(This information was originally presented during a January 21, 2025, GrowingOn® webinar hosted by Farm Credit Services of America®. Watch the recording here: GrowingOn® | FCSAmerica.)

Milk components such as milkfat and protein are becoming more critical for producers' long-term success.

Traditionally, milk production growth has been used to measure success and growth in the dairy industry, at a macro level and at the on-farm level. However, the reality of milk production has shifted in recent years, requiring a shift in our success benchmarks.

Specifically, milk components such as milkfat and protein are becoming more critical for producers' long-term success. As a result, component output growth increases while milk production growth flattens out. Focusing on components instead of fluid milk itself allows producers to better meet consumer demand, manage their risk, and get the most value in the long run.

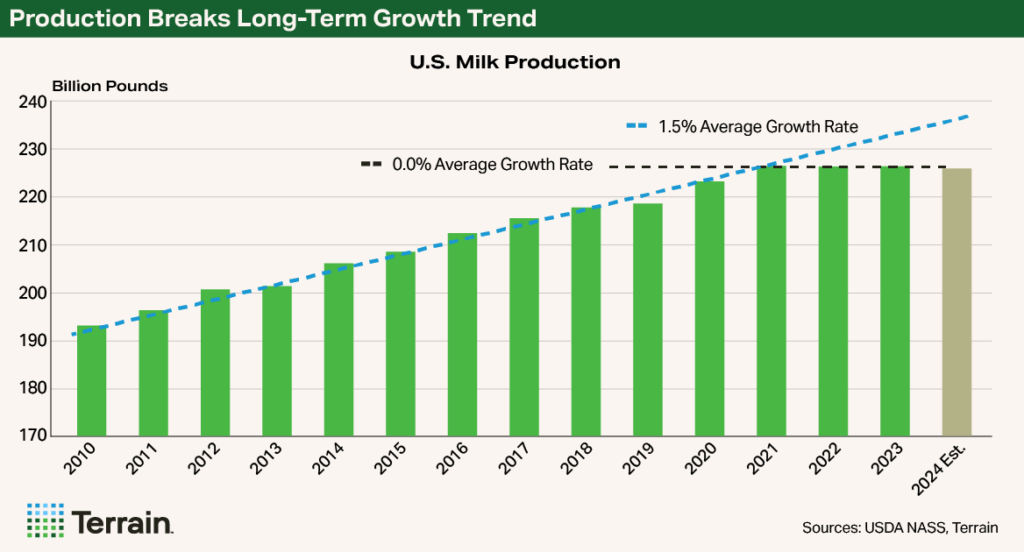

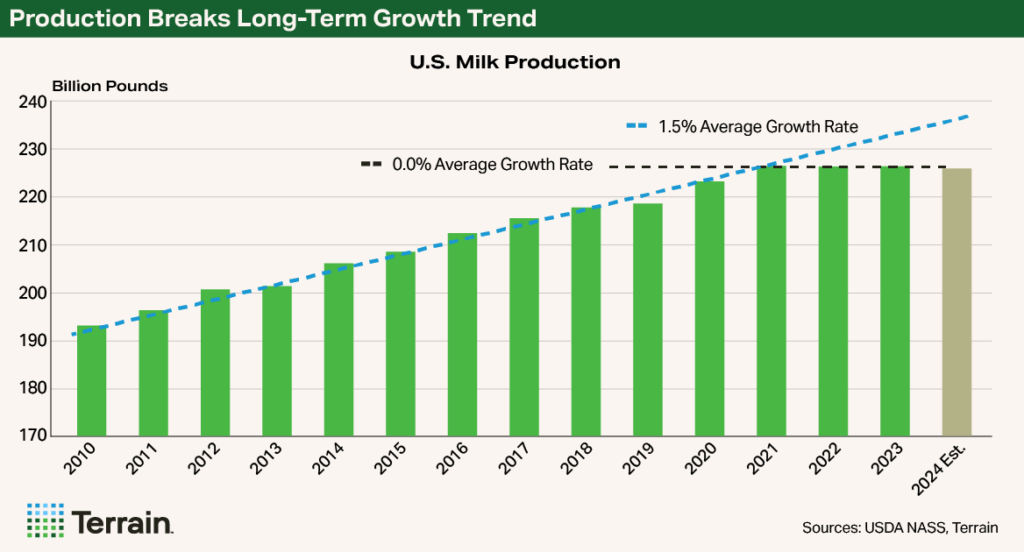

New Era of Milk Production Growth

It’s become clearer each year that the U.S. is in a new era of milk production growth. USDA data show that from 2010 to 2021, U.S. milk production increased at an equilibrium rate of 1.5% year over year. But since 2021, milk production has flattened out, making the 1.5% growth rate a less reliable measure of industry success.

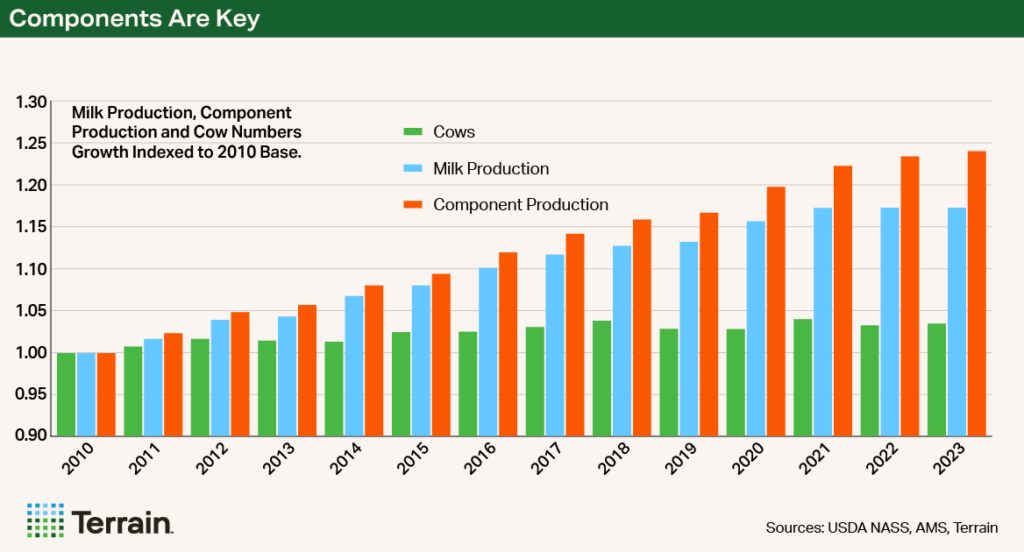

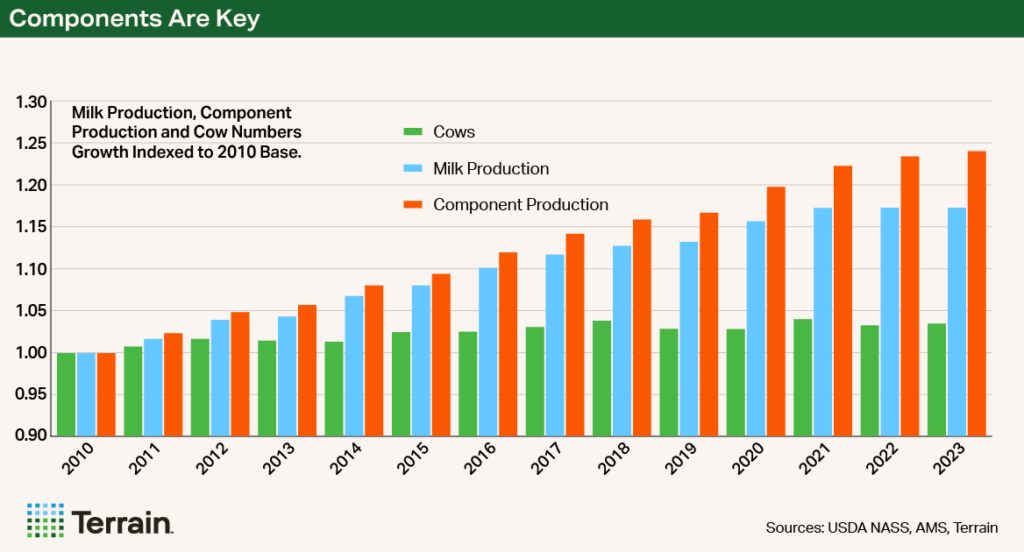

Two things are behind the flattening in milk production growth: We're making the same amount of milk but with fewer cows and, more importantly, we're continuing to grow our output in terms of components.

Even as milk production has leveled off, we've made more cheese, butter and other dairy products thanks to the continual growth in component output. Although the number of cows is down a little from the recent peak in 2021, today’s cows each produce more milk, and the component levels within that milk keep climbing. A couple of factors have incentivized this increase in component output:

- Most producers are paid for the pounds of components versus the milk itself. Cooperatives and other milk buyers put a limit on how much milk they were willing to take from producers when markets were in a surplus. So, producers worked to maximize the component levels in their milk without going over their allowable base volume of milk.

- Consumers have shifted their preferences to dairy products like cheese rather than fluid milk. Components are the key to making these products and strong demand has pushed their value higher.

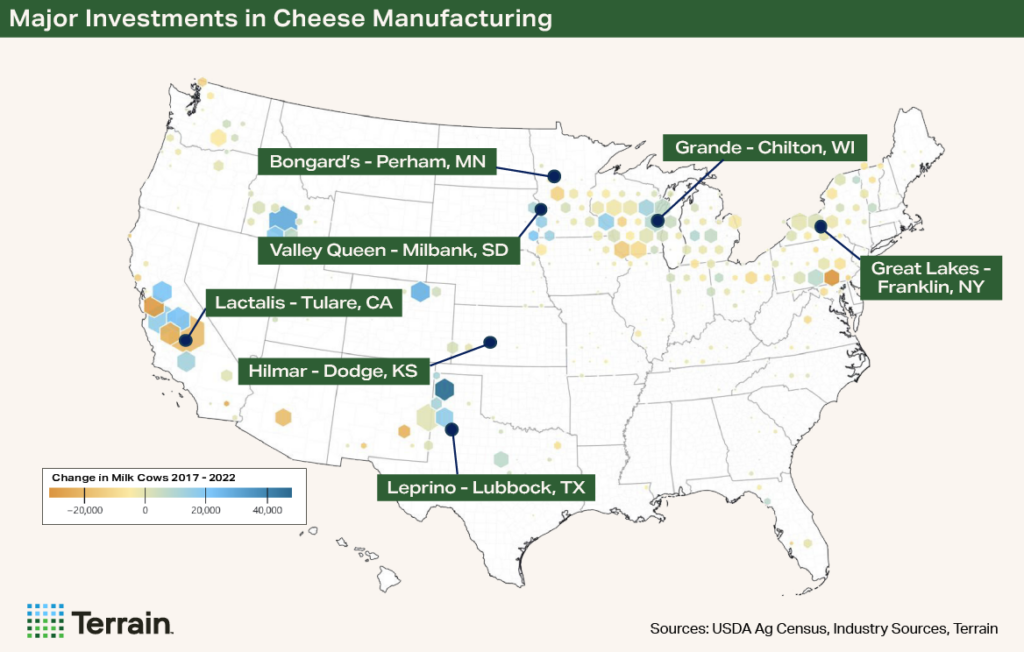

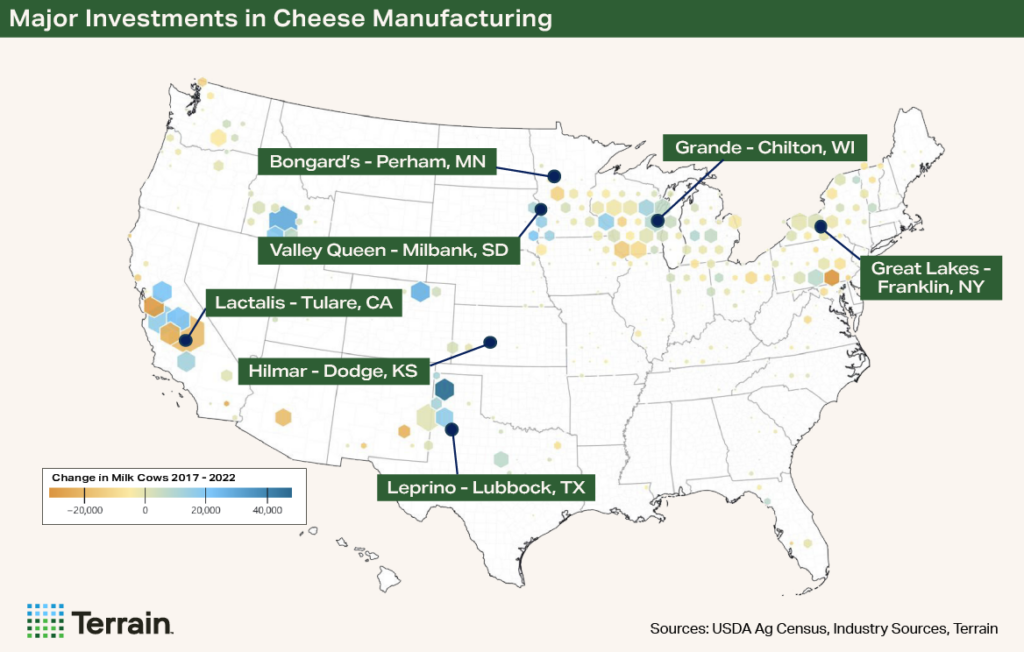

Around $5 billion to $7 billion is being invested in new cheese manufacturing plants nationwide.

Proof Is in the Cheese Plants

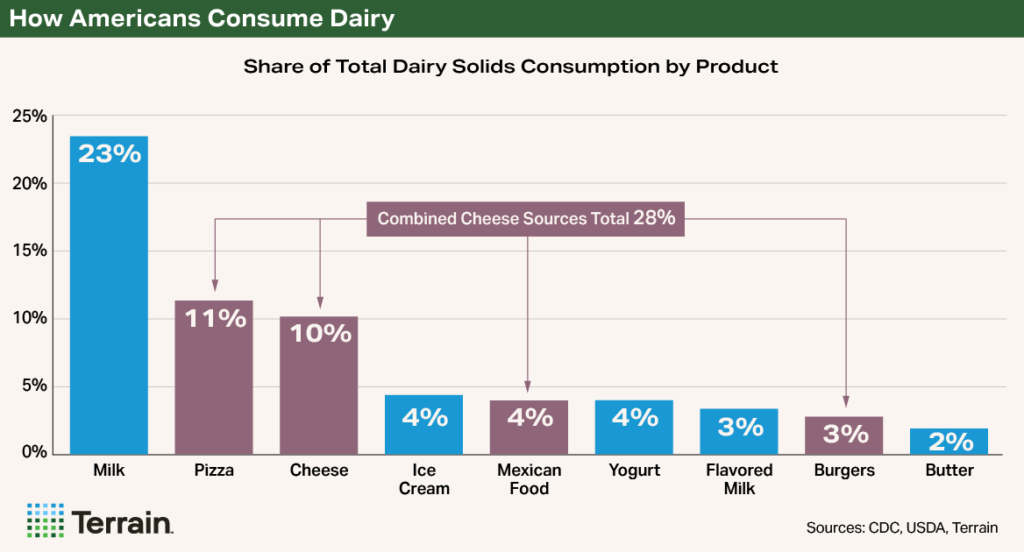

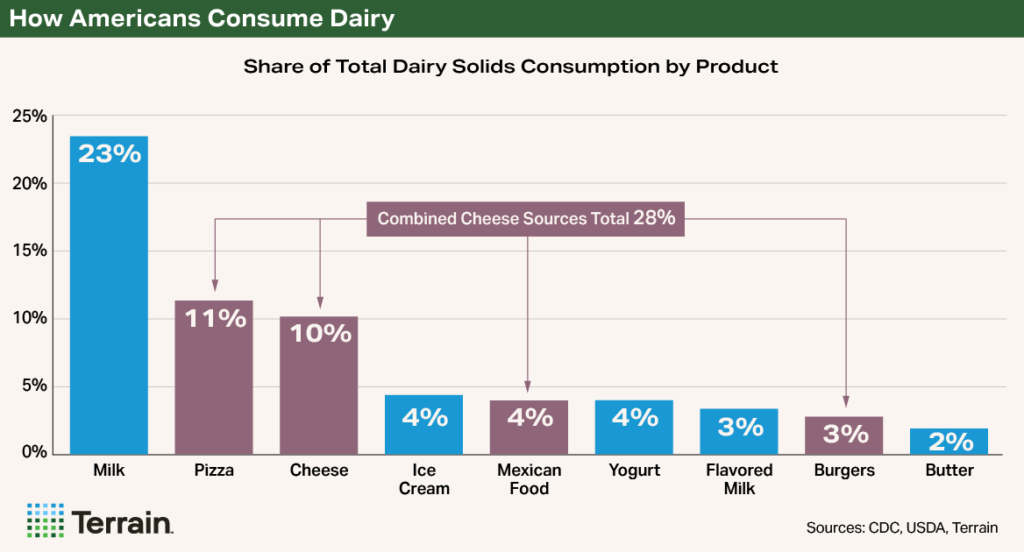

Despite a decline in fluid milk consumption overall, the story for milk demand is positive. Though per capita consumption of fluid milk has been declining since the 1970s, each person is consuming more milk than ever before. For instance, if it takes 9 or 10 pounds of milk to make 1 pound of cheese, that’s a win for producers. Instead of focusing our attention on the decline in fluid milk consumption, it’s more important to figure out what consumers are looking for, how to provide that, and how to get the most value out of that.

Around $5 billion to $7 billion is being invested in new cheese manufacturing plants nationwide, with somewhere around 25 million pounds more milk capacity per day coming on line. This is an encouraging sign of manufacturers’ confidence in the long-term growth of cheese demand globally and domestically.

For producers, this speaks to the need to optimize component production. Some questions to ask are: What components am I making if I'm shipping mostly to a cheese manufacturer? How do I optimize my components to make sure I'm meeting what the plants need in terms of their product mix and optimizing their own efficiency?

Population, and Component, Predictions

In a previous report, I looked at how different age groups and population change in the U.S. will influence the types of dairy products U.S. consumers demand and, ultimately, what the component needs of those products are.

The U.S. population is aging, which has important implications for component demand. The U.S. Census Bureau projects that from 2020 to 2050, the 70 to 79 and 80-and-older cohorts will see a surge in their numbers. As people age, the types of products they demand change, and thus the components. For example, ice cream becomes popular again with those near retirement age.

More broadly, Americans consume the majority of their dairy in the form of pizza and cheese over their lifespan. These have important implications for the components needed to make those products and the components that processors will need.

Shifting focus to components can help the U.S. dairy sector stay competitive globally as well.

Components Key at Home and Abroad

Shifting focus to components can help the U.S. dairy sector stay competitive globally as well.

Nearly 20% of U.S. milk production is exported to global markets, largely driven by skim solids, which have more value in export markets than domestically.

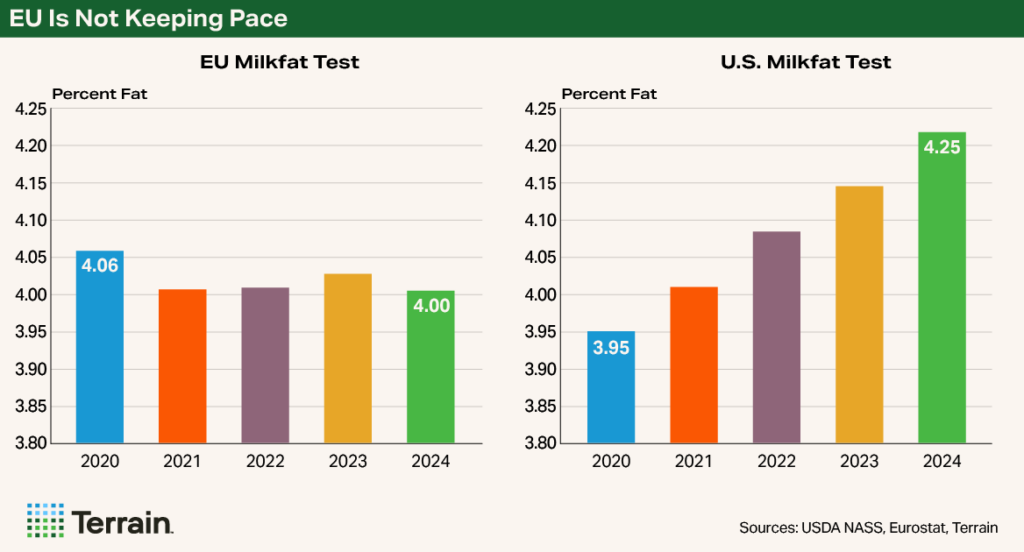

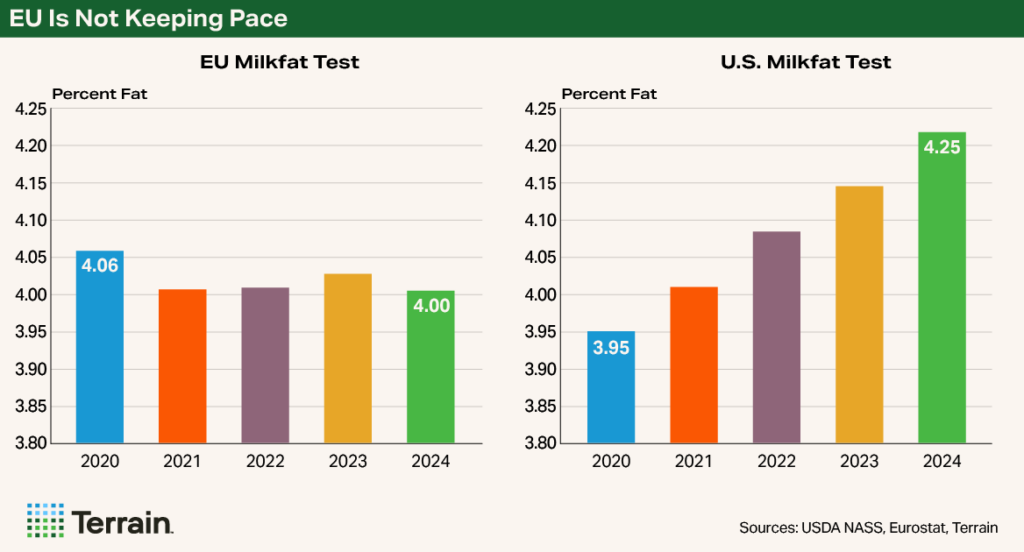

The U.S. and the EU are major competitors in global dairy markets, and both have seen milk production stagnate in recent years. But the growth in component output sets the U.S. apart. Milkfat tests in the U.S. rose to 4.22% in 2024 from 3.95% in 2020, compared with the EU, which held steady right around 4%. This positions the U.S. well to be able to serve growing global demand and continue to gain market share.

As export markets become a bigger part of total U.S. production, producers’ milk checks become more susceptible to the volatility in those global markets. It’s important to note that the volatility will disproportionately impact the protein and other solid values more than fat values, because the fat is still doing pretty well in the domestic market.

In terms of risk management, it may be time to start thinking about where you’re more at risk. Maybe instead of just locking in milk prices, you look at ways to manage certain components that might be more susceptible to those global markets than fat.

By optimizing component production, dairy producers can better meet market demands, enhance profitability, and ensure long-term success.

What Does This Mean for Producers?

Maximizing profit no longer means maximizing the number of cows you're milking or rolling herd average alone. More important is producing higher component levels, because despite the fact that everyone talks about a "milk price," producers get paid for the pounds of components and the value of each of those components.

By optimizing component production, dairy producers can better meet market demands, enhance profitability, and ensure long-term success in a competitive and dynamic industry. Embracing this approach will allow producers to stay ahead of industry trends and capitalize on the growing value of milk components.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.