Situation: Digester construction has boomed thanks to lucrative credits and tax incentives for converting biomethane into renewable natural gas. Now some of those tax incentives are phasing out, and credit values have fallen from their peaks.

Impact: Projects can still be viable under current market conditions but require more careful feasibility assessment.

Outlook: Construction likely will continue at a more cautious pace.

Finding: Long-term industry development will rely on ongoing incentives from credit generation and would benefit from state and federal tax incentives and risk management opportunities.

Anaerobic digesters have been installed on dairy farms for decades. The technology traps biomethane that is released when manure in a lagoon biodegrades—a win from an environmental standpoint. The gas can then be used for something productive—a win from an economic standpoint.

Initially, the most productive path was to use the biomethane to generate heat and electricity for on-farm use and to sell back surplus electricity to the electric grid. Over the past several years, the ability to clean biomethane enough so it is suitable to inject into gas pipelines or compress into trucked tanks has opened the door to lucrative tax incentives and renewable energy credit revenue.

Digester investment and construction has boomed because of these incentives. Now uncertainty around credit values and future tax incentives will require some additional pencil-sharpening by producers and developers.

Economic Feasibility Requires Credits

To be sure, running manure through an anaerobic digester is an expensive way to generate natural gas. The costs significantly exceed the value of the gas produced. This approach is only currently feasible when the gas is used as transportation fuel and generates valuable Low Carbon Fuel Standard (LFCS) credits, Renewable Identification Number (RIN) credits or similar.

The additional step of scrubbing the bio-methane produced by a digester into renewable natural gas (RNG) suitable for pipeline injection requires substantially more investment and scale than a digester alone. In 2019 and 2020, the high value of LCFS credits reduced projected payback periods for RNG digesters to a matter of 2 to 3 years in some cases despite the high cost of construction and the expected operating life of at least 20 years.

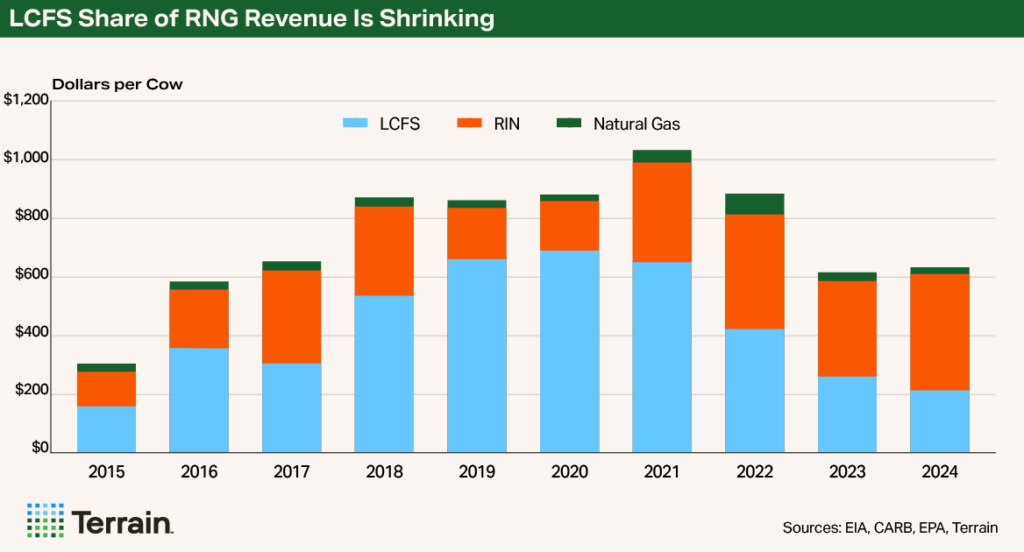

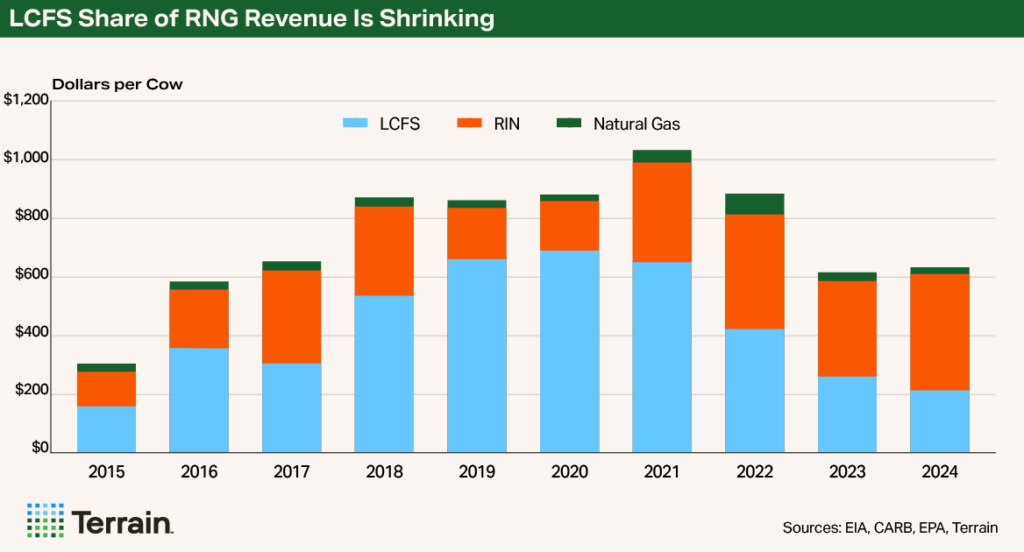

The value of the fuel is typically the smallest share of the revenue stream.

The primary economic incentives can be broken into four categories:

- Fuel Value

- LCFS Credits

- RIN Credits

- Tax Credits

Fuel Value

The output of most digesters today is methane or natural gas. That gas can be injected into pipelines or converted into compressed natural gas for transportation. The value of the fuel is typically the smallest share of the revenue stream.

The Energy Information Administration expects the price of natural gas to increase from current levels as domestic and export demand increase faster than production. Prices are projected to increase from a record low average of $2.21 per million British thermal units (MMBtu) in 2024 to $4.20/MMBtu and $4.50/MMBtu in 2025 and 2026, respectively.

Still, the value of the fuel itself is negligible when compared with the value of the other incentives. Even in a high-priced year like 2022 when the commodity value of natural gas averaged $6.45/MMBtu, a typical dairy cow would have generated about $70 in gas revenue over the course of the year.

LCFS Credits

LCFS credits are central to the feasibility of dairy RNG projects. These credits are traded and price is determined by supply and demand.

It is important to distinguish between compliance markets and voluntary markets for these types of credits. In the case of LCFS credits and RIN credits, fuel companies need to hold or retire credits to remain in compliance with a regulation. This distinguishes the credits from other voluntary markets which have developed in the past several years in which farms can generate credits for some carbon reducing activity to be sold to a company that wants to voluntarily reduce its carbon footprint.

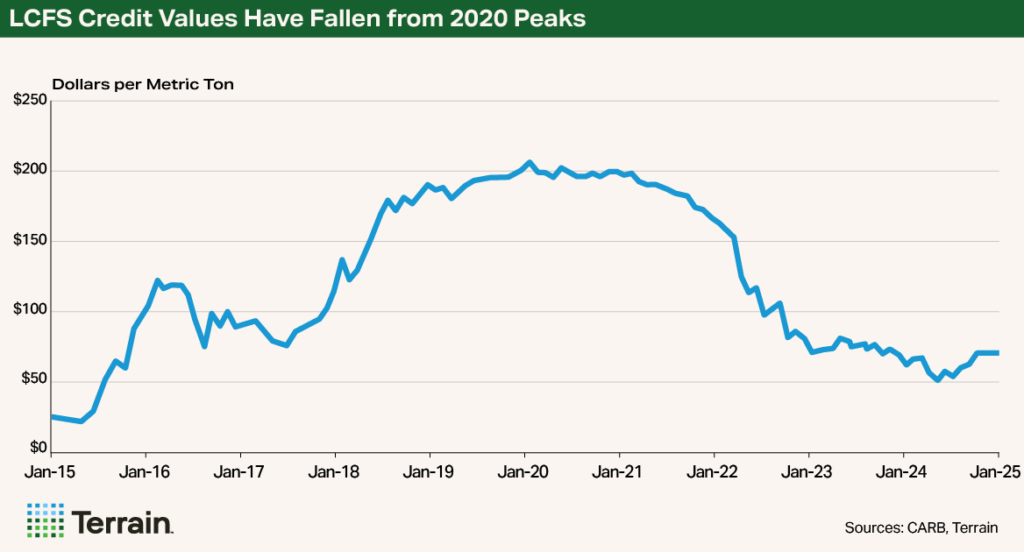

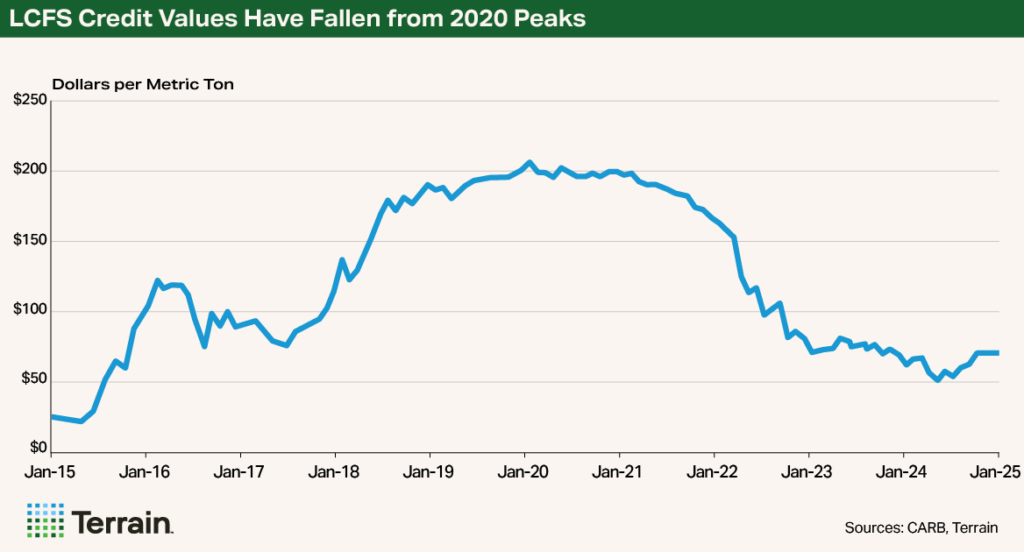

During the most recent boom between 2018 and 2021, LCFS credits provided the strongest ongoing revenue stream for RNG projects. But their value has fallen…

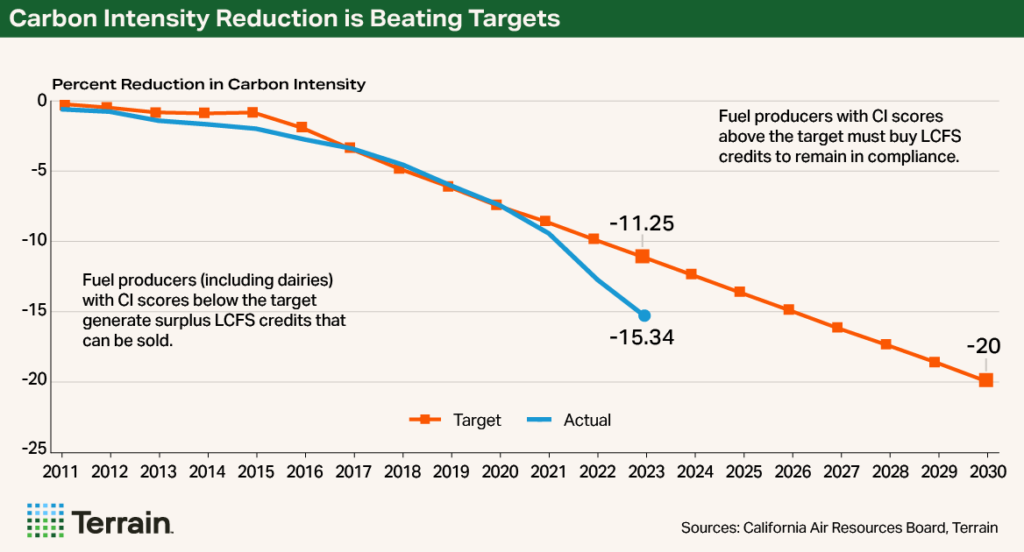

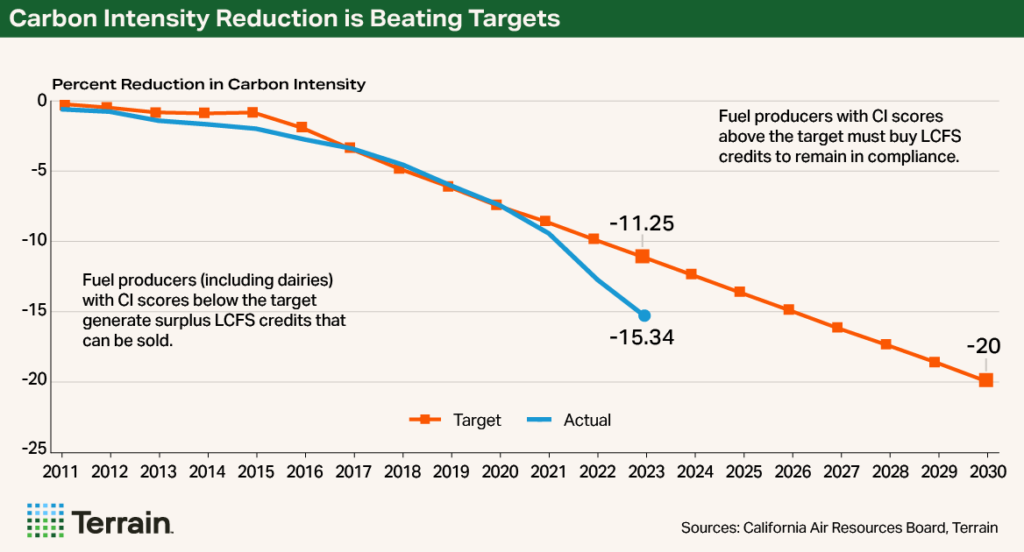

Digesters and RNG projects generate LCFS credits by virtue of being renewable fuel producers. Companies selling transportation fuel in California must maintain a carbon intensity (CI) score for their fuel portfolio below a certain threshold. That threshold is lowered each year by the California Air Resources Board (CARB) which administers the program. If a fuel company is not able to lower its CI score directly, it can buy credits from fuel producers (i.e. dairies) that have CI scores below the target. The need for these credits to remain in compliance with the program is what generates the value of the credits.

During the most recent boom between 2018 and 2021, LCFS credits provided the strongest ongoing revenue stream for RNG projects. But their value has fallen in response to an abundance of credits being generated (though dairy digesters comprise a small sliver of the overall supply of credits).

In 2021, prices had been hovering around $200/Metric Ton. By 2024, prices were more commonly in the $60/Metric Ton range and the carbon intensity reductions in the state were doing better than target. In 2023 the target CI reduction compared to a 2010 base was 11.25%, but actual CI had already been reduced by 15.34%. In November 2024 CARB amended these targets from 20% in 2030 to 30% and added a new target of 90% by 2045.

While more stringent targets would potentially increase credit values, the outlook for the future is still uncertain and the amendments are currently facing a challenge by the Office of Administrative Law. A conservative approach is prudent when deciding if a new project will pencil out.

RIN Credits

RIN credits are part of the Renewable Fuel Standard (RFS) program implemented by the Environmental Protection Agency working with the USDA and Department of Energy. The RFS is national in scope and sets a Renewable Volume Obligation that refiners or importers of fuel must remain compliant with by purchasing and retiring RIN credits. Those RIN credits are generated whenever a renewable fuel is produced (i.e. by a dairy digester) and can be sold to fuel companies that need to remain in compliance.

Importantly, a project like a digester producing natural gas can generate both RIN credits at the federal level and LCFS credits at the state level simultaneously. This “stacking” of credits can help provide a stronger level of revenue to offset the cost of the project, as well as diversify some of the risk of either credit value declining on its own.

When LCFS credits began declining in value around 2021, RIN credits increased from a range of around $1 to $2 per credit to around $3, where they mostly have remained apart from a dip to the $2 range in the first half of 2023. In fact, over the past two years the revenue generated by RIN credits surpassed the revenue generated by LCFS credits for the first time on a typical dairy with a digester producing RNG.

Tax Credits

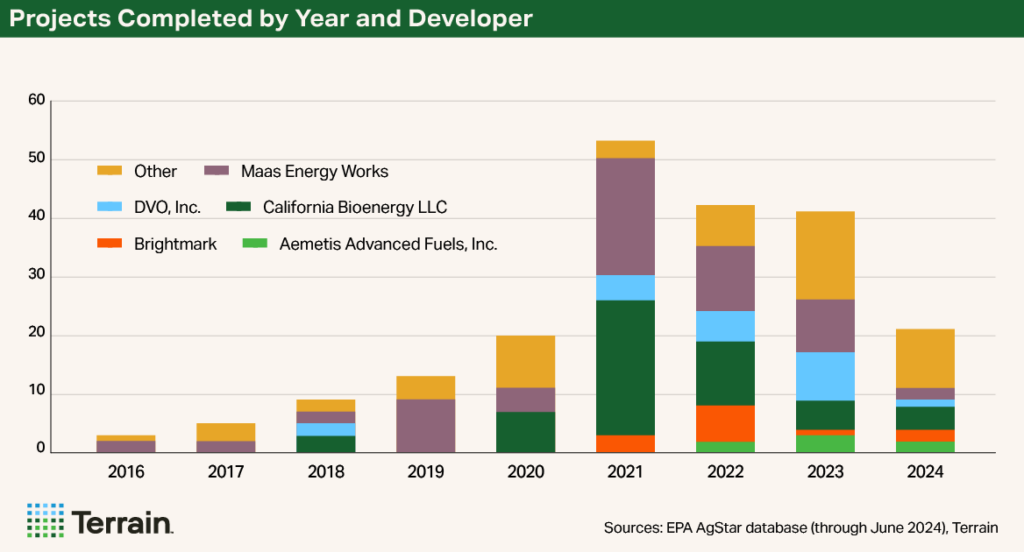

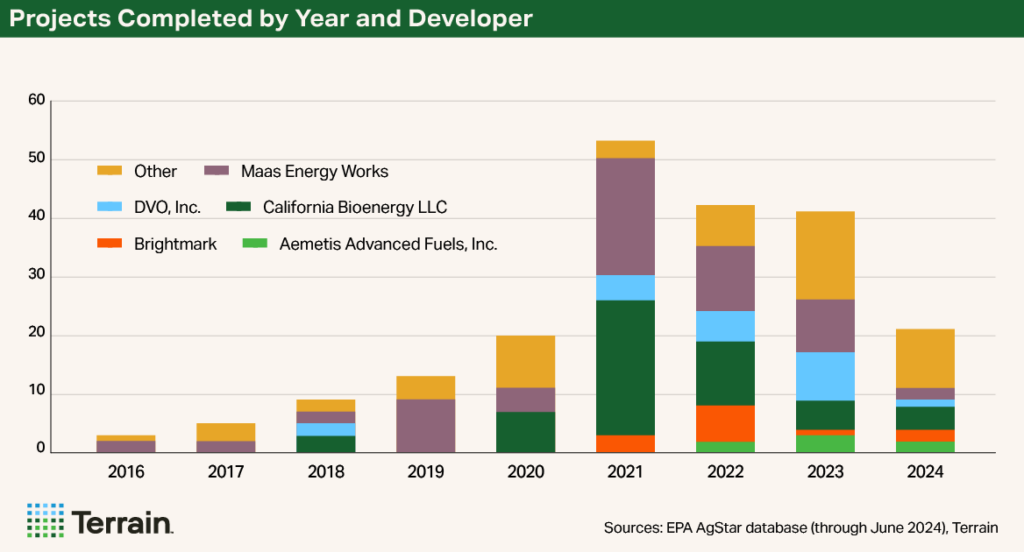

Section 48 investment tax credits were available to projects that began before 2025. This transferable tax credit significantly offset some of the initial high construction costs. The phase-out of the Section 48 tax credit led to a boom in projects in late 2024 rushing to break ground before the 2025 deadline.

After the Section 48 tax credit phases out, Section 48E is intended to be a technology-neutral replacement that focuses on clean electricity generation. This could shift some incentive toward once again generating electricity with digesters.

The incentives and other revenue factors will remain dynamic.

45z credits may still be available for digesters as producers of renewable fuel, but they are only available through 2027.

Proceed on New Digester Construction with Caution

The incentives and other revenue factors will remain dynamic. Sometimes incentives and market values will line up favorably; other times, not. But these projects and partnerships with developers are long-term agreements and careful consideration needs to be taken when entering into any such partnership.

The primary consideration should be partnering with a reputable developer. The market leaders in terms of number of projects are currently Maas Energy Works, California Bioenergy and DVO, Inc. There are smaller developers as well that may be a better fit in some situations like geographic or operational specialization. Due diligence is warranted in all cases.

These long-term agreements will limit the freedom of the dairy to make some operational changes like expansion, breed changes or major changes to feed. It may prove difficult for the dairy to exit the industry while remaining obligated to supply manure to the digester. The dairy will also want some recourse if the developer exits or transfers ownership to another party. Including lawyers, lenders and other partners in these conversations is important.

There is a range of ownership structures for these projects. A dairy fully owning and operating a digester producing RNG is increasingly rare. Aside from the market risk, the challenges of operating a digester and RNG facility are unique and very different from the operation of a dairy.

On the other end of the ownership spectrum are digester or RNG facilities fully owned by a developer with some offtake agreement where the dairy is compensated for providing a manure supply.

Most projects fall somewhere in the middle with some degree of equity sharing which can make the project more profitable to the dairy. But this structure comes with increased risk by opening the producer to the volatility of LCFS, RIN and gas prices.

The swings in market values for RIN and LCFS credits, as well as the uncertainty around future tax incentives, highlight the need to plan conservatively.

Tax incentives have been beneficial in helping offset the initial cost of construction. This has been a major driver of the recent increase in digester development. There is less certainty of federal tax benefits for these projects for plants in 2025 and beyond, but state programs may provide some assistance.

The swings in market values for RIN and LCFS credits, as well as the uncertainty around future tax incentives, highlight the need to plan conservatively. When considering future projections, stress test a range of scenarios for future credit values and consider potential scenarios for the future of the dairy operation and how they would be affected by a long-term digester partnership.

Market and Regulatory Stability Would Benefit Industry

One of the biggest challenges to the development and financing of digester RNG projects is volatility and fluctuation of LCFS credit values. Many projects began when LCFS credit values were near $200, based on assumptions that the value would remain in that range for several years. When market values fell dramatically from those heights, the projects became much less of a homerun.

Better development of risk management tools would help smooth some of the variability. LCFS futures contracts exist on the Inter-Continental Exchange, and some private counterparties will offer over-the-counter contracts. While these may help with near-term volatility, longer-term fixed price negotiations may help add stability and predictability to cash flows for producers. More markets and more counterparties focused on offering solutions for dairy producers would benefit growth of the digester industry.

Tax incentives have been a major boon to offset the construction cost of digester projects. Many projects rushed to meet the 2025 deadline to be eligible for tax credits under the Inflation Reduction Act. The future availability of similar tax credits at the federal level remains unclear, though incentive programs from individual states may remain and continue to develop.

Opportunity Hinges on Incentives

Since the feasibility of dairy digesters producing RNG hinges on the value of LCFS, RIN credits and tax incentives, the future trajectory of digester development opportunities depends heavily on the future of these incentives.

Some stakeholders in California had been pushing to limit the credit generating potential of dairy digesters, arguing that dairies should not receive credit for mitigating methane emissions by installing digesters. Ultimately, in November 2024, CARB chose to lock in at least 30 years of credit generating potential for projects already built and up to 20 years for projects built by 2030.

The silver lining to currently low credit values and limited tax incentives is that it forces greater care to be taken in considering these projects with more assurance that the projects being taken on in current conditions are likely to succeed in the long run. Additionally, other pathways, including using digesters to generate electricity specifically for electric vehicle charging stations, are being investigated.

The LCFS credit market is specific to California, though producers who can get their RNG through either pipelines or trucks are able to take advantage. Other similar markets have begun in Oregon and Washington and are being considered in several other states. This could add additional demand and stability for credits and be supportive of prices while reducing the risk of being exposed to a single market. It would also potentially increase feasibility for projects in geographic areas that were unable to take advantage of the California program previously.

Looking to the future, producers need to conduct thorough due diligence on partnering with developers, and include lenders, lawyers and other partners in the process. Developers need to look conservatively to the long term for revenue generating potential. Developing options to reduce market value variation for credits like LCFS would help decrease market uncertainty and financing hurdles. Federal and state governments should seek more consistency, availability and certainty around long-term tax incentives available for construction and on-going clean fuel production from these projects.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.