Situation

Given the high levels of inventory in recent years, there is concern that a large 2024 almond crop could keep the grower price below breakeven. Yet there seems to have been a turnaround with prices rising in recent weeks. Despite the risk of the market remaining out of balance, there are reasons to think the supply-demand balance is normalizing and that prices will continue to either remain elevated or rise even further in coming months.

Background

High inventory levels have thrown the almond market off balance ever since 2020 due to a record crop as well as shipping constraints associated with the pandemic. Whereas a normal carry-in, or the inventory brought into a new crop year, is in the 350 million- to 450 million-pound range in absolute terms, the last two have been 860 million and 800 million pounds, respectively.

Even when measured against supply (to account for increases in production), these numbers are large. My analysis using Almond Board of California data shows that in the decade before the pandemic, the average carry-in was approximately 15% of total supply; it was 25% this year and last year.

Prices increased just over 10% from early May to early June and show few signs of slowing down.

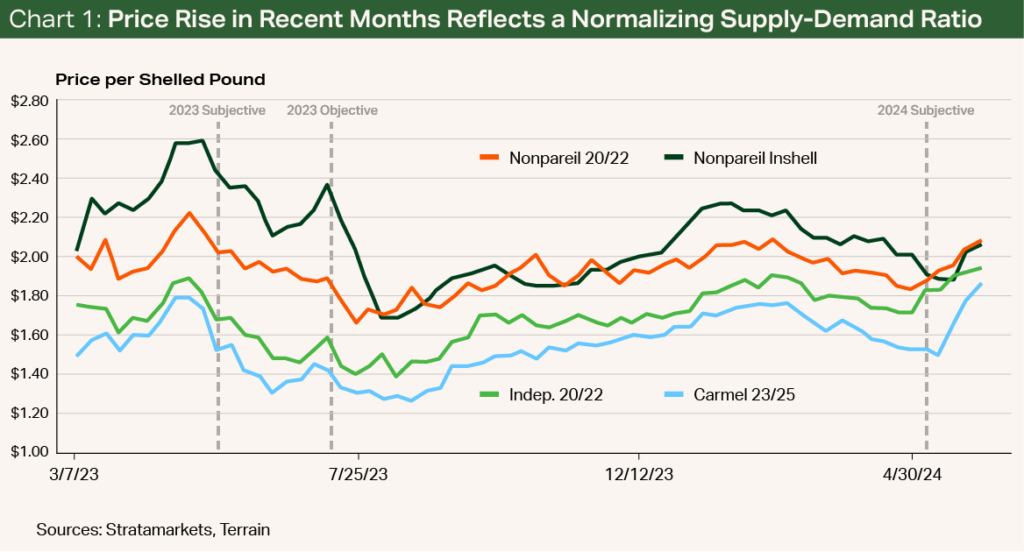

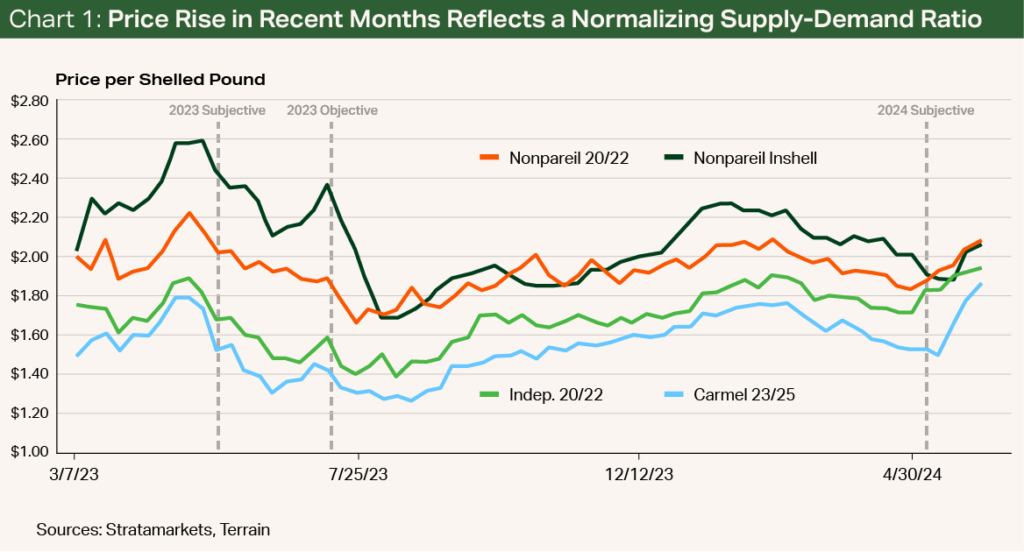

Given the effect the USDA estimates had on prices last year and worries about a large 2024 crop, some growers feared the subjective estimate released this May would sink prices once again. Yet, as Chart 1 shows, the opposite occurred. Prices increased just over 10% from early May to early June and show few signs of slowing down. The spike has injected some much-needed optimism into an industry that has been struggling the last few years.

There are a couple of reasons that explain the post-estimate increase.

First, the ideal bloom conditions this year led many to believe the crop could set a production record, which lowered prices post-bloom. The market had priced-in a crop of 3 billion pounds or higher. Then market activity dwindled, with buyers waiting for the bottom.

Demand has been strong, helping to eat away at the large inventory.

Second, demand has been strong, helping to eat away at the large inventory. The Almond Board of California’s position report shows that year-to-date shipments as of April have beat every year except 2020/2021, and all indications point to a carryout of less than 500 million pounds at this stage.

The good news, however, does not come without risks of another high future carry-in in 2025/2026 and beyond. It will be crucial for the industry to be able to soon surpass the record shipment number set in 2020/2021 of around 2.9 billion pounds given the number of non-bearing acres that are only just coming into production. For example, Land IQ data shows that 2020 had the third-highest bearing acreage on record.

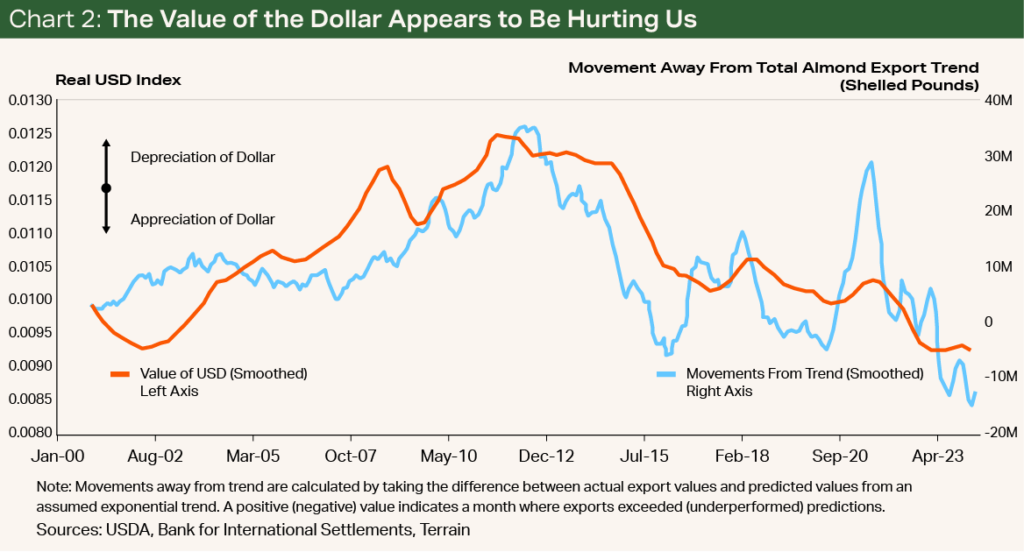

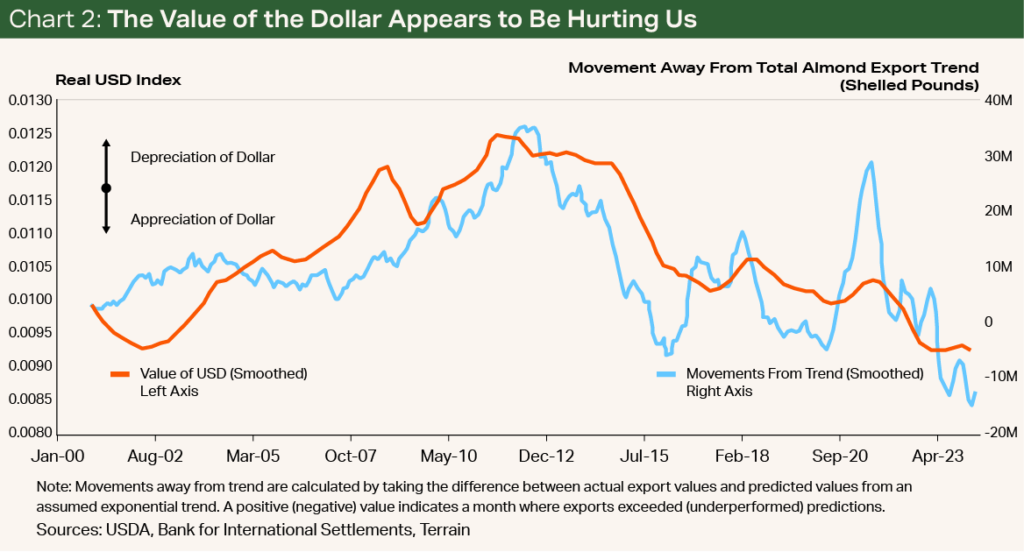

And surpassing the record shipment number is not without headwinds. High domestic retail prices, competition in value-added products like the rise of oat milk, and an appreciated dollar challenging trade (see Chart 2) could jeopardize an improving supply-demand ratio.

Nevertheless, given how high demand has stayed despite these challenges and an improving inventory position, there are reasons to be cautiously optimistic about the almond market.

Given how high demand has stayed despite these challenges and an improving inventory position, there are reasons to be cautiously optimistic about the almond market.

Outlook

The almond price will likely continue its rise in the next couple of months as we enter the new crop year on August 1. Though risks remain to stronger shipment numbers, reports of limited availability of certain items among California handlers and low inventories in importing countries suggest that the momentum will continue and perhaps the industry is turning a corner. An increase in price will provide some much-needed relief to almond growers who have been below breakeven for multiple seasons.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.