Report Snapshot

Outlook:

With fewer acres and EPA-proposed Renewable Volume Obligations (RVOs) supporting strong demand for soybeans, Terrain expects the season-average price for soybeans for the 2025/26 marketing years to be slightly higher than the 2024/25 average.

Impact:

Watch for changes to RVOs, China purchasing now through July, weather in the U.S., and both weather and acreage expectations in Brazil to gauge soybean prices this year.

Lower Acres and Supplies than Last Year

Farmers responded to lower profitability expectations for soybeans by reducing acreage this year to 83.38 million acres, below the 87.1 million acres planted last year. With a higher percentage of double crop soybean indicated in the June 30 acreage report, recent weather over the past weeks and that in early July will be key for final soybean acres.

Weather so far this spring has generally been favorable for soybeans, with my current estimates not indicating a significant deviation from the current trend yield level of 52.5 bu./ac. However, much can change over the next few months.

RVO Supports Domestic Demand Growth for Soybeans

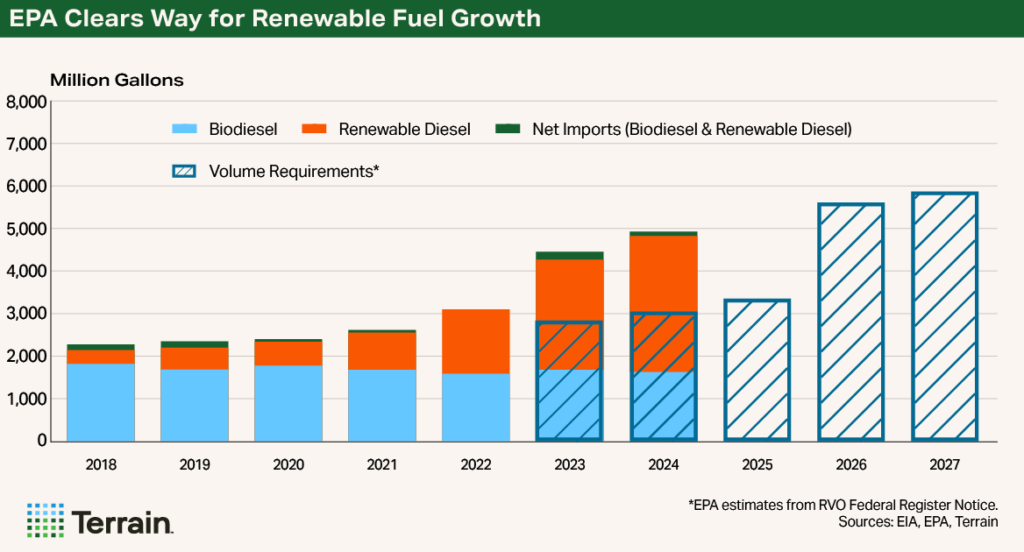

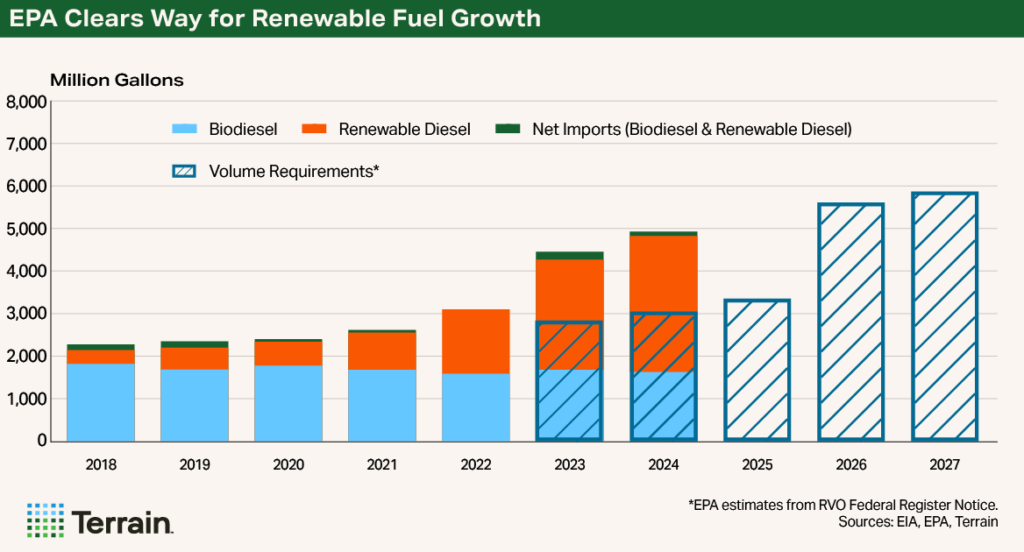

The outlook for domestic crush growth depends largely on the RVOs set by the EPA. The proposed volumes for 2026 and 2027, released June 16, 2025, are generally positive for soybean markets. Two components of the EPA proposal are particularly important for U.S. soybean demand:

- The RVO is higher than the levels initially proposed by industry earlier in the year and incentivizes crush of more soybeans than initially expected. This initially led to an increase in soybean futures prices, though part of that initial increase has been offset by weaker basis in the cash market.

The RVO proposed by industry was 5.25 billion gallons, while the RVO proposed by EPA on June 16 was 7.12 billion Renewable Identification Numbers (RINs), or about 5.61 billion gallons, according to EPA’s estimations. There is some uncertainty of the exact volume needed because the compliance requirements are now on a RIN-basis and the current proposal changes how RINs are generated based on the origin of either the renewable fuel or the feedstock. - The proposed rules allow 50% less RINs to be generated from renewable fuels imported from other countries or from renewable fuels made in the U.S. from imported feedstocks than for renewable fuels produced in the U.S. from domestic feedstocks. This offers an advantage to U.S. production of renewable fuels using U.S. feedstocks, of which soybean oil is a major component.1

Collectively these factors make it difficult to know for sure how many gallons will be needed to supply the required number of RINs.

These are only proposed RVOs. They still need to make it through the rest of the rulemaking process to be finalized later in the year. Also, outstanding Small Refiner Exemptions (SREs) are another policy-related uncertainty hanging over the biofuel (and thus soybean) market over the next few months.

Crushing More Beans Will Weigh on Soybean Meal Prices

I currently estimate crush is about 20 million bushels higher than the current USDA estimates for 2024/25, potentially tightening ending stocks and offering support for prices through summer. Watch for crush pace to increase as we start the new marketing year in Q4 2025 and crushers start preparing for higher RVOs in 2026 and 2027 if there are few changes between the current proposed rules and the final rule.

Stronger demand for soybean oil, while incentivizing crush, is likely to weigh on soybean meal prices, potentially challenging crush margins. Continued growth in domestic soybean meal use as well as robust growth in exports will be needed to sustain crush margins, preserve adequate supplies of soybean oil for renewable fuels, and prevent soybean oil prices from increasing sharply.

Export Commitments Behind Average Pace But Similar to Year Ago

The lack of new crop soybean purchases by China – our top market – has emerged as a recent concern on the outlook for soybean exports. When looking back over the past 10 years, China has had forward commitments to import anywhere from 0 to 283 million bushes as of mid-June. Last year, they did not start buying until July and did not buy in a significant way until August.

There are two factors that I think explain this:

- When Brazilian supplies are plentiful and U.S. weather looks favorable, there is little incentive to book purchases early as favorable supply expectations generally mean steady or lower prices, and

- Purchases could be delayed amid ongoing trade negotiations, especially since fundamental incentives to secure future supplies are not there.

Watch for when China starts buying U.S. soybeans; I expect there to be at least a small rally in prices then.

Soybean Price Outlook

Currently, my season-average price forecast for 2024/25 is $10.05/bu., slightly above USDA’s June estimates as I expect average soybean prices to remain in the low-$10 range for the rest of the marketing year. Higher priced forward sales are expected to partially offset sub-$10 spot cash prices to support average prices in the low-$10 range. If we see unfavorable weather in later July and August, be on the lookout for last-minute pricing opportunities.

Looking to the 2025/26 marketing year, I currently expect the season-average price to be $10.50/bu., above USDA’s projection, with fall prices in the high $9 or low $10/bu. range and then rising throughout the marketing year. Global stocks could tighten in the later part of the marketing year if Brazil plants less than the currently projected 1 million additional hectares (about 2.47 million acres) of soybeans or their yields fall below trend. Either factor could lead to higher prices than currently expected.

Included in the One Big Beautiful Bill Act currently working its way through Congress are various proposed changes to farm bill programs such as Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC) and other programs as well as a few changes to crop insurance, tax policy and much more. Changes to these programs could have an impact on the risk management plans for some farmers, especially next year and beyond, so be on the lookout for these changes after they become law.

Watch for Pricing Opportunities

- Watch for news on any changes to proposed RVOs in the final rule as well as news on SREs or state-specific biofuel policy changes.

- Watch for soybean purchases by China through the end of July and into August.

- As we move closer to Brazil’s soybean planting season beginning in September, watch for acreage expectations that come in above or below 48.8 million hectares or production expectations above or below 175 million metric tons.

While my current outlook is for slightly higher prices, less than favorable news on any of these factors, or others, could move prices lower. Reviewing marketing and risk management strategies may be a good idea in light of recent news and price moves as we move through summer and look forward to harvest in a few months.

Endnote

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.