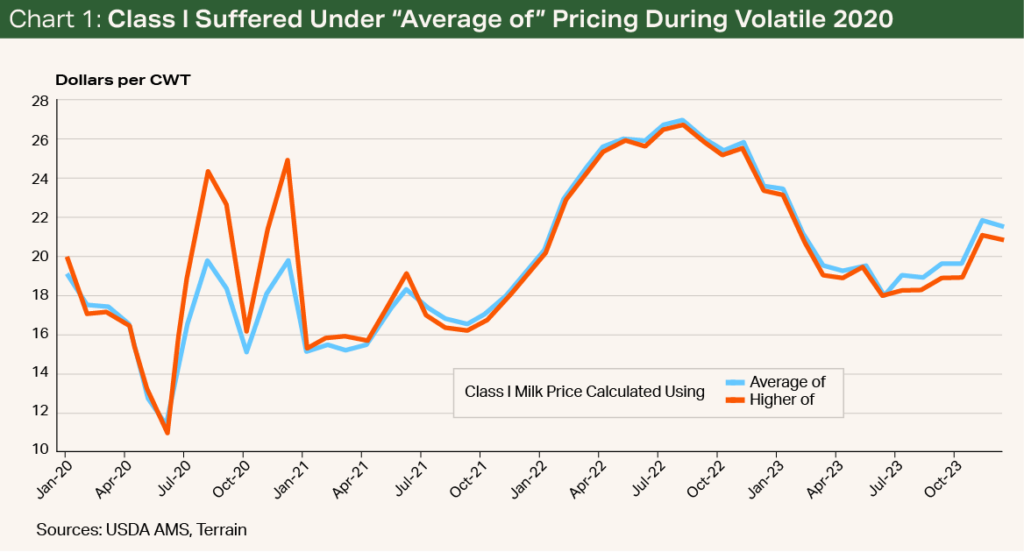

Recent history provides a useful illustration of these types of unintended consequences. In 2019, the Class I milk pricing formula was changed slightly to help make the Class I price easier to hedge. The skim milk portion of the price had previously been based on the “higher of” either the advanced Class III or Class IV skim milk price. This was changed to the “average of” those two pricing factors plus 74 cents. The 74-cent addition was calculated based on historical data and was intended to make the two calculation methods even out on average over time.

It is critical to consider not only the first-degree price movements up or down but also the less obvious, unintended consequences that could result.

As well-intentioned and innocuous as the change seemed, the next couple of years illustrated that back-testing is not always a reliable indication of the future. Market disruptions around the COVID-19 pandemic, wild price swings, and divergence between Class III and Class IV prices led to high volatility and dramatically lower pay prices than would have been experienced under the previous system (see Chart 1).

Revising that change by reverting to the prior “higher of” system is one of the USDA’s recommended changes.

What Are the Recommendations?

After considering an initial 21 proposals during the hearing period from August 2023 to January 2024, which is documented in over 12,000 pages of testimony, the USDA summarized its recommendations as follows:

- Milk Composition Factors. Update the factors to 3.3% true protein, 6% other solids and 9.3% nonfat solids.

- Surveyed Commodity Products. Remove 500-pound barrel cheddar cheese prices from the Dairy Product Mandatory Reporting Program survey and rely solely on the 40-pound block cheddar cheese price to determine the monthly average cheese price used in the formulas.

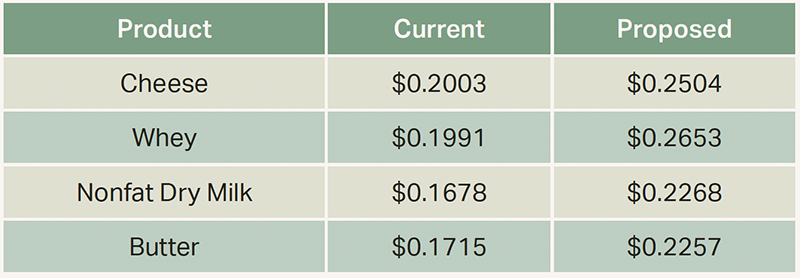

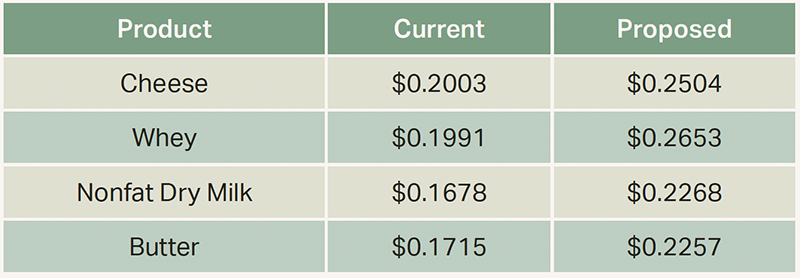

- Class III and Class IV Formula Factors. Update the manufacturing allowances to: Cheese $0.2504; Butter $0.2257; Nonfat Dry Milk $0.2268; and Dry Whey $0.2653. This decision also proposes updating the butterfat recovery factor to 91%.

- Base Class I Skim Milk Price. Update the formula as follows: The base Class I skim milk price would be the “higher of” the advanced Class III or Class IV skim milk price for the month. In addition, adopt a Class I extended shelf life (ESL) adjustment equating to a Class I price for all ESL products equal to the “average of” mover, plus a 24-month rolling average adjuster with a 12-month lag.

- Class I and Class II Differentials. Keep the $1.60 base differential and adopt modified location-specific Class I differential values.

Each of these recommendations will likely have primary effects, which will be seen in the initial impact on prices, and secondary effects, which will be reflected in the market response and potential unintended consequences.

What Are the Primary Effects?

Part of why changing FMMOs is such a sensitive process is that the system intervenes in the market between producers and processors. Any changes to the system tend to benefit either producers or processors at the expense of the other when compared with the status quo.

The debate can be oversimplified as producers and the groups that represent them wanting milk prices to go up, and processors wanting to support plans that lead to the milk price (their input cost) going down.

These initial and relatively predictable changes to price could be considered the primary effects of the proposals.

Reality is more complex, particularly with the cooperative structure of the U.S. dairy industry. Dairy producers often belong to and have equity in cooperatives that own manufacturing plants.

Each of the proposed changes will drive milk prices either up or down. These initial and relatively predictable changes to price could be considered the primary effects of the proposals.

1. Milk Composition Factors

USDA Recommendation

Update the factors to 3.3% true protein, 6% other solids and 9.3% nonfat solids.

Context

In seven of the 11 orders, producers are paid based on the component values of butterfat, protein and other solids multiplied by the pounds of each component they produce. In four orders — Appalachian, Southeast, Florida and Arizona — producers are paid based on pounds of butterfat and pounds of skim milk. The skim milk price they are paid is based on fixed assumptions about how much protein and other solids are contained in the skim milk. Those assumptions have not changed over time, despite the upward trend in milk component levels.

Increasing the assumed component levels in the milk would increase the price of the milk. However, since those orders are primarily focused on fluid milk manufacturing, opponents of the change argue that they cannot recoup that higher cost from the fluid milk market. Higher component levels may allow a cheese manufacturer to make more cheese, but a fluid milk manufacturer cannot make any more fluid milk from high-component raw milk.

Analysis

This recommendation increases the assumed component factors in skim milk from current levels of 3.1% protein, 5.9% other solids and 9% nonfat solids. This would increase the milk price in the orders that do not use component pricing. Producers in the other “component pricing” orders would not be directly impacted, but the resulting higher Class I price would increase the pool value for those orders somewhat. It is worth noting that the two proposals in this category from the National Milk Producers Federation and National All-Jersey Inc. both included mechanisms for dynamically updating these component levels; however, the USDA has opted to recommend updated but fixed levels.

2. Surveyed Commodity Products

USDA Recommendation

Eliminate the 500-pound barrel cheddar cheese price from the protein price formula.

Context

The input to the FMMO pricing formulas begins with the USDA’s National Dairy Products Sales Report, a weekly survey of manufacturers of wholesale bulk commodity dairy products including 40-pound block cheddar cheese, 500-pound barrel cheese, salted butter, nonfat dry milk and sweet dry whey. There were four proposals to either add products to these surveys and price formulas or remove surveyed products.

Analysis

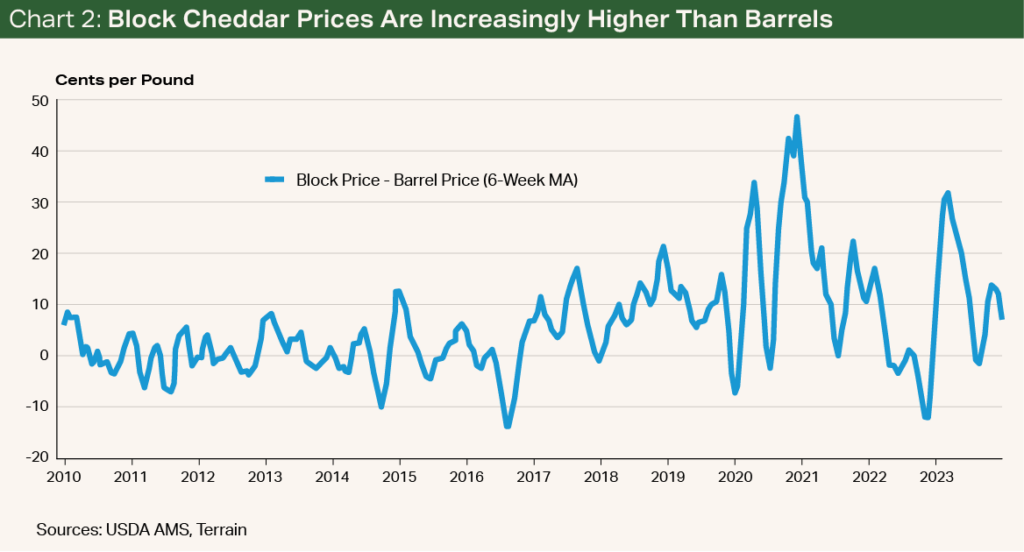

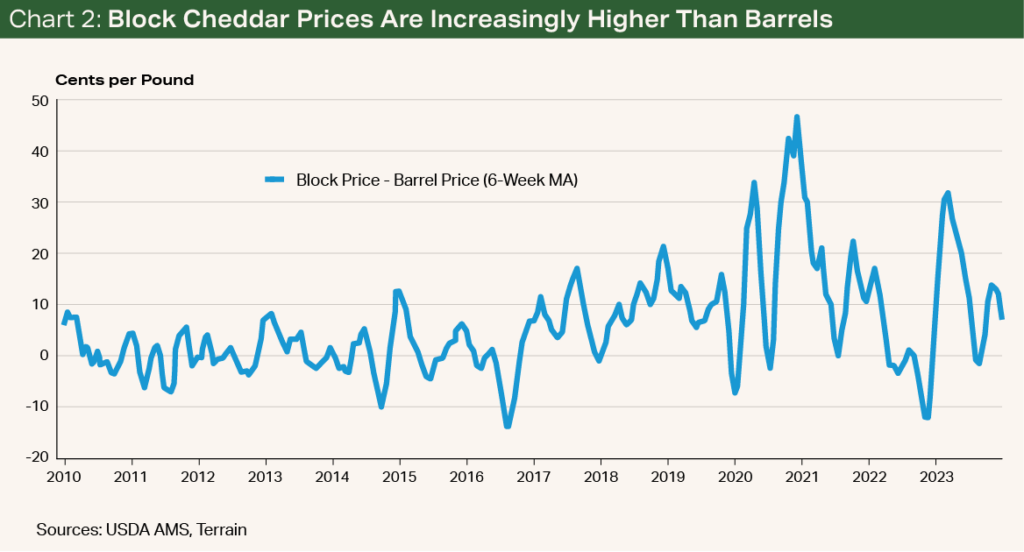

The cheese value that is the basis for the protein price used to pay producers and used in the Class III price is determined by subtracting 3 cents from the cheddar barrel price and averaging it with the cheddar block price. These prices move independently, but in recent years, the barrel price is most often well below the block price (see Chart 2). Over the past five years, if barrels had not been in the calculation, the average Class III milk price would have been 47 cents higher.

3. Class III and Class IV Formula Factors

USDA Recommendation

Increase the make allowances as follows:

These increases fall slightly above the levels proposed by the National Milk Producers Federation. They are also above the levels proposed for Year 1 of the International Dairy Foods Association’s four-year phase-in schedule but below the levels proposed for the end of the phase-in.

Along with the make-allowance increase, Select Milk Producers Inc. proposed an increase in the butterfat recovery factor (how much butterfat from raw milk can be recovered during cheesemaking) from 90% to 93%. The USDA recommendation is to increase the factor to 91%, with a corresponding change to the butterfat yield factor in cheese from 1.572 to 1.589.

Context

These proposals address increases to the manufacturing “make allowances” in the Class III and Class IV milk formulas. The make allowances represent the theoretical cost of converting components into finished products, and it is generally accepted that those costs have increased over time. The proposals from the National Milk Producers Federation, International Dairy Foods Association and Wisconsin Cheese Makers Association provide different levels of increase as well as methods for phasing in and increasing over four years.

Analysis

Increasing make allowances was at the heart of the current reform process. There is general agreement that make allowances are due for an increase, but that will result in a decrease in milk prices. This is a perennially contentious issue in the dairy industry. If the new USDA recommended make allowances had been in place over the past five years (2019 through 2023), the Class III milk price would have been 89 cents/cwt lower, on average, and Class IV would have been 74 cents/cwt lower. Including the recommended change to the butterfat recovery factor and yield factor improves the Class III price by a modest average of 1 cent/cwt.

4. Base Class I Skim Milk Price

USDA Recommendation

Update the formula as follows: The base Class I skim milk price would be the “higher of” the advanced Class III or Class IV skim milk price for the month. In addition, adopt a Class I extended shelf life (ESL) adjustment equating to a Class I price for all ESL products equal to the “average of” mover, plus a 24-month rolling average adjuster with a 12-month lag.

Context

Until 2019, the skim milk value in the base Class I milk price had been calculated using the “higher of” either the Class III or Class IV skim milk pricing factor. In 2019, the calculation was changed to use the “average of” the Class III and Class IV skim milk pricing factor plus a 74-cent adder, which was designed to increase the price to where it would have been historically on average under the “higher of” calculation. However, in 2020, Class III and Class IV milk prices diverged significantly to the point where the 74 cents was not nearly enough to make up the gap, and producers fared much worse than they would have if the price had still been calculated based on the “higher of” formula.

Analysis

Under normal market conditions, the two formulas should be similar over time, but under conditions where Class III and Class IV milk prices diverge, the Class I price will be higher under the recommended rule. Over the past five years, the Class I price would have been 21 cents/cwt higher using the recommended rule rather than the “average of” system that had been in place.

The addition of the ESL pricing adjuster is a novel approach without a point of comparison to the current system. It should impact only the pricing of milk used for ESL and smooth out some of the near-term volatility consistent with the longer shelf life and marketing lifespan of ESL milk.

5. Class I and Class II Differentials

USDA Recommendation

Adopt a modified Class I differential map.

Context

Fluid milk marketing within the federal orders is nudged along by a map of location differentials. The goal is to incentivize milk to flow from surplus areas to deficit areas. All Grade A fluid milk starts with a differential of $1.60. From there, every county in the U.S. has varying degrees of additional differential on top of that.

Milk surplus areas generally remain at the base $1.60 level, while urban population centers that need to pull in milk will have higher differentials incentivizing milk to move there. For example, the major milk-producing counties in the Central Valley of California have a base $1.60 differential, whereas San Diego and Los Angeles counties have differentials of $2.10.

Analysis

Increasing Class I differentials will increase milk prices as a primary effect. The nuances of changing the differential map are complex. The initial degree of the price change will vary by farm and county, depending on where farms and plants are located and by what magnitude the differential changes (see Map). Not only will there be a price change, but those price changes will alter the incentives for where milk is shipped, making historical back-testing of limited value.

One analysis from the University of Missouri estimated the impacts compared with its baseline projections in the years ahead. It found that increasing differentials would initially increase the all-milk price, but that the additional milk production that would be incentivized as a result would then push down prices, resulting in only minimal increases in milk prices of 2 cents within four years.

Map: Degree of Price Change Will Vary by Farm and County

Change in Differential From Current

The ramifications of these recommendations on both producers and processors, as well as consumers, are felt well beyond the initial price changes.

Secondary Effects Pose the Greatest Risk

The ramifications of these recommendations on both producers and processors, as well as consumers, are felt well beyond the initial price changes. Minimum milk prices can be regulated through changes to the FMMO, but we cannot regulate that consumers must buy dairy products at a given price, or that producers must continue to produce milk.

One broad category of secondary effects occurs when milk is priced at levels that don’t match its true value.

The market will ultimately push toward equilibrium. But along the way, it will be important to avoid driving prices up artificially to the point that demand suffers, or so low that producers exit the industry prematurely due to what might be considered, in FMMO terms, “disorderly marketing conditions.”

Milk marketing has several unique characteristics that lead to market failures or market inefficiency. The FMMO formulas should do just enough to neutralize these inefficiencies and market failures while letting the market function on its own where it can.

One broad category of secondary effects occurs when milk is priced at levels that don’t match its true value. This would risk several unintended consequences that are difficult to quantify.

Some of the potential unintended consequences would include:

- Milk moving inefficiently to or from areas to benefit from a skewed Class I differential map.

- Investment in processing that is not optimal, or lack of investment in other types of processing driven by inconsistent make allowances.

- Disincentive to increase protein and other solids production in skim-fat orders where the component levels are assumed to be fixed, or lack of investment in product manufacturing plants due to lower-component milk.

- Milk and dairy products being persistently priced above world markets, limiting competitiveness.

One consequence that can be foreseen is that we will likely find ourselves needing to revisit these rules years from now. The motivating factor for increasing make allowances, which started the whole federal order hearing process, is that manufacturing costs change over time. The same can be said for the component levels in milk, and surplus and deficit regions that need to be nudged along by the Class I location differentials.

The recommended decisions bring these factors into better alignment with the market conditions today, but they remain fixed. At some point, they will become outdated and need to be revisited.

This is a critical point in the process where there is an opportunity for public comment.

Conclusion

FMMOs influence the industry broadly, including producers who are not pooled in the FMMO, especially through the secondary effects that can sway plant investment and location, milk flows, and global competitiveness.

This is a critical point in the process where there is an opportunity for public comment. Even producers and processors who are not pooled in federal orders have a chance to voice concerns or support for the recommendations.

Once changes have been implemented, prices will likely end up close to where they would have been if no change had been made. The benefits and risks of modernizing the federal order system are in the secondary effects. These should be measured against four key criteria:

- Price levels: Will minimum prices be in line with their natural equilibrium to allow the market to clear efficiently without hurting supply or demand?

- Investment in processing: Will incentives be neutral, allowing the needs of the market to drive investment in new or existing plants?

- Milk flows: Will changes in the Class I differential map encourage efficient milk flows or artificially advantage or disadvantage existing plants and regions?

- Competitiveness in global markets: Will our prices be artificially inflated compared with world values, making it difficult to compete in export markets?

The secondary effects are more important to the long-term health of the industry than whether price goes up or down initially.

The secondary effects are more important to the long-term health of the industry than whether price goes up or down initially. These effects are key to the industry's ability to grow to meet the needs of both the U.S. and global markets. The goal of changing the pricing formulas should not be to raise the milk price for producers or to lower it for processors. The goal is to make sure that milk is moved efficiently to its highest-value use.

If the federal order system is modernized in a way that is mindful of the keys to a modern milk production system, the entire dairy supply chain will benefit. The U.S. dairy industry is well-positioned for the future, and the federal order system still plays an important role in neutralizing market inefficiencies inherent in the industry.

The USDA’s recommended decision appears to balance the primary effects in a way that should have a minimal impact on prices. The unintended consequences are difficult to foresee, but as a whole the proposed changes accomplish the key goal of updating make allowances and should be favorable compared with the status quo or the alternative of eliminating the orders completely.

How to Submit Feedback — Industry participants can submit a formal comment on the USDA's recommended decision here: https://bit.ly/FMMORule

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.