Outlook • November 4, 2025

CME Beefs Up Its Cattle Contracts

Article Originally Published in the November 2025 Issue of the National Cattlemen Magazine

The Chicago Mercantile Exchange (CME) recently expanded its offerings for live cattle and feeder cattle futures and options contracts, a vital tool for price discovery and risk management in the cattle industry. The expansion was designed to provide cattle producers with enhanced risk management tools and greater flexibility.

Overview of CME Contract Expansion

Traditionally, contracts were standardized in terms of size and delivery months. The expansion on June 9 introduced additional contract months — including “serial” contracts that fill gaps between standard expirations — along with new option types. For example, serial contracts will be available for months not covered by standard live cattle contracts, such as January, March, May, July, September and November.

Additionally, on June 9, the CME added a contract month on the back end of the listed contract calendar for both live cattle and feeder cattle futures and options. Then on September 22, the CME began listing for trade new weekly or short-dated options for live cattle contracts that will trade for several weeks before expiring on Monday mornings. These options will settle to the nearby live cattle futures contract on Monday following the release of the monthly Cattle on Feed report from the USDA. These releases occur on the third or fourth Friday of the month.

Implications for Cattle Producers

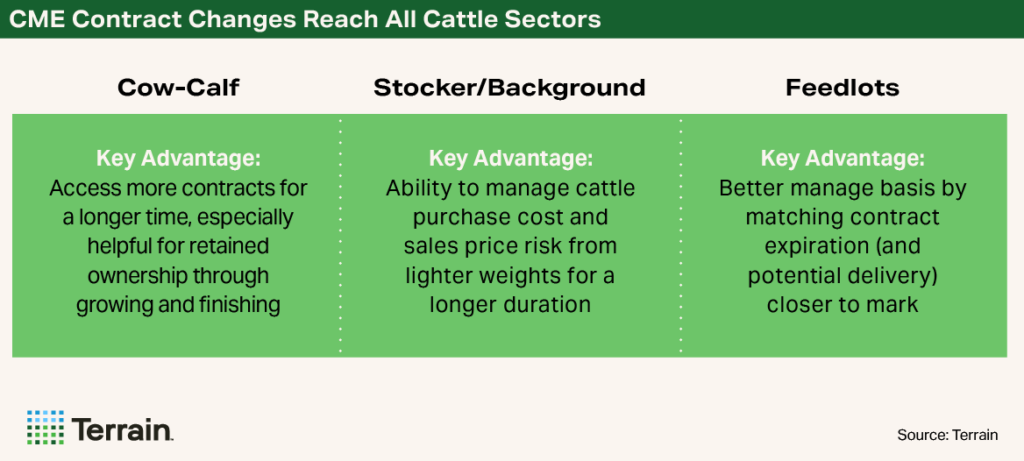

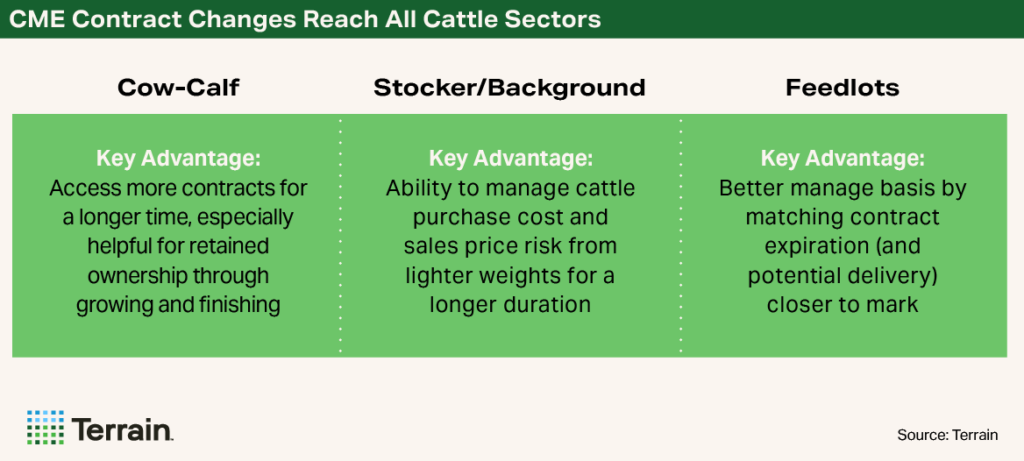

The expansion benefits producers by enhancing risk management; improving market liquidity and price discovery; enabling extended supply chain ownership; and potentially creating more effective insurance tools. However, challenges include the added complexity of navigating the new contract choices.

Enhanced Risk Management

Producers gain more opportunities to hedge price risk by tailoring strategies to their actual marketing or production schedules. More contract months mean better alignment with individual operations, reducing basis risk and improving the effectiveness and flexibility of risk management. Cattlemen can now risk-protect cattle for longer with the CME adding additional contracts at the far end of the contracts listed. The added live cattle listings will add two months to the duration that fed cattle can be hedged, while the feeder cattle futures contracts that are listed will add one to three months of hedge coverage.

Improved Market Liquidity and Price Discovery

The introduction of new contracts increases overall market activity, potentially leading to tighter bid-ask spreads (lower volatility) and more current price signals.

Opportunity for Supply Chain Ownership

The expanded time/duration of hedge coverage when combining feeder cattle and live cattle contracts will be an advantage for the cattle business as operations extend ownership through more phases of production to manage through tight cattle supplies. This is important for operations that are buying lightweight cattle for grazing or backgrounding programs or beef-on-dairy crossbred calves.

Improved Insurance Tools

More contract months may allow Livestock Risk Protection (LRP) coverage to be added to better match producers’ marketing periods, making insurance more attractive and effective. This will require action by the USDA Risk Management Agency and insurers.

Complexity and Education Needs

With more contract choices, producers may face increased complexity and require additional professional support to effectively utilize new products.

Liquidity Concerns

While serial contracts offer flexibility, they may initially have lower trading volumes, resulting in wider bid-ask spreads and less efficient trading.

Practical Steps for Producers

Producers can take advantage of the new contract choices in a few ways:

- Review your marketing calendar to determine if new contract months align with your production and sales schedules.

- Consult with your broker or risk management adviser to integrate serial and expanded contracts into your hedging strategies.

- Check with your Farm Credit insurance agent to ensure your LRP strategy is aligned with any potential changes to your hedging strategy.

- Monitor liquidity and pricing in new contracts to ensure efficient trading.

- Stay informed about CME updates and market trends to maximize the benefits of new risk management tools.

The Bottom Line

The CME’s expansion of live cattle and feeder cattle futures and options contracts, including the introduction of serial contracts, offer enhanced risk management and greater access for cattle operations. By understanding and utilizing expanded CME contracts, cattle producers can better protect their bottom line and navigate the evolving cattle market with confidence.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.