Quarterly Outlook • April 2023

Dairy Margins Still Under Pressure But With Upside Potential

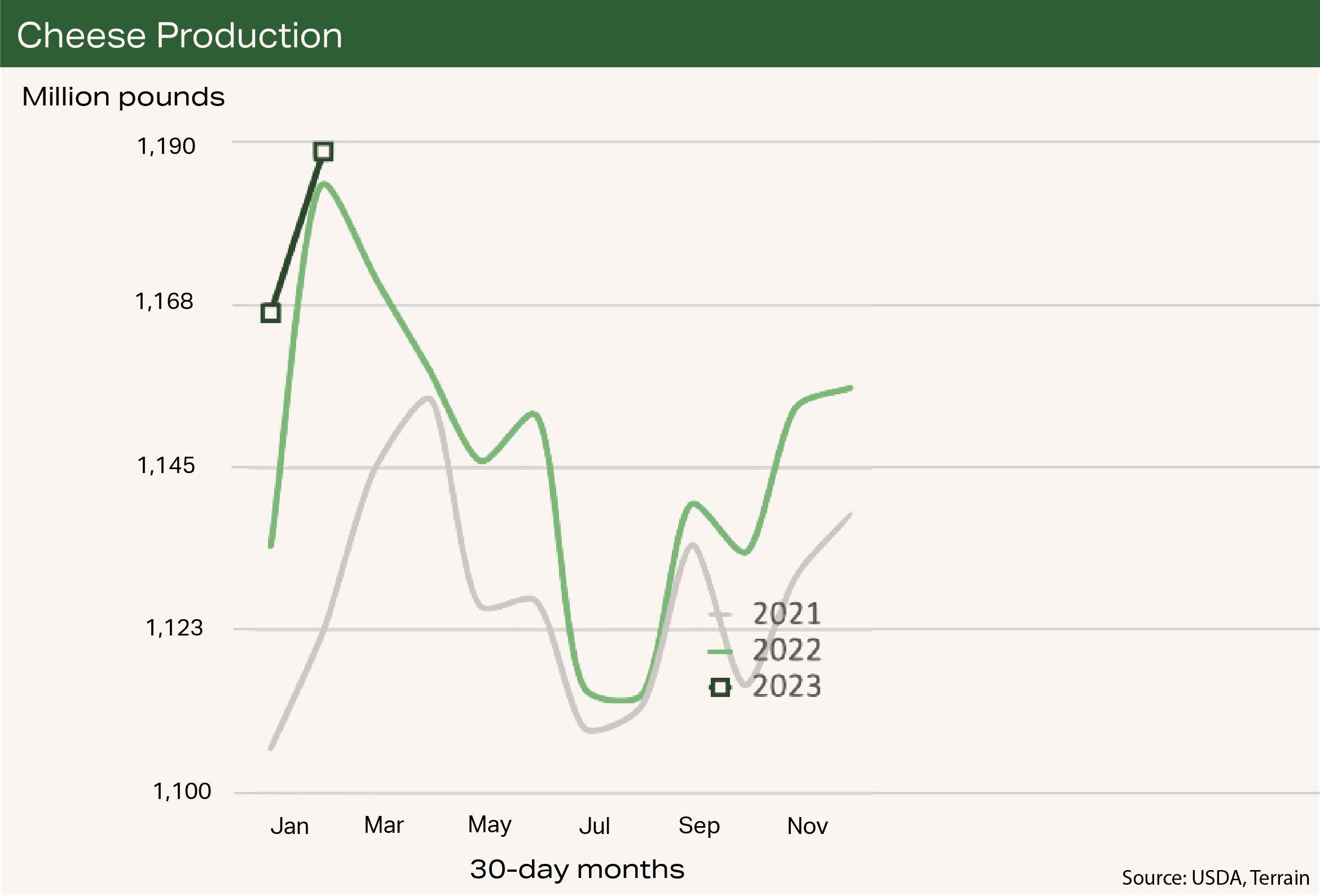

Milk production growth in 2023 has been slower than many anticipated coming into the new year. Milk production in Q1 2023 was reported to be 1.0% higher than last year. An increase of 1.5% year-on-year (YOY) would be considered normal, but in the beginning of 2023 that growth is underwhelming compared with a very easy-to-beat prior year.

Despite the growth in production compared to 2022 levels, we trail behind 2021 levels in overall volume. I expect milk production growth to remain limited for the remainder of 2023, less than 1% YOY over Q2 and Q3 levels from last year.

Meanwhile, reports of spot loads of milk in the Midwest trading at a $10/cwt or greater discount have persisted through the first four months of the year. In the past, this might have indicated a broad market surplus of milk, but this year I expect that the discounted spot loads reflect local market situations that could stick around for a while.

Parts of the Upper Midwest and the I-29 corridor have seen cow numbers climb and favorable weather for a heavy spring flush. These factors, magnified by unplanned downtime at some plants and the ongoing staffing challenges preventing plants from running full schedules, have likely contributed to the discounted milk.

Offsetting the strong flush in the Upper Midwest – at a national level – are the negative impacts of repeated heavy rains and regionalized flooding in California. The magnitude of the impact on California dairies has yet to be measured, but cows are being moved to higher ground and shipments of milk and feed are being disrupted. The differing conditions in California compared to the Midwest will likely lead to tighter supply in Class IV markets in the West and heavier Class III markets in the Upper Midwest.

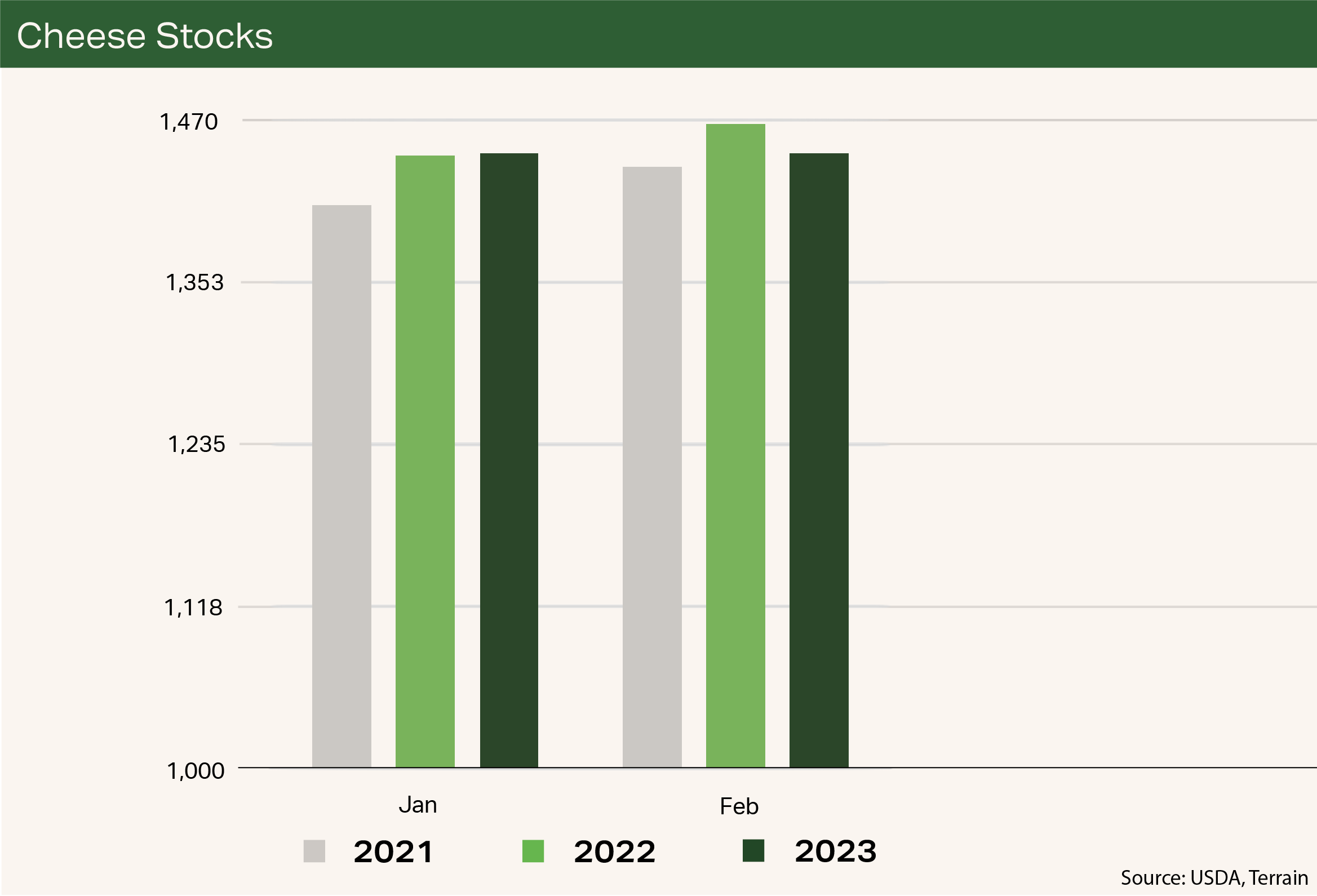

Demand for dairy is holding up through the start of 2023. Heavier milk production and discounted spot loads in the Midwest have moved more milk into cheese vats, yet cold storage inventories have remained flat in the first two months of the year. Cheese in cold storage at the end of March is down slightly compared to the same time last year. Cheese producers cranked out more cheese in February compared to January by about 743,000 additional pounds per day, but by the end of the month, cold storage inventories had fallen by 234,000 pounds.

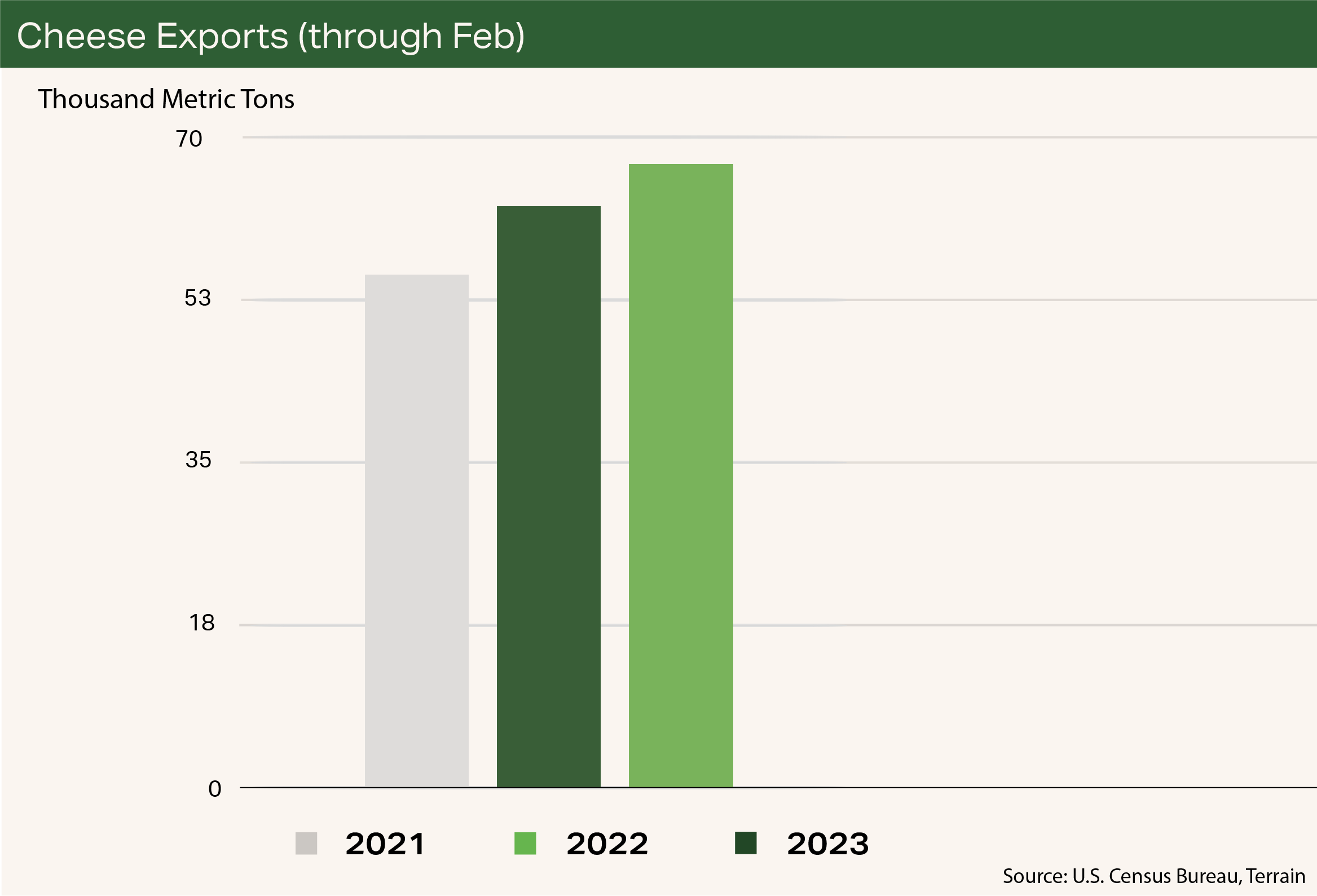

Dairy exports have played an important role in the financial outlook for U.S. producers. Cheese exports were the star of 2022, and 2023 is off to a strong start, up 7.1% YOY through February. The U.S. benefited from cheese prices that were lower than those of its global competitors for much of 2022. Currently, any near-term strength in cheese prices erases this international competitive advantage, so exports could face headwinds. Milk powder exports have also started strong in the opening months of 2023 after being down slightly last year. The reopening of China should be a net positive for global dairy demand this year, although geopolitical tensions continue to rise, and Fonterra in New Zealand has recently revised its milk price lower in response to slower-than-expected Chinese demand for whole milk powder.

Dairy margins will remain under pressure in Q2 with milk prices likely bottoming out in May. Beyond that, there is more upside potential as we move into the summer, but it is unlikely that markets will approach the highs seen in 2022. The biggest downside risks would be a major economic recession involving a large-scale reversal of the strong labor market or an escalation of geopolitical tensions, particularly with China.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.