It’s the time of year when the annual discussion begins on spring planting acre numbers — and what that means for prices. Early indicators hint that corn could have a strong acreage year, but I don’t think heavier production would crash the corn market. The market is still unsure of the size of the 2024 crop. Any further changes that the USDA makes to the stocks number in upcoming reports will likely help support the corn market, too.

Based on the current market outlook, I am more bullish on corn prices in the $4.50 to possibly $5 range.

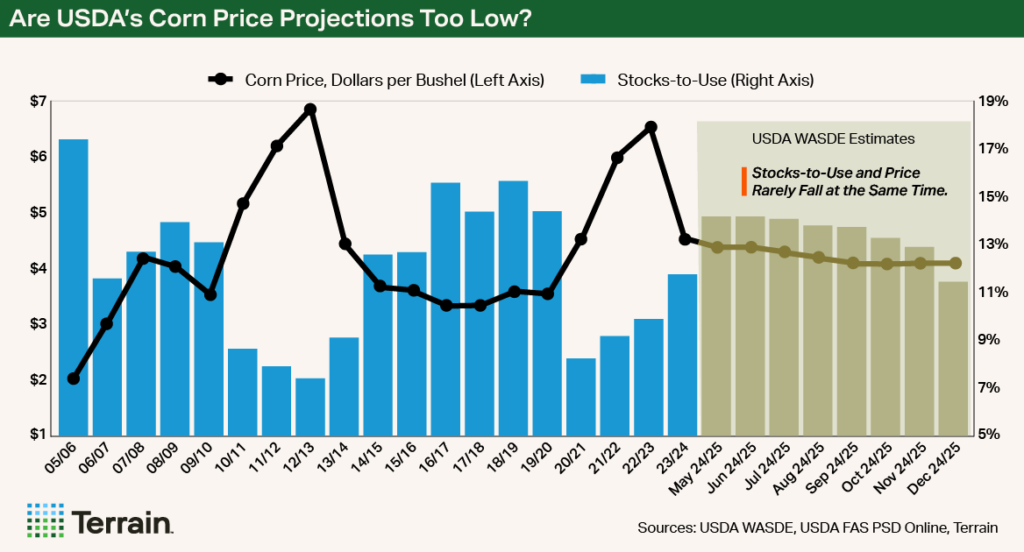

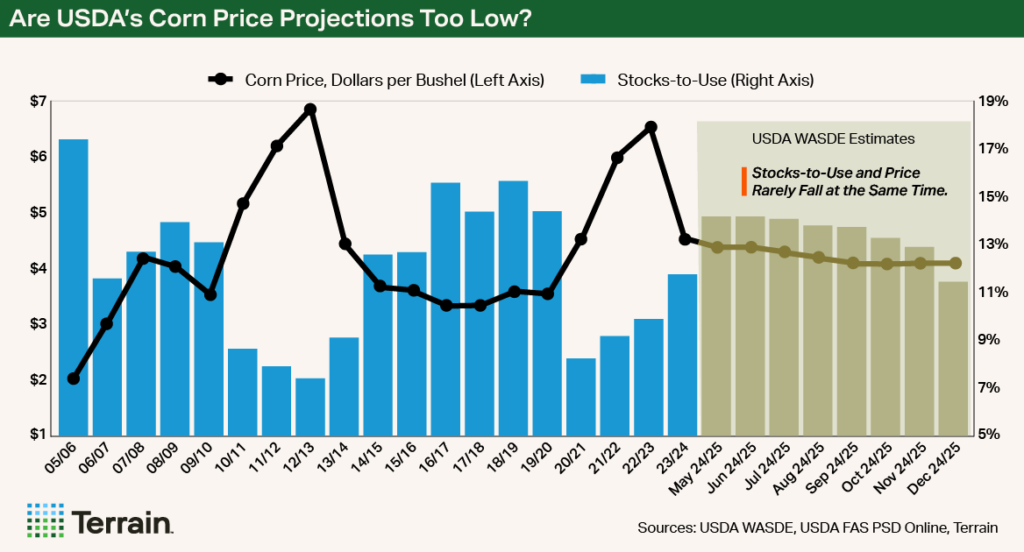

Since the USDA's first supply and demand estimates in May for the 2024 crop, the department has increased consumption projections by 385 million bushels, or 3%; reduced ending stocks by 364 million bushels, or 17%; and to the confusion of industry observers, reduced the projected marketing year average price by 30 cents, or 7%.

The fundamentals in the corn complex are improving, albeit marginally, but the USDA continues to keep price projections unchanged. Based on the current market outlook, I am more bullish on corn prices in the $4.50 to possibly $5 range.

Milo vs. Corn

After the U.S. presidential election, China and Brazil signed several trade agreements, including one allowing Brazil to export milo, or grain sorghum, to China. As a result, demand for U.S. milo could decrease, especially as farmers plan their spring plantings.

The U.S. is the largest producer of milo, accounting for 15% of global production at 362 million bushels in 2024/2025, according to the USDA. Brazil is tied for third place globally in milo production, accounting for 8% of world output. However, the U.S. exports over 70% of its milo, with 95% of it going to a single customer: China.

Farmers may decide it is not worth the risk to plant as much milo with the possibility of reduced export demand.

Still, Brazil has an estimated 70 million additional acres of pastureland that can be converted to cropland, showing it can erode the U.S. market share in China (as it has done with soybeans). If China imposes tariffs on U.S. milo as it did in 2018 (also tied to an anti-dumping claim, with import duties a lofty 179%), the U.S. could see competition for feed and ethanol between milo and corn in the domestic market.

Farmers may decide it is not worth the risk to plant as much milo with the possibility of reduced export demand. (In 2019/2020, following the U.S.-China trade war, milo harvested acres decreased 8%.) Instead, farmers could switch milo acres to corn, further increasing corn supply.

That shift to corn in the western corn belt and Southern Plains may not be all bad news for corn prices, though. The USDA reduced 2024/2025 corn production by 60 million bushels in the November WASDE report, and with December’s WASDE report, stocks-to-use has decreased nearly 2% from October’s report. Production may fall again in January, which will help draw down stocks.

Return of King Corn?

When deciding whether to plant corn versus soybeans, farmers should consider the 2025/2026 crop price ratio. Despite recent contract lows for corn and soybeans, the corn-to-soybean price ratio remains near its 15-year average at 2.3, suggesting regular crop rotations. Although input costs are expected to remain high in 2025, demand fundamentals are more optimistic for corn than for soybeans, even though soybeans have lower input costs. Corn fundamentals remain strong with feed, ethanol and export demand.

The USDA's 10-year baseline outlook confirms this theory, with planted soybean acres expected to decline by 2%, or 2.1 million acres, and corn increasing 1%, or 1.3 million acres, in 2025/2026.

Demand Side Looks Positive for Corn in 2025

The USDA may further reduce 2024/2025 corn production in January and boost the demand side of the balance sheet, as it did with the December WASDE report. Exports, particularly to Mexico, have far exceeded expectations. While Mexico is likely front-loading purchases in case tariffs are implemented, the country does not produce enough corn to meet domestic demand.

Additionally, U.S. ethanol reached record weekly production at 1.1 billion barrels per day before the Thanksgiving holiday, driven by strong exports to Canada and India. Those exports should continue as other countries around the globe implement blend rate mandates.

Corn price rallies are likely in 2025, so producers should understand their break-even points to capitalize on opportunities in the expected tight margin environment.

These factors might allow milo to join the domestic market in a bigger fashion again without weighing on corn demand and prices. Corn price rallies are likely in 2025, so producers should understand their break-even points to capitalize on opportunities in the expected tight margin environment. Higher-coverage insurance plans could be crucial given the expected volatility in 2025, so working with a Farm Credit insurance agent will help producers make more informed choices.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.