Report Snapshot

Situation

The U.S. depends on Canada, the world’s top producer of canola, for the sourcing of our canola meal for feed and canola oil for biofuel and food uses. The U.S. government currently exempts canola seed, oil and meal from the reciprocal tariffs, as they are a part of the United States-Mexico-Canada Agreement (USMCA). But any non-USMCA Canadian goods face a 35% tariff as of August 1.

Outlook

As the U.S.-Canada trade relationship continues to evolve, the future cost of importing canola meal and oil remains uncertain.

Impact

In the meantime, the positive momentum building for U.S. biofuel, increased dairy demand, and trade uncertainty offer an opportunity for canola.

Corn and soybeans may get all the attention, but canola is becoming a more attractive crop given the biofuel boom, lower production costs, increasing dairy feed demand, and tariff uncertainty involving Canada. Farmers should consider planting canola as an alternative to hedge against the downside soybean risk due to reduced demand from China.

Canada Canola Climbs

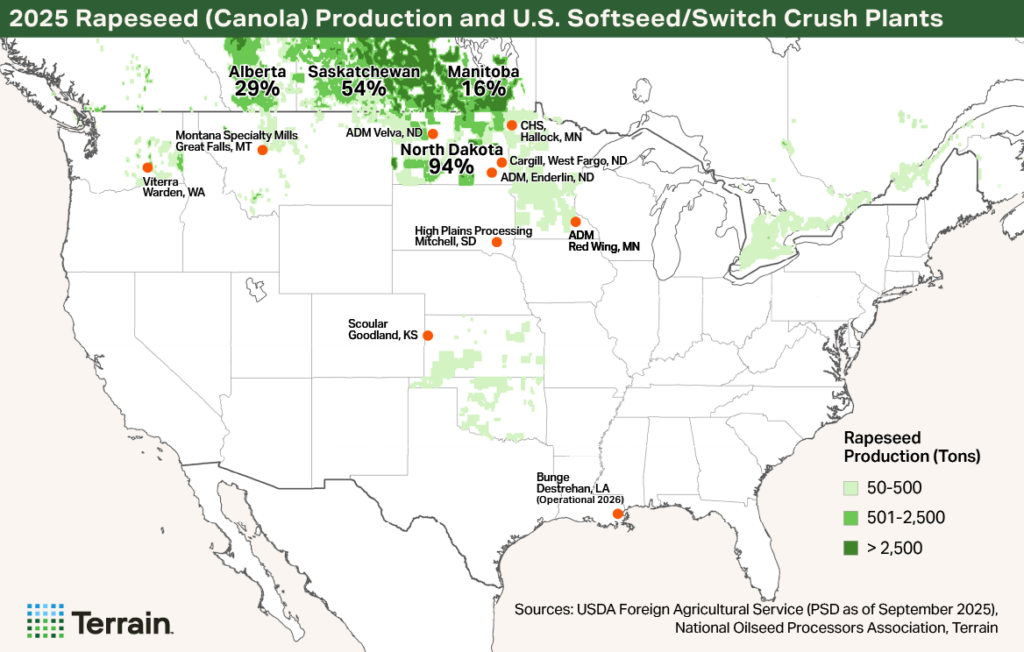

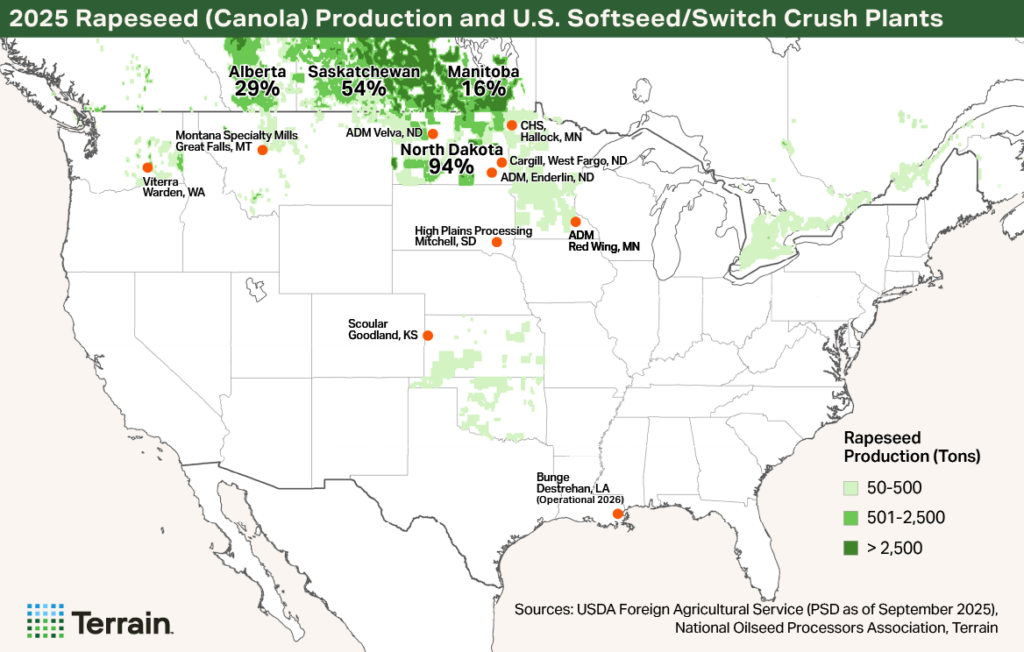

For 2025/26, the USDA expects Canadian canola production to increase nearly 4%, from 19.24 million metric tons (MMT) to 20 MMT. Meanwhile, U.S. canola production is projected to fall 11%, from 2.21 MMT to 1.97 MMT, because of fewer planted acres.

As a result, U.S. imports of canola seed are expected to nearly double, accounting for 20% of total supply. Canada typically has been the biggest supplier of U.S. canola seed imports — with over an 85% market share based on the five-year average — although U.S. buyers have reduced seed imports in recent years.

Like the U.S., Canada’s domestic canola crush capacity has accelerated because of growth in vegetable oil feedstocks for biofuel production, which have increased 28% since 2021, per the USDA. Canada’s newest crush plant opens any day now (Cargill in Regina, Saskatchewan), and its canola crush is expected to increase 7% year over year (YOY) to 14.5 MMT.

In the U.S., a new canola crush plant (Bunge in Destrehan, Louisiana) is set to become operational in 2026. Through a partnership, Bunge, Chevron and Corteva launched a pilot program to contract canola acres with farmers in the Southeast. Farmers began pursuing double-crop winter canola acres to meet this upcoming demand and have reported lower input costs and higher profit margins compared with soft red winter wheat (their alternative crop), as reported by Farm Progress.

If more U.S. farmers were to expand planted acres of canola, there is enough domestic demand for the additional meal and oil byproducts. Reliance on canola seed imports would also lessen.

Currently, canola oil consumption is driving an increase in crush.

Crush Competitors: Soybeans vs. Canola

The USDA forecasts U.S. canola crush in 2025/26 at 2.24 MMT, up 6% YOY, which will lead to record production of canola oil and meal. In July 2025, canola crushed was nearly 210,000 tons, down slightly from a year earlier but up over 25% from the prior month.

Currently, canola oil consumption is driving an increase in crush. The amount of U.S. canola oil stocks on hand came in at 26 million pounds (0.011 MMT) at the end of July 2025, a decline of nearly 40% YOY and down 16% from the previous month. However, this pales in comparison to U.S. soybeans crushed in July 2025 at 6.1 MMT.

40% of canola seed byproduct is oil, whereas soybeans’ byproduct is only 20% oil.

Overall, the canola crush numbers should continue to increase, with High Plains Processing opening in Mitchell, South Dakota, and Scoular recently reopening a plant in Goodland, Kansas. For plants that can crush either soybeans or canola, U.S. biofuel policy might shape their decision-making. Where quantity per oilseed is concerned, canola is the clear winner: 40% of canola seed byproduct is oil, whereas soybeans’ byproduct is only 20% oil.

Record canola oil production here at home is being met with near record use.

Biofuels’ Best Bet?

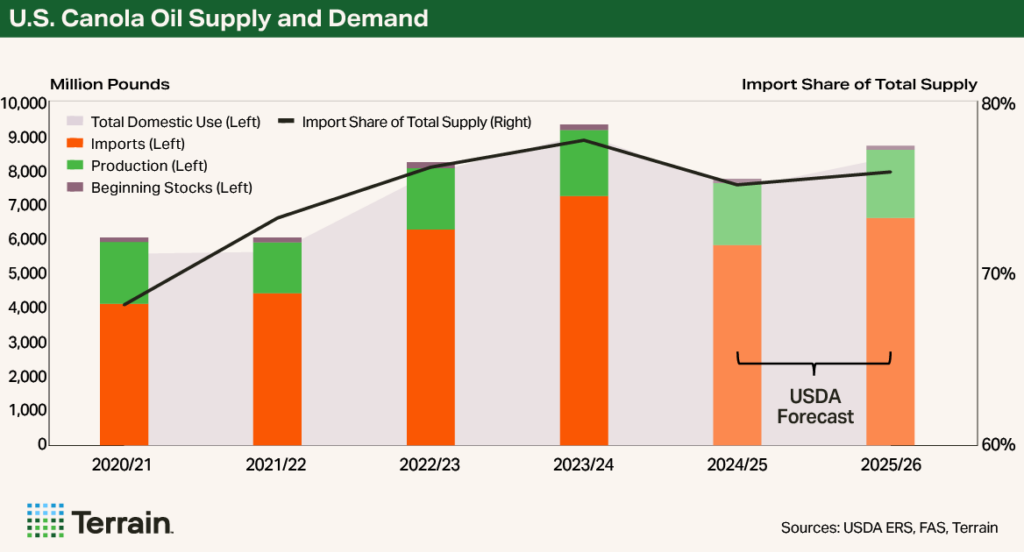

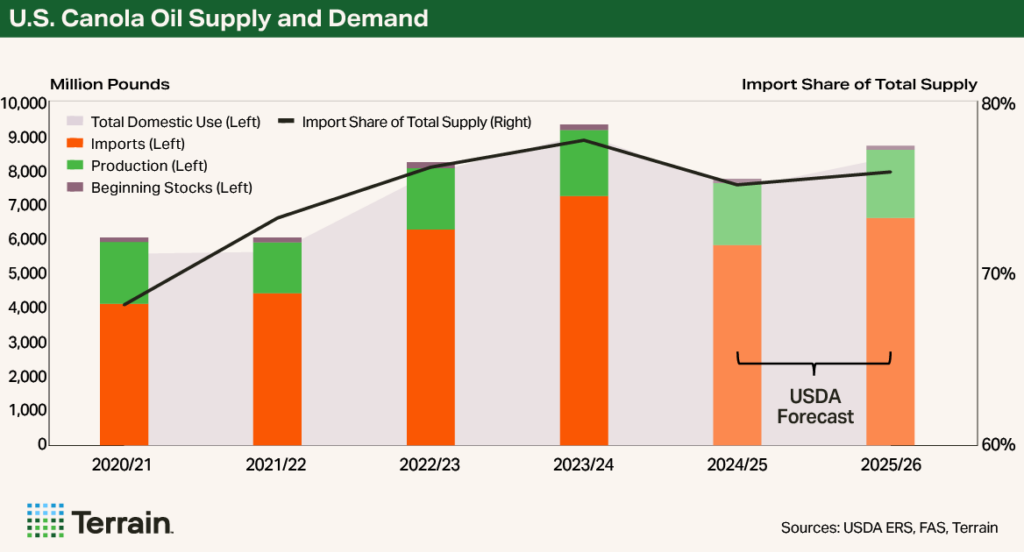

While U.S. beginning stocks for canola oil continue to be drawn down, record canola oil production here at home is being met with near record use. Demand for feedstocks like canola oil started to ramp up in 2022 following the renewable diesel boom driven by California’s Low Carbon Fuel Standard. Since then, domestic use of canola oil in biofuel has nearly doubled, while use in food has also steadily risen.

The U.S. relies heavily on imports for this consumption, with imports accounting for 75% of our total canola oil supply, and the vast majority supplied by our northern neighbor. Based on the five-year average, Canada has a 98% market share for U.S. canola oil imports.

Given recent developments in the One Big Beautiful Bill Act, only North American feedstocks will qualify for the 45Z biofuel $1 per gallon tax credit, which includes canola oil imports from Canada.

However, if the Environmental Protection Agency (EPA)’s Renewable Fuels Standard proposal for 2026 to 2027 is implemented in its current format, the EPA will award only a 50% RIN (biofuel credit) to biofuel producers using foreign feedstocks, with domestic feedstocks earning the full 100% RIN value.

This may disincentivize imports like canola oil for biofuel use and could even result in vegetable oil supply chain changes if domestic soybean oil is used more in biofuel production and less in food (with imported canola oil potentially backfilling). However, if U.S. canola oil supplies were to increase as a result of rising domestic production and crush, the reliance on imports would decline.

Meal Matters

Biofuels are not the only driver for canola in the U.S. Canola meal accounts for the remaining 60% byproduct of a crushed canola seed. In the U.S., canola meal can be used in livestock (primarily hogs and dairy) and poultry diets (in the Northern Plains), as highlighted in the 2022 Soybean Meal Demand Assessment for the United Soybean Board.

Increased dairy feed demand is the primary driver for increased canola meal utilization in the U.S.

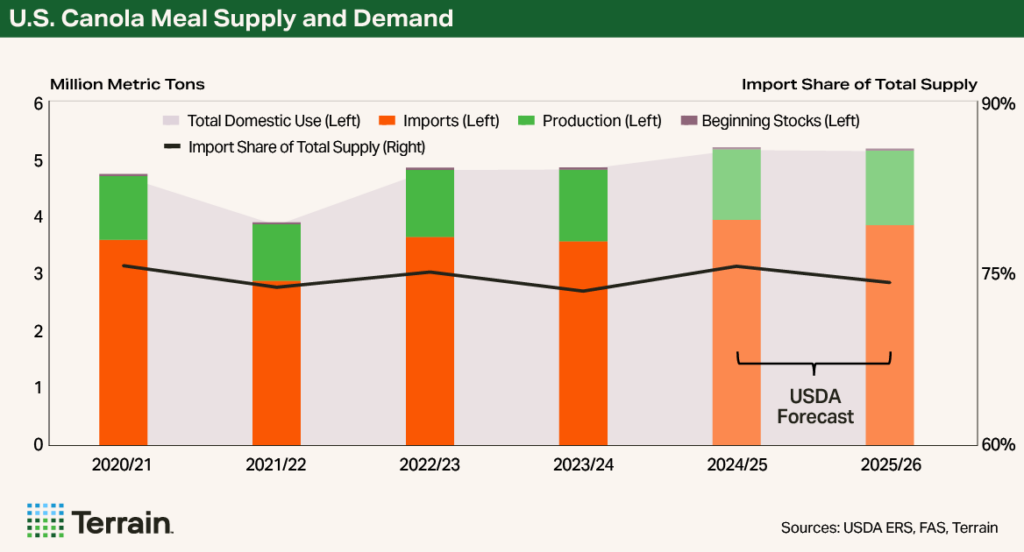

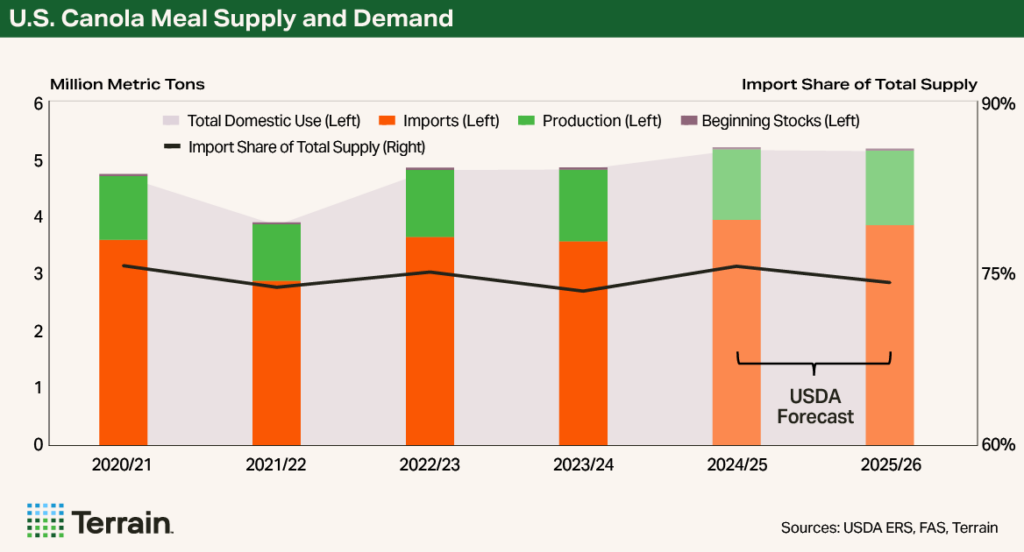

For 2025/26, the USDA forecasts canola meal consumption at a near record 5.14 MMT. But canola meal imports rather than U.S. production will be the primary source for this consumption. Again, Canada supplies 100% of U.S. imported canola meal, increasing U.S. buyers’ exposure to higher costs if tariffs are implemented or if canola, meal and oil are excluded in future trade agreements between the two countries.

Increased dairy feed demand is the primary driver for increased canola meal utilization in the U.S. Nationwide dairy cow numbers have risen, according to the USDA, from 9.33 million in January 2024 to 9.49 million in July 2025, driven by Midwest cheese expansion. South Dakota has led the increase, up over 150%, or 74,000 head, over the past five years (from January 2021 to January 2025). Other top growth states in the Midwest include Texas, Iowa, Kansas, Wisconsin and Colorado.

This presents a local feed market for year-round canola meal use and is one more reason farmers near these geographies should consider canola. But global supply chains are dynamic and worth paying attention to in weighing future planting decisions.

North America-China Trade War

Canada has not been immune to trade tit-for-tat with China, the world’s second-largest canola crusher and importer of canola seed. In March, China implemented 100% tariffs on Canada canola meal and oil imports. Based on the three-year average reported by Trade Data Monitor, China accounts for 60% of Canada’s seed exports as well as 30% of its meal exports.

Based on the USDA’s 2024/25 forecast, China’s total crush by oilseed is expected to be 73% soybeans and 13% canola, with other oilseeds (peanuts, sunflower seed and cottonseed) accounting for the remaining 14%.

In August, Chinese trade officials initiated an unfair trade practices probe into Canadian canola seed imports, implementing a nearly 76% preliminary tariff. The timeline for the investigation and potential final tariff was extended until March 9, signaling the realization that China needs Canadian canola seed to crush without U.S. soybeans.

If the canola seed tariff is implemented in the spring, China’s imports of Canadian canola seed would essentially stop and so would China canola crushers, who are already crushing at a reduced rate. While Brazil can technically supply 100% of China’s imported soybean needs, the same cannot be said for Australia in replacing Canadian canola. Without U.S. soybeans or Canadian canola, China must tap into its domestic oilseed reserves (and China prefers to keep a stockpile on hand). If Canada is cut off from China, Canada’s domestic canola supplies will increase and present opportunities for U.S. buyers.

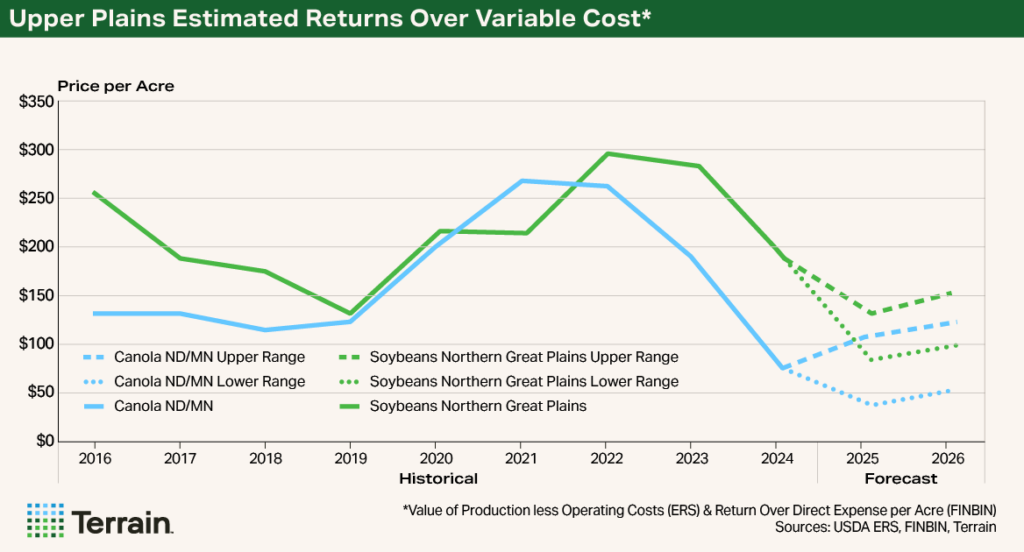

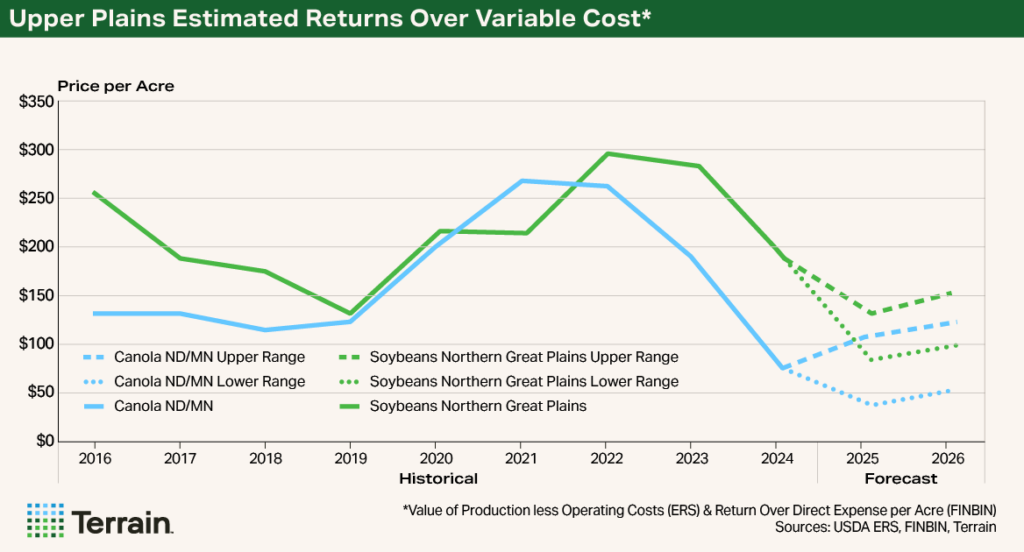

Total production expenses are almost half when planting canola compared with soybeans, creating a diversification opportunity for farmers.

Canola Crossroads

The U.S. remains heavily reliant on Canadian imports of canola meal and oil, but the upcoming USMCA review in 2026 and current trade tensions could disrupt current supply chains, potentially making domestic production more attractive.

Total production expenses are almost half when planting canola compared with soybeans, creating a diversification opportunity for farmers. If we assume input costs remain elevated and trade issues persist longer term for soybeans, local prices in North Dakota could remain near $8/bu. at harvest in 2026.

If the EPA implements its current proposal of imported feedstocks receiving only a 50% RIN, imports will be disadvantaged. Increased biofuel demand, higher oil byproduct supply and advantaged domestic RIN value could drive up local cash canola prices to exceed $11/bu. Combined with the on-farm added benefits of adding canola in the crop rotation (yield improvement for crops following canola, weed/disease reduction and improved soil health), this could present an opportunity for equal or better returns to the operation compared with soybeans.

For U.S. farmers, especially those near softseed crush plants, check with your local crush plant and their plans to crush canola, as diversifying into canola could offer a hedge against soybean trade volatility in the next crop year and beyond. Continue to watch out for EPA biofuel announcements and developing trade relations between the U.S., Canada and China.

Canola might be worth pursuing given its advantage as a domestic feedstock for biofuel production, increased local dairy feed demand for canola meal, and the uncertainty around import tariff costs.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.