The USDA’s December 2024 Farm Sector Income Forecast revealed that U.S. crop farmers had experienced two consecutive years of declining cash receipts, falling from an inflation-adjusted value of $300 billion in 2022 to $278 billion in 2023, and down to a projected $246 billion in 2024. For many crop producers — and depending on their management, marketing, land ownership, and risk management decisions — margins may have been tight or returns may have been below breakeven for several years in a row because of inflation in farm production expenses.

While the current marketing year is underway, farmers are already looking toward 2025 as they consider renewing their operating loans for the spring planting season. The USDA’s recently updated Cost-of-Production forecast for major U.S. field crops and Early-Release Tables from the USDA Agricultural Projections to 2034 provide early insight into national average costs of production, revenues, and crop farm profitability for 2025. This information helps farmers begin to consider management decisions on crop inputs, crop rotations, credit needs, and how to employ marketing and risk management strategies to potentially improve their farm-level economic returns for the upcoming year.

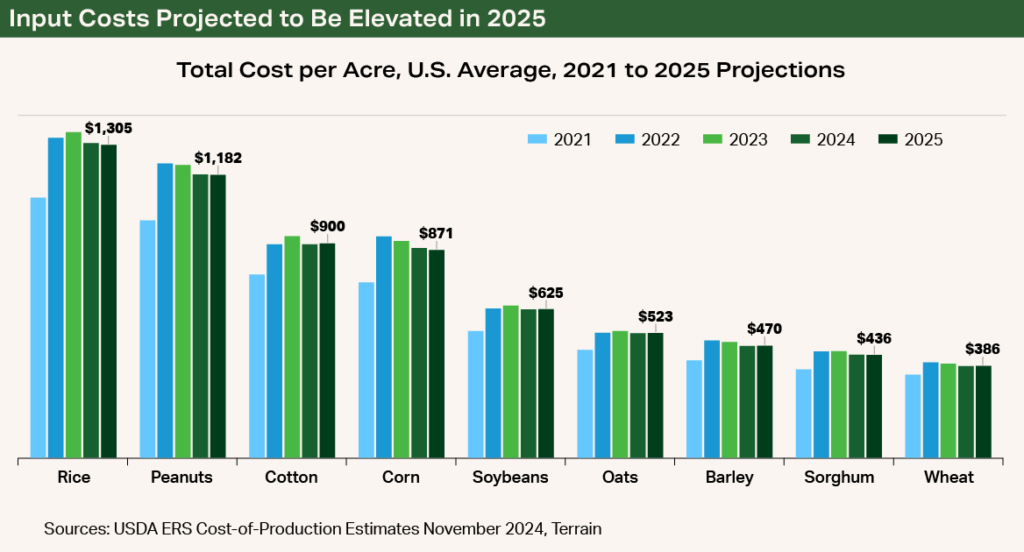

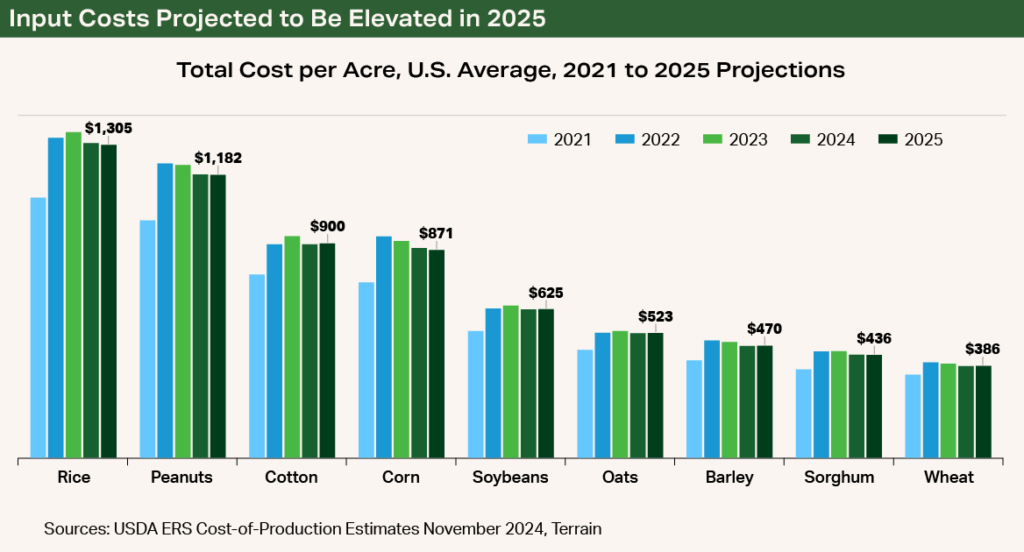

2025 Cost-of-Production Forecasts

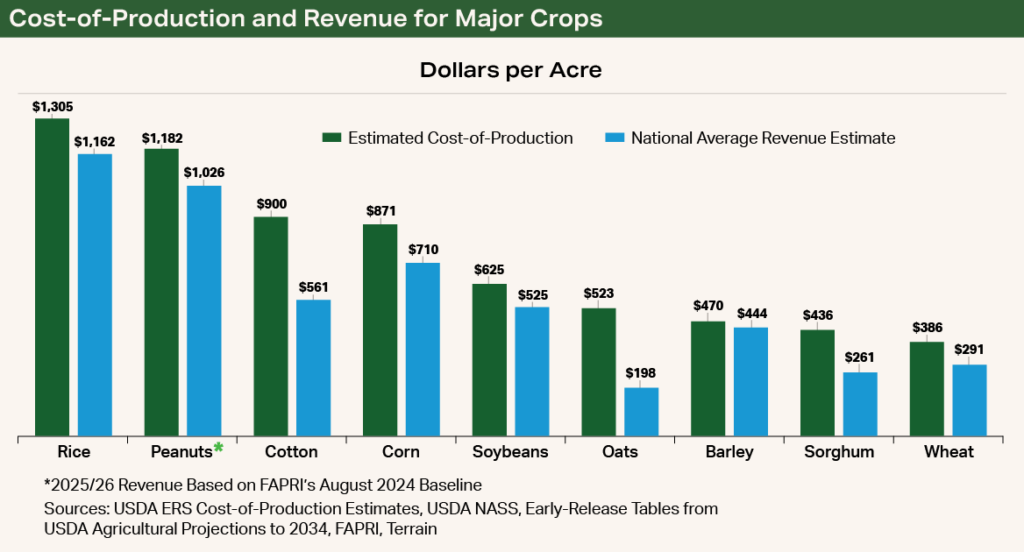

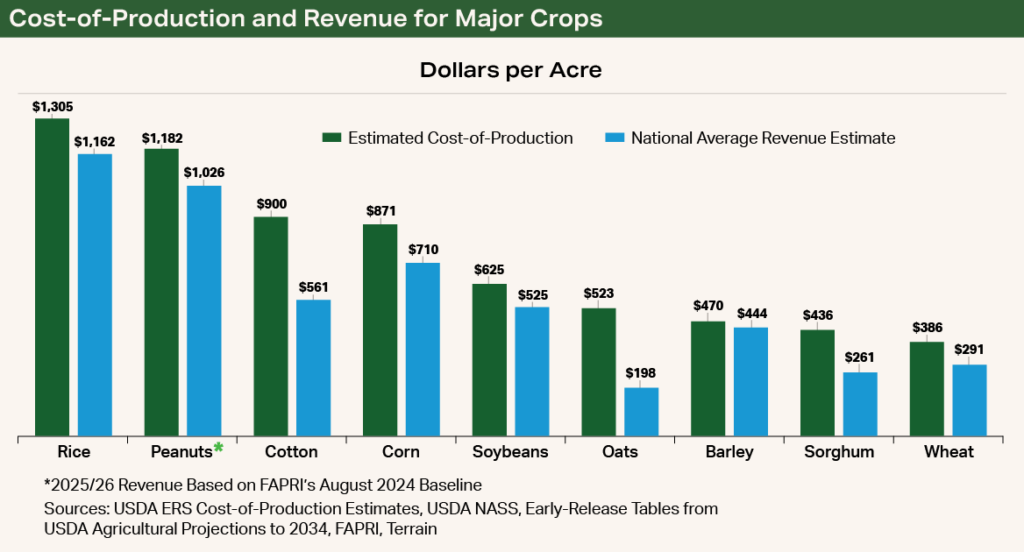

For 2025, the cost of production for major field crops is expected to remain elevated but down marginally from 2024 for all major crops except cotton. Costs are projected to be higher for seed, chemicals, custom operations, repairs and maintenance, and taxes. Lower costs are projected for fertilizers, fuel and electricity, and interest.

Next year, the cost of production is expected to be the highest for rice at more than $1,300/ac., down 0.7% from 2024. Next come peanuts, then cotton. For cotton, cost of production is forecast at $900/ac., up 0.6%. The cost to produce an acre of corn is projected at $871/ac., down 0.9%, and for soybeans the projected cost of production is $625/ac., down 0.1%. Among the major field crops, wheat’s cost of production is forecast to be the lowest at $386/ac., down 0.5% from 2024.

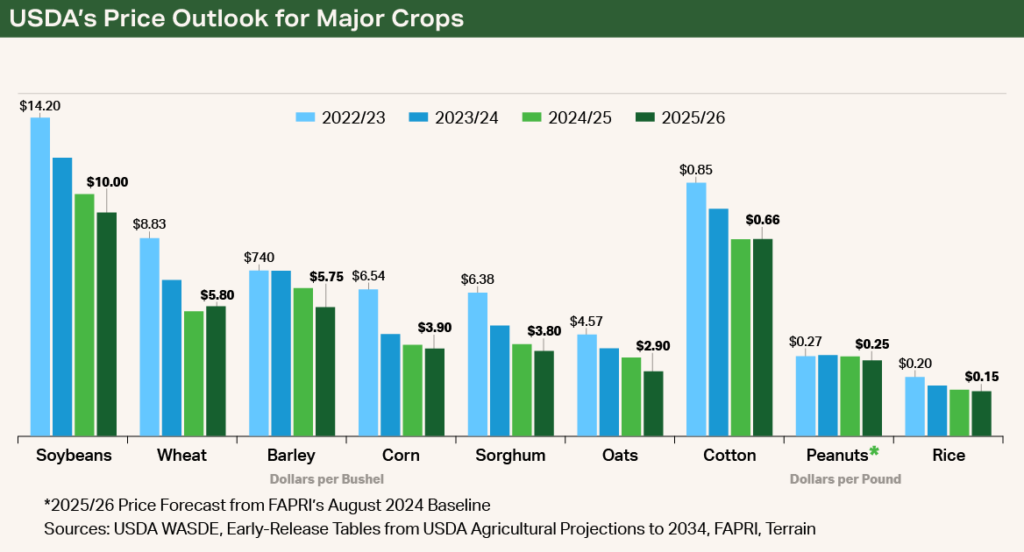

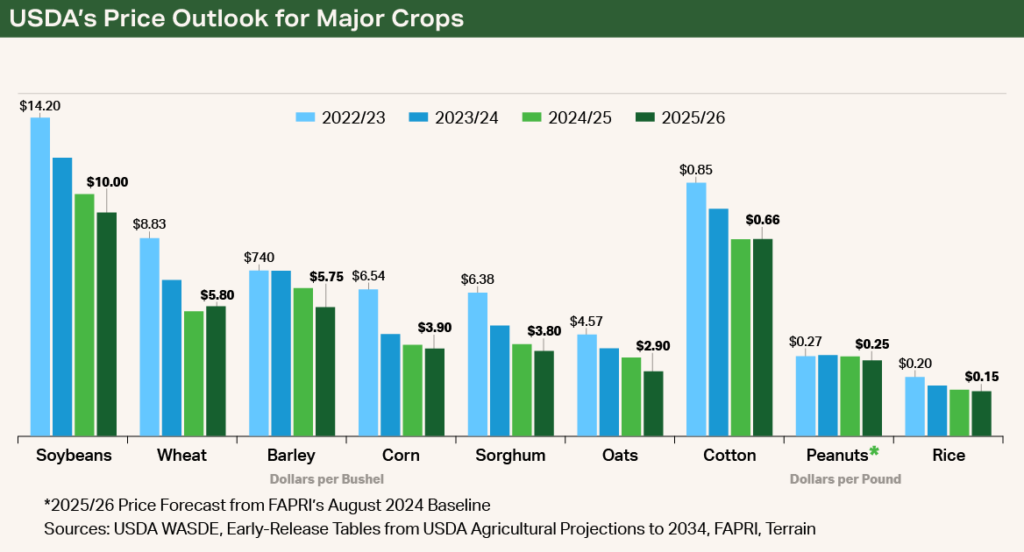

National Average Price and Revenue Projections for 2025

In early November, the USDA provided an early release of select commodity supply, demand, and price projections to 2034. For the 2025/2026 crop year, the national marketing year average corn price is projected at $3.90/bu., down 5% from the current projections for 2024, and down 40% from the recent high of $6.54/bu. in 2022/2023. Soybean prices are projected at $10/bu., down 7% from the 2024/2025 marketing year average price projection and down 30% from two years ago. All major crops except wheat are expected to see lower or flat prices for the 2025/2026 marketing year. While wheat prices are projected to climb to $5.80/bu. in 2025/2026, wheat prices will remain 34% lower than the price farmers received in 2022/2023.

To estimate the national average crop revenue per acre, the 2025/2026 marketing year average price was multiplied by the projected crop yield included in the USDA’s long-run baseline. For example, given a projected marketing year average price of $3.90/bu. and an expected yield of 182 bu./ac., the estimated revenue per acre of corn is nearly $710 for 2025/2026, $161/ac., or 18.5%, below the estimated cost of production. Estimated revenues range from a high of $1,162/ac. for rice ($1,162 = $15.20 per hundredweight × 7,590 pounds per acre) to a low of $291 per acre of wheat ($291 = $5.80 per bushel × 50.1 bushels per acre), both of which are below estimated national average costs of production.

Crop Margins Likely to Remain Tight in 2025

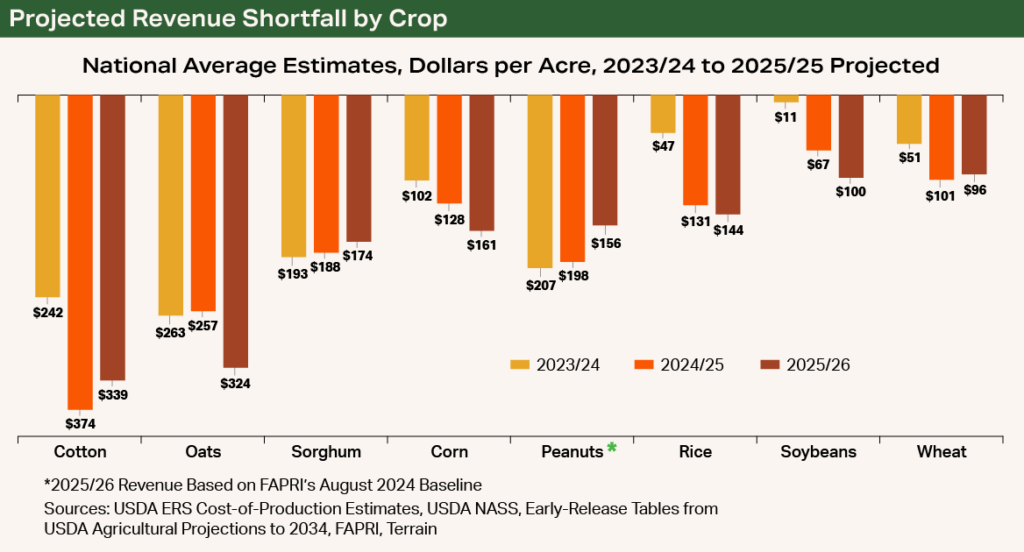

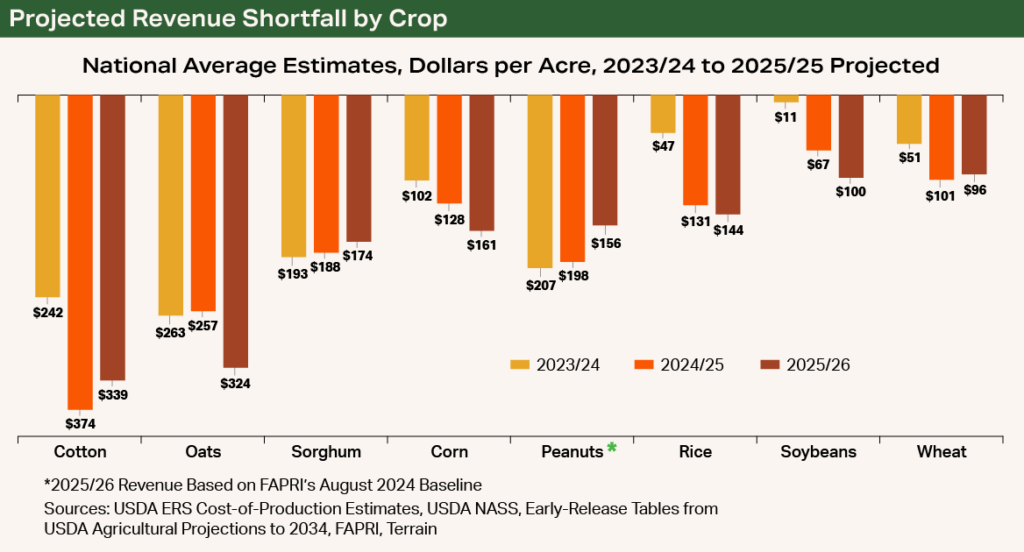

Given expectations for input costs to remain elevated in 2025 and for crop prices to mostly move lower again in 2025, it is no surprise that another year of margins at or below breakeven may be on the horizon. The University of Illinois’ 2025 Crop Budgets confirm similar findings for high-productivity farmland in Central Illinois.

Based on current price and yield expectations, for the 2025/2026 marketing year, the revenue shortfall (that is, crop revenue1 minus total costs) is expected to be the largest for cotton at $339, or 38% below breakeven. Other crops such as grain sorghum are projected at $174, or 40% below breakeven, and corn at $161, or 19% below breakeven. Wheat is the “least loser” with a $96/ac. shortfall. Importantly, for every major U.S. field crop, the projected revenue in 2025 is below the projected cost of production, marking the third year in a row of low or negative economic returns, on average, for crop farm families.

Many of these variables are far from certain. For example, farmers’ planting decisions — influenced by each commodity’s expected returns and by Mother Nature at planting time — can change acreage decisions (for example, prevent plant, production, and prices received by farmers). Higher-than-expected consumption in export markets or through domestic consumption could also push prices and, potentially, revenues higher.

On-Farm Implications

Obviously, these national average estimates are not farm-level projections. Farm-level input costs will vary depending on management decisions, actual input costs and quantities used. Revenues will vary based on farm-level yields, risk management and marketing decisions, local basis, crop variety, and ultimately the impact of supply and demand on the prices received.

In a high-cost environment, like the one forecast for 2025, farmers can consider multiple levers to control their own costs, including but not limited to:

- Scaling back on machinery purchases

- Attempting to negotiate lower rental rates for cropland

- Sharpening the pencil on the utilization of fertilizers and chemicals (at the risk of lower yields, however)

- Potentially restructuring or consolidating debt

- Selling land or equipment to increase working capital

As farmers head into loan renewal season, ongoing and forward conversations with lenders will be extremely important to stay ahead of any potential liquidity gaps.

To help boost their revenues above the projected national average, farmers may consider forward-pricing bushels (physically or on the board) if prices rally to profitable (or near profitable) points; buying higher levels of crop insurance coverage; or buying crop insurance endorsements to increase their level of protection. Additionally, USDA commodity support programs, should they be reauthorized and/or enhanced in a farm bill, may help to mitigate the risk associated with the current and prolonged downturn in the farm economy. Congressional efforts to provide ad hoc support may also help farmers experiencing financial losses due to natural or economic disasters.

Uncertainty in the farm economy remains. Absent an unforeseen increase in demand or supply shock, recent projections from the USDA and university extension budgets suggest the financial tightening in the corn and cotton belts is likely to continue into 2025, challenging farmers already weathering a historic downturn in the farm economy.

1Crop revenues exclude federal support for farm programs or ad hoc disaster aid, crop insurance indemnities, and are based on the primary crop product (for example, cotton lint or corn for grain).

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.