Quarterly Outlook • March 2024

Delayed Marketings Bolster Cattle Feeders’ Bargaining Position

Situation

Drought-reduced beef cow numbers and resulting tightening feeder cattle and calf supplies are expected to decrease slaughter totals and increase fed cattle and beef prices going into the spring grilling season. Winter snowstorms have led to poor feeding conditions and weight loss in northern feeding areas. In response, cattle feeders are delaying marketings to allow cattle time to recover. This has started the seasonal spring rally and added resolve to feeders asking higher prices.

A Harsh Winter but a Brighter Season Ahead

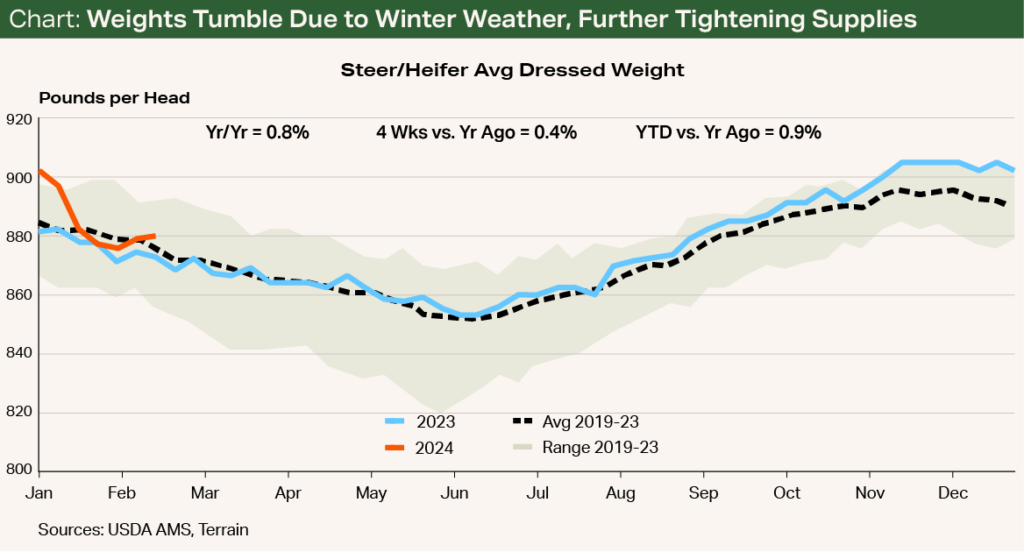

Cash fed cattle prices and boxed-beef cutout values found some footing by mid-December with better-than-expected holiday demand and began the new year in rally mode. In early January, the polar vortex created horrible pen conditions and poor cattle performance, dramatically reducing fed cattle carcass weights by more than 25 lbs./head. Cattle feeders, in turn, reduced offerings to packers as they tried to feed some of the lost weight back into the cattle. Average fed cattle carcass weights bottomed the first week of February before trending higher (see Chart).

A snowstorm in early March produced significant snowfall with depths of 12 inches or more covering much of northeastern Colorado and extending into western and central Nebraska and Kansas. I expect that this snow event will add to the seasonal decline in weights that normally lasts into June and delay fed cattle marketings through April.

Declining grain costs are expected to help feeders offset some of the lost weight with somewhat cheaper gains.

Fortunately, the percentage of steers and heifers reaching the Prime or Choice quality grade was reduced for only a couple of weeks and has returned to the five-year average of 84%. Fed weights could have a big enough setback to just return to the seasonally declining pattern and not see much rebound like they did in February.

Declining grain costs are expected to help feeders offset some of the lost weight with somewhat cheaper gains.

From a price perspective, the lighter weights and delayed fed cattle marketings put cattle feeders in a better bargaining position, and help packers, as the beef from those cattle moves into a stronger spring grilling market.

Price Outlook

For Q2 2024, I expect feeder cattle and calf prices to trade at $240/cwt to $260/cwt for 700- to 900-pound steers and $325/cwt to $350/cwt for 400- to 500-pound steer calves. Trade at these levels represents a $35/cwt to $45/cwt increase from year-ago levels for feeder cattle and a $55/cwt to $65/cwt increase versus a year earlier for calf prices.

Demand for cattle suitable for turnout on late-spring and summer grazing programs is expected to be very strong. Buyers for these cattle will be competing with feeding operations that have already seen lower grain prices reduce expected cost of gain and raise their break-even purchase price.

I expect late-summer live cattle cash prices in the low to mid-$190s/cwt will result in at least modest fed cattle profits during Q3 2024.

Before severe winter weather hit, fed cattle break-even prices were expected to peak during the second half of March in the high $190s/cwt before trending lower into June, when I projected them to settle in the low $170s/cwt. Weather-induced poor feeding performance will both raise and delay this trend, but I expect late-summer live cattle cash prices in the low to mid-$190s/cwt will result in at least modest fed cattle profits during Q3 2024.

I project that boxed-beef comprehensive cutout values will have at least a normal seasonal rally of $30/cwt from the beginning to end of Q2 2024. This would move prices from about $300/cwt to start the quarter to about $330/cwt for the early-summer peak and about $5/cwt, or 1.5%, above a year earlier.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.