Early Market Impacts of New Cheese Plants Arrive

Article Originally Published in the April 1, 2025 Issue of Progressive Dairy

By Ben Laine, Senior Dairy Analyst

Dairy markets are experiencing significant changes, and some early market impacts are beginning to appear. Two additional major cheese processing plants are now operational, tightening the supply of milk but leaving an abundance of cream.

Hilmar Cheese has built a large cheese plant in Dodge City, Kansas, and Leprino has recently begun operations at a new location in Lubbock, Texas. Each plant will process about 8 million pounds of milk per day. Additionally, Valley Queen Cheese has expanded its existing capacity in Milbank, South Dakota, to take in 3 million pounds more milk per day.

The impact isn’t immediate. The plants will take time to fully ramp up, and there will be offsetting plant retirements and closures, including Leprino’s Lemoore East plant in California, which is slated to close in early 2026. These developments have been in the works for the past few years, with speculation along the way about the market impacts. Those impacts will begin to be realized now that the milk trucks are pulling up to the plants.

Milk Markets Balanced, So Far…

According to the USDA, in December 2024, U.S. milk production was nearly 3 million pounds per day less than a year ago. However, the states in the vicinity of these expansions — Colorado, Kansas, Texas and South Dakota — collectively produced 5 million pounds more milk per day in December 2024 compared with 2023. And component levels continue to climb nationally.

This level of growth is respectable, especially given the high interest rates and appealing alternatives to breed to beef. Still, more milk will be needed, and in the meantime, supply will be tight.

At the beginning of the year and into the spring, milk supplies are usually ample due to seasonally higher production and a relatively quiet period for demand. This should help with availability to fill the new processing capacity. So far, milk markets appear to be reasonably balanced. USDA Dairy Market News reports spot loads of milk in the Midwest trading near Class III. Spot loads trading significantly above or below Class III would indicate a shortage or surplus of milk, but for now, markets appear balanced.

On the output side of the plants, markets will need to contend with additional cheese. Spot cheese prices at the CME have held in the $1.80 to $1.90 range so far this year, but the direction for the rest of the year will depend heavily on the ability to maintain the strong level of exports experienced in the last couple of years.

While the names on the plants are known for cheese, you can’t make cheese without also making whey as a byproduct. Whey markets were hot during 2024, but spot prices have fallen since the beginning of 2025, and the additional supply could make it harder for prices to climb again.

…But Cream Is Another Story

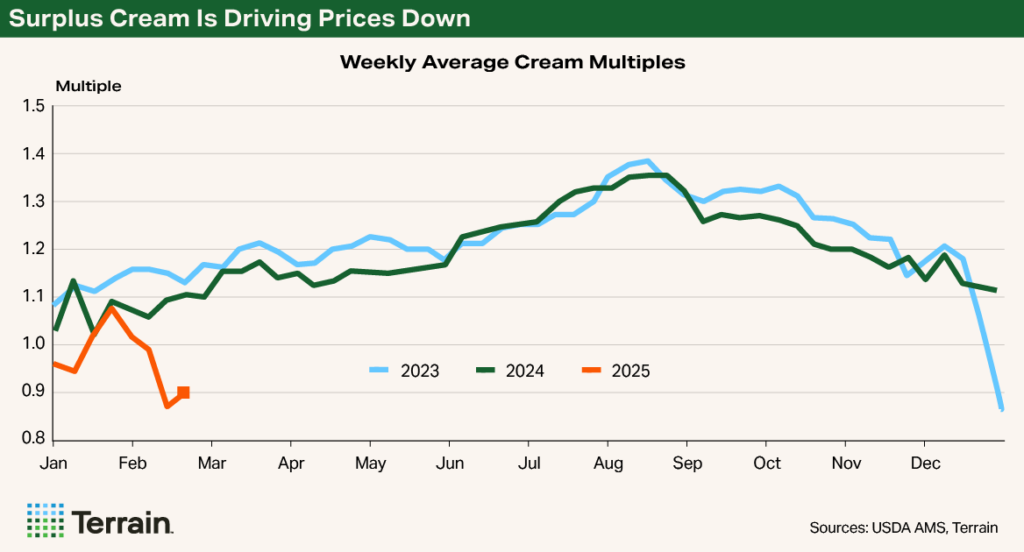

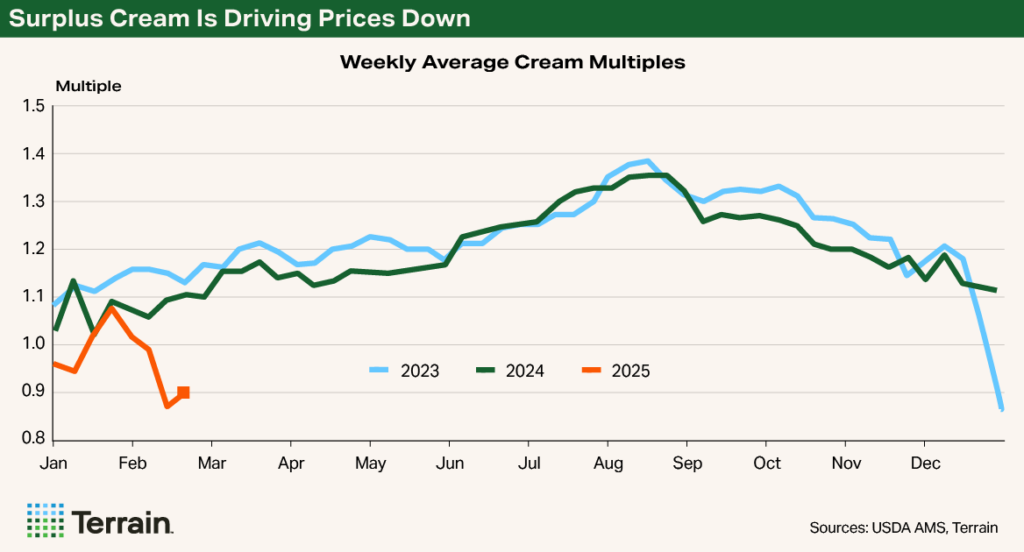

The impacts are also being felt beyond the Class III markets. Fat content in U.S. farm milk has been climbing in recent years, and the ratio of fat to protein has surpassed what is needed for cheese manufacturing. As a result, the leftover fat is leading to an oversupplied cream market.

Cream multiples, which represent a factor for pricing cream relative to the price of butter, are hitting record lows for this time of year, reaching levels not seen since the pandemic disruptions in 2020. This indicates that cream is plentiful. Butter inventories are likely to start the year strong, with butter churns taking advantage of the discounted cream.

Ultimately, if this pattern continues, it could limit the upside potential for butter and push fat values lower than in the last couple of years.

Milk supply could be tighter than normal heading into the spring, especially in the central region of the country. However, dairy commodity markets should be well supplied, limiting upside price potential.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.